Publication Submission: Joint Standing Committee on Trade and Investment Growth

Daniel Gocher, Director of Climate and Environment

Australasian Centre for Corporate Responsibility (ACCR)

The Australasian Centre for Corporate Responsibility (ACCR) is a registered charity with the Australian Charities and Not-for-profits Commission (ABN 95 102 677 417; ARBN 648 883 194). ACCR invests in and engages with Australian listed companies in regard to their performance on various issues, including climate and the environment. ACCR also works closely with institutional investors and has direct visibility of their current and emerging priorities, including management of climate risk.

Robyn Parkin, Head of Sustainability

Ethical Partners Funds Management

Ethical Partners Funds Management is an independent, boutique Australian fund manager with funds under management of approximately $2.5 billion. Ethical Partners has a dual focus on performance and investing ethically. Its investment approach directly manages risk for its clients, provides the ability to invest in line with clients’ values and actively advocates for change. As well as investing in a manner that reflects our own and our clients’ moral and ethical beliefs, Ethical Partners strongly believes that companies that treat the world and people in a better way will also do better than the broader market in the long run. By focusing on companies with the best practices when it comes to knowing where their products come from, who made them and what impact they had on the planet, we believe we are lowering risk, and generally have more confidence in investing in companies that are ahead of the pack with respect to social and sustainability issues. We also believe that investing in this way is an integral part of addressing the need for business and finance to be part of creating a more sustainable and equitable world.

While the response to climate change risk by regulators, financial institutions and publicly listed companies is welcome, it currently is not enough to ensure a safe climate. To date, the market has failed to reduce emissions at the speed required. If Australia is to deliver on its commitment to the Paris Agreement, it needs urgent, integrated government policy to reduce emissions across all sectors. In the absence of government policy, the communities currently reliant on the coal and gas export industries are at risk of dramatic and abrupt disruption.

Please find below our responses to the terms of reference for this inquiry.

1. The existing and future contribution of Australia's export industries

Australia’s fossil fuel exports are significant, but they must decline in order to avoid dangerous climate change.

According to the Department of Foreign Affairs and Trade (DFAT), in 2019-20 Australia’s five largest exports were iron ore and concentrates, coal, natural gas, education-related travel services and gold.[1]

Table 1. Australia’s top 5 exports, goods and services (AUD million)

| Commodity | 2017-18 | 2018-19 | 2019-20 | % share 2019-20 |

|---|---|---|---|---|

| Iron ore and concentrates | 61,392 | 77,520 | 102,864 | 21.6 |

| Coal | 60,379 | 69,595 | 54,620 | 11.5 |

| Natural gas | 30,907 | 49,727 | 47,525 | 10.0 |

| Education-related travel services | 32,602 | 37,824 | 39,661 | 8.3 |

| Gold | 19,293 | 18,867 | 24,394 | 5.1 |

Source: DFAT

Export volumes of metallurgical and thermal coal have remained largely flat since 2013-14, while export volumes of natural gas have more than tripled over the same period, from 25 million tonnes in 2013-14 to 79 million tonnes in 2019-20.[2]

According to DFAT, the top five markets for Australia’s exports are China, Japan, the Republic of Korea, the United States and the United Kingdom.[3]

Table 2. Australia’s top export markets (AUD million)

| Country | 2017-18 | 2018-19 | 2019-20 | % share 2019-20 |

|---|---|---|---|---|

| China | 123,604 | 153,515 | 167,625 | 35.3 |

| Japan | 51,256 | 61,675 | 56,161 | 11.8 |

| Republic of Korea | 23,713 | 27,839 | 27,647 | 5.8 |

| United States | 21,355 | 24,769 | 27,404 | 5.8 |

| United Kingdom | 11,759 | 13,450 | 20,951 | 4.4 |

Source: DFAT

Australia ratified the Paris Agreement in November 2016. The Paris Agreement compels Australia to “strengthen the global response to the threat of climate change”, and to “limit the increase in the global average temperature to well below 2°C above pre‑industrial levels”.[4]

