Publication Part 2: Royal Dutch Shell in a decarbonised economy

2.0 RDS' financials and carbon analysis

In this section of our report, we review how decarbonisation will impact RDS’ existing business model, and how well RDS is positioned to respond to transition.

2.1 How is RDS placed for a zero emissions world?

In FY20, RDS reported Adjusted Earnings (profit after tax excluding the impacts of one-off items such as impairments) of $4,846m, a decline of 70% on FY19. This was largely driven by lower production and prices for oil and gas during COVID-19. RDS’ return on capital (RoACE, Adjusted Earnings) has ranged between 3-8% over the last four years. As at 2Q21, RDS' net debt has decreased from $70bn in FY20 to $65bn, and gearing from to 32% to 28% (RDS format), which has improved RDS' financial capacity for investment and payment of dividends.

Chart: RDS Profit After Tax (US$m), Adjusted Earnings (US$m) and Return on Average Capital (RoACE %), FY17 to FY20

From FY17-FY20 RDS Group RoACE has ranged from 3% to 8%

We have estimated emissions by segment and compared this to the segment's financial returns (table below).

We have assumed Scope 1-3 emissions from RDS’ own production of oil and gas is allocated to Integrated Gas (including LNG liquefaction) and Upstream, and the Scope 1-3 emissions from sale of third-party oil and gas products to Oil Products. The Chemicals segment reflects Scope 1 and 2 emissions only, as RDS does not disclose Scope 3 GHG emissions for this segment.

Table: RDS segment and carbon summary FY20

| Segment | Adj. earnings (US$m) | Estimated % of RDS GHG emissions | Adj. earnings/ Average capital employed (%) | Commentary |

|---|---|---|---|---|

| Integrated Gas | 4,383 | 21% | 5.2% | Higher earnings to emissions than Oil Products. More capital intensive. |

| Upstream | -2,852 | 35% | -2.4% | FY20 impacted by weak oil production and prices. |

| Oil Products | 5,995 | 43% | 12.7% | Most stable earnings profile. Emission intensity driven by product sales. |

| Chemicals | 962 | 1%* | 4.4% | Emission intensity understated. Returns structurally low. |

| RDS Group | 4,846 | 2.8% |

Source: Company data,Global Climate Insights estimates. * Scope 1 and 2 only.

For FY20, Oil Products RoACE is highest at 12.7%, and has ranged from 13-17% over FY17 to FY19 (chart below). Oil Products’ GHG emissions footprint of ~43% of RDS Group is reflective of the product mix sold through RDS' large distribution network. We would expect this to decline as the carbon intensity of RDS products reduces.

RoACE for Upstream was impacted by COVID-19 in FY20. This segment is structurally more volatile and capital intensive than other segments, with FY20 RoACE of -2.4% and contributing 35% to RDS Group GHG emissions. Integrated Gas is also capital intensive, but has higher earnings than Upstream with RoACE of 5.2% in FY20, and 5-11% over FY17 to FY19. We estimate this segment is accountable for ~21% of RDS’ FY20 GHG emissions, although we expect this to increase significantly as RDS executes its LNG growth strategy.

The Chemicals segment represented ~11% of RDS Adjusted earnings in FY20; it is a small, but not insignificant segment. Chemicals’ returns are relatively low with FY20 RoACE of 4.4%, which has declined from 18% in FY17. The Chemicals industry has seen large margin pressure, and peers with less scale have divested their businesses (such as BP’s ~US$5bn sale of its Chemicals business in 2020). We expect the segment to continue to transform as a result of decarbonisation (move to recycled feedstocks) and focus on waste (less consumption of plastics).

RDS needs to set, measure, and disclose targets against all Chemicals GHG emissions (Scope 1-3). Currently, the company only accounts for emissions that come from its own chemical plants. RDS does not measure the emissions from further processing of chemicals to create end products by its customers (processes that are energy intensive), or measure impact from transportation, and end use. We expect these overlooked emissions to be significant, as the chemicals and petrochemicals sector ranks third behind iron and steel-making for contribution to global GHG emissions from industry.[1]

Chart: RDS % of Adjusted Earnings by segment (ex-corporate and non-controlling interests), FY17 to FY20

Contribution of Integrated Gas is large and has increased from 30% to 50% over the last 4 years

Oil products provided the largest contribution to FY20 earnings at ~70%

Chart: RDS RoACE (Adj. Earnings, %) by segment, FY17 to FY20

Oil Products RoACE is more stable than other divisions ranging from 13-17%

Source: Company data, Global Climate Insights estimates

2.1.1 Impairments

RDS' ability to generate sufficient underlying profit for reinvestment and to withstand likely ongoing impairments is critical to the company’s future success. This needs to be achieved while shrinking rather than expanding its existing fossil fuel business.

