Publication South32: Climate Transition Action Plan Analysis

South32 Ltd

(ASX:S32, ISIN:AU000000S320)

AGM date and location: 27 October 2022 (AU).

Contacts:

Harriet Kater, Climate Lead, Australia

Fiona Deutsch, Company Analyst

Summary

South32 has released its Climate Change Action Plan (CCAP) to be put to an advisory shareholder vote at its upcoming Annual General Meeting (AGM). Similar to other ASX-listed diversified miners, South32 has committed to providing this “Say on Climate” every three years. The CCAP reiterates the company’s 50% Scope 1 and 2 emissions target for 2035 (with a 2021 baseline), its net zero scope 1 and 2 target for 2050, and for the first time it discloses a net zero Scope 3 goal for 2050.

In many ways South32 is just starting to decarbonise its complex assets. Whilst the bones of its strategy have merit, it has little progress to report on thus far. The company has not, and perhaps cannot, indicate how much abatement it expects to achieve by 2035 at each of its three major polluting assets – Hillside Aluminium (60% S1 & S2 emissions), Worsley Alumina (18%) and Illawarra Metallurgical Coal (10%). Whilst some positive priorities for Scope 3 emissions management have been set, implementation is yet to commence. This delay in prioritising decarbonisation has prevented South32 from getting ahead of some major challenges in its portfolio.

Some positive developments and CCAP commitments include:

- The decision to not progress with the Dendrobium Next Domain project and its commitment to not pursue greenfield metallurgical coal projects. The decision indicates South32 is focused on restructuring its portfolio towards “metals critical to a low-carbon future”.

- Whilst the 2035 Scope 1 & 2 target is not completely aligned with a 1.5°C trajectory, the Transition Pathways Initiative has determined that the company’s aluminium and alumina pathway is. This is the most material emissions source for South32, comprising 83.3% of total Scope 1 & 2.

- South32 has significantly increased its recognition of climate change in its FY22 financial statements.

- Whilst more detail will be necessary, the company presents the foundations of a concerted approach for a Just Transition.

However ACCR is concerned about the following:

- With regard to Hillside, ACCR has engaged with South African energy market experts and whilst challenges exist, the company has ready opportunities to underwrite the build out of renewable energy systems on the Eskom grid. This will aid in much needed system security and decarbonisation. South32 is an attractive counterparty for any renewable energy developer to consider innovative contracting structures. ACCR encourages South32 to progress as swiftly as possible, in the interests of Hillside’s competitiveness and the South African economy more broadly.

- South32 is not sufficiently prioritising the leapfrogging or minimisation of gas use at Worsley Alumina. South32's delay in shifting from coal has also meant it has to contemplate coal imports from Indonesia, after Griffin Coal entered into administration a second time. We strongly encourage the company to engage proactively with governments to explore funding and support packages to expedite its shift to the highest possible share of renewable energy at the site.

- Investors would benefit from seeing further evidence of South32 constraining negative climate lobbying from industry associations and, like BHP, more positive advocacy that complements its decarbonisation strategy.

On balance, it is ACCR’s view that this plan is supportable due to South32’s changed position on greenfield fossil fuel expansion, in contrast to peers like BHP. The core principles of South32's transition strategy are sound. However, we encourage the company to provide a more granular, quantified update in 2023 to arm investors with the detail they need to assess the probability of the company meeting its 2035 target.

Voting recommendation: FOR, subject to provision of quantified updates in 2023

Table 1: ACCR assessment of South32’s CCAP against CA100+ benchmark

| Disclosure Indicator | South32 Databook Disclosure | CA100+ Score pre-CCAP | ACCR assessment of score post CCAP |

|---|---|---|---|

| 1. Net-zero GHG emissions by 2050 or sooner | Net zero operational emissions by 2050 | Partial | Yes. South32’s inclusion of a goal to reach net zero Scope 3 emissions will see it meet all criteria for this indicator. |

| 2. Long-term (2036-2050) GHG reduction target(s) | Net zero operational emissions by 2050 | Partial | Partial will remain since long term target is not completely aligned with the 1.5°C trajectory |

| 3. Medium-term (2026-2035) GHG reduction target(s) | 50% reduction by 2035 | Partial | Partial will remain as excludes Scope 3 emissions, not aligned with 1.5°C |

| 4. Short-term (up to 2025) GHG reduction target(s) | N/A | Does not meet any criteria | No short term target due to “complexities in decarbonising energy sources for Hillside Aluminium and Worsley Alumina” (CCAP, p73) |