In order to limit global warming to well below 2°C, the combustion of fossil fuels including coal, oil and natural gas must rapidly decline. The Intergovernmental Panel on Climate Change (IPCC) Special Report on Global Warming of 1.5°C projects that in the absence of carbon capture and storage (CCS), or with only a limited use of fossil fuels with CCS, the use of coal and gas must decline significantly if we are to limit dangerous climate change.[5] The IPCC concluded that the share of primary energy provided by coal must decline by 61-78% by 2030 and by 77-97% by 2050 (relative to 2010).[6] Similarly, the share of primary energy demand provided by gas must decline by 20-25% by 2030, and by 53-74% by 2050 (relative to 2010).[7]

While Australia has not formally committed to reach net zero emissions by 2050, Prime Minister Scott Morrison has said that he aims for Australia to get to net zero “as quickly as possible and preferably by 2050”.[8]

Many of our largest trading partners, particularly our largest export markets have committed to reach net zero emissions by mid-century.

Table 3. Climate commitments of Australia’s largest export markets

| Country | Short- to medium-term | Long-term |

|---|---|---|

| China | Peak carbon emissions before 2030 Non-fossil share: 20% in 2030 | Carbon neutrality before 2060 |

| Japan | 46% below 2013 by 2030 | Net zero by 2050 |

| Republic of Korea | 37% below BAU by 2030 | TBA |

| United States | 50-52% below 2005 by 2030 | Net zero by 2050 |

| United Kingdom | 68% below 1990 by 2030 | Net zero by 2050 |

Source: Climate Action Tracker

Despite significant increases in ambition from Japan, the United Kingdom and the United States in the lead up to or at US President Biden’s Climate Summit in April 2021, few countries’ commitments are consistent with limiting global warming to well below 2°C. According to Climate Action Tracker, commitments at the summit “led to the single biggest reduction in the 2030 emissions gap - at 12-14% - that we’ve ever seen”,[9] but more ambition is needed, particularly from global laggards like Australia, Brazil, Russia and Saudi Arabia.

Such commitments are likely to have an enormous impact on Australia’s fossil fuel exports. Ahead of the release of the 2021 NSW Intergenerational Report, NSW Treasury found that “global coal demand is projected to decline over the next forty years, which will “negatively impact productivity growth in the absence of New South Wales transitioning these workers into similarly productive industries”.[10] Similarly, the Australian National Outlook 2019—a collaborative report between the CSIRO and National Australia Bank—projected that in a “cooperative global context”, global coal demand would decline by approximately 70% by 2060.[11]

In order to ensure that their domestic producers are not disadvantaged by carbon intensive imports, some countries are considering introducing carbon border adjustment mechanisms. In March, the European Union (EU) voted to introduce a carbon border adjustment mechanism as part of a broader EU industrial strategy.[12] It is likely that such a mechanism will impact on Australia’s emissions intensive imports into the EU, including aluminium, liquified natural gas (LNG) and steel. China, the United Kingdom and the United States are also reportedly considering such carbon border taxes.[13]

In addition to the commitments from Australia’s trading partners to reduce emissions, technological change is rapidly changing the economics of energy. According to Bloomberg New Energy Finance (BNEF), Solar PV and onshore wind are now the cheapest sources of new-build electricity generation for at least two-thirds of the global population.[14] Furthermore, battery storage is now the cheapest new-build technology for peaking purposes (up to two-hours of discharge duration) in gas-importing regions including China and Japan.[15] Such developments pose an existential threat to Australia’s fossil fuel exports.

The production of coal and gas for export is very emissions intensive. According to Australia’s National Greenhouse Gas Inventory, fugitive emissions from coal and gas production account for 10% of Australia’s total annual emissions, or 51.2 million tonnes CO2-e (to September 2020).[16] These emissions have increased 30.5% or 12 million tonnes CO2-e since 2015 as a result of the growth of LNG exports.[17] Similarly, emissions from stationary energy (excluding electricity)—from the direct combustion of fuels, predominantly from the manufacturing, mining, residential and commercial sectors—have increased 53.3% or 35.4 million tonnes CO2-e since 1990, also driven largely by the growth of LNG exports.[18] Given that there are limited alternatives to the combustion of gas in producing LNG, or to capture fugitive emissions, Australia will need to dramatically reduce coal and gas production in order to deliver on its commitment to the Paris Agreement.

