Publication AGL Energy Demerger

EGM date: Wednesday 15 June, 2022

Contacts:

Dan Gocher, Director of Climate and Environment

Harriet Kater, Climate Lead, Australia

The Australasian Centre for Corporate Responsibility (ACCR) has engaged with AGL Energy (ASX:AGL) for several years about its approach to decarbonisation, air pollution and climate-related lobbying.

Following a prolonged period of poor share price performance, AGL plans to demerge into two companies, Accel Energy and AGL Australia. Shareholders will vote on the demerger at an extraordinary general meeting (EGM) on 15 June 2022. In order for it to proceed, the demerger must be approved by 75% of votes cast.

In 2021, ACCR’s shareholder resolution[1] to AGL Energy was supported by 54% of shareholders. It requested the company disclose for both demerged companies, within or alongside the demerger scheme documents:

- Short, medium and long-term emissions reduction targets aligned with the Paris Agreement;

- How capital expenditure for both demerged companies will align with the targets; and

- How remuneration policies for both demerged companies will incentivise progress against the targets.

The Demerger Scheme Booklet and the accompanying investor presentation do not satisfy the request of ACCR’s 2021 shareholder resolution. ACCR is opposed to the demerger for the following reasons:

- The board has failed to make a compelling argument that the demerger will result in a quicker energy transition, or that it is ultimately in the best interests of shareholders.

- Neither Accel Energy or AGL Australia will have emissions reduction targets aligned with the Paris Agreement:

a. Accel Energy’s interests in delaying the closure dates of its thermal generation assets will be further concentrated by the demerger.

b. AGL Australia’s Scope 3 emissions will be substantial, and while its targets are relatively ambitious, there is no plan to meet those targets. - The future for Accel Energy looks bleak, with an unambitious pipeline of clean energy investments, increasing costs of maintenance, insufficient rehabilitation provisions and its industrial customers decarbonising, while the market is flooded with renewables and flexible generation.

- The remuneration structures disclosed will not incentivise rapid emissions reductions in either Accel Energy or AGL Australia.

- The AGL board has a history of poor decision-making.

- The risk that climate-aware investors lose influence in Accel Energy, or that it’s taken private are too great.

ACCR will be voting AGAINST the demerger.

This briefing seeks to address some of the issues climate-aware investors should consider before voting on the demerger.

1. Proposed demerger

AGL announced in March 2021 that it would demerge into two entities: Accel Energy and AGL Australia.

Accel Energy will be comprised of:

- Thermal generation assets: Liddell, Bayswater, Loy Yang A and Torrens Island

- Operation and offtake from 1GW of wind energy

- Major industrial customer contracts, including those with aluminium smelters in NSW and Victoria, and an offtake agreement with AGL Australia until 2027.

- Investment in RayGen Solar Generation and Thermal Storage.

- A minority interest of 15% in AGL Australia.

AGL Australia will be comprised of: - AGL’s 4.5 million retail customers across electricity, gas, broadband and other services.

- Ownership and operation of the hydro and gas peaking plants, battery assets, and the electricity and gas trading business.

- Wind and solar offtakes with Tilt Renewables and an offtake agreement with Accel Energy until 2027.

- Investments in Tilt Renewables (20%) and ActewAGL (50% of retail).

