Annual Review 21/22

This annual review complements our formal ACT and ACNC annual reporting which consists of our Annual Information Statement and Financial Report for the FY22 year. Our Annual Report to our members will be submitted at our AGM in November 2022 and available publicly shortly thereafter. ACCR’s past annual reporting is available on the ACNC website here

Forward

From our

Executive Director

Highlights in the past year include ACCR’s path-breaking collaborative engagement with major asset managers and Japanese listed companies, and our world first ‘greenwashing’ case, commenced against Australian oil and gas producer Santos. But shareholder power really hit the headlines when significant shareholders successfully blocked the demerger of Australia’s largest corporate emitter, AGL. After four years of advocacy, our objective of bringing forward the closure dates of AGL’s coal fired power stations is now within reach.

It’s not just an exciting time to be a shareholder activist, it’s a critically important time. If used effectively, shareholder strategy offers some of the most powerful decarbonisation tools available. We are rapidly running out of time to reduce industrial greenhouse gas emissions, so the imperative to exploit these tools to their full potential couldn’t be stronger.

What can you expect from us in the next year? Expect to hear more about climate science. Our climate work will be laser-focused on reducing real world industrial greenhouse gas emissions, targeting the largest-emitting listed companies in Australian and other jurisdictions where shareholder tools can be used.

Expect to hear more about political influence: it’s in shareholder interests that companies stop lobbying for delay and start lobbying for accelerated decarbonisation. And expect to hear more about ‘universal ownership,’ a concept that helps explain how climate risks show up in the portfolios of long term, diversified owners.

It is easier than ever for shareholders to partner with us and learn about our work, through our new Shareholder Hub. I encourage you to take a look, and to introduce your networks to this powerful tool.

ACCR is powered by a highly motivated, multidisciplinary team and it’s my absolute privilege and pleasure to lead and learn from them. I extend my heartfelt thanks to our board, especially our convenor and founder, Howard Pender, our shareholder community and our supporters.

Together, we are ACCR.

Brynn O'Brien

Executive Director

From the Convenor of

our Office Bearers

ACCR was incorporated in October 2012 - nearly a decade ago. Sometimes I get asked – what’s coming in the next decade? I say – all I can see are the intellectual forces at work.

ACCR’s purpose is to assist ‘ethical investors so that humanity may live more justly and within the carrying capacity of supporting ecosystems’. Every day, in pursuit of that purpose, we deal with people who are stewards of other peoples’ money – e.g. company directors, superannuation trustees.

So, the legal and intellectual framework behind the conduct of these stewards is vital to the nature and impact of our work. In the last few years that framework has started to shift.

The current/still dominant paradigm - ‘Modern Portfolio Theory’ - is reaching its shelf life. It dates back to the mid 1950s. It sees justice and the carrying capacity of ecosystems as given, irrelevant to financial risk and return and outside the sphere of influence of investors.

The new/challenger paradigm sees most investors as ‘universal owners’ – investors who own shares in many companies – investors whose best interests entail adoption of a stewardship approach which seeks to curtail activity undertaken by a company they own if it causes social and environmental costs, e.g. damages ecosystems. Even if restricting that activity could decrease returns at that company. Because such activity is likely to decrease aggregate portfolio return.

The future focus and impact of ACCR’s work will be heavily influenced by this paradigm shift (and the pushback against it) in process.

To illustrate I’ll give two examples. Divestment of fossil fuel intensive businesses often fails the universal owner test. Universal owners want actual GHG emissions genuinely cut not just owned by someone else but causing as much damage. In future ACCR will continue to focus on stewardship that results in genuine GHG emission cuts.

Company boards (directly or via trade associations or ‘revolving door’ postings) often seek to influence politics to enhance their company’s returns – to internalise profit and externalise cost. But their universal owner shareholders’ interests lie in a healthy democracy. In future ACCR will continue to focus on attempting to restrain corporate political activity that misuses shareholder funds for socially, environmentally or ‘body politic’ damaging purposes.

For getting ACCR to the point where we can think about the decade ahead, on behalf of the ACCR board, my thanks to our current Executive Director Brynn O’Brien, her predecessor Caroline Le Couteur, our staff, past board members, current and past research committee members and all our donors, grantors and ‘shareholder hub co-filer’ supporters.

