Publication Rio Tinto Group Ltd/Plc Assessment of 2021 Climate Change Action Plan

Rio Tinto Group Ltd/Plc

(ISIN: AU000000RIO1/GB0007188757)

Assessment of 2021 Climate Change Action Plan

AGM date and location: 8 April (UK), 5 May (AU)

Summary

In March 2021, Rio Tinto announced that it would provide shareholders with an advisory vote on its 2021 Climate Change Report (a ‘Say on Climate’). The company has since clarified that this vote will be provided to shareholders every three years.

Step-change in ambition for Scope 1 & 2 targets and capital allocation

Rio Tinto has made impressive progress on its climate change commitments in the last year by committing to a 50% reduction in Scope 1 and 2 equity emissions by 2030 and committing US$7.5 billion to support meeting this target. Such ambition is extremely welcome.

3-yearly climate vote insufficient considering Scope 3 risks

Rio Tinto has not applied the same ambition to its Scope 3 emissions (95% of its total carbon footprint). Whilst there are understandable reasons why, the situation is not static. There is considerable momentum around steel decarbonisation technologies and opportunities. In addition, there are specific risks for Rio Tinto since Pilbara iron ore is incompatible with current green steel technologies. Investors should be demanding enhancements to Rio Tinto’s Scope 3 strategy over the next year. Waiting until 2025 for another vote on the climate change plan, midway through this critical decade for decarbonisation, is too late. As noted by Glass Lewis in its commentary on BHP’s three-yearly vote: “in a rapidly evolving landscape, three years is enough time for today’s standards and expectations to become obsolete”.[1]

Insufficient positive advocacy for climate policy

A key theme in Rio Tinto’s 2021 Climate Change Action Plan is the lack of Paris-aligned government policy, such as carbon pricing, to complement its decarbonisation commitments. This threatens Rio Tinto’s ability to meet its Scope 1 and 2 targets, and also undermines its efforts and options for managing Scope 3 emissions. There is insufficient evidence that Rio Tinto is advocating for the policy settings required to rapidly decarbonise and in fact, it remains a member of some of the most obstructive industry associations to climate policy in Australia and the United States.

Voting recommendation: FOR (subject to conditions)

In summary, Rio Tinto’s 2030 Scope 1 and 2 target, strategy and capital allocation commitments are significant and worthy of investor support. However such support should come with conditions:

- Rio Tinto should commit to an annual Say on Climate vote and present an enhanced Scope 3 plan in 2023, ideally with quantifiable targets and timelines.

- Rio Tinto should commit to significantly enhance its positive advocacy (direct and indirect) for Paris-aligned climate change policy in key jurisdictions and at an international level.

ACCR strongly encourages investors to advocate for these outcomes in their engagement with Rio Tinto prior to the AGM. Should Rio Tinto be unwilling to make these commitments, we recommend voting AGAINST.

1. Say on Climate: 1.5°C alignment is paramount

The 2018 Intergovernmental Panel on Climate Change (IPCC) Special Report[2] on the impacts of global warming at 1.5°C cemented the acceptance that “keeping 1.5°C alive”[3] must be prioritised over limiting warming to 2°C or below in all climate mitigation efforts.

The 2021 IPCC Sixth Assessment Report—described as the “code red for humanity”[4]—concluded that “we are at imminent risk of hitting 1.5°C in the near term” and that “the only way to prevent exceeding this threshold is by urgently stepping up our efforts and pursuing the most ambitious path.”[5]

The IPCC also emphasised that the 1.1°C of warming we have already experienced is increasing the frequency and intensity of extreme weather events.[6] Many attribution studies have found that major floods, fires and droughts in 2021 were either ‘virtually impossible’, ‘much more likely’ or ‘made worse’ due to climate change.[7]

The 2022 IPCC Working Group II Report on impacts and adaptation reinforced that if warming exceeds 1.5°C in the “coming decades or later, then many human and natural systems will face additional, severe risks, compared to remaining below 1.5°C”[8] and that “near-term actions that limit global warming to close to 1.5°C would substantially reduce projected losses and damages…compared to higher warming levels”.[9] The report concludes that:

“Any further delay in concerted anticipatory global action on adaptation and mitigation will miss a very brief and closing window of opportunity to secure a liveable and sustainable future for all”[10]

Consequently, ACCR strongly encourages investors to use alignment with the Paris Agreement, particularly the goal to limit warming to 1.5°C, as the primary measure to assess climate transition plans. Companies should not be rewarded for transparency or their ‘direction of travel’. We are in a critical decade for action and the time for incrementalism and gentle encouragement has passed.

2. Transition opportunities and challenges for Rio Tinto

In 2018, Rio Tinto divested the last of its coal assets, and in doing so, the company stated that it was “well positioned for the transition to a low-carbon economy”.[11] This divestment decreased Rio Tinto’s Scope 1 and 2 emissions footprint by ~41%.[12] However, no real climate outcomes were achieved as all of these coal assets are still producing and a number of the new owners have no climate change commitments at all.[13] It is questionable whether Rio Tinto could execute the same shift today, with the timing of this divestment predating a growing acceptance that divestment of fossil fuel assets can lead to adverse climate outcomes. It also occurred at a time when there were more willing buyers, thus avoiding the challenges that BHP is currently experiencing with its attempted disposal of coal mines like Mt Arthur.[14]

Importantly, the emissions produced from Rio Tinto’s remaining portfolio including bauxite, aluminium, copper and iron ore, and their respective value chains, vastly exceed those attributable to its former coal assets. It is acknowledged that Rio Tinto has materially increased its ambition to manage Scope 1 and 2 emissions, which is commended and analysed further below. The company is progressing plans to decarbonise its largest scope 1 and 2 emission sources, being electricity consumption, aluminium smelting and alumina refining. However, a major challenge for Rio Tinto is the absence of Paris-aligned climate policies in the key jurisdictions in which it operates, which are critical to meeting its 2030 and 2050 targets.

The other material challenge for Rio now is its colossal Scope 3 footprint, dominated by the processing of iron ore into steel. Similarly, it is heavily dependent on government policies to drive 1.5°C aligned decarbonisation of the steel sector.