2. Emissions reduction targets

2.1 Accel Energy

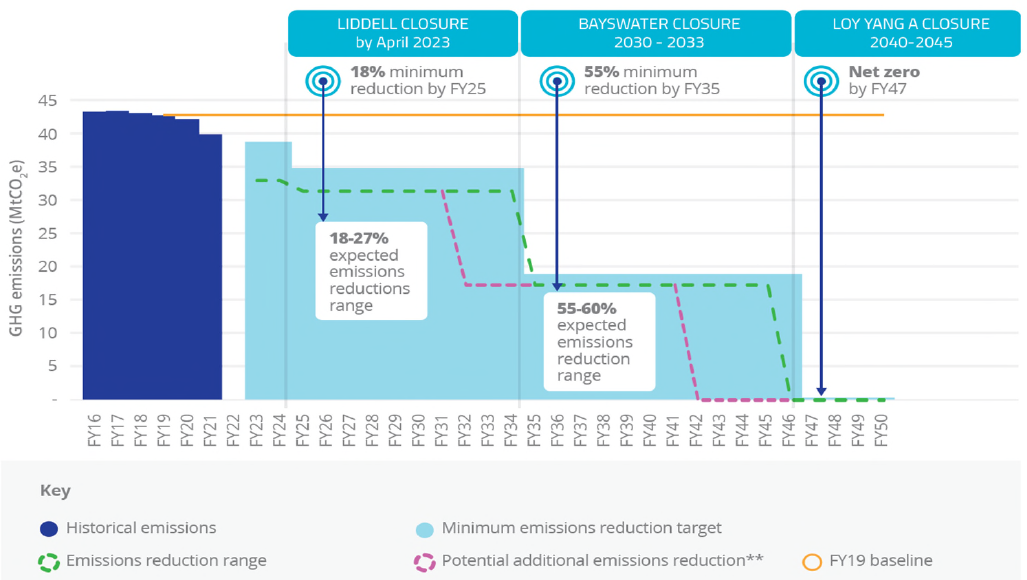

The Demerger Scheme Booklet outlines the following targets for Accel Energy:[2]

- Short-term: Reduce operational emissions by 18% by FY25 (FY19 baseline)

- Medium-term: Reduce operational emissions by 55% by FY35 (FY19 baseline)

- Long-term: Net zero operational emissions by FY47

The Demerger Scheme Booklet states that Accel Energy’s climate “commitments are not aligned to the goals of the Paris Agreement as at the date of the Scheme Booklet”.[3]

Given that Accel Energy will take control of the vast majority of AGL’s operational emissions, its lack of Paris-aligned targets poses a material risk for all investors. Accel Energy’s operational emissions will be approximately 40 million tonnes CO2e in FY23.

AGL disclosed the following chart[4] reflecting the closure dates of Liddell, Bayswater and Loy Yang A in 2022-23, 2030-35 and 2040-45, respectively.

Chart 1. Accel Energy forecasted GHG emissions to 2050

Source: AGL Energy

The need to phase-out coal-fired power generation is rapidly intensifying, especially in developed economies like Australia. According to the International Energy Agency’s Net Zero by 2050 (NZE) scenario, “unabated coal-fired generation is cut by 70% by 2030, including the phase-out of unabated coal in advanced economies, and phased out in all other regions by 2040”.[5]

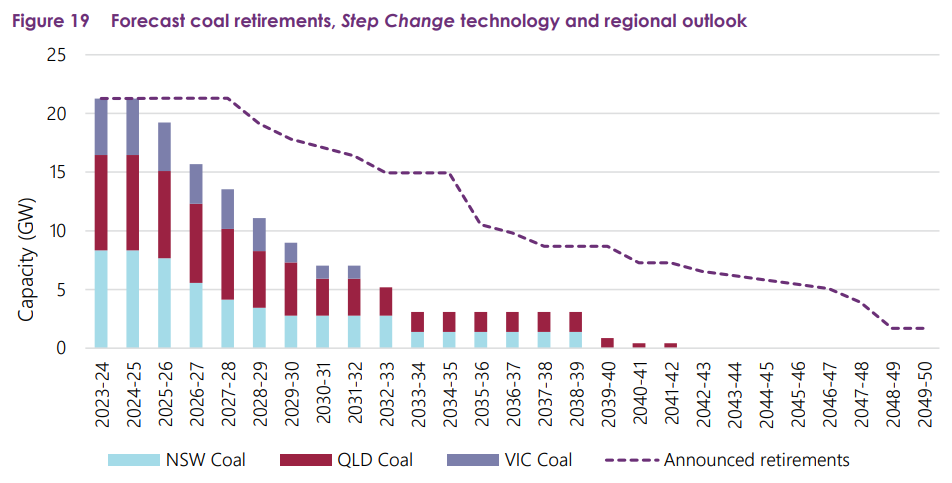

Proposed Accel Energy CEO Graeme Hunt recently claimed that replacing Bayswater and Loy Yang A with renewable energy and storage by 2030 was an “engineering impossibility”.[6] While this statement is reflective of AGL’s long-term underinvestment in clean energy, it is also at odds with the Australian Energy Market Operator’s (AEMO) “Step Change” scenario. AEMO modelled 14GW of the National Electricity Market’s current 23GW of coal generation closing by 2030, with only Queensland’s younger fleet remaining open into the early 2040s (see Chart 2).[7]

