Publication Information

- 258 KB PDF

- 1st August 2025

Stay Informed

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign UpPlease read the terms and conditions attached to the use of this site.

Equinor has an opportunity to materially reduce its greenhouse gas emissions and deliver value to Norway – moving away from international oil and gas growth is key

Equinor is under pressure to go further on transitioning its business, with its majority owner, the Norwegian government, asking the company to reduce emissions in line with the Paris Agreement.[1] Minority shareholders are also concerned that Equinor is not keeping pace with global climate goals, with two major Nordic pension funds filing a shareholder resolution at the 2025 annual general meeting.[2] Another institutional investor recently sold its shares, saying the company’s refusal to reduce its emissions is putting “capital at risk”.[3]

Yet, Equinor is moving against the tide with a strategy to sanction further oil and gas projects, principally outside of Norway.[4]

ACCR’s research presents a future pathway for Equinor which reduces emissions by moving away from an international oil and gas growth strategy – investment that has historically eroded value. As ultimate beneficiaries of the government's majority shareholding, the Norwegian public has a strong interest in prudent investment decisions by Equinor.

Our research shows:

It recommends:

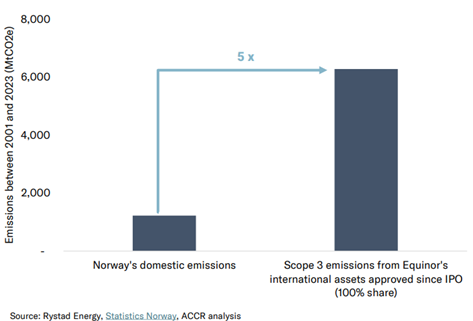

Since its 2001 IPO, Equinor’s international projects have emitted around 6,000 MtCO2e - five times Norway’s emissions over the same period. These assets are forecast to emit a further 13,000 MtCO2e by the end of the century.

Equinor’s international projects have emitted 5x Norway’s domestic emissions.

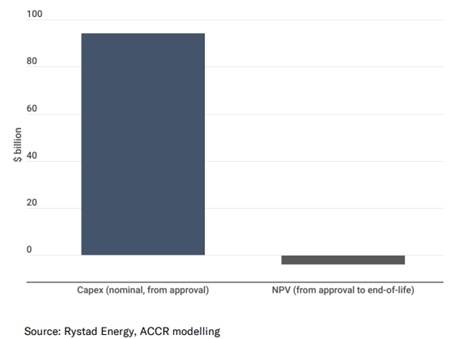

Our Discounted Cash Flow (DCF) analysis found that Equinor’s international projects fail to deliver adequate financial returns for shareholders. These projects have:

Equinor’s international projects are high cost and have eroded value

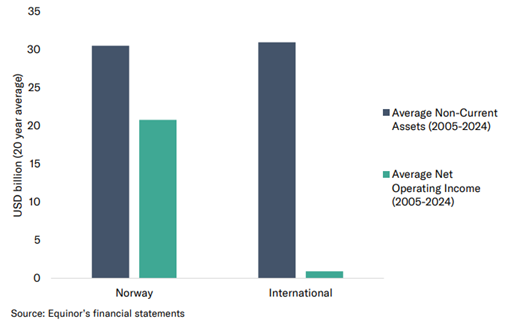

These findings are broadly consistent with Equinor’s audited financial statements, which show that over 20 years, the international oil and gas assets have delivered an average net operating income of $920 million from an average non-current asset base of $31 billion. As a comparison, the Norwegian oil and gas assets delivered 23 times higher net operating income, despite having a similar asset base.

Equinor’s financial statements confirms that its international projects chronically underperform

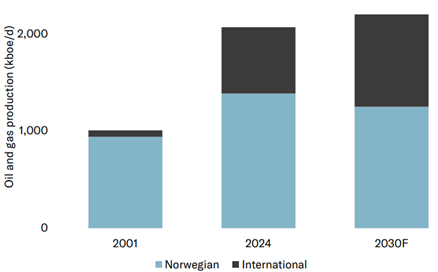

Since its 2001 IPO, Equinor has made international growth a strategic priority, increasing international oil and gas production tenfold. Despite consistently inadequate returns, the company continues to prioritise this strategy, with plans to grow international production by a further 40% - from 681 kboe/d to 950 kboe/d in 2030.

Equinor’s international oil and gas production since IPO has increased ten-fold and is projected to increase a further 40% by 2030

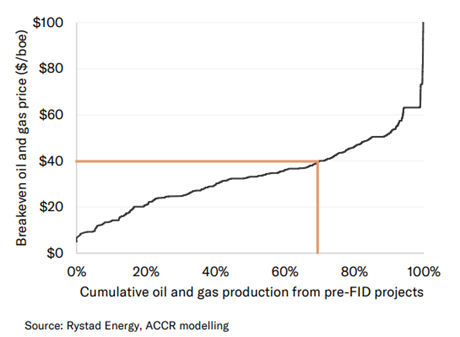

Equinor’s unsanctioned international portfolio is relatively high cost, with average breakeven prices higher than 70% of unapproved oil and gas volumes from global competitors.

Equinor’s future international oil and gas projects have a higher break-even price than other unapproved supply

For over a decade, Equinor has pledged to “improve” or “optimise” its international segment yet returns have remained weak. Since 2008, the company’s international segment has failed to deliver on optimistic guidance. This ongoing underperformance is compounded by mounting structural risks, with global oil and gas demand likely to decline due to the rise of electric vehicles, renewables and the broader energy transition.

For the full report, please visit:

Equinor’s challenge: which way to Paris?

Download this PDF - Equinor’s opportunity | 08/2025

Minutes of Annual General Meeting, 10 May 2023 at point 9, Statement of the Ministry of Trade, Industry and Fisheries read by the company's Chair at the Equinor's 2023 AGM. ↩︎

https://www.accr.org.au/news/institutional-investors-call-equinor-to-account-on-climate/ ↩︎

https://www.netzeroinvestor.net/news-and-views/capital-at-risk-sarasin-partners-divests-from-equinor-over-climate-concerns ↩︎

https://www.accr.org.au/research/wrong-direction-equinor-charts-course-away-from-paris-alignment/ ↩︎

Specifically, unsanctioned assets and exploration. ↩︎

excludes the $14.5 billion (nominal, net) acquisition and pre-FID costs ↩︎

from time of FID ↩︎

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign Up