3. Climate policy engagement

Rio Tinto remains a member of at least six industry associations with climate lobbying practices that are misaligned with the Paris Agreement, including the Minerals Council of Australia (MCA), the Queensland Resources Council (QRC) and the National Mining Association (US).[15] Recent examples of these industry associations pushing for plans that obstruct the goals of the Paris Agreement include:

- Throughout 2020-21, the QRC advocated for further expansion of the coal industry as part of the Queensland government’s Resource Industry Development Plan,[16] and recently claimed “Queensland coal mines should be the last coal mines closed in the world”.[17]

- In June 2021, the MCA published a report “Australian Export Thermal Coal: The Comparative Quality Advantages”,[18] that claimed Australian coal could “reduce emissions” in Asia by displacing other types of coal. More recently, the MCA criticised the Australian Labor Party’s plan to strengthen the Safeguard Mechanism,[19] claiming that reducing emissions should not come at the cost of international competitiveness.[20]

There are material opportunity costs to Rio Tinto from funding this advocacy. Effective, Paris-aligned climate policy is a critical enabler for the decarbonisation of economies and the companies operating within them, including Rio Tinto. There are frequent references to the need for carbon pricing to drive the decarbonisation of Rio Tinto’s Scope 1, 2 and 3 emissions in its 2021 Climate Change Report. For example:

“Our longer-term net zero analysis indicates that higher carbon prices than shown here are needed for projects that will address harder-to-abate emissions post-2030.” Climate Change Report 2021, p.19.

“We face continuing challenges to improve the commercial returns and overall readiness of many of our abatement projects. The commercial returns of abatement projects will also be influenced by the level of local carbon prices, which currently remain relatively low in many of the countries where we operate.” Climate Change Report 2021, p.19.

“Our portfolio is expected to perform more strongly in scenarios with proactive climate action.” Annual Results 2021, p.47.

With regard to steel decarbonisation: “The speed and scale of deployment of these new technologies will be dependent on technological breakthroughs, trends in capital intensity to close the cost gap with existing production methods, and government policies, including carbon prices.” Climate Change Report 2021, p.21.

Carbon pricing presents a significant opportunity to diversified miners such as Rio Tinto. Recently published research found that “carbon taxes have a negligible effect on the cost of mining raw metals and materials but will lift demand”.[21] The paper concluded that “most metals and mining industries have an economically vested interest in supporting international carbon taxation agreements”.[22]

In addition to its funding of destructive industry associations, Rio Tinto rarely advocates for the very policies it states are required to achieve its climate change commitments. Positive advocacy can come in both direct and indirect forms. Rio Tinto could advocate indirectly through industry associations such as the Business Council of Australia (BCA) and the International Council on Mining and Metals (ICMM). Alternatively, Rio Tinto could advocate directly by speaking publicly about the urgent need to act on climate change and the opportunities that a decarbonised economy presents.

Positively advocating for Paris-aligned climate policy is one of the most material actions that Rio Tinto could take in support of its own decarbonisation commitments and the urgent need to limit warming to 1.5°C.

4. Rio Tinto’s contribution to climate change

Rio Tinto is one of the largest emitters of greenhouse gases in the global mining sector and the largest in Australia.[23] This is primarily due to Rio Tinto’s significant Scope 3 emissions profile, of 553.5 MtCO2e in 2021, representing 95% of total emissions (see Figure 1). The processing of Rio Tinto’s iron ore represents 62% of total emissions and 66% of Scope 3 emissions.

Additionally, Rio Tinto has substantial Scope 1 and 2 emissions, the largest among its peers (see section 5 below), driven by emissions from alumina refining and aluminium smelting. In 2021, emissions produced from bauxite and alumina were 6.5 MtCO2e, representing 21% of Scope 1 and 2 emissions, and emissions produced from aluminium smelting were 15.4 MtCO2e, representing 50% of Scope 1 and 2 emissions.[24] Bauxite and alumina Scope 3 emissions were also material in 2021 at 114.5 MtCO2e, representing 25% of total emissions, primarily due to third parties processing aluminium with Rio Tinto-produced alumina.

Figure 1: Rio Tinto emissions by commodity, 2021 (MtCO2e)[25]

5. Rio Tinto’s short, medium, long-term climate targets

The following sections assess Rio Tinto’s short, medium and long term targets for its Scope 1, 2 and 3 emissions.

5.1 Rio Tinto’s performance against its short-term target

Rio Tinto’s short-term target is to reduce absolute equity emissions by 15% by 2025.[26] Following the divestment of the coal assets in 2017-18, Rio Tinto adjusted its target baseline from managed to equity emissions. Since 2018, Rio Tinto has reduced Scope 1 and 2 emissions by just 4.6% (see Figure 2). To reach its short-term target, Rio Tinto needs to reduce its Scope 1 and 2 emissions by a further 10.4% in the next 4 years, a reduction of at least 2.6% year-on-year. While it is likely the company will meet this target in 2025 due to increased renewable energy roll-out and ELYSIS reaching commercial maturity in 2024, it is concerning that emissions increased in 2020. When it comes to emissions reduction efforts, the trajectory and the target are equally important.

Figure 2: Rio Tinto Scope 1 and 2 equity emissions (2018-2021), emission targets for 2025 and 2030

5.2 Rio Tinto’s medium and long-term targets

Rio Tinto’s prior emissions targets were deemed incompatible with the goal of limiting warming to 1.5°C, according to the Transition Pathway Initiative (TPI) assessment for the Climate Action 100+ Net Zero Company Benchmark.[27] In late 2021, Rio Tinto significantly increased its ambition and updated its 2030 target, committing to reduce equity share Scope 1 & 2 emissions by 50% by 2030, which the company states is “aligned with efforts to limit warming to 1.5°C”.[28] ACCR welcomes these new targets, however, with the continued absence of a quantifiable Scope 3 emissions reduction target, it is highly likely that Rio Tinto’s targets will again be deemed incompatible with limiting warming to 1.5°C in the impending update to the Climate Action 100+ Net Zero Benchmark in March 2022.

Whilst Rio Tinto has no Scope 3 target, it has had quantifiable scope 3 goals for steelmaking and maritime shipping since 2020.[29] However, ACCR notes an apparent softening or redefining of the steelmaking Scope 3 goals in Rio Tinto’s 2021 Climate Change Report and the company’s intent is not entirely clear. Rio Tinto is also assessing various initiatives for Scope 3 emissions from steelmaking, which are discussed below in section 7. ACCR has not classed these as targets or goals, as they lack quantifiable reduction metrics and target timeframes.

Rio Tinto’s has brought forward by five years its medium-term goal for reducing its maritime shipping of products to reduce the emissions intensity of its chartered and time-chartered fleet by 40% by 2025. The company has the long-term goal of net zero emissions from shipping by 2050. In 2021, chartered shipping represented 0.9% of the company’s total Scope 3 emissions.

Table 1: Rio Tinto’s quantifiable medium- and long-term emission reduction targets and ambitions[30]

| 2030 | 2050 | |

|---|---|---|

| Scope 1 & 2 Target | Reduce absolute emissions by 50% by 2030 (2018 equity baseline, adjusted for divestments) | Net zero operational emissions by 2050 |

| Scope 3 Ambitions and Goals | Ambition to reduce emissions intensity of shipping by 40% by 2025 | Goal: net zero emissions from shipping[31] Rio Tinto products by 2050 |

NB: ambitions and goals are not firm commitments.

