Publication First read: Royal Dutch Shell Energy Transition report

Today Shell released its Energy Transition report, which sets out its emission reduction targets and decarbonisation strategy. This report will be put forward for shareholders to vote on as part of Shell’s Say on Climate vote at its AGM in May. This is our initial read of the announcement (We've since posted an in-depth analysis).

- What is new? Unfortunately, not much. Shell has made no change to its emission reduction targets (still excluding relevant scope 3) or emissions reduction strategy (still heavily reliant on offsets) Underwhelmingly, the report reflects the announcements on climate transition provided in February. The new content is geared towards supporting Shell to make its case for Paris-alignment, justifying abatements, and downplaying the importance of aligning capital expenditure with low-carbon emission investments.

- The claim on capital expenditure. Shell believes their capex spend in upstream (Oil) and transition (Gas) is justified (65% of capex), and that low investment in renewables (13% of capex) does not indicate a lack of seriousness in climate transition. Adding to that, Shell states it is limiting spending on upstream to “just” US$8bn p.a., “not enough to offset the natural decline in oil and gas reservoirs”, but not enough to reduce it materially either.

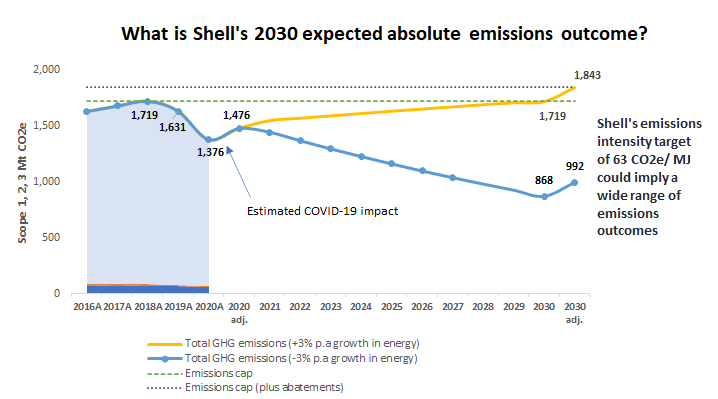

- What is lacking? The key aspect management could have addressed to enhance the credibility of its plan and move investors towards a “Yes” vote is to disclose its 2030 targeted absolute emissions. Shell states that its emissions intensity target for 2030 is Paris-aligned. After 2030 it is relying on society to get it to its net zero target. The claim of Paris-alignment could more credibly be supported with disclosure of expected absolute emissions. As our chart below shows, to meet its emission intensity target (and noting Shell’s guidance that emissions peaked in 2018) a wide range of 2030 emissions outcomes are possible, ranging from a 30% increase (pre-abatement) to a 30% decline. A difference in absolute terms that is equivalent to the carbon footprint of Germany.

- Our view. Insufficient detail on 2030. Shell needs to provide a more credible plan to secure a mandate for its climate transition. With near-term Paris-alignment and scope of emissions a clear gap, we do not see any credible changes to Shell's Net-Zero Company Benchmark assessment.

Royal Dutch Shell key changes to climate commitments

Apr 2021 values are those in the Energy Transition report.

Emission reduction targets

| Indicator | Feb 2021 | Apr 2021 |

|---|---|---|

| Reduction target | Net Zero | No change |

| Year | 2050 | No change |

| Scope inclusion | 1,2, and 3 (energy business only). Excludes Chemicals business with relevant scope 3 emissions. | No change |

| Baseline | 2016 | No change |

| Reduction target | Intensity-based (gCO2e/MJ) | No change |

| Scope inclusion | 1,2, and 3 (energy business only). | No change |

| 2022 | 3-4 % | No change |

| 2023 | 6-8% | No change |

| 2030 | 20% | No change |

| 2035 | 45% | No change |

| 2050 | 100% | No change |

| Exclusions from targets | Chemicals and lubricants business (relevant scope 3). Emissions from producing fuel and transporting it to Shell assets (not expected to be material). Trading activity that does not result in a physical product sale. | No change |

Peak

| Indicator | Feb 2021 | Apr 2021 |

|---|---|---|

| Carbon emissions from energy sold | Expected to have peaked in 2018 at 1.7 Gt p.a. | No change |

| Oil production | Peaked in 2019 | No change |

Abatement

| Indicator | Feb 2021 | Apr 2021 |

|---|---|---|

| Carbon Capture and Storage | 25 million tonnes per year by 2035 | No change |

| Carbon Capture and Storage | Currently capacity 4.5 million tonnes (Quest in Canada, Northern Lights in Norway and Porthose in Netherlands) | No change |

| Nature Based Solutions | 120 Mt a year by 2030 | No change |

Capital expenditure

| Indicator | Feb 2021 | Apr 2021 |

|---|---|---|

| General statement | - | Shell will be setting carbon budgets for all businesses to drive investment decisions, reducing emissions. |

| Renewable Energy (Growth) | US$2-3bn p.a | No change |

| Marketing (Growth) | US$3bn p.a | No change |

| Upstream | US$8bn p.a | Shell states they are limiting investment in Upstream. “Our planned capital investment of US$8 billion in our Upstream business in the near term is well below the investment level required to offset the natural decline (5%p.a) in production of our oil and gas reservoirs, and will not sustain current levels of production.” |

| Integrated gas (Transition) | US$4bn p.a | No change |

| Chemicals (Transition) | US$4-5bn p.a | No change |

Decarbonisation strategy 2030

| Indicator | Feb 2021 | Apr 2021 |

|---|---|---|

| Operating efficiency | Maintain methane emissions intensity <0.2% by 2025 Eliminate routine flaring | No change |

| Growth Pillar: Low-carbon power (renewables) | Increase electric vehicle charge points from 60,000 to ~500,000 by 2025 >50 million households equivalent renewable power by 2030 560 terawatt hours of electricity a year by 2030, twice current amounts | No change |

| Growth Pillar: Low-carbon fuels (biofuels and hydrogen) | Produce 8x more low-carbon fuels by 2030 Double-digit share of global clean hydrogen by 2030 Developing integrated hydrogen hubs, aim to achieve double-digit share of global clean hydrogen sales | Potentially a new comment but not material: Increase low-carbon fuel sales to >10% of transport fuels |

| Transition Pillar: Gas | 7 Mt per annum of new capacity on-stream by 2025 (20% on FY20) Share of gas to increase to 55% of hydrocarbon production in 2030. | No change |

| Upstream Pillar: | 1-2% p.a reduction in oil production, including divestments and natural decline. No new frontier exploration entries after 2025. | Additional insight: Shell will reduce annual spending on exploration from around US$2.2 billion in 2015 to around US$1.5 billion between 2021 and 2025. |

Remuneration

| Indicator | Feb 2021 | Apr 2021 |

|---|---|---|

| Incentives linked to climate transition | For FY21: Executives Long Term Incentive Plan (LTIP) will be 20% weighted to Energy Transition (2022 emission intensity targets, as well as measures to drive future intensity reductions including from CCS and biofuels, and growing its power business (i.e increased gas). Executives Annual Bonus will have a 15% weighting for Energy transition, including execution of Greenhouse Gas (GHG) abatement projects 5% and GHG emissions intensity targets for key lines of business 10%. Awards for 16,500 staff under the Performance Share Plan will have a 20% weighting for energy transition. | Additional insight: The LTIP metric linked to commercialising biofuel technology will be broadened to measure growth in clean energy products. We note it is unclear how this is defined. |

Update: We have since published in-depth analysis on Shell's climate transition plan.