2. The investment guidance and advice provided by Australia's financial regulators, including the Australian Prudential Regulation Authority (APRA), the Reserve Bank of Australia (RBA) and the Australian Securities and Investments Commission (ASIC), to banking, insurance and superannuation institutions, and also to publicly-listed companies, in relation to investment in Australia's export industries

The Bank for International Settlements (BIS), which acts as a “bank for central banks”[19], has defined the term ‘green swan’ to express the threat that climate change presents to our financial systems.[20] Green swan events are seen to differ from black swan events, such as the COVID-19 pandemic, in three ways:

“First, although the impacts of climate change are highly uncertain, “there is a high degree of certainty that some combination of physical and transition risks will materialize in the future.”

“Second, climate catastrophes are even more serious than most systemic financial crises: they could pose an existential threat to humanity, as increasingly emphasized by climate scientists.”

“Third, the complexity related to climate change is of a higher order than for black swans: the complex chain reactions and cascade effects associated with both physical and transition risks could generate fundamentally unpredictable environmental, geopolitical, social and economic dynamics.”

This is the context for the emerging efforts of Australia’s financial regulators, banks and insurers to limit the impact that both physical (the direct impacts of climate change) and transition (the impacts from transitioning to a zero carbon economy) risks pose to Australia’s financial system. This is particularly important as Australia is highly vulnerable to both physical and transition risks, being the driest inhabited continent[21] with carbon intensive exports.

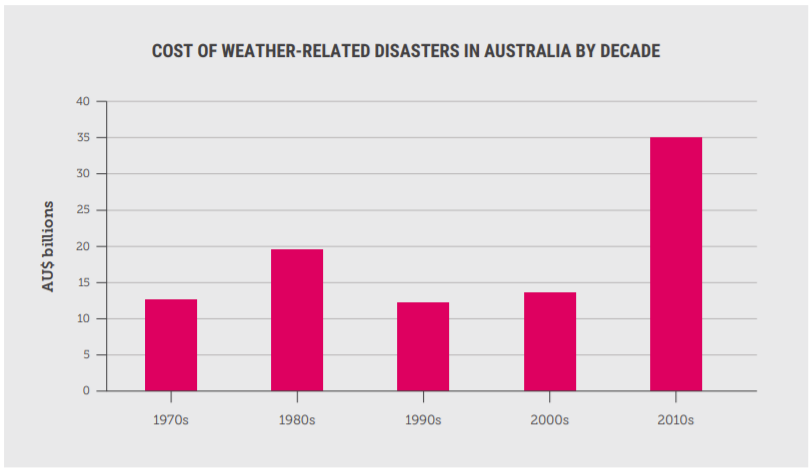

The physical impacts of climate change are rising globally, with the economic costs from natural disasters having “exceeded the 30‑year average for seven of the last 10 years, while the number of extreme weather events globally has tripled since the 1980s”.[22] In Australia, as demonstrated in Figure 1, the inflation-adjusted costs of weather related natural disasters have more than doubled since the 1970s. This trend is only projected to continue, with recent modelling from NSW Treasury estimating that the “cost of natural disasters to the state will more than triple by 2061, to as much as $17.2 billion per annum, as climate change drives more frequent and severe weather”.[23]

Figure 1: Inflation-adjusted cost of weather-related disasters in Australia by decade[24]

In terms of transition risks for Australia’s economy, as highlighted earlier in this submission, rapid technology change and increasing decarbonisation efforts of our major trading partners present material challenges for our major exports, particularly coal and LNG.

It is important to recognise that Australia’s regulators are not acting in isolation of their international peers. The previously mentioned BIS, the Basel Committee on Banking Supervision (BCBS), the International Association of Insurance Supervisors (IAIS) and the International Organisation of Securities Commissions (IOSC) all have strong messaging around the need for national regulators to be managing the risks that climate change presents to economies.

In addition, there are emerging efforts to mandate the disclosure of climate risks to enable “informed investment, credit and insurance underwriting decisions”,[25] with New Zealand recently legislating mandatory climate risk disclosure for “all banks with total assets of more than NZ$1 billion, insurers with more than NZ$1 billion in total assets under management, and all equity and debt issuers listed on the country's stock exchange”.[26] Similar legislation has been proposed in the US, via the Climate Risk Disclosure Act,[27] as well as the UK.[28]