In 2021, Rio Tinto also set a commitment to reach net zero carbon emissions by 2050, in line with the majority of its peers in the sector. Whilst the company’s reference to “operational emissions” is somewhat confusing, it is ACCR’s understanding that this target also refers to the 2018 equity baseline. By way of comparison (see Table 2), Fortescue Metals Group has committed to reaching net zero operational emissions by 2030 and net zero Scope 3 emissions (including steelmaking) by 2040, primarily through the production (and ultimate end use) of green hydrogen.[32] Additionally, Glencore has committed to reducing its total emissions—Scope 1, 2 and 3—by 50% by 2035[33] and Anglo American has a net zero target for 2040, with an ambition to reduce its Scope 3 emissions by 50% in the same time period.[34]

Despite being the largest emitter of greenhouse gas emissions of its peers (see Figure 3), Rio Tinto’s Scope 3 goals lack the ambition of its peers. While ACCR commends the material increases of Rio Tinto’s short- and medium-term Scope 1 and 2 emissions targets, the company’s lack of a quantifiable roadmap to decarbonise its value chain emissions is concerning and is discussed further in Section 7 below.

Figure 3: Scope 1, 2 and 3 emissions for Rio Tinto and peers (Mt CO2e)[35]

Table 2: Quantifiable medium and long-term emission reduction targets of Rio Tinto and peers

| Company | Medium-term target | Long-term target | Scope 3 |

|---|---|---|---|

| Anglo American[36] | Reduce net emissions by 30% by 2030 (2016 baseline). Improve energy efficiency by 30% by 2030 (2016 baseline). | Net zero operational emissions by 2040. | Ambition to reduce Scope 3 emissions by 50% by 2040. |

| BHP Group[37] | Reduce operational emissions by at least 30% by 2030 (2020 baseline). | Net zero operational emissions by 2050. | 2030 goals: Support development of technologies capable of 30% reduction in integrated steelmaking; Support 40% emissions intensity reduction of BHP-chartered shipping. 2050 targets: Net zero by 2050 for operational GHG emissions of direct suppliers, subject to widespread availability of carbon neutral goods and services; Net zero by 2050 for GHG emissions from all shipping of BHP products, subject to the widespread availability of carbon neutral solutions. Goal of net zero Scope 3 emissions by 2050. |

| Fortescue Metals Group[38] | Net zero operational emissions by 2030 (2020 baseline). | Net zero operational emissions by 2030. | Net zero Scope 3 emissions by 2040. Reduce emissions intensity in shipping of FMG iron ore by 50% by 2030 (on 2021 levels). Reduce emissions intensity in steelmaking by FMG customers by 7.5% by 2030 (on 2021 levels). |

| Glencore[39] | 50% reduction of total (Scope 1, 2 and 3) emissions by 2035 (2019 baseline). | Ambition to achieve net zero for Scope 1, 2 and 3 emissions by the end of 2050. | 50% emissions reduction by 2035 (2019 baseline) and ambition of net zero Scope 3 emissions by end of 2050. |

| Rio Tinto[40] | Reduce absolute emissions by 50% by 2030 (2018 equity baseline, adjusted for divestments). | Net zero operational emissions by 2050. | Ambition to reduce the emissions intensity of shipping[41] by 40% by 2025; goal of net zero emissions from shipping Rio Tinto products by 2050. |

| Vale[42] | Reduce Scope 1 and 2 absolute emissions by 33% by 2030 (2017 baseline). Reduce Scope 3 emissions by 15% by 2035 (2018 baseline). | Net zero operational emissions by 2050. | Reduce Scope 3 emissions by 15% by 2035 (2018 baseline) Supporting a reduction in shipping emissions intensity by 40% by 2030 and 50% absolute emissions by 2050. |

6. Scope 1 & 2 Decarbonisation Strategy

6.1 Scope 1 and 2 medium-term target: 50% reduction by 2030

The three primary categories of abatement driving Rio Tinto’s 2030 Scope 1 & 2 decarbonisation strategy are discussed below. In addition, 9% of the target will be met via business-as-usual initiatives, which ACCR understands are already committed activities (see Figure 4).

Electricity decarbonisation: 39% of 2030 target

Considering renewable energy is readily deployable and the cheapest source of electricity generation, it is unsurprising that this is the first priority for Rio Tinto. In addition, electricity is a material emissions source for the company, constituting 45% of Scope 1 and 2 emissions in 2021.[43] The aluminium smelting process contributes 74.3% of Rio Tinto’s electricity emissions, due to the carbon intensity of electricity supplied to the Boyne and Tomago smelters in Australia. Rio Tinto has noted that its “group-wide consumption of electricity is about 4 times that of other global diversified mining majors”[44] and this is primarily due to the aluminium smelters.

Rio Tinto intends to reduce emissions from its electricity supply by developing repowering solutions for the Boyne and Tomago smelters and by “deploying solar and wind renewables at scale”[45], including the “rapid deployment”[46] of 1GW of renewables to support supply to Pilbara operations. At this stage, however, only 34MW of solar with a 45MWh battery has been approved for decarbonising the Pilbara operations, which is expected to come online this year.[47] Rio Tinto has also recently signed a Statement of Cooperation with the Queensland government to develop central Queensland into a sustainable industrial hub.[48]

In 2021, Rio Tinto approved 0.26 MtCO2e of new abatement projects, including small renewable projects at Weipa (4MW solar)[49], QIT Madagascar Minerals (20-year renewable PPA)[50] and Kennecott copper mine, in Utah (30MW)[51].

As these major renewable electricity projects develop, it will be important for Rio Tinto to clearly articulate its intended accounting method to track the electricity emissions reductions achieved for grid-connected facilities in Australia, such as the Tomago and Boyne aluminium smelters, due to the risks of double-counting when grid-average emissions factors are used.[52]