Impairments increased significantly in FY20 to $27.5bn pre-tax, from $3.7bn in FY19. This was largely driven by revised pricing, margin, and demand assumptions due to changes in the energy market and COVID-19 impacts. The majority of impairments related to exploration and production assets ($20.2bn). This includes Integrated Gas impairments ($11.6bn) for the Queensland Curtis LNG and Prelude Floating LNG facilities, Upstream impairments ($8.7bn) relating to the Gulf of Mexico, assets in North America, Brazil and Europe, and ongoing issues in Nigeria. Impairments for manufacturing, supply and distribution were $6.5bn, reflecting Oil Products assets in Europe and the closure of Convent refinery (USA).

Chart: RDS Impairments (US$bn, pre-tax), FY17 to FY20

Impairments rose significantly from FY19 to $27.5bn

Driven by Integrated Gas (LNG and Prelude FLNG), Upstream assets in the Gulf of Mexico and broader portfolio and closure of the Convent refinery

Source: Company data, Global Climate Insights estimates

Property Plant and Equipment (PPE) is the largest asset on RDS' balance sheet at US$211bn (56% of total assets and 125% of equity). This is one of the largest risks to solvency. Fortunately, impairments are typically taken over time, providing the ability for company earnings to cover losses. However, it is unclear if this will be possible for an industry undergoing such a significant transformation.

Chart: RDS Property Plant and Equipment vs Equity (US$bn), FY17 to FY20

PPE of $211bn exceeds the value of equity

Further impairment of PPE represents a key risk to RDS

Source: Company data, Global Climate Insights estimates

2.1.2 Cash capital expenditure

RDS’ cash capital expenditure (including expenditure and investments) was ~$18bn in FY20 - a reduction of 25% on FY19. RDS has focused on capital efficiency, particularly given lower revenue in FY20. Upstream was the largest driver of FY20 capex at $7.3bn decreasing from $10.2bn in FY19. Integrated Gas capex has been relatively steady at ~$3-4 bn from FY17. Oil Products capex declined from ~$5bn in FY19 to $3.3bn in FY20. Chemicals capex was lowest at $2.6bn. Current capex on the Renewable and Energy Solution business is not disclosed.

In the near-term, RDS anticipates total cash capex of between $19-22bn (1H21 was $8.4bn). The chart below summarises RDS' guidance of capex by division, which at the upper range is a total of $23bn. Upstream will continue to be the key driver of RDS capex at $8bn (80% to be spent on its core positions). Chemicals capex is forecasted to increase to $5bn as the segment is repositioned and further integrated with Oil refineries. Oil Products $3bn and Integrated Gas $4bn in capex are largely unchanged, and Renewables and Energy Solutions capex is expected to be $3bn. While RDS has not provided details on where renewables capex will be spent, we expect a significant investment will be required for hydrogen in order to meet market share targets. We expect less capex will be needed in renewable generation than peers. Additionally, as RDS' strategy is also driven by distribution, we anticipate an increase in operating expenditure for Marketing and Renewables in the next 5 years.

We do not yet have sufficient detail from RDS to determine if it has the financial capacity to execute its climate transition plans and will be monitoring this closely. We see high costs associated with CCUS (carbon capture utilisation and storage, Gorgon cost ~$2.4bn[2] to date), LNG expansion and hydrogen production.

Chart: RDS Cash Capex by segment (US$bn), FY17 to FY20, and RDS guidance

Source: Company data, Global Climate Insights estimates

2.1.3 Debt

In 2Q21, RDS achieved its target to reduce Net Debt to $65bn. This was a condition set by management in order to increase the dividend, and set as a target to ensure it maintains its A+ credit rating. RDS' debt maturity profile appears diversified, as at FY20 $13bn of its $80bn debt (16%) was due to mature in the next year, $23bn (30%) in the following four years, and the remaining $42bn (54%) due 5 years and later.

Chart: RDS Net debt (US$bn) and gearing (%), FY17 to FY20

RDS is targeting net debt below $65bn in order to maintain its A+ credit rating

Source: Company data, Global Climate Insights estimates

2.1.4 Decommissioning provisions

In FY20, decommissioning and other provisions were ~$31bn, equating to ~15% of total PPE and ~8% of total assets. This increased by $5.5bn from FY19 (10% of total PPE), the value of which is impacted by project assumptions and discount rates (1.75% in FY20). RDS expects ~$6.1bn of its provision to be used in the next 10 years (~20%).