| 5. Decarbonisation strategy | Optimisation, energy efficiency, low-carbon technology | Partial | Partial will remain. Company identifies actions it intends to make but does not quantify key elements of the strategy. |

| 6. Capital allocation alignment | Capex of US$40-50m for decarbonisation over FY22-23 | Does not meet any criteria | Partial No explicit commitment to align capital expenditure with 1.5°C |

| 7. Climate policy engagement | Published industry association review in 2019, 2020 and 2021 | Partial | Partial Review focused on policy rather than advocacy |

| Climate policy engagement alignment assessment | Mid range Organisational Score | 51% | Indicates mixed engagement with Paris-aligned policy |

| 8. Climate governance | 20% linkage to LTI for emissions targets and the transition of the portfolio towards a low-carbon future. | Partial | Partial score will likely remain as no explicit position on board named as having accountability. |

| 9. Just transition | N/A | N/A | South32 has significant Just Transition considerations, particularly at Hillside Aluminium in South Africa |

| 10. TCFD disclosure | Discloses consistent with TCFD pillars | Meets all criteria | Yes |

| Accounts and audit alignment assessment | Red score for all indicators | No | Partial: Assessment likely to improve with added commentary in FY22 accounts |

1. ACCR view of South32’s CA100+ Net Zero Company Benchmark scores with CCAP

On 9 September 2022, Climate Action 100+ (CA100+) released an updated Net Zero Company Benchmark assessment for 14 Australian companies in preparation for Australia’s upcoming AGM season. Since South32’s 2022 CCAP was also released on this date, meaning it was not covered in CA100+’s assessment, ACCR has conducted its own analysis of South32’s CCAP using the CA100+ benchmark as a framework and this is shown in Table 1. This analysis is aligned with the structure of the CA100+ benchmark.

2. South32’s contribution to climate change

Since South32 was spun out from BHP in 2015, the divestment of its thermal coal assets has seen the company’s scope1 and 2 emissions footprint decline by around ~3%. Its emissions footprint remains sizeable (see Figure 1) and is characterised as follows:

- Scope 3 emissions represent 76% of total emissions;

- The processing of alumina and aluminium represents 53% of total emissions and 83% of Scope 1 and 2 emissions. It is also the largest source of Scope 2 emissions due to the carbon intensity of the South African grid which supplies the Hillside Aluminium smelter;

- Metallurgical coal produces 20% of Scope 1 emissions, driven by diesel consumption and fugitive methane emissions;

- Supply chain emissions for manganese ore makes up ~25% of Scope 3 emissions.

Figure 1: South32 emissions by commodity, FY22 (MtCO2e)[1]

3. South32’s medium and long-term climate targets

South32’s medium and long term targets are shown in Table 2. The company does not have a short-term target, stating that due to technical, commercial and social complexities associated with Hillside Aluminium and Worsley Alumina, it is not confident emissions reductions could be achieved within a timeframe of a credible short-term target.[2] These challenges are explored in more detail in Section 6.

South32’s medium term target is to reduce absolute operational emissions by 50% by 2035, from a FY21 baseline.[3] The company set this target in 2021 and the baseline has been adjusted for the following divestments:

- The divestment of its thermal coal asset in South Africa (South Africa Energy Coal, SAEC) in 2021; and

- The divestment of its 60% share in Tasmanian manganese alloy smelter (Tasmanian Electro Metallurgical Company, TEMCO) in 2020.

Importantly, divestment is not decarbonisation. This is discussed further in Section 6: Decarbonisation Strategy.

Table 2: South32’s quantifiable medium- and long-term emission reduction targets and goals

| 2030 | 2050 | |

|---|---|---|

| Scope 1 & 2 Target | Reduce absolute operational emissions by 50% by 2035 (2021 baseline) | Goal: Net zero operational emissions by 2050 |

| Scope 3 Goals | Goal: net zero Scope 3 emissions by 2050 |

NB: goals are distinct from targets and not firm commitments; baseline adjusted for divestments.

Due to the breadth of commodities that South32 produces, the Paris-alignment of its medium-term targets is difficult to assess. As shown in Table 3, the Transition Pathways Initiative (TPI)’s assessment of South32’s targets for the CA100+ Net Zero company benchmark determined that the company’s medium and long term aluminium intensity pathway, which includes alumina refining,[4] was aligned with the IPCC’s Special Report on 1.5°C.[5] However its diversified mining business (bauxite, copper, silver, lead, zinc, nickel and manganese) was deemed inconsistent with this pathway[6] and the metallurgical coal business doesn’t appear to have been assessed. In aggregate, South32’s medium-term Scope 1 and 2 target is inconsistent with a 1.5°C pathway and it excludes Scope 3 emissions. ACCR notes that in FY22, South32 introduced a Scope 3 net zero by 2050 goal along with its already stated position of a goal of net zero operational emissions by 2050.