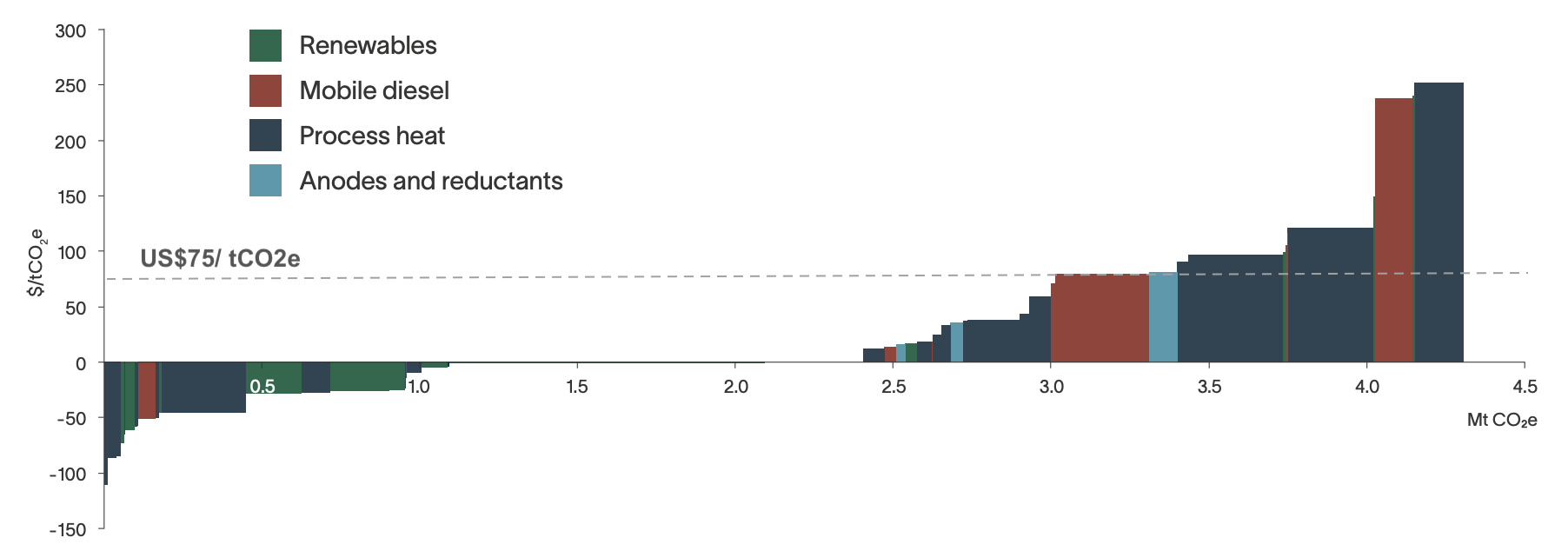

MACC projects: 27% of 2030 target

The second strategy underlying Rio Tinto’s Scope 1 and 2 decarbonisation plan to 2030 includes optimising processing plants in their alumina and minerals operations to reduce emissions from process heat, electrifying mobile fleets, and decarbonising anodes and reductants.[53] Details for these optimisation and emission reduction plans are limited, however, they form part of Rio Tinto’s abatement projects in their Marginal Abatement Cost (MAC) curve to 2030, which includes 63 projects with potential abatement of 4.3 MtCO2e (see Figure 4).[54] Notably, 44% (1.9 MtCO2e) of this abatement is NPV negative and ~30% is from projects that require further technology development.[55]

In assessing MAC and energy efficiency projects, Rio Tinto plans to use an internal carbon price of US$75/tCO2-e.[56] This will capture about half of the 1.9 MtCO2e that is NPV negative, leaving a material proportion of projects sitting above a cost of $75/tCO2-e. Whilst $75/tCO2-e is not an insignificant carbon price, Rio Tinto acknowledges it will not drive sufficient abatement to limit warming in line with the Paris Agreement.[57]

It is the absence of economy-wide, Paris-aligned carbon pricing and related policies to facilitate the transition that puts a material share of these projects out of reach and threatens Rio’s ability to meet its 2030 target. As mentioned previously, Rio Tinto stands to benefit significantly from carbon pricing policy. However, it is unclear what tangible steps the company is taking to advocate for such policy measures in the key jurisdictions in which it operates, particularly Australia where 60% of its equity scope 1 and 2 emissions are generated.[58]

Figure 4: Rio Tinto’s Marginal Abatement Cost (MAC) Curve for Scope 1 and 2 emissions abatement to 2030[59]

Other: 25% of 2030 target

The final pillar of Rio Tinto’s Scope 1 and 2 decarbonisation plan to 2030 includes:

- Increasing energy efficiency across operations (using the $75/tCO2-e carbon price)

- Deploying ELYSIS - Rio Tinto’s inert anode technology that will produce zero-carbon aluminium and is expected to reach commercial maturity in 2024; and

- The use of offsets.[60]

With regard to offsets, Rio Tinto states that “carbon offsets and removals are expected to form a limited part of our decarbonisation strategy,”[61] and further notes that offsets and removals “are at the bottom of the mitigation hierarchy.”[62] ACCR notes that the company is still developing a portfolio of carbon offset projects[63] and it is unclear what proportion of the 4.1 MtCO2e of abatement from “other” offsets comprise (see Figure 5). Without a firm cap on offset use, the climate benefits of Rio Tinto’s ambitious 2030 plan may be undermined. The Science-Based Targets Initiative’s (SBTi) Net Zero Standard states company investments in offsets “should be in addition to deep emissions cuts, not instead of them”.[64] Increasingly, offsets are being regarded as a tool for companies to address their historical emissions legacy,[65] not as a license for prolonged polluting.

Figure 5: Rio Tinto’s decarbonisation roadmap to 2030

6.2 Scope 1 and 2 long-term target: net zero by 2050

Rio Tinto’s long term target is to be “net zero by 2050 across our operations”.[66] Rio Tinto’s Scope 1 and 2 decarbonisation plan to 2050 is, for the most part, conceptual, with Rio noting that “although we have the outline of a broad pathway to net zero, we do not have all the solutions today.”[67] As it stands, Rio Tinto’s decarbonisation plan to 2050 includes continuing to decarbonise power, electrifying processes and mobile fleets, decarbonising anodes, reductants and process heat, as well as exploring new offset technology including CO2 mineralisation. Rio Tinto recognises that “higher carbon prices” than those in its current MAC curve, which reach a maximum of $250/tCO2-e, “are needed for projects that will address harder-to-abate emissions post-2030”[68]. This again demonstrates that companies such as Rio Tinto can only decarbonise so far without Paris-aligned government policy interventions and that advocacy for such interventions is very much in the interests of Rio Tinto and its shareholders.

7. Decarbonisation strategy - Scope 3

Rio Tinto does not have explicit, measurable targets covering its most material Scope 3 emissions in its value chain and is lagging its competitors on ambition. It is the only company out of its peers that is without a quantifiable target or goal within a defined time frame to reduce its most material Scope 3 emissions (see table 2). Notably, as a member of ICMM, Rio Tinto has committed to “set Scope 3 targets, if not by the end of 2023, as soon as possible.”[69]

Steel decarbonisation in particular presents a range of major risks and opportunities to Rio Tinto’s business and in this rapidly changing sector; what isn’t possible in 2022 may well be possible in 2023.