Chart: RDS Decommissioning provision (US$bn), FY17 to FY20

As decarbonisation accelerates, decommissioning provisions are likely to increase

Source: Company data, Global Climate Insights estimates

3. RDS segments

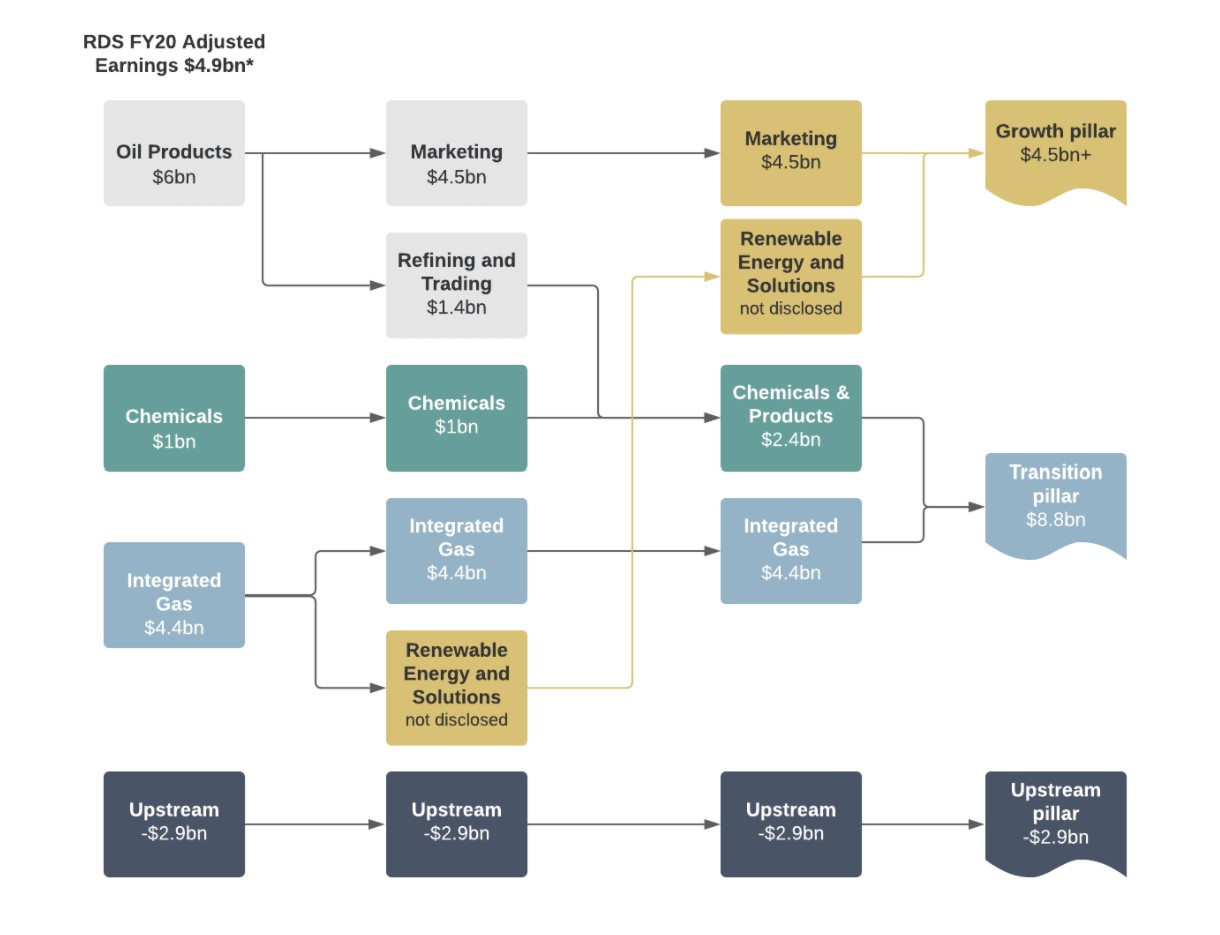

From FY22, RDS will report under five key segments (ex-Corporate) aligning with its new strategy. By applying FY20 adjusted earnings, we can assess the materiality of these new segments:

- Upstream (-$2.9bn) and Integrated Gas ($4.4bn) will be unchanged;

- Chemicals and Oil Products (Refining and Trading) will be combined ($2.4bn);

- Marketing will be separated ($4.5bn) - becoming the largest segment; and

- Renewables and Energy Solutions will be a separate segment (earnings not yet disclosed).

The segments will be further aggregated into three key pillars:

- The Transition pillar - likely to be the largest in the interim ($8.8bn);

- The Growth pillar - expected to grow over time (~$4.5bn+); and

- The Upstream pillar - likely rebound from FY20 but shrink over time.

Diagram: RDS segment restructure, FY20 Adjusted Earnings (excludes corporate, US$bn)

Source: Company data, Global Climate Insights estimates. * Adjusted Earnings includes all segments excluding corporate.

3.1 Integrated Gas (upstream)

3.1.1 RDS' position

Integrated Gas reflects the earnings from: natural gas exploration and extraction, production of Liquefied-Natural-Gas and Gas-to-Liquids, midstream infrastructure (pipelines, shipping, storage), sale and trading of gas products and electricity, and the Renewables and Energy Solutions business.