As an example of Australian regulator conduct, APRA has focused its efforts on enabling its regulated entities to understand and manage climate risks. Its recently released draft Prudential Practice Guide (PPG) for climate risk “does not seek to determine an institution’s individual investment, lending or underwriting decisions, but does aim to ensure that these decisions are well-informed”.[29] The PPG rightly emphasises the compounding nature of climate risks and their interplay with traditional risk areas. For example credit risks can be exacerbated by physical climate impacts through loan defaults due to natural disaster disruptions at the same time that assets, used as collateral, decline in value due to their physical risk exposure and associated insurance affordability issues.[30]

When a material climate risk is identified by a regulated entity, APRA expects the entity will work with “customers, counterparties and organisations... to improve the risk profile of those entities”.[31] Where this is not possible, APRA highlights the following mitigation options:[32]

a) reflecting the cost of the additional risk through risk-based pricing measures;

b) applying limits on its exposure to such an entity or sector; or

c) where the risks cannot be adequately addressed through other measures, considering the institution’s ability to continue the relationship.

Any effort to limit the ability of banks, insurers and superannuation funds to contemplate the above mitigation options, in line with their own risk management protocols, conflicts with fiduciary duty and sound business practice.

3. The approach and motivations of our financial institutions, including banks, insurers and superannuation funds, as well as publicly-listed companies, to their investment in Australia's export industries

Australia’s financial institutions and publicly-listed companies are informed by the latest climate science which feeds into their own research and forecasting, guidance from regulators (as covered in the previous section), engagement with their own shareholders and members, and broader community concerns. Their approach to investment in Australia’s export industries, particularly the coal and gas industries, is predominantly one of risk management, particularly by the transition and physical risks from climate change.

Australia’s largest banks and insurers produce and have access to enormous amounts of information relating to the financial impacts of climate change.

For example, National Australia Bank (NAB) has collaborated with the CSIRO for several years on the Australian National Outlook (ANO), last published in 2019.[33] The ANO uses the CSIRO’s integrated modelling with input from NAB and 20 other leading Australian companies and not-for-profit organisations, to forecast two very different pathways that Australia may follow: a “slow decline” and an “Outlook Vision”.[34] These forecasts propose shifts in industry, urbanisation, energy, land and culture in order to achieve a more prosperous outcome for all Australians. Other Australian banks produce similar, if not as comprehensive, economic modelling.

Insurance Australia Group (IAG) and Westpac have been involved in the Australian Business Roundtable for Disaster Resilience and Safe Communities for most of the previous decade.[35] It has produced five research reports to inform their own and Australian policy-makers thinking about natural disasters and extreme weather events.

In 2020, IAG published the second edition of its ‘Severe Weather in a Changing Climate’ report which concluded that climate change is having a significant impact on Australian communities right now.[36] IAG warned that “in a warming climate, extreme weather events will become more frequent and intense for many regions of Australia, causing greater property, personal and economic damage, and resulting in further hardship for our communities”.[37]

Asset manager Mercer published the second edition of its ‘Investing in a time of climate change’ report in 2019.[38] It found that “a 2°C scenario leads to enhanced projected returns versus 3°C or 4°C and therefore a better outcome for investors”.[39] Mercer warned that “the current trajectory of at least 3°C above the preindustrial average by 2100 could put us beyond the realm of human experience sometime in the next 30 years”.[40]

Progressively, the companies in which financial institutions invest have also become a source of information on climate risk, as the companies themselves analyse the future of their businesses.

The G20’s Financial Stability Board’s Task force on Climate-related Financial Disclosures (TCFD),[41] established in 2015, created a framework for standardised climate risk disclosure by public companies, including banks and insurers. It is based on four pillars: Governance, Strategy, Risk Management, and Metrics and Targets.[42] As part of the disclosures related to Strategy, companies are expected to assess and disclose the resilience of their organisations’ strategy using various climate-related scenarios, including a 2°C or lower scenario, otherwise known as scenario analysis.

Scenario analysis by publicly listed companies over the last several years has produced fairly consistent results. While some companies may stand to benefit from a delayed global response to climate change—including coal and gas companies—almost universally, companies have concluded that runaway climate change would pose an existential threat to their business and society at large.

Some of these findings are detailed below.