Howard Pender

ACCR Convenor

Our work in focus

ACCR approaches ethical investing by applying a broader lens to traditional financial analysis. Our research includes external risk considerations, economic trends, societal shifts and stakeholder engagement when looking at a company’s environmental sustainability, social impact and corporate governance (ESG). We believe a decarbonisation and emissions-led strategy will protect the long-term value of companies, be profoundly motivating for investors, and position us to work confidently in a changing world. ACCR uses sustained and escalating shareholder pressure to have an impact on company decision-making into the future.

1. Climate

We continue our strategic focus on the decarbonisation plans and lobbying footprints of the most carbon-intensive listed companies in Australia and over the last year have commenced engagements with some of the largest emitters in the world.

Forceful Stewardship

ACCR’s team collaborates with a broad range of stakeholders across the community and corporate sectors. Institutional investors are not only willing to work with us on forceful stewardship engagement, they have welcomed and appreciated ACCR’s strategy and negotiation skills, as well as our operational nous and agility.

- Following Rio Tinto’s lead, both BHP & South32 put its industry associations on notice over advocacy that is inconsistent with the Paris Agreement. By supporting ACCR’s lobbying resolutions, all three boards have committed to strengthen their review of industry association advocacy and suspend membership if their record of advocacy is at odds with the goals of the Paris Agreement. ACCR is encouraging companies to disclose more information in their industry association reviews. Investors need to see more than superficial alignment on top level messages of support for net zero and the Paris Agreement.

- We saw the growing engagement from institutional investors in the 43.71% support for our shareholder proposal to explosives and fertiliser giant, Incitec Pivot. It was our first resolution with the company in asking for stronger emissions targets. Incitec Pivot also agreed to give shareholders a ‘Say on Climate’ vote in 2022. The company must address the significant climate risk in its business.

- Rio Tinto, Santos and Woodside all provided their shareholders with a ‘Say on Climate’ advisory vote on their company climate transition plans in 2022. ACCR prepared analysis on the Rio Tinto and Woodside climate plans and engaged with their major shareholders to influence their voting. A record 37% of shareholders voted against the Santos plan and then a huge 49% of shareholders voted against the Woodside plan. These record results surpassed our expectations and have provided a critical leverage point to enforce board accountability on their climate response over the next 12 months.

- UK-listed Glencore, which has a significant coal mining presence in Australia, provided its shareholders with a ‘Say on Climate’ progress vote. After 94% support for its climate plan at Glencore’s 2021 AGM, ACCR’s analysis and advocacy exposed the company’s coal expansion agenda in Australia, resulting in 24% of shareholders voting against Glencore’s climate plan. Glencore is now required under the UK Corporate Governance code to engage with shareholders on its climate plan and publish an update on its findings by October.

- We filed a shareholder resolution asking Rio Tinto to exit industry associations that continue to advocate for the development of new and expanded coal mines. Following a negotiation with the company, we withdrew the resolution upon its commitment to cease membership of the Queensland Resources Council (QRC). Leaving associations like this is a major win as it decreases the funding base for their destructive lobbying. Rio Tinto remains a member of the Minerals Council of Australia (MCA) and ACCR was pleased that the MCA’s voice in the Federal Election was constrained. We will closely monitor the conduct of the MCA and the QRC as the new Australian government fine tunes its climate policy.

- ACCR has been campaigning for AGL, as Australia’s largest GHG emitter, to show better leadership on climate for four years. We called for board renewal two years ago. This year, we saw the rewards for those efforts - with AGL withdrawing the demerger proposal and the resignation of a number of the company’s directors. ACCR's shareholder community was critical to this long overdue outcome. We continue to monitor the company’s strategy review and board appointment processes.

- ACCR successfully facilitated the first institutional investor group-led climate resolution in Japan. Together with Man Group (the world's largest publicly traded hedge fund), HSBC AM and Amundi, we filed a “Paris aligned targets” resolution at one of the largest utilities in Japan, J-Power. The shareholder proposal was supported by leading proxy advisors ISS and Glass Lewis, and 26% of shareholders supported the resolution at the Company’s AGM in June, a very strong result which in many jurisdictions would be considered a shareholder revolt.

- ACCR also facilitated successful engagement with the Japanese steelmaker JFE. We were joined by Man Group and Nordic asset manager Storebrand. During the course of our engagement, the company committed to strengthen its climate targets.