Table 3: TPI assessment of South32 target by commodity for CA100+ Net Zero Company Benchmark

| Commodity | Short-term alignment in 2025 | Medium-term alignment in 2035 | Long-term alignment in 2050 | Indicative emissions Scope 1 and 2 |

|---|---|---|---|---|

| Aluminium | Not aligned | Aligned: 1.5°C | Aligned: 1.5°C | 84% |

| Alumina | ||||

| Metallurgical Coal | Not assessed | Not assessed | Not assessed | 10% |

| Diversified Mining | Not aligned | Not aligned | Not aligned | 7% |

Peer comparison

When compared to peers as opposed to what the science requires, South32 is at the lower end of the pack (see Table 4). Its commitments are comparable to BHP Group, however they lag behind Fortescue Metals Group, which has committed to reaching net zero operational emissions by 2030 and net zero Scope 3 emissions (including steelmaking) by 2040, primarily through the production (and ultimate end use) of green hydrogen.[7] Additionally, Glencore has committed to reducing its total emissions—Scope 1, 2 and 3—by 50% by 2035[8] and Anglo American has a net zero target for 2040, with an ambition to reduce its Scope 3 emissions by 50% in the same time period.[9]

Table 4: Quantifiable medium and long-term emission reduction targets of South32 and peers

Company

| Company | Medium-term target | Long-term target | Scope 3 |

|---|---|---|---|

| Anglo American[10] | Eight assets to be carbon neutral by 2030. Reduce net emissions by 30% by 2030 (2016 baseline). Improve energy efficiency by 30% by 2030 (2016 baseline). | Net zero operational emissions by 2040. | Ambition to reduce Scope 3 emissions by 50% by 2040 (2020 baseline). Carbon neutrality in controlled ocean freight by 2040. |

| BHP Group[11] | Reduce operational emissions by at least 30% by 2030 (2020 baseline). | Net zero operational emissions by 2050. | 2030 goals: Support development of technologies capable of 30% reduction in integrated steelmaking; Support 40% emissions intensity reduction of BHP-chartered shipping. 2050 targets: Net zero by 2050 for operational GHG emissions of direct suppliers, subject to widespread availability of carbon neutral goods and services; Net zero by 2050 for GHG emissions from all shipping of BHP products, subject to the widespread availability of carbon neutral solutions. Goal of net zero Scope 3 emissions by 2050. |

| Fortescue Metals Group[12] | Net zero operational emissions by 2030 (2020 baseline), with an emissions reduction of at least 3% annually. | Net zero operational emissions by 2030. | Net zero Scope 3 emissions by 2040. Reduce emissions intensity in shipping of FMG iron ore by 50% by 2030 (on 2021 levels). Reduce emissions intensity in steelmaking by FMG customers by 7.5% by 2030 (2021 baseline). |

| Glencore[13] | 50% reduction of total (Scope 1, 2 and 3) emissions by 2035 (2019 baseline). | Ambition to achieve net zero for Scope 1, 2 and 3 emissions by the end of 2050. | 50% emissions reduction by 2035 (2019 baseline) and ambition of net zero Scope 3 emissions by end of 2050. |

| Rio Tinto[14] | Reduce absolute emissions by 50% by 2030 (2018 equity baseline, adjusted for divestments). | Net zero operational emissions by 2050. | Ambition to reduce the emissions intensity of shipping[15] by 40% by 2025; goal of net zero emissions from shipping Rio Tinto products by 2050. |

| South32[16] | Reduce absolute emissions by 50% by 2035 (2021 baseline). | Goal of net zero operational emissions by 2050. | Goal of net zero Scope 3 emissions by 2050. |

| Vale[17] | Reduce Scope 1 and 2 absolute emissions by 33% by 2030 (2017 baseline). Reduce Scope 3 emissions by 15% by 2035 (2018 baseline). | Net zero operational emissions by 2050. | Reduce Scope 3 emissions by 15% by 2035 (2018 baseline) Supporting a reduction in shipping emissions intensity by 40% by 2030 and 50% absolute emissions by 2050. |

