Investor Insight Investor Bulletin: ACCR files members’ statement against re-election of Santos’ Chair

ACCR has filed a members’ statement with Santos Ltd, outlining the reasons why ACCR will be voting against the Chair, Keith Spence, who is up for re-election at the 11 April AGM.

Read the members’ statement in full here.

ACCR believes a vote against the Chair is warranted because under his direction the Santos board has failed to deliver a company strategy that maximises shareholder value.

Key points:

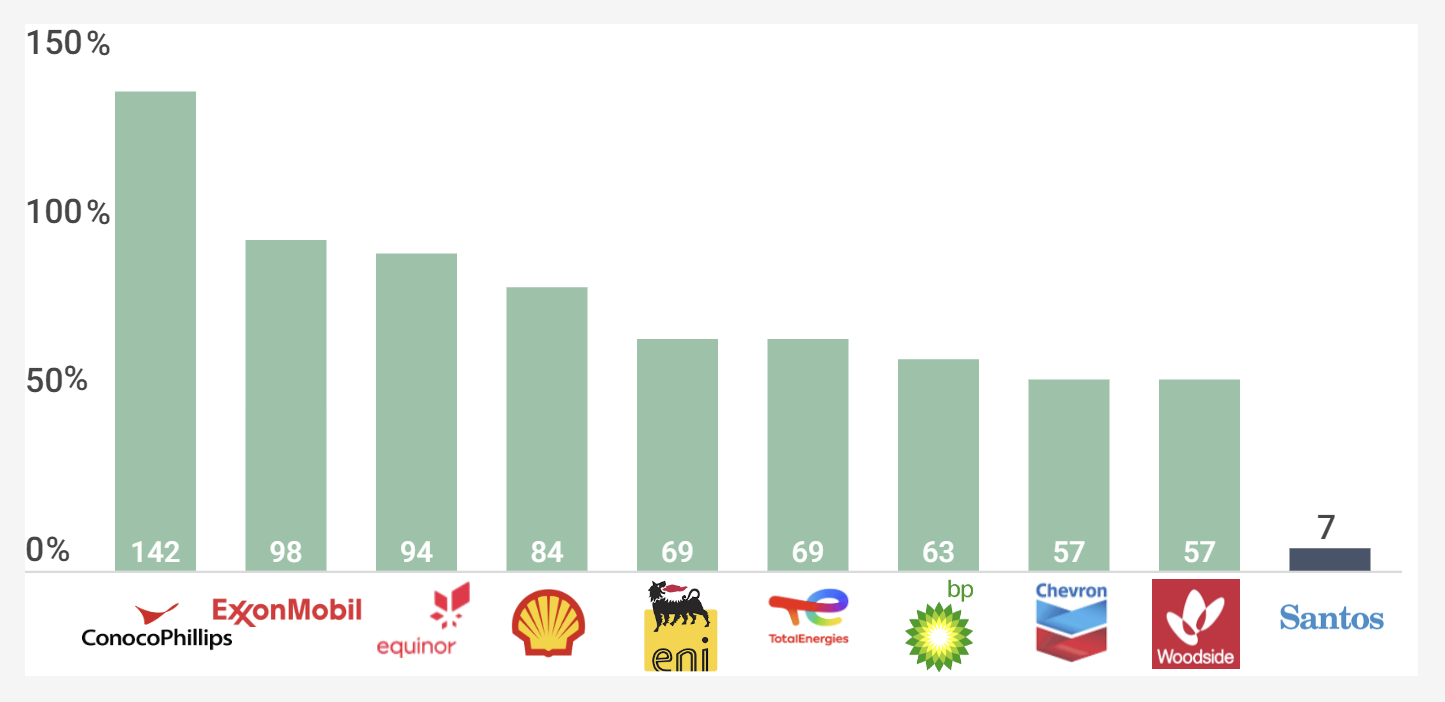

- According to ACCR analysis, Santos’ pivot to a growth strategy in early 2021 has increased capex by 150%, but only delivered 7% total shareholder returns (TSR). The average TSR for global and Australian oil and gas peers over the same period was 82%.

- Santos’ is a laggard in returning capital to shareholders. With a 5.8% 2023 dividend and share buyback yield, it is the lowest amongst its peer group.

- Santos has implemented an A$6m CEO bonus that incentivises growth regardless of shareholder returns.

- ACCR also has concerns about the long-standing business relationship between Keith Spence and Kevin Gallagher, which spans decades across a range of companies. We question whether there is sufficient independence for Spence to exercise an appropriate level of control over management.

ACCR will provide pre-AGM analysis and a webinar in the coming weeks.

Chart 1: Total Shareholder Return (TSR) of Santos and selected global and Australian O&G peers (30 March 2021* to 31 December 2023)

* 30 March 2021, date of Barossa FID

** Data used with permission of Bloomberg Finance L.P.

Please read the terms and conditions attached to the use of this site.