7.1 Decarbonisation of steelmaking

The steel industry is responsible for approximately 8% of current global anthropogenic CO2 emissions and it represents 62% of Rio Tinto’s total carbon footprint. An accelerated steel decarbonisation pathway is critical for keeping global temperatures from rising above 1.5°C. The steel sector’s emissions need to be reduced by at least 50% by 2030 and by 95% by 2050, on 2020 levels.[70] A 10-year delay in action results in an additional 20 GtCO2 being emitted from the steel industry between 2020 and 2050.[71] Meeting this budget is challenged by the persistently growing steel demand, which is expected to rise from 1.82 Gt steel in 2020 to 2.55 Gt steel in 2050.[72] Recent research has demonstrated that the steel industry faces $US47-70 billion in stranded asset risk for coal-fired blast furnaces under development, as these plants represent the most carbon-intensive method of producing steel with “limited, difficult and high-cost decarbonisation options”.[73]

However there is momentum towards green steel with a COP26 global commitment to establishing near-zero-emission steel making in every region by 2030.[74] Additionally, 80Mt of low-carbon steelmaking capacity is commissioned to go online before 2030,[75] and 113 announcements have been made in the last four years to build green steel capacity by 2030.[76] The first industrial-scale, hydrogen-based Direct Reduced Iron (DRI) plant is slated to be online in China in early 2022.[77] With appropriate ambition, intergovernmental collaboration, investment and policy support, this trend could be greatly accelerated.

ACCR recognises the challenges faced by diversified miners, particularly iron ore producers when it comes to Scope 3 reductions. These challenges are distinct from those of oil and gas producers who have direct control of their Scope 3 emissions. Until recently the steel sector has had limited options for decarbonisation and understandably there has been hesitancy from Rio Tinto about the setting of ambitious, absolute emissions targets for steelmaking. Rio Tinto rightly recognises that the company “has a role to play to support the development of technologies that can accelerate the transition of the steel sector towards net zero.”[78] The question is whether Rio Tinto, a major global mining company that achieved “record financial results”[79] in 2021, has identified all levers within its control to ensure the company is doing everything it can to influence the rapid decarbonisation of this sector.

Current customers and decarbonisation

Rio Tinto notes that close to 95% of its Scope 3 emissions are generated in countries that have carbon neutrality pledges. However such pledges are not guaranteed to be Paris-aligned. China buys 80% of Australian iron ore[80] and has a net zero by 2060 target, which has been deemed “poor” and consistent with warming levels of nearly 3°C by the end of the century[81]. Rio Tinto also stated that about 28% of the company’s iron ore sales are to steel producers that have set public targets for their operational emissions, with ambitions to reach net zero by “around mid-century.”[82]

Rio Tinto has committed to engage directly with iron ore customers that represent 75% of their sales and iron ore Scope 3 emissions.[83] Rio Tinto’s initiatives include partnerships with Baowu, Nippon Steel and POSCO to optimise the blast furnace process for use of various lump ores and pellets (see Table 3).[84] However, significantly, before 2030, 71%[85] of existing coal-based blast furnaces will require major reinvestment. Of critical importance is the decision to either reline the coal-based blast furnace capacity - thereby locking in coal for several decades - or to invest in low- or zero-carbon pathways, including electric arc furnaces (EAFs), which can be powered by renewable electricity. This presents a major opportunity for steelmakers and a key subject for engagement by Rio Tinto that would lead to superior climate outcomes to the optimisation of coal-based blast furnaces. This opportunity must be embraced urgently, to prohibit locking in coal and gas emissions from relined blast furnaces over the next several decades.

Table 3: Rio Tinto’s steel decarbonisation initiatives for current customers[86]

| Decarbonisation initiatives | Time frame and project stage | ACCR commentary | |

|---|---|---|---|

| Blast Furnace Optimisation | Partnerships with Baowu, Nippon Steel and POSCO that focus on blast furnace optimisation, and investigating the optimal use of lump ores and pellets. | No associated time frame for completion Participating in the funding of pilot plans and lab-scale testing | Given the upcoming opportunity to invest in green steel pathways, investing in blast furnace optimisation will not deliver the much-needed step change in steel emissions, given that coal will be locked in for several decades. |

Risks to Rio in steel decarbonisation: Pilbara ores

Iron ore generated 73.1% of Rio Tinto’s underlying EBITDA (US$37.6 billion) in 2021.[87] Additionally, 96.5% of Rio Tinto’s equity iron ore production occurs in the Pilbara, with the remaining 3.5% in Canada.[88] Rio Tinto is also pursuing the high-grade Simandou project in Guinea, with early development works expected to be carried out in 2022.[89] Simandou has been described as so huge, it could “completely displace Australian iron ore production tonne for tonne or pump so much additional supply into the market that prices would fall off a cliff”.[90] However there are geographical, political and reputational risks that will affect the pace and even probability of this project coming to fruition.[91]

Current green steel methods, including DRI-EAF, require high-grade ores (>65% iron, Fe) such as those found at Simandou. Yet, ores mined from the Pilbara region in Western Australia are generally haematites with low-grade iron (~54-66% Fe). For use in the DRI-EAF pathway, Australian ores, which have high levels of gangue,[92] are required to go through the additional process of beneficiation to remove impurities. Haematites are more costly to grind and require high-intensity magnetic separation. Magnetites, which are found in the Pilbara, mid-west regions of Western Australia and in South Australia[93], are a poorer grade of ore (30-35% Fe), however they are cheaper to grind, requiring only low-intensity magnetic separation. Therefore, the beneficiation process for magnetites can be more readily decarbonised through electrification due to its lower energy requirements. This may explain the increased appetite from Australian iron ore miners seeking to expand their magnetite capacity, including Fortescue Metals Group[94] and Hancock Prospecting,[95] noting there are ecological trade-offs with the mining of magnetite due to the larger mining footprint. Rio Tinto has instead continued to invest in haematites, expanding production in the Pilbara with key projects including Western Range, Bedded Hill Top, Hope Downs 2 and Brockman Syncline 1 to be delivered between 2025-27.[96]

The current decarbonisation options for steel introduce a threat not just to Rio Tinto’s Pilbara ore production, but to the Australian economy as a whole.[97] This is compounded by China signalling its intention to reduce dependency on iron ore imports from Australia.[98] This explains the focus of many of Rio Tinto’s steel decarbonisation initiatives (see Table 3), which are lacking in specific timeframes at a minimum. Considering the near-existential risk that steel decarbonisation presents to Pilbara iron ore, and the rapidly evolving technology landscape, investors would be well placed to push for more granular, annual updates on initiatives and targets for Rio Tinto’s steel decarbonisation strategy.