In February, proposed Accel Energy CEO Graeme Hunt claimed AEMO’s “Step Change” scenario was not “credible” and “difficult to envisage”, but admitted that the plan “forces the early closure of coal”.[8]

Accel Energy’s industrial customers are likely to pursue their own decarbonisation pathway before 2030. In order to retain those customers, Accel Energy will need to supply zero or very-low carbon electricity. AGL’s single largest customer—Tomago Aluminium—announced last year that it would source the vast majority of its electricity from renewable sources by 2029.[9] Tomago Aluminium is currently contracted to the Bayswater coal-fired power station until 2028, while the Alcoa smelter is currently contracted to Loy Yang A until 2026.

Chart 2. Forecast coal retirements, Step Change technology and regional outlook (AEMO)

Source: AEMO

The Demerger Scheme Booklet did not disclose estimates of Scope 3 emissions for either of the demerged entities. ACCR estimates that Accel Energy’s Scope 3 emissions will be 21.6 million tonnes in FY23, which are slightly lower than those disclosed by AGL in FY21,[10] due to the gas sales attributed to AGL Australia.

Table 1. Estimated Accel Energy Scope 3 emissions, FY23

| Source | MtCO2e |

|---|---|

| Supply of electricity to customers | 6.9 |

| Supply of natural gas to customers (52% of AGL Energy's gas sales) | 0.9 |

| End use of natural gas by customers (52% of AGL Energy's gas sales) | 3.5 |

| End use of coal sold to Loy Yang B | 9.9 |

| Other (travel, waste, investments) | 0.4 |

| Total | 21.6 |

Source: ACCR

Alinta, the owner and operator of Loy Yang B, intends to keep that plant open until 2047.

Accel Energy has not set a target to reduce its Scope 3 emissions.

2.2 AGL Australia

The Demerger Scheme Booklet outlines the following targets for AGL Australia:[11]

- Short-term: Carbon neutral operations immediately (using offsets)

- Medium-term: Reduce emissions by 50% by FY30 (Scopes 1, 2 & 3, FY19 baseline)

- Long-term: Net zero emissions by FY40 (Scope 1, 2 & 3)

The Demerger Scheme Booklet states that “AGL Australia’s climate commitments… are not verified as being aligned to the climate goals of the Paris Agreement as at the date of [this] Scheme Booklet. AGL Australia intends to seek such verification to confirm its alignment as soon as practicable.”[12]

For AGL Australia, while it may claim to be “carbon neutral for Scope 1 and 2 emissions immediately”, it will rely entirely on carbon credits to do so. While AGL Australia has committed to purchasing “quality offsets” to achieve carbon neutrality, the Demerger Scheme Booklet sheds no further light on what this will mean in practice. Investors should be wary of integrity risk in any carbon credit, especially given recent reports of “environmental and taxpayer fraud” in the generation of Australian Carbon Credit Units (ACCUs).[13]

Despite its claims of carbon neutrality, AGL Australia will have significant Scope 3 emissions. These include the electricity sourced from Accel Energy (until 2027) and the grid, and the supply and end use of natural gas sales. ACCR conservatively estimates that AGL Australia’s Scope 3 emissions will be 22.2 million tonnes CO2e in FY23 (see Table 2).

Table 2. AGL Australia estimated Scope 3 emissions, FY23

| Source | MtCO2e |

|---|---|

| Electricity sourced from Accel Energy (13.3 TWh @ 0.95 tCO2e/MWh) | 12.6 |

| Electricity sourced from the grid (7.2 TWh @ 0.7 tCO2e/MWh) | 5.0 |

| Supply of natural gas to customers (48% of AGL Energy's gas sales) | 0.8 |

| End use of natural gas by customers (48% of AGL Energy's gas sales) | 3.3 |

| Other (travel, waste, investments) | 0.4 |

| Total | 22.2 |

Source: ACCR

While AGL Australia has set a target to reduce its Scope 3 emissions by 50% by 2030, it is unclear how that target will be met. Investors should consider the following:

- Electricity sourced from Accel Energy: these emissions will not decline until the end of the offtake agreement in 2027. In fact, they may actually increase after the closure of Liddell in 2022-23, if the more emissions intensive Loy Yang A produces a greater share of Accel Energy’s generation.