RDS is the largest seller of LNG globally (70Mt sales in FY20), one of the largest LNG shipping operators (owning and having access to around 20% of the world's LNG shipping fleet[3]), and one of the largest Gas-To-Liquids producers.

3.1.2 Decarbonisation demand outlook

As RDS does not disclose the materiality of earnings from its Renewables and Energy Solutions business, our comments on the decarbonisation outlook relate largely to its gas business. We have included detailed analysis of lower-carbon fuels in part 1 of our RDS report.

- In FY20, RDS Integrated Gas key products comprised: pipeline gas (13%), LNG (49%), GTL (21%) and other liquids (17%).[4] We estimate this segment's GHG emissions footprint was 262 Mt CO2e, contributing around 21% to RDS Group.

- To understand the use of gas in a 1.5°C aligned pathway we have reviewed estimates for gas consumption under the IEA Net‐Zero Emissions by 2050 Scenario (NZE) which expects a decline of 13% by FY30 and 70% by FY50 compared to FY20. In FY20, gas consumption was driven by industry at 48%, buildings (primarily heating) 42%, and transportation 7%. By FY50, industry is expected to be the predominant driver of gas consumption at 80%, buildings 15%, and transport ~0%.[5]

- LNG trade is expected to fall 60% by FY50 under the IEA NZE (to ~134 Mt from a FY20 base of 336 Mt).[6]

- The IEA NZE specifically states that “no new natural gas fields are needed in the NZE beyond those already under development. Also not needed are many LNG liquefaction facilities currently under construction or at the planning stage.”[7]

- This outlook is not aligned with RDS’ decarbonisation strategy, which assumes growth in LNG of 4% p.a until 2040 (~40% between FY20 and FY40), including gas for transportation. Furthermore, RDS assumes continued investment in LNG infrastructure. By 2040, RDS expects LNG to supply 39% of all gas.[8]

- RDS’ assumptions are reliant on increasing LNG demand from China, India, emerging economies in SouthEast Asia, and Europe as natural gas onshore is declining. RDS expects LNG to play a material role in reducing GHG emissions across power, industry, and residential and commercial (heating).

- In addition, RDS is looking to create new LNG markets, particularly for shipping and long-haul transportation fuels.

- In the IEA NZE, by FY50, shipping is expected to be primarily fuelled by hydrogen and ammonia (60%), followed by biofuels (20%).[9]

- With LNG carbon intensity at ~71g CO2e/MJ compared to oil at ~89g CO2e/MJ, we see significant risk to the extent LNG can contribute to lowering absolute emissions.

- With RDS’ current ambitions, capacity to make significant reductions to net emissions are limited to compensating tools such as carbon offsets. RDS believes that LNG with offsets, currently termed “carbon neutral” LNG, will be a growing share of the market and a competitive advantage. Since 2019, RDS has delivered seven cargoes of “carbon neutral” LNG, which the company claims can power 1 million households for a year - equivalent to the energy produced by 0.5-0.6 Mt of LNG.

- We have material concerns about LNG used with offsets, and labelling this as carbon neutral. As set out in part 1 of our report, our concerns with offsets relate to quality, permanence, difficulty in comparing it to GHG emissions released, and we see its use as needing to be reserved for sectors without alternatives. CCUS can only address a small proportion of CO2 emissions from gas. The only customers of RDS that can implement CCUS will be those with large single point sources of CO2 that can make post-combustion CCUS successful and that have the balance sheet to fund the projects.

- LNG investment may risk impairment if long-term demand is weaker than expected. RDS uses a long-term (post FY24) Henry Hub natural gas price of $3 per MMBtu.

- Gas-to-Liquids products such as motor oils are likely to be required in a decarbonised economy (electric vehicle - EV use). Fuels are less likely to be needed. Plastics consumption may be under pressure from both emissions (energy use and incineration) and the focus on waste and alternatives to plastics.

3.1.3 Earnings

In FY20, Integrated Gas delivered Adjusted Earnings of $4,383m, -51% compared to FY19. Including one-offs, earnings were -$6,278m. The key driver was impairments of $12,221m pre-tax ($9,282m post-tax), and lower volumes of LNG sales (-6%) and liquefaction (-6.5%). Production of oil and gas was broadly unchanged at 911 k boe/d. However, this includes the net impact of lower volumes from the Prelude Floating LNG and Gorgon projects due to maintenance, transfers of production from Upstream and new fields.

Integrated Gas is RDS' second largest segment and accounts for ~30% of capital employed, yielding a RoACE in FY20 of 5%, down from 10% in FY19. RDS is targeting a 20% decline in operating expenditure in FY22.