Table 4: Rio Tinto’s steel decarbonisation initiatives for ‘Green’ steel[99]

| Scope 3 initiatives | Time frame and project stage | ACCR commentary | |

|---|---|---|---|

| Pilbara beneficiation | Partnership with the Australian National University and Rio’s in-house Bundoora Technical Development Centre. Rio Tinto’s goal is to explore how much upgrading of the ore can be done effectively prior to metallurgical processing. | No associated time frame for completion Planning stage | ACCR welcomes this initiative. It is critical that Rio Tinto prioritise the accelerated development of a carbon-free beneficiation process that would allow Pilbara ores to be used in zero carbon steel pathways. |

| Low-carbon research project | Partnership with the University of Nottingham. Rio Tinto’s goal is to develop a carbon-neutral pathway to process Pilbara ores using microwave energy and biomass as a reductant. | No associated time frame for completion Planning stage | Research has found that reliance upon biomass resources presents supply chain uncertainty such as access to land, yield and impacts on biodiversity.[100],[101] |

| Pilbara H2 DRI and melter | Partnership with BlueScope. This project aims to investigate the use of green hydrogen directly reducing Pilbara ores, using an intermediary electric melter to remove impurities so that the product can be processed in an electric arc furnace. | No associated time frame for completion Planning stage | It is essential that Rio Tinto and its peers expedite pathways for zero carbon steelmaking using Pilbara ores. |

| Canadian ore | Engagement with direct reduction technology providers, hydrogen producers and the Governments of Canada and Quebec to produce hot briquetted iron (HBI), a premium form of DRI, that is more easily transported. | No associated time frame for completion Planning stage | ACCR acknowledges the high-grade ore from Iron Ore Company of Canada (IOC) is readily processed with existing green iron and steel technologies. ACCR notes however that IOC ore makes up 3.5% of Rio Tinto’s production (in 2021) and there is an unmet need for steel producers to build EAF capacity, which Rio Tinto could advocate for through customer and government engagement. |

| Simandou ore | Rio Tinto is pursuing the Simandou project in a joint venture with the Government of Guinea and Chalco Iron Ore Holdings (Chinalco and Baowu). The ore deposits at Simandou are high grade, which can already meet DRI specifications. | No associated time frame Early works and stakeholder engagement | Simandou ore is high grade (66.8% Fe) and readily deployable in existing green steel technologies, noting the major geographical, political and reputational risks associated with the probability and speed of this project coming to fruition. |

Rio Tinto’s influence on policy and government

Steel is a globally traded commodity that will require international cooperation among governments, civil society, and industry to accelerate the decarbonisation of the sector in line with the Paris Agreement and limit global warming to 1.5°C. While all stakeholders play a vital role in this strategy, there is a critical need for immediate government intervention to decarbonise steel. Governments need to provide a regulatory framework by creating policies to establish green steel markets, increase investment and create subsidies, build the necessary hydrogen supply and infrastructure, develop certification schemes for green steel, and deploy and scale-up green steel projects.[102],[103] Importantly, given the majority of existing steel mills are unlikely to convert from coal-based furnaces to renewable energy carriers, many furnaces will be required to decommission, in some cases before the end of their technical life. Policymakers should, early on, facilitate dialogues for a just transition of workforces and communities.[104]

Australian iron ore producers are at significant risk if they move too slowly, much in the same way utilities have been caught out by the switch to renewables: as noted by Bloomberg New Energy Finance “Australian companies will need to take the lead to shape the future of the industry in their favour, or risk it evolving in a way that deals them out”.[105] Recent research suggests that when steel and mining companies and governments work closely together, countries and industries are in a better position to unlock their full export potential.[106]

Rio Tinto’s internal analysis states that “our portfolio is expected to perform more strongly in scenarios with proactive carbon action.”[107] ‘Proactive’ climate action policies are therefore in the direct commercial interest of Rio Tinto, yet the company is not using its influence and reach to enable the implementation of such policies. Rio Tinto is, in effect, undermining the steel decarbonisation process through its membership of the MCA and the QRC, which are too dominated by coal interests to advocate for steel decarbonisation pathways and ‘proactive’ climate change policies, more generally.

Rio Tinto is demonstratively lagging behind its peers in setting emissions reductions targets for its most material Scope 3 exposure and has recognised that in order to reduce these emissions, the “speed and scale of deployment of these new technologies will be dependent on technological breakthroughs, trends in capital intensity to close the cost gap with existing production methods, and government policies, including carbon prices.”[108]

Consequently, a major gap in Rio Tinto’s steel strategy is disclosure and commitments relating to how the company is working with governments to expedite the policy settings that are needed to facilitate the development of a green steel or iron industry in Australia and internationally.

8. Capital allocation

Rio Tinto has committed to aligning its capital expenditure plans with its long-term carbon emissions reduction targets and the objectives of the Paris Agreement.[109] In line with this commitment, Rio Tinto recently announced that it will invest an estimated US$7.5 billion in direct capital expenditure for the decarbonisation of the company’s assets from 2022 to 2030.[110] This includes commitments to spend US$50 million on iron and steel decarbonisation initiatives in 2022, and incremental operational expenditures, including R&D, to support the Climate Action Plan with approximately US$200m per year.[111] The US$7.5 billion in capex is also slated to fund the full decarbonisation of the Pilbara electricity system, and the initial deployment of ELYSIS and other abatement projects. Notably, Rio Tinto has not disclosed how much it has allocated to spend on the aforementioned projects.

While in the short-term, Rio Tinto seems to have a fairly clear picture of how it will allocate this capital, CFO Peter Cunningham recently stated that a “conceptual roadmap”[112] guides how the money will be spent in the second half of the decade.

The table below provides detail on the capital that Rio Tinto and its peers are allocating to the climate transition (see Table 5). Rio Tinto is leading its peers with elevated ambition and capital allocated to fund their decarbonisation strategy to 2030. In addition, Rio Tinto also has the largest internal shadow carbon price of its peers. However, as mentioned previously, this carbon price is still not sufficient enough to align with limiting global warming to 1.5°C, nor is it high enough to justify a number of the company’s MAC projects.

Table 5. Peer analysis on climate investments

| Company | Climate investments |

|---|---|

| Anglo American[113] | US$108 million investment to develop technology to capture SO2 from its Polokwane platinum smelter in South Africa. |

| BHP Group[114] | US$400 million Climate Investment Program (CIP) over 5 years (announced July 2019); has internal shadow carbon pricing, amount not disclosed. |

| Fortescue Metals Group[115] | Allocation of 10% net profit after tax (NPAT) to fund Fortescue Future Industries (FFI). The FY2021 allocation to FFI was US$1 billion, with expenditure of US$122 million. FY2022 expenditure is expected to be US$400-600 million; internal shadow carbon price between A$25-80/ tCO2e. |

| Glencore[116] | Glencore has not disclosed a budget for investment in climate solutions, however, has committed to “align capital allocation discipline with the goals of the Paris Agreement” through prioritising investment of transition metals. |

| Rio Tinto[117] | US$7.5 billion direct capital expenditure for decarbonisation of Rio Tinto’s assets from 2022 to 2030 (announced Oct 2021), internal shadow carbon price US$75/ tCO2e. |

| Vale[118] | $US4-6 billion investment by 2030 for GHG reduction and internal shadow carbon price of $US 50/tCO2e for all capital allocation decisions. |

9. Climate governance

Rio Tinto’s approach to climate change governance is appropriately structured however the quantum of the climate component within executive remuneration may not be sufficient to incentivise robust climate performance. This is discussed further below.