While ANZ does not foresee the transition and physical risks of climate change posing a material risk to its strategy over the short- to medium-term, it acknowledges that “over the longer term (more than 5 years), material risks are likely to emerge unless we take steps to manage the potential impacts of climate change”.[43]

In assessing its portfolio, BHP used a “Climate Crisis” scenario, which “ultimately results in a lower demand trajectory post-climate shock, as the world settles on a permanently low GDP growth trajectory”.[44] Conversely, BHP found that a 1.5°C scenario is an “attractive scenario for BHP, [its] shareholders and the global community”.[45]

In its latest climate report, Rio Tinto assessed three scenarios, the least ambitious of which found that a rapid increase in global temperatures would intensify physical impacts from climate change.[46] Those impacts have the potential to “occasionally disrupt mine supply and logistic chains, resulting in additional volatility across commodity markets”.[47]

It is clear that publicly listed companies take a risk-based approach to investing in Australia’s coal and gas industries. While there is an imperative to avoid the systemic risk of dangerous climate change, financial institutions are also keen to avoid negative returns in the short- to medium- term.

In the United States, the broad-based S&P500 index has returned 14.25% p.a. in the ten years to April 2021, while the S&P500 Energy index has returned -1.37% p.a. in the ten years to April 2021 (both inclusive of dividends).[48] This is demonstrated in Figure 2 below.

Figure 2: S&P500 vs S&P500 Energy total returns 2011-21

Similarly, in Australia the broad-based S&P/ASX200 index has returned 8.44% p.a. in the ten years to April 2021, while the S&P/ASX200 Energy index has returned -4.14% p.a. over the same period (both inclusive of dividends).[49] This is shown in Figure 3 below.

Figure 3: S&P/ASX200 vs S&P/ASX200 Energy total returns 2011-21

The transition risks in the energy and utilities sectors in particular, are playing out right now with real-world consequences for investment returns. Australia’s financial institutions would be compromising their duties to shareholders and members by ignoring these risks.

4. The consequential impacts of (2) and (3):

a) For legitimate, law-abiding businesses connected to Australia's export industries;

b) On regional and rural economies that are reliant on Australia's export industries. particularly in light of the COVID-19 recession;

c) Our national economy. particularly in light of the COVID-19 recession;

As detailed thus far, climate change presents material physical and transition risks to Australia, hence the efforts by regulators, banks, insurers and companies to minimise the impact of these risks. Such efforts will only intensify with climate change impacts and mitigation efforts, with some industry sectors and regions more vulnerable than others.

For some “legitimate, law-abiding” businesses that are heavily exposed to carbon intensive industries or physical climate impacts, risk mitigation efforts such as diversification or adaptation may be possible. However it is not solely the role of individual businesses to take on this burden. Federal and State governments carry significant responsibility to support the just transition of our economy and communities, particularly those most reliant upon the fossil fuel industry. The decline of carbon intensive industries is “entirely predictable and it is crucial that governments act to support workers and communities impacted by the energy transition”.[50] Any effort by the Federal Government to abandon its own obligations to support a just transition by forcing regulators, banks, insurers and companies to ignore climate risk is pure negligence.

Finally, whilst this submission has predominantly focused on the risks of climate change, the commercial opportunities from the clean energy transition and climate resilience measures are significant. Due to our abundance of sunshine, wind and land Australia has “enormous potential to thrive in a low-carbon global economy” but only if our government is willing to get the transition right.[51]

5. Any other related matter

While the response to climate change by regulators, financial institutions and publicly listed companies is welcome, we would argue that it currently is not enough to ensure a safe climate. The Australian Council of Superannuation Investors (ACSI) found that just 18 companies in the S&P/ASX200 index have committed to net zero emissions by 2050 or sooner, but only five of those companies have disclosed a strategy to achieve those targets.[52] The overwhelming majority of publicly listed companies simply aren’t doing enough to reduce emissions and manage their exposure to climate change risk.

If Australia is to deliver on its commitment to the Paris Agreement, it needs urgent, integrated government policy to reduce emissions across all sectors. To date, the market has failed to reduce emissions at the speed required. In the absence of government policy, the communities currently reliant on the coal and gas export industries will be at risk of dramatic and abrupt disruption.