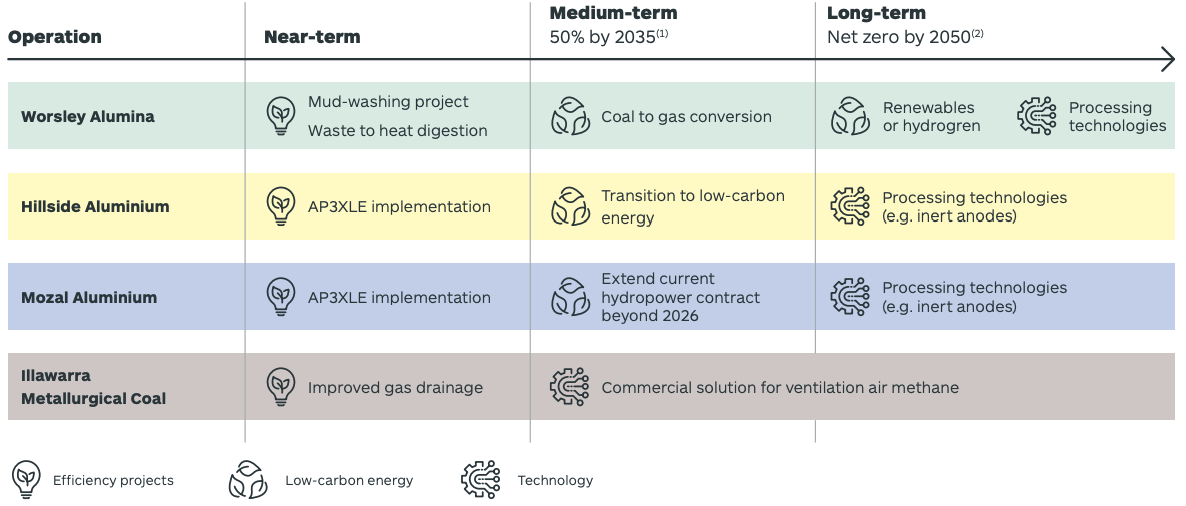

4. Decarbonisation strategy

South32’s decarbonisation plan concentrates on its four operations that generate the vast majority (93.3%) of its Scope 1 and 2 greenhouse gas emissions profile: Hillside Aluminium, Mozal Aluminium, Worsley Alumina and Illawarra Metallurgical Coal. Figure 2 demonstrates the scale of reduction required to 2035 and 2050, along with the contribution to the total Scope 1 and 2 emissions from each major source. It is unclear how much each asset will contribute to the required abatement to 2035 as South32 has not quantified the key elements of its strategy, which is inconsistent with the expectations of the CA100+ benchmark. Within this section, ACCR has assessed the opportunities, challenges and risks to the decarbonisation plans for South32’s highest emitting assets.

Recent restructuring of South32’s portfolio, particularly the divestment of South Africa Energy Coal (SAEC), means the Scope 1 and 2 decarbonisation task improved marginally (~3% reduction), with the primary impact being upon Scope 3 emissions (~42% reduction).[18] Importantly, whilst divestment of fossil fuel assets helps to decrease the exposure of companies to climate change transition risk, it rarely leads to real world reductions in greenhouse gas emissions. As such, divestment should not be relied upon as a decarbonisation strategy. In the case of SAEC, there is a relationship between South32’s need to decarbonise Hillside electricity supply and SAEC’s future emissions profile, since it supplies 32% of Eskom’s required thermal coal.[19]

Figure 2: South32’s decarbonisation task to 2035 and 2050

Hillside Aluminium (59.5% operational emissions)

The Hillside Aluminium smelter is wholly owned and operated by South32 and it represents the largest share (59%) of South32’s Scope 1 and 2 emissions.[20] Hillside sources its electricity from Eskom, the South African state-owned entity, which owns and operates South Africa’s coal-dominated national grid. Hillside is the largest consumer of power in South Africa, with a demand of 1.2GW and consuming approximately 11TWh per year. The smelter plays a key role in stabilising South Africa’s national grid and its power agreement with Eskom (out to 2031) allows for load shedding in times of system emergency.[21] Load shedding in South Africa in 2021 was the worst on record, spanning 1,165 hours with a total of 1.8TWh unserved.[22] Despite the carbon intensity of the electricity supply at South32’s Hillside Aluminium smelter, the company has noted that Eskom is currently the only viable provider of electricity for its operations at the scale required.[23] However Hillside Aluminium risks becoming internationally uncompetitive over time, given the emergence of carbon border tariffs and growing demand for low-carbon aluminium.[24] Therefore, South32’s medium-term target and the commercial viability of its largest aluminium smelter, hinge on the ability to decarbonise Hillside’s electricity supply before 2035.