Climate change accountability

Rio Tinto’s Board is responsible for approving the overall climate change strategy, policy positions and the Climate Change Report. Furthermore, the Board is charged with setting the short-, medium- and long-term emissions targets and monitors performance against them. The Chair of the Board is ultimately responsible for the Group’s overall approach to climate change, with the Chief Executive responsible for delivering the strategy.

Climate competence of board

While the assessment of the climate competency of any board is challenging, Rio Tinto has disclosed a Board ‘skills and experience matrix’ in its annual report. This assesses the Board’s competencies for knowledge and experience of climate-related threats and opportunities including climate science, low carbon transition and public policy. To be counted as competent in ‘climate change’ as an area of expertise, a Board member needs only meet one of these criteria. Rio Tinto has noted that just six directors met one or more of these criteria in 2021, although the identities of these board members are not disclosed. This suggests that the Rio Tinto board should consider appointing directors with these skills when vacancies next arise.

Remuneration

In terms of remuneration, climate change forms 5% of the Short Term Incentive Plan (STIP), which relates to the progress of two climate change performance objectives.[119],[120] In 2021, the first objective was to approve 0.22 MtCO2e of abatement projects to progress the company’s Scope 1 and 2 targets. The second objective was to deliver progress on Scope 3 partnership strategies. In summarising the 2021 performance under the STIP, Rio Tinto stated that it “took important foundational steps to advance towards our ambitious climate change targets by approving abatement projects and progress(sic) our Scope 3 strategy.”[121] ACCR argues that the STIP does not incentivise ambitious climate change performance. By lacking links to specific, quantifiable emissions reduction targets, Rio Tinto risks rewarding incremental progress rather than incentivising the accelerated change required in the decade to 2030.

10. Conclusion

To conclude, Rio Tinto’s 2030 Scope 1 and 2 target, strategy and capital allocation commitments are significant and worthy of investor support. However such support should come with conditions:

- Rio Tinto should commit to an annual Say on Climate vote and present an enhanced Scope 3 plan in 2023, ideally with quantifiable targets and timelines.

- Rio Tinto should commit to significantly enhance its positive advocacy (direct and indirect) for Paris-aligned climate change policy in key jurisdictions and at an international level.

ACCR strongly encourages investors to advocate for these outcomes in their engagement with Rio Tinto prior to the AGM. Should Rio Tinto be unwilling to make these commitments, we recommend voting AGAINST.

Contacts

Dan Gocher | Director of Climate and Environment | dan@accr.org.au

Harriet Kater | Climate Lead - Australia | harriet.kater@accr.org.au

Please read the terms and conditions attached to the use of this site.

Glass Lewis, “Glass Lewis raises concerns over BHP’s Climate Transition Action Plan”, 4 Oct 2021, link ↩︎

IPCC, Global Warming of 1.5°C: Headline statements for policymakers, link\ ↩︎

UNFCCC, “UN Secretary General: COP26 must keep 1,5 degrees celsius goal alive”, link\ ↩︎

United Nations, “Secretary-General calls latest IPCC climate report ‘code red for humanity’, stressing ‘irrefutable’ evidence of human influence’, press release, 9 August 2021, link\ ↩︎

ibid. ↩︎

ibid. ↩︎

Zero Carbon Analytics, “IPCC Sixth Assessment Report: Impacts, adaptation and vulnerability”, Feb 2022, Link\ ↩︎

IPCC, Climate Change 2022: Impacts, Adaptation, Vulnerability. Summary for Policymakers, 27 Feb 2022, link\ ↩︎

ibid. ↩︎

ibid. ↩︎

Rio Tinto, “Climate Change Report 2020,” link ↩︎

On a managed basis, Rio Tinto Sustainability Fact Book 2021 ↩︎

Company reports for Glencore, Yancoal, EMR Capital and Adaro Energy Tbk, TerraCom, New Hope Corporation, MACH Energy Australia. ↩︎

SMH, “‘Negative Value’: BHP struggles to offload NSW’s biggest coal pit”, August 2021, link\ ↩︎

InfluenceMap, Australian Industry Association assessment, link\ ↩︎

Queensland Resources Council, “Resources sector ready to get down to business on industry development plan”, 22 March 2021, link ↩︎

Queensland Resources Council, “Qld’s high quality coal industry here for the long haul: QRC”, 19 November 2021, link ↩︎

Minerals Council of Australia, “Reducing emissions & powering jobs with Australian thermal coal”, 10 June 2021, link ↩︎

Minerals Council of Australia, “MCA supports maintaining international competitiveness as Aus heads towards net zero,” 3 Dec 2021, link. ↩︎

ibid. ↩︎

Cox, B., Innis, S., Kunz, N.C. et al. 2022. The mining industry as a net beneficiary of a global tax on carbon emissions. Commun Earth Environ 3, 17. https://doi.org/10.1038/s43247-022-00346-4 ↩︎

ibid. ↩︎

Joe Aston “Rio Tinto Australia’s biggest mining emitter,” 15 April 2020, The Australia Financial Review, link ↩︎

Rio Tinto, Sustainability Fact Book, 2021 ↩︎

Note: In 2021, Rio Tinto aggregated Scope 1 and 2 equity emissions in its reporting suite. ↩︎

Rio Tinto, “Rio Tinto to strengthen performance, decarbonise and grow,” 20 October 2021, link ↩︎

Climate Action 100+, Net Zero Company Benchmark – Rio Tinto, March 2021, link ↩︎

Rio Tinto, Climate Change Report 2021, link ↩︎

Rio Tinto, Our Approach to Climate Change, 2020, pp. 36-37, link. ↩︎

Rio Tinto, “Rio Tinto to strengthen performance, decarbonise and grow,” 20 October 2021, link; Rio Tinto, Investor seminar – Performance, strategic direction and shareholder returns, 20 Oct 2021, link. ↩︎

From Rio Tinto's own and time-chartered fleet. ↩︎

Fortescue Metals Group, “Fortescue announces target to achieve net zero Scope 3 emissions”, 5 Oct 2021, link ↩︎

Glencore, Climate Change webpage, link ↩︎

Anglo American, “Anglo American sets to halve Scope 3 emissions by 2040,” 29 Oct 2021, link ↩︎

Source: Respective company sustainability reports, latest available operational emissions. ↩︎

Anglo American, “Anglo American sets to halve Scope 3 emissions by 2040,” 29 Oct 2021, link ↩︎

BHP, Climate Transition Action Plan 2021, link. ↩︎

Fortescue Metals Group, FY21 Full Year Results, 30 Aug 2021, link ↩︎

Glencore, Pathway to Net Zero 2021, link. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link. ↩︎