From FY22 the segment will be split, with the Renewables and Energies business being reported separately. By 2050, RDS expects the majority of its fuels to be low-emissions, with any remaining fossil fuels using carbon capture utilisation and storage (CCUS) or carbon offsets.

Chart: Integrated Gas Adjusted Earnings (US$bn), RoACE (%, Adjusted Earnings) and Profit Margin (%). FY17 to FY20

Integrated Gas RoACE (%) has averaged 5-11%

Source: Company data, Global Climate Insights estimates

Chart: Integrated Gas organic free cash flow (US$bn), % of RDS Group (RHS)

Integrated Gas cash generation has varied over the last four years

Chart: Integrated Oil and Gas production (thousands b/d)

Integrated Gas production of Oil and Gas declined 1% in FY20

Chart: Integrated Gas LNG sales (Million Tonnes per annum)

Total LNG sales declined 6% in FY20 to ~70Mt, in FY19 sales increased 5%

Source: Company data, Global Climate Insights estimates

3.1.4 Assets

RDS has 26,114,000 million standard cubic feet of natural gas reserves at FY20 - equivalent to ~548 Mt LNG, or ~4.5 billion boe. Australia is RDS’ largest gas producing region - contributing 19% to total - followed by Asia, USA and Malaysia. The top 10 regions account for ~80% of total reserves.

RDS' largest Integrated Gas assets are its LNG fields in the North-West Shelf (16.4 Mt p.a,[10] 16.67% equity stake), its LNG Plant Prelude FLNG (5.3 Mt p.a,[11] 67.5% equity stake), and its GTL Plant Pearl in Qatar (12.2 Mt p.a,[12] DPSA with the State of Qatar).

Map: Location of RDS Gas Assets 2Q21

Source: Company data, Global Climate Insights

3.2 Upstream

3.2.1 RDS position

The Upstream segment includes the exploration of oil, natural gas, and natural gas liquids, along with the trading and sale of crude oil and natural gas. Upstream owns pipelines to deliver oil and gas to customers.

3.2.2 Decarbonisation outlook

- We estimate the Upstream GHG emission footprint, including RDS production of oil and gas, was 446 Mt CO2e, around 35% of RDS Group.

- From FY20, under the IEA NZE, oil consumption is forecast to decrease 16% by FY30 and 73% by FY50.[13] A large driver of this decline will be the increased electrification of transport, where fossil fuel share in road transport reduces from 95% in FY20 to 81% in FY30 and 10% in FY50.[14]

- This compares to our forecasts for RDS, where oil delivered is expected to increase by 7% between FY20 and FY30 and decline 28% from FY30 to FY50. These forecasts are driven by a 17% decline in RDS’ own oil production (2% p.a from FY19) and a 27% increase in third-party sales between FY20 and FY30 largely underpinned by a post-COVID-19 rebound.

- Under the IEA NZE, the mix of oil use will shift towards non-combustion applications, increasing to 70% of consumption by FY50.[15] Transport’s oil consumption decreases from 62% in FY20 to 59% (of a declining market) in FY30 and 21% by FY50. Industry becomes the greatest user of oil, increasing from 20% of consumption in FY20 to 55% by FY50.[16]

- RDS will need to determine which upstream assets (fields and pipelines) are required in a decarbonising world, and which assets justify investment in new technologies and low-carbon energy sources to improve Scope 1 and 2 GHG emissions.

- RDS has a large portfolio of deep-water assets, with key assets in the Gulf of Mexico (Whale, Stones, Appomattox), Brazil (Parque Das Conchas), and Nigeria (Bonga North West). These may be more difficult and costly to upgrade, to reduce GHG emissions, and to power by renewable energy sources.

- A key risk for Upstream is its stranded assets that may be subject to impairment. While near-term asset values may be supported by higher cyclical prices, valuations are based on long-term assumptions. If the expected life, long-term production, prices, or cost of these assets to exist in a low-carbon world change (via technology or carbon price), impairments could increase significantly.

3.2.3 Earnings

In FY20, Upstream Adjusted Earnings were -$2,852m, a $7,304m decline on FY19.

FY20 production declined 10% on FY19; -4% from oil and gas liquids, and -19% from natural gas. Natural gas production was impacted by ongoing issues at RDS' joint venture, Nederlandse Aardolie Maatschappij B.V. (NAM), of which RDS owns a 50% stake. This was underpinned by an order from the Netherlands Government to decrease and to cease production of the Groningen field by 2022, of which NAM owns a 60% stake. FY19 Groningen field production was 17.5 billion cubic metres, with 5.25 billion cubic metres allotted to RDS (29% of RDS’ own FY19 gas production). Groningen production halved to 8.7 billion cubic meters in FY20. Across Upstream the average realised price of oil in FY20 was $37 per barrel, vs $58 in FY19.