Due to 86% of electricity in South Africa coming from coal-fired power, the grid is one of the most carbon intensive in the world.[25] The power sector is responsible for nearly half of South Africa’s total carbon footprint, largely via Eskom.[26] Eskom’s coal fleet is aging and failing, with power stations lacking appropriate maintenance over the years, which has resulted in a significant deficiency of reliable power generation, as well as increasing operational costs.[27] Concerningly, the South African government has been looking to replace coal generation with gas, which would cost 40% more and result in seven times more emissions than renewable electricity solutions.[28]

In addition to the cost and climate benefits, renewable energy also presents significant system security benefits. Recent modelling conducted by Meridian Economics demonstrated that an additional 5GW of wind and solar would have allowed Eskom to eliminate 96.5% of load shedding in 2021.[29] Unsurprisingly, Meridian Economics’ recommendation to the South African government is to mobilise “thousands of economic actors throughout the economy to take the necessary steps to bring new capacity online urgently.”[30] Not unlike Australia, grid constraints are a challenge for connecting additional renewable energy projects and this will need to be resolved over the short-medium term, yet there are current opportunities to locate projects in provinces without grid bottlenecks.[31]

Another challenge for decarbonising the South African grid is Eskom’s debt of ~R400 billion (US$22.6 billion), which detracts from its ability to finance the transition. Around half of Eskom’s debt is unserviceable due to large time and cost overruns on its power station construction program, and regulated tariff increases that have consistently been too low to cover operational costs.[32] Eskom is currently restructuring to separate its generation, transmission and distribution business into distinct entities. A key task for these newly formed entities will be to raise capital and rapidly invest in new transmission and distribution infrastructure. Recent research by the Centre for Sustainability Transition and Blended Finance has determined that South Africa will need US$250 billion over the next three decades to transform its coal-fired economy, but that at least US$175 billion can come from the private sector.[33] Of this US$250 billion, around 56% (US$151 billion) will be required for build out of wind, solar and storage, whilst transmission and distribution upgrades will require ~20% of the total (US$50 billion).[34]

Thus far, South32 has stated that it is progressing three core streams of work to decarbonise Hillside’s electricity:[35]

- Engagement with Eskom to convert the existing power agreement to low-carbon energy;

- Investigation of options to source and secure low-carbon power agreements with independent power producers and aggregators of renewable energy; and

- Exploration of behind-the-meter technology options such as energy storage.

South32 would be a highly attractive counterparty for any renewable energy developer. There would be significant market enthusiasm for contemplating innovative contracting models that factor in its existing energy supply agreement with Eskom to 2031. Aligning the significant and constant energy needs of Hillside with a portfolio of variable renewable energy projects will be complex however, importantly, the asset will always be grid connected for back-up. Considering this early, and undertaking this as a staged approach is more practical considering the scale of project build-out that is necessary.

Considering the increasingly attractive economics of renewable energy have rendered it one of the most viable decarbonisation opportunities for corporations for some time, ACCR has concerns that South32 is coming to these opportunities at Hillside late in the day. We are also concerned the company is not exerting sufficient urgency and expediting options within its control to tackle its largest source of emissions. Given the materiality of the emissions at Hillside and the risk to the viability of this business in the medium-term, investors would be well placed to push for more granular, substantial and tangible updates on the initiatives and advocacy the company is undertaking to secure renewable power supply to its Hillside Aluminium smelter.

Mozal Aluminium

Mozal Aluminium is the only aluminium smelter operating in Mozambique. It is a joint venture with South32 (63.7%) and the Mitsubishi Corporation, the Industrial Development of South Africa Ltd and Government of the Republic of Mozambique, who constitute the remaining 36.3% share. Electricity supplied to Mozal is generated by Hidroeléctrica de Cahora Bassa (HCB), a hydroelectric power generator situated on the Zambezi River in the north-west of Mozambique. The electricity is supplied via Eskom’s South African grid under an agreement with MOTRACO.[36] Notably, Eskom also provides back-up energy to Mozal for periods where HCB produces less than its contracted maximum supply. Since 2018, South32 has reported higher than anticipated emissions at Mozal due to a “shortfall in delivery of third-party contracted power, which resulted in greater consumption of coal-powered electricity.”[37]

South32 indicates in the CCAP that there are risks surrounding the renewal of the hydroelectricity power purchase agreement from 2026. The company states, “we are working to extend the power supply agreement for Mozal Aluminium beyond 2026, as there are no viable alternative suppliers of renewable energy at the necessary scale and, without extension of the agreement, we will be limited in our ability to achieve our medium-term target.”[38] South32 assured ACCR that the agreement is likely to be renewed and that this is a big focus for the company. ACCR recommends that investors track this matter closely and engage with the company regularly for updates on this agreement, given the carbon emissions risk should the agreement fall through.