From Rio Tinto own and time-chartered fleet. ↩︎

Vale, Climate Change Report 2021, link. ↩︎

Rio Tinto, Sustainability Fact Book, 2021 ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link, p.10. ↩︎

ibid, p.16. ↩︎

ibid, p.18. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, p.18. ↩︎

Rio Tinto, “Central Queensland leads the way in clean energy,” 12 Oct 2021, link. ↩︎

Rio Tinto, “Rio Tinto to triple Weipa solar capacity and add battery storage to help power operations,” 19 Sept 2021, link. ↩︎

Rio Tinto, “Rio Tinto QMM launches contrstruction of its renewable energy project,” 10 Dec 2021, link. ↩︎

Rio Tinto, Strategic Report 2021, link, p. 56. ↩︎

Climate Active, Electricity Accounting, April 2021, link. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link p.16. ↩︎

ibid, p.19. ↩︎

ibid. ↩︎

ibid. ↩︎

Rio Tinto, Annual Results 2021, link, p.47. ↩︎

Rio Tinto, Sustainability Fact Book 2021, link. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link p.19. ↩︎

ibid, p.16. ↩︎

ibid, p.10 ↩︎

ibid, p. 20. ↩︎

ibid. ↩︎

Science Based Target Iniative (SBTi), The Net Zero Standard, 2021, link.\ ↩︎

UNFCC, “Microsoft: Carbon Negative Goal”, 2020 link; George Monbiot, “Carbon offsetting is not warding off environmental collapse - it’s accelerating it”, The Guardian, 26 Jan 2022, link.\ ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link, p.19. ↩︎

ibid, p.20. ↩︎

ibid, p.19. ↩︎

ICMM, Our commitment to a goal of net zero by 2050 or sooner, 2021, link ↩︎

Sha Yu, et al. 2021. 1.5°C Steel: Decarbonizing the steel sector in Paris-compatible pathways, E3G, link, p.3. ↩︎

ibid. ↩︎

Yonggi Sun, et al. 2022. Decarbonising the iron and steel sector for a 2°C target using inherent waste streams. Nature Comms, 13, 297, link. ↩︎

Global Energy Monitor, “Pedal to the metal 2021,” June 2021, link, p. 3. ↩︎

UN Climate Change Conference UK 2021, “COP26 world leaders summit-statement on the breakthrough agenda,” 2 Nov 2021, link. ↩︎

Agora Industries, Global steel at a crossroads, link, Nov 2021, p. 8. ↩︎

Agora Industries, Global Steel Transformation Tracker, last updated 28 Feb 2022.\ ↩︎

Agora Industries, Global steel at a crossroads, link, Nov 2021 p. 9. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link, p.23. ↩︎

Rio Tinto, Full Year Results 2021, link, p.1. ↩︎

Department of Industry, Resources and Energy Quarterly, December 2021, link. ↩︎

Climate Action Tracker, China profile, November 2021, link ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link, p.16. ↩︎

ibid. ↩︎

ibid, p.24. ↩︎

Agora Industries, Global steel at a crossroads, Nov 2021, p.6. ↩︎

Based on Rio Tinto’s table in their report, Our Approach to Climate Change 2021, p. 24. ↩︎

Rio Tinto, Full Year Results 2021, link, p.19. ↩︎

Rio Tinto, Annual Report 2021, link, p. 356. ↩︎

Rio Tinto, Strategic Report, link, p. 34. ↩︎

Ben Graham, Mega mining project that could cripple Australia, News.com, 18 June 2021, link. ↩︎

Reuters, Timeline: The battle for Simandou”, January 2021, link\ ↩︎

The commercially valueless material in which ore is found. ↩︎

Geoscience Australia, Iron ore, accessed from link on 3 March 2022. ↩︎

In Jan 2022, FMG and Sinosteel signed an MOU to assess and acquire up to 50% of the Midwest Magnetite project in WA, see link. ↩︎

In Nov 2021, Hancock Prospecting through its wholly-owned subsidiary, Hancock Magnetite, acquired 30% interest in the Mt Bevan project in the Central Yilgarn region of WA, see link. ↩︎

Rio Tinto, Strategic Report 2021, link, p. 41. ↩︎

Peter Hannam, “Global push for green steel could hit Australia’s $150bn iron ore exports if miners don’t adapt, report finds”, The Guardian, Dec 2021, link.\ ↩︎

Michael Smith, “China’s plan to end its Australian iron ore dependency,” 2 Dec 2021, Australian Financial Review, link. ↩︎

Based on Rio Tinto’s table in their report, Our Approach to Climate Change 2021, p. 24. ↩︎

Alexandra Devlin & Aidong Yang, 2022, Regional supply chains for decarbonising steel: Energy efficiency and green premium mitigation, Energy Conversion and Management, 254, 1-13. ↩︎

Jamie Speirs, Christope McGlade & Raphael Slade, 2015, Uncertainty in the availability of natural resources: Fossil fuels, critical metals and biomass, Energy Policy, 87, 654-644. ↩︎

Agora Industries, Global steel at a crossroads, Nov 2021, p.19. ↩︎

Leadership Group for Industry Transition (LeadIT), “Green steel production: How G7 countries can help change the global landscape, 10 June 2021, link. ↩︎

Valentin Vogl, Olle Olsson & Bjorn Nykvist, 2021, Phasing out the blast furnace to meet global climate targets, Joule, 5 2645-2662. ↩︎

Peter Hannam, “Global push for green steel could hit Australia’s $150bn iron ore exports if miners don’t adapt, report finds”, The Guardian, December 2021, link.\ ↩︎

Agora Industries, Global steel at a crossroads: why the global steel sector needs to invest in climate-neutral technologies in the 2020s, Nov 2021, p.27.\ ↩︎

Rio Tinto, Annual Results 2021, link, p. 47. ↩︎

Rio Tinto, Rio Tinto, Our Approach to Climate Change 2021, link, p.21. ↩︎

ibid, p.26.\ ↩︎

Rio Tinto, Investor Seminar, 20 Oct 2021, link. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, p. 26. ↩︎

Rio Tinto, Investor Seminar 2021, Q&A 2, link, p.9. ↩︎

Anglo American, Sustainability Report 2020, link, p. 61. ↩︎

BHP, Climate Transition Action Plan 2021, link, p. 10. ↩︎

Fortescue Metals Group, FY21 Full Year Results, 30 Aug 2021, link, p.2. ↩︎

Glencore, Climate change, link, p.24-25. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link, p. 26. ↩︎

Vale, Climate Change Report 202, link, p. 8. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link, p. 28. ↩︎

Rio Tinto, Annual Report 2021, link, p. 177. ↩︎

Ibid. ↩︎