At Storebrand, we believe partnership is the new leadership. Collaboration among investors will be key in order to achieve the Paris agreement. Therefore, it has been very rewarding collaborating with ACCR, a great facilitator and deeply knowledgeable partner for these collaborative engagements with companies. Through our constructive negotiations, the Japanese steel producer JFE, committed to strengthening the company’s climate governance and the credibility of its decarbonisation strategy. We look forward to a continued and mutually beneficial partnership with ACCR.

Senior Sustainability Analyst at Storebrand Asset

Media Highlights

- In the largest ever contested resolution in Australian corporate history, 55% of AGL shareholders voted for the company to adopt Paris-aligned climate targets in both of its demerged businesses.

- The Sydney Morning Herald featured our lead analyst, Alex Hillman, as a former Woodside senior executive working to debunk gas industry spin.

- Our work on Glencore and their underreporting of methane emissions made global news in the lead up to their AGM. Here we are in Bloomberg.

Global Climate Insights

Global Climate Insights publishes independent equities research, powered by ACCR. The research is deeply valued by both asset managers and civil society organisations in supporting their corporate engagement programs. GCI carbon forecasts have become the cornerstone for verifying corporate transition plans.

- Our two-part report on Royal Dutch Shell’s climate transition strategy was released in October 2021, comparing the carbon forecasts from the company's climate transition plan to a 1.5C temperature pathway. This was the first publicly available carbon forecast tied to Shell’s climate plans.

- We reviewed South Africa’s second largest emitter of GHG emissions, energy and chemical company Sasol’s (SOL) climate transition plan ahead of the ‘Say on Climate’ vote at its AGM in November 2021.

- In March, we released our initiation of coverage for BP. Providing investors with a clear view of BP’s emissions footprint from oil and gas sold which we estimate is at least ~2.5Gt C02e.

- Heading into the 2022 AGM season, we assessed the climate transition plans of the major oil and gas stocks we cover (BP and Shell) alongside a diverse set of peers (ExxonMobil, Equinor and TotalEnergies).

Media Highlights

- GCI Lead Analyst, Shu Ling Liauw featured on BBC News to discuss our findings on Royal Dutch Shell's emissions targets.

- Our Shell report, Sasol analysis & BP coverage generated significant media attention and all received global distribution through Bloomberg.

- Our carbon analyst Dimitri Lafleur co-authored a study finding fossil fuel companies that claim to be aligned with the Paris Agreement need to accelerate their transition plans. He was also featured in The Guardian commenting on whether LNG is really cleaner than coal.

Global Climate Insights

In 2021, we launched our company-focused climate analysis, research and insights to empower global institutional capital to transform corporates towards a safe climate.

The Aboriginal Heritage Action Alliance (AHAA) are a small group who oppose discriminatory Aboriginal Heritage Legislation in Western Australia & the subsequent destruction of sites & culture. Through James Fitzgerald & ACCR, we receive valuable insights into the resource sector & create wider awareness with shareholders. We draw on their advice for our future engagement strategies to dismantle the ongoing colonial resource extraction process. AHAA see this process as central to influencing government & the ‘awful legal’ that allows the destructive nature of mining in WA.

Co-founder, Aboriginal Heritage Action Alliance

3. Governance

The basic principles of corporate governance are accountability, transparency, fairness, responsibility and risk management. ACCR advocates for investors to use every tool in their toolkits when engaging with companies on ESG matters.

Super Votes

In September 2021, we released Super Votes, our analysis of the voting behaviour of Australia’s 50 largest superannuation funds across ESG resolutions.The superannuation industry holds $3.4 trillion in assets. Our report recommendations encouraged funds to demonstrate more active ownership. We highlight the importance of proxy voting and disclosure, with an aim to improve consistency in reporting across the industry.

Media Highlights

- ACCR was featured often in the news commenting on Russian oligarchs' profiteering from investments and connections to Australian listed companies, including this from David Crowe.

- Our climate litigation against Santos has received extensive coverage including this in The Guardian.

- We are regularly featured in articles about corporate accountability.

‘Greenwashing’ litigation

In August 2021, ACCR brought a case in the Federal Court, challenging claims made by oil and gas company Santos Ltd and alleging that Santos has engaged in misleading or deceptive conduct in potential contravention of both corporate and consumer law.

News of the case has received significant media attention in Australia and internationally. Thank you to our legal advisors, the Environmental Defenders Office. This case is ongoing.