FY20 impairments were large at $8,697m pre-tax ($6,447m post-tax), driven by;

- $1.27bn post-tax impairment at Appomattox deep-water field (Gulf of Mexico); and

- Reduced price assumptions of unconventional assets in North America, offshore projects in Brazil and Europe, and in Nigeria.

FY20 cash capex was $7.3bn, and is expected to be $8bn in FY21. RDS targets US$7-9bn p.a in capex for Upstream, with the exploration budget accounting for $1.5bn.

Chart: Upstream Adjusted Earnings (US$bn), RoACE (%) and Profit Margin (%). FY17 to FY20

Upstream adjusted earnings were -$2.9bn in FY20, a large decline from FY19 earnings of $4.5bn

In FY17 to FY19 RoACE (%) has averaged 5%

Chart: Upstream organic free cash flow (US$bn), % of RDS Group (RHS)

Organic free cash flow was positive in FY20, but reduced 60% from FY19 to $4bn

Chart: Upstream production (thousands b/d)

Upstream oil and gas production declined 10% on FY19 to 2.4 million tonnes of barrels per day

Source: Company data, Global Climate Insights estimates

3.2.4 Assets

The current project pipeline for Upstream includes over 1,200 thousand boe/d of additional capacity (half of Upstream’s current production). The average break-even price for pre-FID projects is $30 boe with a payback period of 7 years.

We note that RDS recently announced the sale of its assets in the Permian Basin to ConocoPhillips. The transition is expected to be complete in 4Q21. We will assess the impact on emissions forecast post-completion in 4Q21.

Map: Location of RDS Upstream Core Assets 2Q21

Source: Company data, Global Climate Insights

3.3 Oil Products (downstream)

3.3.1 RDS position

The Oil Products segment is divided into two key businesses: Refining, Trading and Supply (this will move to RDS' new Chemicals and Products business), and Marketing, its retail and distribution business (this will be a standalone segment going forward). RDS has trading offices in Houston, Rotterdam, London, Singapore, and is the largest global trader of physical crude and energy products. RDS is the largest seller of lubricants globally.[17]

3.3.2 Decarbonisation outlook

- We estimate Oil Products has the largest GHG emission footprint of all segments at 545 Mt CO2e, around 43% of RDS Group (includes RDS third-party oil and gas sales, and excludes RDS oil and gas production).

- As outlined in the Upstream segment, the consumption of oil is expected to decline in the IEA NZE. Non-combustion uses of oil will become the major driver of consumption accounting for 70% of consumption by FY50.[18]

- Refining of oil sands and other energy intensive processes (higher carbon intensity) will be at a disadvantage vs lower carbon intensity sources of oil. RDS will need to determine which fields justify the additional investment in technology to decarbonise.

- As the largest seller of lubricants globally, RDS’ business will need to adjust to the growth of electric vehicles, which are expected to make up 20% of cars by FY30 and 86% of cars by FY50%.[19] Lubricants for electric vehicles are likely to be more specialised than motor vehicles, with different performance specifications required.[20]

- The aviation fuel market is expected to evolve. In the IEA NZE, traditional aviation fuels decrease from 100% of aviation fuels in FY20 to 20% by FY50. The remainder of aviation fuel in FY50 is expected to come from Sustainable Aviation Fuels (40%) and synthetic hydrogen‐based fuels (30%).[21] We note that no aviation fuels are likely to be zero emissions in the next 10 years, thus the relative carbon intensity of alternatives requires further analysis.

- RDS currently has 46,000 retail service stations globally, and is expected to continue to expand its footprint to 55,500 by FY25. RDS will need to transform its network, leveraging its scale and retail brand for a future with electric vehicles being the predominant technology. Thus far, RDS has flagged increasing charge points, increasing convenience store sales, and digitisation as potential avenues for growth. It also plans to sell hydrogen, LNG, fuels with offsets, and biogas through its network.

- The infrastructure required for EVs will be different to traditional fuels. EV charging can be decentralised and the barriers to entry for providing charge points are much lower than fuels. In addition, the amount, the location (metro vs regional), and type of vehicles (long haul vs cars) using service stations are likely to change.

- While we see opportunities for RDS’ retail network in a decarbonised world, we believe the path ahead will be challenging. RDS will need to balance the focus on maintaining higher product margins with maximising volume of sales. Banking and postal services sectors have faced similar issues of how to maximise returns from large retail footprints, often looking to increase sales of third-party products.

3.3.3 Earnings

Oil Products Adjusted Earnings was $5,955m, a decline of 4% on FY19.