- Electricity sourced from the grid: these emissions will decline as the grid decarbonises, or more quickly as AGL Australia signs offtake agreements with new renewable generation.

- Supply and end use of natural gas sold: these emissions could decline far more quickly if AGL Australia takes an ambitious approach to electrification. However, the proposed AGL Australia CEO, Christine Corbett recently suggested that electrification of domestic gas consumption was a “longer-term game” which would take “more than a decade or so… to play out.”[14]

3. Capital expenditure

The allocation of capital to achieve emissions reduction targets was the second component of ACCR’s 2021 shareholder resolution. We review the forecast capital expenditure for both demerged companies below.

3.1 Accel Energy

AGL recently announced a partnership with Global Infrastructure Partners (GIP) to establish a $2 billion Energy Transition Investment Partnership (ETIP).[15] ETIP will develop, own and manage 2.4-2.7GW of new clean energy projects for Accel Energy, valued at approximately $4.1-4.7 billion (see Table 3).

Table 3. Accel Energy planned renewable and flexible generation investments

| Project | Capacity | Est. capex | Target FID |

|---|---|---|---|

| Broken Hill Battery (NSW) | 50 MW/1 hour | ~$40 million | FID taken |

| Liddell Battery (NSW) | 250 MW / up to 2 hours | ~$180 million | 2H 2022 |

| Loy Yang Battery (VIC) | 200 MW / 1 hour | ~$150 million | 2H 2022 |

| Bells Mountain Pumped Hydro (NSW) | 250 MW / 8 hour | ~$800 million | 2023-24 |

| Bowmans Creek Wind Farm (NSW) | 350-450 MW | ~$600-800 million | Late 2022 |

| Barn Hill Wind Farm (SA) | 250 MW | ~$450 million | Mid 2023 |

| Wind Project 1 (VIC) | Up to 600 MW | ~$1.1 billion | Mid 2023 |

| Wind Project (NSW) | 450-650 MW | ~$800m-1.2 billion | Late 2023 |

| Total | 2.4-2.7 GW | $4.1-4.7 billion |

Source: AGL Energy

While this commitment is welcome, it is a fraction of what is required to replace the capacity of Accel Energy’s thermal generation assets. Proposed Accel Energy CEO Graeme Hunt recently admitted that replacing Bayswater and Loy Yang A with renewable energy would require “somewhere between 12-15GW because the wind doesn’t blow all the time and the sun doesn’t shine all the time.”[16]

Accel Energy does not have plans to develop or underwrite 12-15GW of renewable energy. AGL has failed to articulate how quickly Accel Energy will replace its thermal generation with zero emissions energy sources, so investors must assume that won’t happen until the suggested closure dates (2030-35 for Bayswater and 2040-45 for Liddell). Investors must question the long-term viability of Accel Energy as a standalone business if it is not responsible for developing the replacement capacity for its thermal generation assets.

AGL is also expecting investors to believe that Accel Energy’s future investments in clean energy will be significantly greater than its recent history. AGL has spent just $1.2 billion on clean energy over the last decade (excluding the non-cash $200 million for the Powering Australian Renewables Fund in FY17)(see Table 4). Over the same period, AGL spent $3.8 billion on new and existing thermal generation (see Chart 3).

Table 4. AGL Energy investments in renewables and storage, 2012-21

| Year | $m | Notes |

|---|---|---|

| FY12 | 415 | Hallett 5, Macarthur Wind Farm |

| FY13 | 138 | Macarthur Wind Farm |

| FY14 | (77) | Solar (subsidies exceeded expenditure) |

| FY15 | 253 | Solar, new energy |

| FY16 | 105 | Solar, new energy |

| FY17 | 200 | Powering Australian Renewables Fund (non-cash) |

| FY18 | 0 | - |

| FY19 | 0 | - |

| FY20 | 0 | - |

| FY21 | 358 | PARF acquisition of Tilt Renewables |

Source: AGL Energy

Fundamentally, AGL’s long-term resistance to invest in clean energy is not addressed by the demerger, and we’d argue that it is made worse by further concentrating Accel Energy’s interests in thermal generation.