Our ethical investor community

We share our stories, our successes and our struggles with an amazing group of shareholders who have signed-up their shares alongside us. It is a community that cares about the long-term value of their investments as well as the long term health of society and the planet, and supports our work to make a difference. Our community’s backing is essential to the impact we can make.If you own shares in ASX-listed companies or are considering getting more involved, please contact us or learn more about advocacy via our Shareholder Hub.

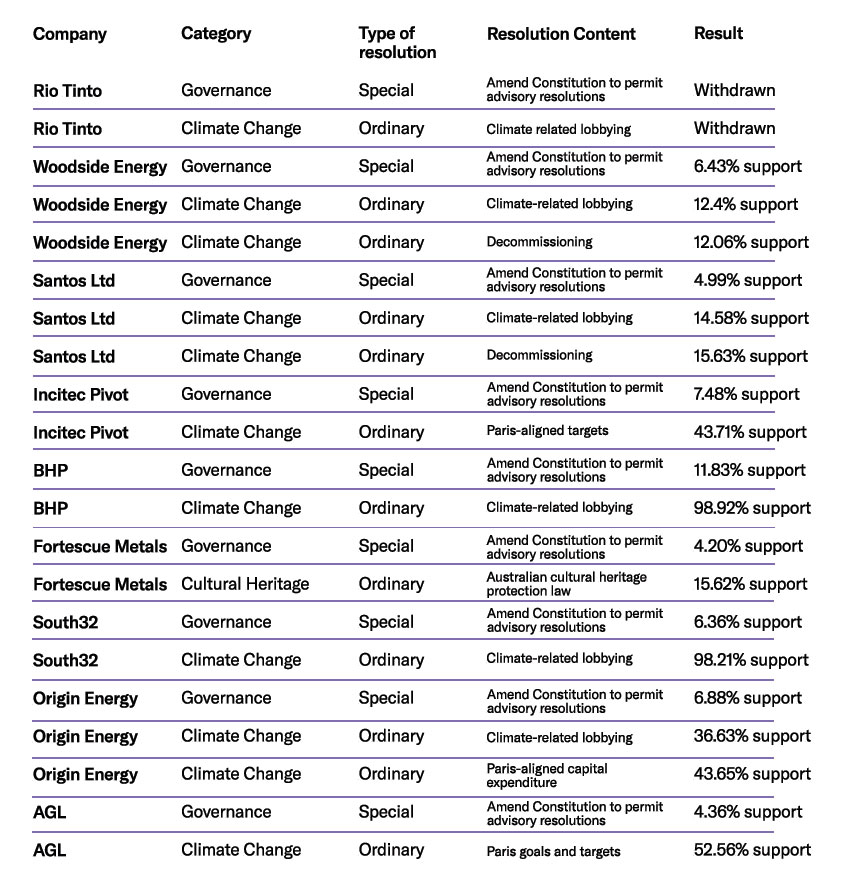

Holding corporations accountable in the absence of government leadership is one of the reasons ACCR was founded, and why shareholder action has a continuing vital role in our society. During FY22, ACCR filed 21 shareholder resolutions. "Filing a shareholder resolution creates a moment for the private views of major institutional shareholders but also retail investors to come out into the public and for that conversation to be had in a time-limited, powerful and direct way." Brynn O’Brien on The Business, ABC News

Media Highlights

- Our Executive Director, Brynn O’Brien talks about shareholder activism and effectiveness, in this article about AGL and the demerger. She also features in this fantastic look at the new era of Australian activism in Bloomberg.

Shareholder action and lobbying super funds is very effective at pushing corporations on big issues like climate change & social responsibility. Get involved with ACCR to help make a difference. My ASX shares help support AGM resolutions to effect positive change.

Scientist & ACCR Shareholder

You can also show support by:

- Registering new shareholdings or updating your existing ones on the shareholder hub - Keeping your information up-to-date ensures that the submission of resolutions remains a smooth process.

- Telling your family, friends and colleagues about us. Direct them to our website or social media, or tell them to get in contact with us. We welcome further support of any kind.

Resolutions brought in FY22

Ordinary Resolution

These resolutions cover general matters, such as the everyday running of the company and the appointment of auditors.