In FY20, the Refining, Trading and Supply business contributed $1,425m, ~25% of the Oil Products Adjusted Earnings. The business refines oil products and produces synthetic crude oil and bitumen (from oil sands) with inputs from RDS' upstream business, and trades and supplies crude oil, refined products, chemical feedstocks, and sale of carbon credit to customers. The Trading and Supply business deals in both RDS and third-party products, and sells products to RDS' Oil Products Marketing business.

In FY20, the Marketing business contributed $4,570m, ~75% of the Oil Products Adjusted Earnings. This is RDS' key distribution business and the centre of its transformation strategy. RDS has 6,000 km of pipelines (with access to an additional 14,000km of non-operated businesses). The segment also includes the Shell Sulphur Solutions business, that refines and markets sulphur for use in fertiliser, mining and chemicals.

The largest part of Marketing earnings is derived from RDS' Retail business, which contributed ~50% of Marketing's earnings in FY20. Lubricants contributed ~30% to Marketing earnings. The remaining 20% of earnings stems from sales to commercial customers including aviation, shipping, transportation and industry. In 1H21, Marketing produced one of the strongest quarterly results in the last decade given margin management and a growing footprint.

Chart: Oil Products Adjusted Earnings (US$bn), RoACE (%, RHS) and Profit Margin (%, RHS). FY17-FY20

Adjusted earnings were ~$6bn in FY20, a decline of 4% on FY19

RoACE (%) has averaged 14% in the last four years

Chart: Oil Products organic free cash flow (US$bn), % of RDS Group (RHS)

FY20 organic free cash flow was ~$7.6bn, the highest of RDS’ segments

Chart: Oil Products Sales (thousands b/d)

Oil products sales declined 28% in FY20, impacted by COVID-19

Gasoline remains the largest contributor at ~37%

Source: Company data, Global Climate Insights estimates

3.4 Chemicals (downstream)

3.4.1 RDS’ position

RDS' Chemicals business refines and sells base chemicals (ethylene, propylene, benzene, ammonia and methanol) to be used in further manufacturing processes, as well as intermediate chemicals (solvents, styrene, olefins). The largest driver of Chemicals end-use is plastics, rubber and fibres (~40%) and fertiliser (~30%, ammonia and urea).[22]

The Chemicals segment has been undergoing a transformation over the last three years, as lower margins from increased capacity in the Middle East and Asia[23] have decreased profitability. RDS has rationalised its chemical plants and divested assets, including its 50% interest in Deer Park refinery (due to complete in 4Q21 for $2.5bn) and Puget sound refinery (to complete in 4Q21 for $350m).[24]

Using Scope 1 and 2 emissions disclosed for RDS’ Downstream business, we estimate the Chemicals segment Scope 1 and 2 for FY20 at 14.6 Mt; down from 15.8 Mt in FY19. Currently RDS reports Chemical intensity for GHG emissions per tonne of production. As at FY20, this was 0.98 CO2e/tonne, lower than FY19 but broadly in line with FY16.

3.4.2 Decarbonisation outlook

- The petrochemicals sector is the largest industrial consumer of energy globally, higher than cement, iron and steel. In 2017, the sector consumed 14% of global oil and 8% of global gas through energy (~40%) and feedstocks (~60%).[25]

- Under the IEA NZE, base chemicals production is forecasted to increase at a CAGR of 1.9% between 2020-30 to reach 641 Mt (~21% total increase), and a CAGR of 0.9% between 2020-50 to reach 688 Mt (30% total increase).[26] Base chemicals account for two-thirds of energy consumption in the chemicals sector.[27]

- The IEA NZE shows fossil fuels remaining the primary energy source for the chemicals sector, falling from 83% in 2020 to 76% in 2030 and 61% in 2050.

- Although it is not the primary source of energy, hydrogen will play a key role in the chemicals sector. IEA estimates show that around 45.9 Mt of hydrogen produced today is used in the chemicals sector.[28] This is expected to increase by 18% from 2020 to 54.1 Mt by 2030, and 31% to 60.3 Mt by 2050.

- In the next 10 years, the IEA NZE shows the main sources of emissions reduction in the chemicals sector to be recycling, plastic reuse, and more efficient use of nitrogen in fertilisers, which will offset some growth in demand for primary chemicals.[29]

- Given the energy intensity of chemicals, as well as GHG emissions associated with the end use of the production (particularly incineration), accurate measurement and strategies to reduce RDS’ Scope 1-3 GHG chemical emissions are key to decarbonisation.

- Opportunities for reduction in GHG emissions for chemicals include the inclusion of low-carbon fuels for energy and heat, replacing feedstocks with lower carbon alternatives, and increasing recycling (reducing the amount of new chemicals required and reducing incineration from end of use).