Department of Foreign Affairs and Trade, ‘Australia’s Top 25 Exports, Goods and Services’, 2019-20. ↩︎

Office of the Chief Economist, ‘Resources and Energy Quarterly’, March 2021. ↩︎

Department of Foreign Affairs and Trade, ‘Australia’s trade in goods and services by top 15 partners’, 2019-20. ↩︎

United Nations Framework Convention on Climate Change (UNFCCC), ‘The Paris Agreement’, 2015. ↩︎

IPCC, ‘Special Report on Global Warming of 1.5°C’, October 2018. ↩︎

ibid. ↩︎

ibid. ↩︎

Prime Minister of Australia, Address, Business Council of Australia Annual Dinner, 19 April 2021. ↩︎

Climate Action Tracker, ‘New momentum reduces emissions gap, but huge gap remains - analysis’, 23 April 2021. ↩︎

NSW Treasury, ‘2021 NSW Intergenerational Report Treasury Technical Research Papers’, April 2021. ↩︎

CSIRO and National Australia Bank, ‘Australian National Outlook’, 2019. ↩︎

European Parliament, ‘WTO-compatible EU carbon border adjustment mechanism’, 8 March 2021. ↩︎

Hans van Leeuwen, ‘Australia out of the ‘climate club’ as EU advances carbon border tax’, Australian Financial Review, 7 February 2021. ↩︎

Veronika Henze, ‘Scale-up of Solar and Wind Puts Existing Coal, Gas at Risk’, BNEF, 28 April 2021. ↩︎

ibid. ↩︎

Department of Industry, Science, Energy and Resources, ‘Quarterly Update of Australia’s National Greenhouse Gas Inventory: September 2020’, September 2020. ↩︎

ibid. ↩︎

ibid. ↩︎

BIS, ‘BIS mission statement’, link. ↩︎

BIS, ‘The Green Swan: Central banking and financial stability in the age of climate change’, January 2020. ↩︎

The Australian Academy of Science, ‘The Risks to Australia of a 3 degree warmer world’, March 2021. ↩︎

Reuters, ‘Climate change could make premiums unaffordable’, Reuters, February 2020 link\ ↩︎

NSW Treasury, ‘2021 NSW Intergenerational Report Treasury Technical Research Papers’, April 2021. ↩︎

The Climate Council, ‘Hitting Home: The compounding costs of climate inaction’, 2021 ↩︎

Task Force on climate-related financial disclosures, ‘About’, link.\ ↩︎

Reuters, ‘New Zealand introduces climate change law for financial firms in world first’, April 2021. ↩︎

DLA Piper Sustainability and Environmental, Social and Governance Alert, ‘Democrats reintroduce Climate Risk Disclosure Act’, DLA Piper Sustainability and Environmental, Social and Governance Alert, April 2021 link.\ ↩︎

Reuters, ‘UK proposes requiring businesses to disclose climate risks by 2022’, March 2021 link.\ ↩︎

APRA, ‘Prudential Practice Guide: Draft CPG 229 Climate Change Financial Risks’, April 2021.\ ↩︎

APRA, ‘Prudential Practice Guide: Draft CPG 229 Climate Change Financial Risks’, April 2021.\ ↩︎

APRA, ‘Prudential Practice Guide: Draft CPG 229 Climate Change Financial Risks’, April 2021. ↩︎

APRA, ‘Prudential Practice Guide: Draft CPG 229 Climate Change Financial Risks’, April 2021. ↩︎

CSIRO and National Australia Bank, ‘Australian National Outlook’, 2019. ↩︎

ibid. ↩︎

Australian Business Roundtable for Disaster Resilience & Safer Communities, link. ↩︎

Insurance Australia Group, ‘Severe Weather in a Changing Climate’, 2020. ↩︎

ibid. ↩︎

Mercer, ‘Investing in a time of climate change’, 2019. ↩︎

ibid. ↩︎

ibid. ↩︎

Task Force on Climate-related Financial Disclosures, link. ↩︎

ibid. ↩︎

ANZ Banking Group, ‘2020 Climate-related Financial Disclosures’, 2020. ↩︎

BHP Group, ‘Climate Change Report 2020’, 2020. ↩︎

ibid. ↩︎

Rio Tinto, ‘Our Approach to Climate Change 2020’, 2020. ↩︎

ibid. ↩︎

S&P Global ↩︎

ibid. ↩︎

ACTU, ‘The need for a just transition’, link. ↩︎

The Lowy Institute, ‘Australia’s place in a decarbonising world economy’, February 2021, link. ↩︎

Australian Council of Superannuation Investors (ACSI), ‘Promises, Pathways and Performance’, October 2020. ↩︎