Worsley Alumina (17.6% operational emissions)

Worsley Alumina is an integrated bauxite mine and alumina refinery located in southern Western Australia. South32 operates the facility and holds an 86% interest, in joint venture with Japan Alumina Associates (Australia) Pty Ltd (10%)and Sojitz Alumina Pty (4%).[39] Worsley represents 17% of South32’s Scope 1 and 2 emissions. The primary source of emissions for Worsley is the combustion of thermal coal and gas to generate high pressure steam used in process heating. Worsley is the fourth largest carbon polluter in Western Australia, producing more carbon than the Muja coal-fired power station and almost as much as Chevron’s Wheatstone LNG plant.[40]

In the short-term, South32 is exploring energy and process efficiency initiatives to reduce the operational demand for steam, and energy demand in the Bayer process.[41] A dilution reduction project related to evaporation in the Bayer process will be fully commissioned by FY24, which will have a potential emissions abatement of 0.08 MtCO2-e per year, representing a 2.6% decrease in Worsley’s operational emissions.[42] Additionally the company is advancing energy efficiency studies relating to mud washing and waste to heat digestion studies which look to abate approximately 0.295 MtCO2-e per year and 0.25MtCO2-e per year respectively. South32 states that mud washing will reduce the amount of coal-fired steam required for evaporating water out of the circuit. The waste to heat digestion study, currently in the pre-feasibility stage, will explore options to retain low-grade heat within the circuit to displace the coal-fired steam required for heating in digestion and desilication in the Bayer process.[43]

The larger and looming challenge for Worsley Alumina will be the transition from coal use in its operations and power supply. In addition to reducing carbon emissions, there are supply chain risks motivating this shift, with the shaky financials of the Griffin Coal mine, which supplies Worsley Alumina. The company entered administration again recently, having also done so in 2010[44], which has seen South32 seeking opportunities to import low quality coal from Indonesia to run the Alumina refinery.[45] While South32’s ultimate goal is to electrify its operations at Worsley using renewable energy, this would require a change to Worsley’s process and energy infrastructure, as renewable energy does not generate steam directly. Additionally, it would require investment in renewables and energy infrastructure in the region to supply the scale of renewable power required. The company anticipates this as a longer term strategy by partnering with entities that have expertise in converting the electrical infrastructures and supporting them through long-term PPAs. In the interim, South32 is working towards a conversion of the onsite coal-fired boilers to gas, which would reduce emissions by 15-20% in the medium-term. However, ACCR is concerned by an apparent lack of detail and timeline around when the company would phase out gas use, or the potential for this plan to undermine the imperative to move to renewable energy.

At the very least, South32 could pursue a hybrid model, where onsite boilers are converted to gas for direct steam production and power is supplied from renewable electricity sources.[46] This would enable the adoption of renewable energy immediately for the suitable applications, whilst it works with experts and industry to convert their alumina operations as soon as practicable. Like Hillside, Worsley’s alumina risks becoming uncompetitive in an international market due to border tariff mechanisms implemented by the EU.[47]

As a commodity that is needed for the energy transition, Worsley Alumina should also be seeking government support to enhance the probability of leapfrogging or at least minimising future gas use. Its peer Alcoa has successfully secured Australia Renewable Energy Agency (ARENA) funding to the tune of $20 million[48] to explore proven technologies to electrify both the Bayer process and the calcination process in its alumina refining plant. The funds will be used to demonstrate the technical and commercial feasibility of Mechanical Vapour Recompression^49 and Electric Calcination.[49]

Illawarra Metallurgical Coal (10% operational emissions)

Illawarra Metallurgical Coal (IMC) encompasses two underground metallurgical coal mines: Appin and Dendrobium, both of which are located in the southern coalfields of New South Wales and together represent 10% of South32’s operational emissions.[50] IMC’s Scope 1 emissions are predominantly from fugitive methane emissions. Methane is a powerful but short-lived climate pollutant, which over a 100-year timeframe, traps 28 times more heat than carbon dioxide.[51]

South32’s Appin metallurgical coal mine is the gassiest mine in New South Wales[52] and the most carbon intensive mine in Australia.[53] Between 2019 and 2020, Appin emitted 2.17 MtCO2-e, 75% more than NSW’s second gassiest mine, Tahmoor Coal, operated by SIMEC. Appin also represents 87% of IMC’s Scope 1 emissions.[54]