- The chemicals industry will need to continue to evolve, incorporating circular feedstocks and recycling as part of its processes. This is likely to be supported by legislation, such as the UK’s tax on plastic packaging with less than 30% recycled content,[30] and the European Union’s plan for all packaging on the EU market to be reusable or recyclable in an economically viable way by 2030.[31]

- The industry is likely to be impacted by increasing demand for compostable and more environmentally friendly packaging over traditional plastics. We believe this will be driven by retailers (including supermarket chains) establishing their own sustainable packaging targets to reduce plastic packing, making it compostable or recyclable.[32]

- RDS aims to process 1 Mt p.a of plastic waste for the manufacture of chemicals by 2025 (~7% of FY20 sales). It is also looking to scale up electrification and increase the use of hydrogen and biomass feedstocks, but has no stated targets.

3.4.3 Earnings

In FY20 the Chemical segment Adjusted Earnings were $962m, 30% higher than FY19, although substantially lower than the $2,076m reported in FY18. The Return on Average Capital in FY20 was 4.4% and Profit Margin 6.4%. This segment is RDS' smallest, contributing 4% to Group Adjusted Earnings in FY19 and 11% in FY20.

In FY20, RDS sold 15,036 thousand tonnes of product to 1,000 industrial customers, equally split between base and intermediate chemicals. RDS is seeking to increase its share of intermediate and performance chemicals, given the more specialised nature of production and the higher margins.

Chart: Chemicals Adjusted Earnings (US$bn), RoACE (%, RHS) and Profit Margin (%, RHS). FY17 to FY20

Adjusted earnings for chemicals have declined in the last two years due to divestments and weaker industry margins

The Return on Average Capital in FY20 was 4.4% and Profit Margin 6.4%

Chart: Chemicals organic free cash flow (US$bn) and % of RDS Group (RHS)

Chemicals organic cash flow has been low/negative over the last three years

Chart: Chemical product sales (thousands tonnes p.a)

Sales have declined in the last four years, impacted by divestments

The portion of intermediate chemicals has increased

Source: Company data, Global Climate Insights estimates

3.4.4 Assets

The figure below shows RDS’ five integrated energy chemical parks (Pernis, Scotford, Pulau, Norco, Rheinland), excluding Deer Park refinery, with the divestment due to be completed in 4Q21. RDS has an additional five chemical-only sites. This footprint has been reduced from the 14 refineries held in FY20 and 54 in FY04.

Map: Location of RDS Integrated Energy and Chemical Parks 2Q21*

Source: Company data. * Excludes Deer Park refinery sale which is to be completed in 4Q21.

Initiation of coverage, Part 2: Royal Dutch Shell in a decarbonised economy | October 2021

Please read the terms and conditions attached to the use of this site.

Saygin, D et al (2021) https://doi.org/10.3390/en14133772. ↩︎

Bloomberg Finance L.P. ↩︎

Royal Dutch Shell (2021) Liquified natural gas (LNG) ↩︎

Royal Dutch Shell (2021), Enhanced Quarterly Disclosures ↩︎

IEA (2021) Net zero by 2050: A roadmap for the global energy sector. ↩︎

Bloomberg Finance L.P. ↩︎

see above, 5. ↩︎

RDS (2021), LNG Outlook - page 11, Wood Mackenzie H1 2020 data ↩︎

see above, 5 ↩︎

Bloomberg Finance L.P. ↩︎

Royal Dutch Shell (2019) Prelude FLNG. ↩︎

Royal Dutch Shell Pearl GTL - Overview. ↩︎

see above, 5., Annex A. ↩︎

see above, 5., Figure 2.18. ↩︎

see above, 5., Figure 2.7. ↩︎

see above, 5. ↩︎

Kline & Company (2020) Global Lubricants: Market Analysis and Assessment 2020. ↩︎

see above, 5. ↩︎

see above, 5., figure 2.5. ↩︎

Electric & hybrid (2020) The new age of lubricants for electric vehicles. ↩︎

see above, 5., page 136. ↩︎

Levi, Peter G. et al (2018) doi: 10.1021/acs.est.7b04573, https://pubs.acs.org/doi/10.1021/acs.est.7b04573. ↩︎

IHS Markit (2021) Petrochemical capacity in China and Middle East: Growth amid challenges. ↩︎

ScienceDirect (2015) Petrochemical industry. ↩︎

IEA (2018) The future of petrochemicals. ↩︎

IEA (2021) Net zero by 2050: A roadmap for the global energy sector. ↩︎

IEA (2020), Chemicals, IEA, Paris ↩︎

see above, 5., figure 2.19. ↩︎

see above, 5. ↩︎

UK Government (2021) Introduction of Plastic Packaging Tax from April 2022. ↩︎

European Commission (2020) A new Circular Economy Action Plan For a cleaner and more competitive Europe. ↩︎

APCO, Australia’s 2025 national packaging target; Woolworths Group, Our sustainability plan 2025 and Thomas Parker (2020) How 2020 became the year when supermarkets changed their packaging policies. ↩︎