Special Resolution

A special resolution is for matters beyond the everyday. These include when the company wants to change its constitution. The Corporations Act 2001 (Cth) outlines the process for special resolutions. Note that the ‘result’ percentage given is the percentage of the proxies supporting the resolution whereas the figure for the special resolution is the percentage of all votes cast at the meeting. Under Australian law the ordinary resolutions are not formally put to the meeting.

Our People

Our Office Bearers

Brynn O’Brien Executive Director

Brynn has 15 years’ experience as a lawyer and strategist. She has worked as a consultant and advisor on business and human rights projects and practised as a corporations and international lawyer.

Howard Pender Convenor

Howard was awarded a university medal in Economics at the Australian National University. He worked at the Australian Treasury, an investment bank and was a Visiting Fellow at the Centre for International and Public Law at the Australian National University. He cofounded and was a Director of Australian Ethical Investment for 20 years until 2011. Howard was also a Director of 2 other ASX listed companies.

Rachel Etherington

Rachel has worked in sustainable investment for more than 15 years in the US, UK and Australia, particularly with family offices and those managing wealth intergenerationally. She is an Investment Adviser at Crestone Wealth Management and an active mentor of emerging female leaders.

John McKinnon

John was awarded a University Medal in Mathematics from ANU, has an MA in Biblical Studies and a PhD in Social Enterprise and development. He spent 17 years in the finance industry before joining overseas aid and development NGO, TEAR Australia, in 2005.

Armina Rosenberg

Armina is Portfolio Manager at Grok Ventures, the private investment firm of Mike Cannon-Brookes, one of the co-founders of software company Atlassian. Prior to Grok, she spent eight years at J.P. Morgan in the Equities Research Team covering Emerging Companies.

Adam Verwey

Adam is a founder of Future Super, Australia’s first 100% fossil fuel free super fund. He developed the super fund product and operations before leading the investment and impact/ ESG teams. Prior to founding Future Super he spent nine years at Australian Ethical Investment. He is currently a director at climate investing start up Bloom Impact.

Our Research Committee

Emeritus Professor Robert (Bob) Matheson Douglas AO MD

During his forty-year medical career, Bob Douglas worked as a general practitioner, a specialist physician, a researcher and a community medicine academic. Bob has received an Officer of the Order of Australia (AO) for his contributions to medicine.

Professor Marian Baird AO

Marian is one of Australia's leading researchers in the fields of women, work and care. She is currently the Chief Investigator on a number of significant research grants, including the Centre of Excellence on Population Ageing Research (CEPAR) and The Australian Women's Work Futures project, as well as Co- Coordinator of the International Network on Leave Policies & Research.

Dr Graeme Ivan Pearman, AM

From 1971 to 2004 Graeme worked at the CSIRO. Prior to his departure he was Director of the Division of Atmospheric Research. He was awarded the CSIRO Medal (1988), a United Nations' Environment Program Global 500 Award (1989), Australian Medal of the Order of Australia (1999) and a Federation Medal (2003).

Professor Marcia Langton AO

Professor Dr Marcia Langton AO, BA (Hons), ANU, PhD Macq. U, D. Litt. ANU, FASSA is the granddaughter of an Iman man and is proud of her Indigenous heritage. She has qualifications in anthropology and geography, and since 2000 has held the Foundation Chair of Australian Indigenous Studies at the University of Melbourne. Professor Langton is a Fellow of the Academy of Social Sciences in Australia, a Fellow of Trinity College, Melbourne and an Honorary Fellow of Emmanuel College at the University of Queensland.

Mr Julian Poulter

Julian sits on a range of international committees, advisory boards and councils relating to climate risk, sustainability and responsible investment. From 2008 to 2017 he was the Founder and Chief Executive Officer of the Asset Owners Disclosure Project (AODP).

Mr William Wu

William is an Investment Analyst and Investment Stewardship within Schroders’ Australian Equities team. He is the lecturer and co-author of Sustainable and Responsible Investing at the University of NSW. William has been awarded the 2021 Aspen Institute Ideas Worth Teaching Award, presented for his sustainable and responsible investing work. He holds a Bachelor of Commerce (Accounting and Finance Major) from UNSW.

With Howard Pender

I am excited to be a part of this committee. ACCR conducts research that supports real and significant change for climate action, for workers and for human rights. I look forward to playing a part in this work.