The Demerger Scheme Booklet refers to 140GW of renewable energy projects in the development pipeline[17] in relation to AGL Australia but it does not explain what impact this volume of renewable energy entering the grid will have on Accel Energy. If wholesale electricity prices are driven lower, it will jeopardise the profitability of Accel Energy’s thermal generation assets. It also raises the possibility that Accel Energy may seek some form of compensation from governments for keeping those assets open, as has been suggested by Federal Energy Minister, Angus Taylor, in the form of capacity payments.[18]

The Demerger Scheme Booklet addresses the new or increased risks to Accel Energy associated with the demerger, including the possibility of a credit rating downgrade and reduced access to capital.[19] Such an outcome would greatly inhibit Accel Energy’s investments in renewable energy, and almost certainly delay its transition.

Accel Energy will also have to navigate the path of increasing cost of maintenance of thermal generation assets, whose reliability will further erode over time. In April, Loy Yang Unit 2 was taken out of service due to an electrical fault,[20] and is expected to be offline until August. The same unit was out of service for six months in 2019. Liddell Unit 3 was out of service for three months in early 2021, in addition to multiple short-lived unplanned outages. Investors must question whether Bayswater and Loy Yang A will actually survive until their planned closure dates.

Chart 3. AGL Energy capital expenditure, 2012-21 ($million)

Source: AGL Energy Ltd, Annual Reports 2013-21

Climate-aware investors should also be concerned by the rehabilitation costs associated with Accel Energy’s thermal generation assets, particularly Loy Yang’s associated coal mine. While AGL increased its rehabilitation provision to $1.4 billion[21] in 2021, early closure would bring forward those obligations, significantly increasing the cost.

3.2 AGL Australia

AGL Australia has committed to “contracting or underwriting 3GW of renewable generation and flexible assets” by 2030.[22] AGL stated that “this will primarily be achieved through underwriting third party renewable energy projects through offtake agreements” citing 140GW of renewable energy projects in the development pipeline, according to AEMO.[23]

We assume this 3GW commitment pertains to “new” assets, despite the ambiguity in the Demerger Scheme Booklet and accompanying investor presentation (AGL Australia will own or offtake 2.6GW of renewable generation and flexible assets from inception).

While underwriting new renewable energy projects is welcome, there is no indication that AGL Australia will allocate any of its own capital to developing renewable energy over the short to medium term. AGL Australia’s role in consumer technology, especially via the Kaluza software platform, is cause for optimism, but that opportunity will remain whether the demerger proceeds or not.

4. Remuneration

The remuneration of executives to incentivise emission reductions was the third component of ACCR’s 2021 shareholder resolution. The Demerger Scheme Booklet provides only limited information on the demerged companies’ remuneration structures.

4.1 Accel Energy

Accel Energy’s remuneration structure will closely resemble the existing AGL Energy structure. The terms of Accel Energy’s Short Term Incentive Plan (STIP) “will not materially change upon implementation of the demerger”.[24] Furthermore, the Long-Term Incentive (LTI) Plan “will also continue to operate on substantially the same terms as the AGL Energy existing plan”. The following performance metrics will be applied to Accel Energy’s LTI in FY23:[25]

- An ESG metric focused on emissions and environmental regulatory reporting, weighted as to 50%; and

- A transition metric relating to capital deployment, weighted as to 50%.

“ESG metric” is far too ambiguous for investors to make an informed decision as to whether a 50% weighting is appropriate. AGL Energy disclosed three carbon transition metrics in its 2021 remuneration report, which would form 25% of the LTI in FY22:

- controlled emissions intensity

- controlled percentage renewable and storage electricity capacity

- the percentage of total revenue derived from green and carbon neutral products and services.

These metrics are not relative, meaning executives could be rewarded for incremental change, rather than being assessed against the broader market. AGL’s carbon intensity, for example, has remained relatively constant over the last seven years, while the carbon intensity of the National Electricity Market has declined by 23% (see Table 5).