South32 is exploring two options to reduce methane leakage at its mines.[55] Firstly, coal seam gas (CSG) drainage, where CSG is drained and captured to generate electricity. Where this can be successfully applied, the remaining gas (~1%) is destroyed through flaring. In addition, South32 received NSW Government and Coal Innovation NSW funding of A$15 million[56] in April this year to develop a demonstration facility for CSIRO’s ventilation air methane (VAM) technology, VAM mitigator (VAMMIT), at Appin. VAMMIT is a thermal reactor that works by oxidising almost all of the methane in a combustion chamber, converting methane into water and carbon dioxide.[57] While South32 and CSIRO have been developing this technology for almost a decade, the company had just commenced testing the technology at a commercial scale in FY22.[58]

The best way to avoid increasing emissions from coal mining is to stop funding expansions. Therefore, ACCR welcomes South32’s decision to not proceed with an investment in the Dendrobium Next Domain (DND) project.[59] South32 had originally planned to extract an additional 78 million tonnes of metallurgical coal from the underground operation until Sydney’s drinking water catchment until 2048.[60]

The Appin coal mine however is currently approved to operate until 2041. Given the potency of methane, and with a record underlying revenue increase of 208% from Illawarra Metallurgical Coal in FY22[61] (on the back of supply constraints due to the ongoing Russian invasion of Ukraine), ACCR would expect South32 to accelerate its roll-out of methane reducing technology. South32 can make a more serious investment and accelerate the VAMMIT project in the Appin metallurgical coal mine as soon as practicable.

Long-term decarbonisation plans

Figure 3: South32’s decarbonisation pathway[62]

Note: 1) Medium-term target baseline is FY21; 2) Long-term target is a goal.

South32’s decarbonisation plans post 2035 are vague and intangible, as the company states that technology solutions will form the basis of decarbonisation projects in the longer-term (See Figure 3). While ACCR is not suggesting that the company should have concrete plans on how the business will decarbonise in the long-term, there is a lack of detail regarding how the company will support and advocate for the development of the technology solutions it will need post 2030.

The company has not disclosed a marginal abatement cost curve (MACC), which would help investors identify decarbonisation projects the company is investigating, and the cost and scale of the carbon reduction opportunity for each initiative. South32 has an internal carbon price of $60/t, however without a MACC it is not clear what abatement projects (if any) would be viable within this price. Whilst $60/tCO2-e is not an insignificant carbon price, the company’s 1.5°C scenario assumed a $160/t would be necessary from 2040. It is ambiguous whether the company’s current shadow carbon price will drive sufficient abatement to limit warming in line with the Paris Agreement in the near-term.

Use of offsets

South32 applies a mitigation hierarchy stating that it “prioritises avoidance of emissions, and where avoidance is not possible, we mitigate GHG emissions through efficiency initiatives or transition to low-carbon energy. We intend only to use voluntary carbon offsets after these options have been fully explored. Carbon credits may be used to comply with regulatory requirements in South Africa and Australia.”[63] ACCR welcomes this and encourages South32 to go a step further and place a firm cap on offset use. Without a cap on offset use, the climate benefits of South32’s medium- and long-term plan may be undermined. The Science-Based Targets Initiative’s (SBTi) Net Zero Standard states company investments in offsets “should be in addition to deep emissions cuts, not instead of them”.[64] Increasingly, offsets are being regarded as a tool for companies to address their historical emissions legacy,[65] not as a license for prolonged polluting.

5. Decarbonisation strategy - Scope 3

In FY22, South32’s Scope 3 emissions were 67.4 MtCO2-e.[66] As shown in Figure 1, alumina and aluminium supply chain emissions constitutes 43% (or 29 MtCO2-e) of Scope 3 emissions, followed by metallurgical coal Scope 3 emissions (28% or 18.9 MtCO2-e), and manganese ore Scope 3 emissions sits at 25% of Scope 3 emissions (or 16.9 MtCO2-e). While Scope 3 emissions may not be under the direct control of the company, these emissions comprise the largest share of South32’s total emissions, representing 76.2%. In order to limit warming to 1.5°C, companies need to urgently address their supply chain emissions by formalising accelerated decarbonisation strategies and commitments.