ACCR research committee

Our Key Contacts

Judy Mills Global Team Chief of Staff

Judy worked for over 20 years in investment banking, predominantly in equity and financial markets, working across Australasia, UK and Europe, and most recently with a fintech start up. She holds a Bachelor of Arts, Bachelor of Law (Hons) degree (University of Sydney) and is a graduate of the Australian Institute for Company Directors (AICD).

Elisabeth Baraka Chief Operations Officer

Elisabeth has over 20 years’ experience, as a lawyer and non-profit manager, having worked globally on business and human rights, rule of law development and using the law towards the Sustainable Development Goals. She holds a Bachelor of Arts (Hons in Psychology) /Bachelor of Laws (Hons) from the University of Sydney, and Master of International and Community Development from Deakin University.

James Fitzgerald Legal Counsel / First Nations Engagement Lead

James is a lawyer, negotiator and strategist for more than 28 years’ experience. James has been closely involved in the development of native title law and land use policy, and has worked with Indigenous peoples, governments and industry peak bodies in state and Commonwealth land use policy and legislation development. James is currently a director of the Diplomacy Training Program Ltd, a human rights training organisation, and is adjunct associate professor at the Law School of the University of NSW.

Harriet Kater Climate Lead

Harriet joined ACCR's national climate team in February 2021, bringing 18 years' experience in climate, energy and the NGO sector. She started her career working in a series of environmental NGOs and then worked for a decade with Energetics, consulting to ASX-listed clients in the oil and gas, mining, chemicals and retail industries on climate and energy strategies. Following Energetics, she worked with Indigenous Business Australia in a renewable energy portfolio management role.

Gemma Yeates Global Engagement Lead

Gemma is responsible for investor and company relationships. She has worked in financial markets for 15 years, in both investment banking (equity research sales) and funds management (investor relations and marketing). Gemma holds a Bachelor of Commerce and Bachelor of Business Management (University of Queensland) and a Business Sustainability Certificate from the Cambridge Institute of Sustainability Leadership (CISL).

Eva Kiriakoff Strategic Partnerships Lead

Eva has over 12 years’ experience in project design for complex environments. She has worked in Australia and globally in areas she is deeply passionate about - sustainable development, education, public health, human rights, and ethical business/social enterprise development. Eva holds a Master of Development Practice (International Political Development) and a Bachelor of Arts (Extended Major International Relations) from The University of Queensland.

Our Finances & Donations

The Australasian Centre for Corporate Responsibility (ACCR) is an association incorporated under the Associations Incorporation Act 1991 (ACT). We are registered as a charity with the Australian Charities and Not-for-profits Commission. Our Research Fund has Deductible Gift Recipient status so donations to ACCR’s Research Fund by Australians are tax-deductible.

ACT Association number: AO 5319.

ABN: 95 102 677 417.

ARBN: 648 883 194.

- By the end of the financial year, we had 23 (FTE 19.5) staff, a further increase from the 21 staff (FTE 16.5), we had at the end of FY2021.

- We are a member of the UN Principles for Responsible Investment and continue to report annually to it. We are also a member of the Responsible Investment Association of Australasia.

- ACCR has a portfolio of shares. These investments help to ensure we can be a sustainable organisation into the future.

Donations

We rely on grants and donations to fund our work. We have never received support from any listed companies or governments.

Thanks to our donors and funders - without you we could not exist. Those who supported us with funding of at least AUD50,000 this year include:

- Howard Pender

- Graeme Wood Foundation

- McKinnon Family Foundation

- The Sunrise Project

- ACME Foundation

- Laudes Foundation

- And more who wish to remain anonymous

With thanks to those who partner with us and provide us with in-kind support, such as pro bono legal advice, including Dechert, the Environmental Defenders Office, Equity Generation Lawyers, Hive Legal, MinterEllison and Sparke Helmore.

Fund our work

ACCR is an Approved Research Institute and donations to our Research Fund are tax deductible. Donations to support our other work are also very welcome!

Speak to us directly about your objectives and any opportunities for collaboration:

Eva Kiriakoff

eva.kiriakoff@accr.org.au

Join us as a shareholder

Register through our Shareholder Hub or contact us:

Contact us

Follow ACCR on social media

Have a question? Check out our FAQs or get in touch: office@accr.org.au

2. Social

Impacts

Major corporations should understand their social impacts and take into account the long-term interests of all stakeholders. A focus on these perspectives can preserve company value into the future.