Table 5. AGL Energy Carbon Intensity, 2015-21

| tCO2e/MWh | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 |

|---|---|---|---|---|---|---|---|

| Average market intensity | 0.91 | 0.90 | 0.88 | 0.82 | 0.77 | 0.72 | 0.70 |

| AGL operated intensity (all) | 0.97 | 0.96 | 0.98 | 0.97 | 0.95 | 0.94 | 0.95 |

Source: AGL Energy, Results Presentations 2015-21, FY19-21 ESG Data Centres

4.2 AGL Australia

In relation to the Short Term Incentive Plan for AGL Australia, “it is anticipated that performance will be assessed against a balanced scorecard comprising financial and non-financial measures and details of these measures will be disclosed in AGL Australia’s annual remuneration report”.[26]

The failure of the board to disclose any substantive information about AGL Australia’s remuneration structures is disappointing. Given AGL Australia’s relatively ambitious targets to reduce its Scope 3 emissions, we would expect this measure to be included in the FY23 remuneration structure.

5. Other considerations

5.1 Board Composition

The majority of current AGL board members have overseen a number of poor decisions, including, but not limited to:

- Sold the Macarthur wind farm, signing an offtake agreement until 2038 (Sep-2015)

- Pursued, then abandoned the Gloucester coal seam gas project (Feb-2016)

- CEO Andy Vesey resigned with limited notice (Aug-2018)

- Launched $640 million share buyback (Mar-2020)

- Incurred a pre-tax loss of $1.9 billion on wind investments (Feb-2021)

- CEO Brett Redman resigned with limited notice (Apr-2021)

- Pursued, then abandoned the Crib Point LNG import terminal project (May-2021)

- Terminated special dividend program for FY21 and FY22 (Jun-2021)

- Underinvested in clean energy between 2016-21

Investors have ample reason to be sceptical that the demerger is not simply another poor decision that will erode shareholder value.

AGL also announced that two new directors will join the board of AGL Australia: Fraser Whineray and Wendy Stops (see Table 7). While Fraser Whineray’s experience as CEO of Mercury Energy appears to be suitable, it is unusual for a non-executive director to retain an executive position on another company (Chief Operating Officer at Fonterra). Wendy Stops’ record at the Commonwealth Bank of Australia prior to the Hayne Royal Commission also warrants further discussion.

Table 7. Proposed board composition for Accel Energy and AGL Australia

| Accel Energy | AGL Australia |

|---|---|

| Peter Botten (Chair) | Patricia McKenzie (Chair) |

| Graeme Hunt (CEO) | Christine Corbett (CEO) |

| Diane Smith-Gander | Mark Bloom |

| Graham Cockroft | Wendy Stops |

| Vanessa Sullivan | Fraser Whineray |

| Jacqueline Hey |

Several investors have previously raised concerns about the lack of clean energy experience on the current AGL Energy board. While the appointments of Graham Cockroft and Vanessa Sullivan are welcome, Accel Energy needs at least another non-executive director, preferably with clean energy experience.

ACCR has previously published analysis of the share trading of current AGL directors.[27] Other than Graham Cockroft and Vanessa Sullivan who only joined the board in 2022, no other director has purchased AGL shares since the demerger was announced. Earlier this year, the board rejected two takeover bids after concluding that the prices offered undervalued the company.

5.2 Investor influence

The Demerger Scheme Booklet identifies the risk that “either or both of AGL Australia and Accel Energy may not be able to remain a constituent of the S&P/ASX 100 index. Given where AGL sits in the index at this moment, it is likely that both AGL Australia and Accel Energy will drop out of the S&P/ASX 100 index. There is also a greater risk, if there were to be significant share price declines in either company post-demerger, that they would also drop out of the more widely used S&P/ASX 200 benchmark. This would likely reduce the exposure of passive funds (e.g. those managed by BlackRock, State Street and Vanguard) to the company, therefore diminishing their influence.

