Stay Informed

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign UpThe Australasian Centre for Corporate Responsibility (ACCR) is commenting on the appointment of Meg O’Neill, the CEO of Woodside Energy Group, as BP's new CEO.

Brynn O’Brien, Executive Director of ACCR said:

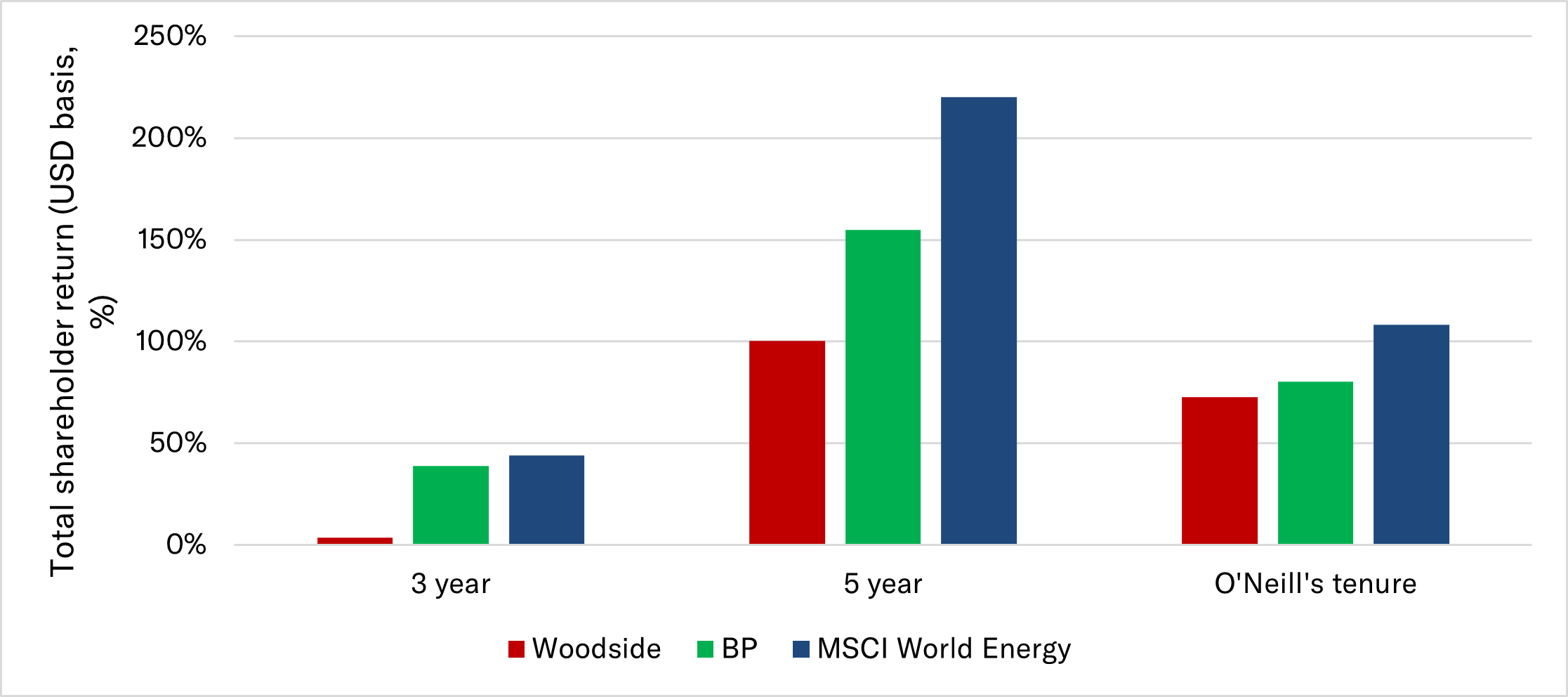

“While BP has chronically underperformed the sector, Woodside has chronically underperformed BP.

“BP is right to be resetting its strategy and focusing on capital discipline to improve investor returns. However, Meg O’Neill is a curious choice in this context. Under O’Neill’s leadership Woodside has chased high-cost, marginal fossil fuel projects and not delivered satisfactory shareholder returns.

“The evidence is clear: exploring for and developing conventional upstream projects has eroded shareholder value at both BP and Woodside.[1] Continuing with this strategy will not deliver the shareholder returns that BP’s board says it is prioritising.

“At Woodside, O’Neill has overseen high-cost, high-emissions investments at a company that has delivered 1% p.a. total shareholder return (TSR) over 15 years and consistently underperformed its peers:

“Woodside has been persistently unresponsive to shareholder concerns and under Ms O’Neill’s watch, has been the only company to suffer a majority vote against its climate plan. [3]

“At Woodside, O’Neill’s departure is an opportunity for a much-needed strategy refresh.

“Investors will be hoping that O’Neill’s departure is a circuit breaker on Woodside’s habit of pursuing high-capex, marginal fossil fuel projects, and is an opportunity to instead start focusing on better capital returns.

“Woodside has an opportunity to move beyond rhetoric with capital discipline and genuinely prioritise its shareholders. The board and the new CEO can now rethink the value destructive Browse project, which is more expensive than 70% of competing potential new gas supplies around the world, as well as the expansion of Louisiana LNG.”

Total Shareholder Return of BP, Woodside and the MSCI World Energy Index [4]

[1]: ACCR, 2025, When growth no longer pays. In addition to this research, which addressed the value oil and gas companies can deliver by moving away from conventional exploration and upstream development, ACCR published research that addressed the need for greater capital discipline at BP (Moving BP from rhetoric to action on capital discipline) in late 2025.

[2]: Economist, 2023, Pemex is the world’s most indebted oil company.

[3]: In 2024, Woodside shareholders delivered the worst Say on Climate vote recorded against a company climate plan (58.4%), beating the previous record set by Woodside in 2022 (48.97%). In addition to a worsening Say on Climate vote, the company has also faced persistently poor votes from shareholders against the re-election of its Directors:

[4]: Total shareholder return for 3 and 5 years are the periods ending 30 September 2025. “O’Neill’s tenure” is from 16 August 2021 to 30 November 2025