Investors must also consider the risk that Accel Energy is taken over post-demerger by a private investor whose climate goals do not align with their own. The Demerger Scheme Booklet refers to “further corporate activity” relating to E.ON and RWE International in Germany, following the structural separation of retail and generation assets.[28] While the possibility of a takeover bid for Accel Energy or AGL Australia post-demerger may seem like an attractive proposition, investors should be asking why such a bidder has not appeared already. Furthermore, the possibility of Accel Energy being acquired by a private investor disinterested in reducing emissions would be a terrible climate outcome.

6. Conclusion

The board has failed to make a compelling argument that the demerger will result in a quicker energy transition, or that it is ultimately in the best interests of shareholders.

Accel Energy’s financial interest in thermal generation will likely slow the energy transition and delay the closure dates of those assets.

While the clean energy investment pipelines outlined for Accel Energy and AGL Australia are welcome, there is little explanation as to why these plans couldn’t be pursued as a single company.

Accel Energy will face serious headwinds: increasing maintenance costs associated with its ageing thermal generation assets, greater rehabilitation costs from early closure dates, industrial customers decarbonising, while the market is flooded with renewables and flexible generation.

There is a real risk that Accel Energy could be taken private by an investor disinterested in climate goals, becoming an obstruction to the energy transition, which investors should seek to avoid.

The AGL board has a history of poor decision-making and the demerger is the latest example.

ACCR will be voting AGAINST the demerger.

Disclaimer

Armina Rosenberg, who sits on ACCR’s Office Bearers’ committee, is also a portfolio manager at Grok Ventures. Grok Ventures is a business name used by the private investment group controlled by Mike Cannon-Brookes. "Grok Ventures" is a registered business name of Cannon-Brookes Services Pty Limited (ACN 616 170 542). An affiliate of Cannon-Brookes Services Pty Limited, the Galipea Partnership, is the holder of an ~11% interest in AGL Energy. This potential conflict has been disclosed and Ms Rosenberg has had no role in ACCR’s decision-making on this matter. Ms Rosenberg is currently on parental leave.

Please read the terms and conditions attached to the use of this site.

Australasian Centre for Corporate Responsibility

ACCR Resolution 2021 https://www.accr.org.au/research/accr-investor-briefing-on-agl-energy-aug-2021/ ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 4.2.2.6 ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 1.3.2 ↩︎

AGL Energy, Investor Presentation, 6 May 2022, p27 ↩︎

International Energy Agency, Net Zero by 2050, 2021, p116 ↩︎

Perry Williams, ‘AGL Energy says ending coal generation by 2030 an ‘engineering impossibility’’, The Australian, 11 May 2022, link ↩︎

Australian Energy Market Operator (AEMO), Draft 2022 Integrated System Plan, December 2021, link ↩︎

Angela Macdonald-Smith, ‘Power grid plan not ‘credible’: AGL’, The Australian Financial Review, 14 Feb 2022, link ↩︎

Angela Macdonald-Smith, ‘Tomago Aluminium to go green’, Australian Financial Review, 10 August 2021, link ↩︎

AGL Energy, Accelerating Our Transition - FY21 TCFD Report, link ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 3.2.2.3 ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 1.3.2 ↩︎

Australian National University College of Law, Australia’s carbon market a 'fraud on the environment', 24 Mar 2022, link ↩︎

Tony Boyd, ‘AGL faces a threat from electrification’, The Australian Financial Review, 23 Apr 2022, link ↩︎

AGL Energy, ‘AGL to partner with Global Infrastructure Partners (GIP) to establish $2 billion Energy Transition Investment Partnership (ETIP)’, 3 May 2022, link ↩︎

Perry Williams, ‘AGL Energy says ending coal generation by 2030 an ‘engineering impossibility’’, The Australian, 11 May 2022, link ↩︎

ibid. ↩︎

Hon Angus Taylor MP, Locking in cheap and reliable energy through the National Electricity Market, 30 Apr 2021, link ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 4.12.1 ↩︎

AGL Energy, Loy Yang A Unit 2 Generator Fault, 20 April 2022, link ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 4.3.7 ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 3.2.2.3 ↩︎

ibid. ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 4.10.5 ↩︎

ibid. ↩︎

AGL Energy, Demerger Scheme Booklet, 6 May 2022, Section 3.9.7.2 ↩︎

https://www.accr.org.au/news/agl-energy-directors-lack-skin-in-the-game/ ↩︎