When South32 divested South Africa Energy Coal in FY21, the company adjusted its Scope 3 emissions, reflecting an approximate 44.5 MtCO2-e reduction in Scope 3 emissions.[67] While it has been noted previously, ACCR stresses that this does not reflect a reduction in real world emissions, as South Africa Energy coal is still producing thermal coal and will continue to for decades while South Africa transitions its energy grid. On the other hand, with the company no longer pursuing the mine extension for Dendrobium, this decision has resulted in approximately 72.5 to 75.8 MtCO2-e foregone Scope 1, 2 and 3 emissions based on the 31 million tonnes (Mt) of ROM coal that would have come from the most recent updated project extension proposal.[68]

In the near-term, South32 intends to look at three strategic areas:[69]

- Partnerships: building meaningful partnerships with customers and suppliers to support and co-design emission reduction programs

- Industry engagement: contributing to industry groups that support decarbonisation and product stewardship initiatives

- Innovation: supporting the development of technology solutions to address value chain emissions

ACCR has provided brief commentary on expectations of these short-term initiatives (see Table 5).

Table 5: South32’ decarbonisation initiatives for Scope 3[70]

| Scope 3 initiatives | Time frame | ACCR commentary | |

|---|---|---|---|

| Partnerships | Goal of entering into 4 partnerships with key customers to collaborate on emissions reduction initiatives in the downstream value chain Goal of working with at least 4 tier one suppliers to identify options to reduce GHG emissions in the value chain Collaborating to improve accounting of GHG emissions associated with processing and use of products. South32 will explore data analytics, artificial intelligence and other smart technologies to manage complex data and identify potential improvement opportunities across the value chain. | By FY25 Commencing FY23 No defined timeframe | ACCR recognises that South32’s downstream value chain represents 89% of Scope 3 emissions, and welcome’s South32’s goal to collaborate with key customers in the downstream value chain. However ACCR expects South32 to expedite partnership forming in order to accelerate plans and strategies to decarbonise these substantial emissions. Technologies are already in existence to decarbonise South32’s most material Scope 3 emissions. While understanding the company’s Scope 3 emissions in more depth is welcomed, clear actions need to be made on decarbonisation opportunities once they have been identified. |

| Industry engagement | Participating in relevant stewardship and innovation initiatives to develop net zero pathways for key commodities including ResponsibleSteel, ICMM, and the Aluminium Stewardship Initiative (ASI) | No defined timeframe | ACCR acknowledges South32’s participation in key stewardship and industry initiatives. |

| Innovation | Implementing a continuous monitoring program for the shipping emissions baseline developed in FY22 to identify emissions reduction opportunities | Developed in FY22 | Technology advances in shipping are recognised, however South32 has not explored the technology opportunities in the supply chains of its most material commodities. For technologies and innovations which require investment and appropriate policy settings to accelerate decarbonisation pathways, South32 could be advocating for this through customer and government engagement. |

South32 is clearly in the early stages of value chain decarbonisation planning. Therefore investors should insist on more regular updates on the initiatives, strategies and advocacy the company is demonstrating to accelerate the decarbonisation of its most material Scope 3 emissions. ACCR expects to see company announcements as these initiatives progress.

6. Scenario analysis - transition risk

ACCR welcomes and recognises the efforts of South32 to undergo scenario analysis stress-testing of its commodities and of the company’s transition risk. The company states that while it supports the objectives of the Paris Agreement, South32’s base scenario is positioned for a warming trajectory of at least 2°C. In FY21, South32 developed a 1.5°C scenario to analyse the resilience of its portfolio under a “rapid global transition to a low-carbon world.”[71] When compared to the company’s 2°C base case, average global demand for all commodities in 2050 increases in the 1.5°C scenario (except for lead), driven by the uptake of mineral intensive, low-carbon technologies.

Metallurgical coal is one of the commodities to increase quite substantially in a 1.5°C scenario when compared to the base scenario, as the company asserts, “seaborne hard coking coal is required to support GHG emissions reduction target and new integrated capacity in the steel industry.”[72] This is a perplexing statement. The IEA Net Zero Emissions (IEANZE) Scenario states that while, “demand for coking coal falls at a slightly slower rate than for steam coal... existing sources of production are sufficient to cover demand through to 2050.”[73] Given this, the additional demand for metallurgical coal, as stated in South32’s scenario analysis, appears to be incompatible with a 1.5°C scenario.

When interrogating South32’s 1.5°C scenario assumptions, ACCR notes that it is hard to ensure that the scenario is 1.5°C-aligned without assumptions that provide the following information:

- Assumed average temperature in 2100;

- Peak temperature throughout the 21st century and when this temperature is breached;

- What assumptions have been made about CCS, BECCS and offsets; and

- The decline in fossil fuel use.

An additional problematic factor is that South32’s 1.5°C scenario uses a carbon budget of 580 GTCO2. The IPCC AR6 Working Group I report estimates a remaining carbon budget of 500 Gt CO2 from the beginning of 2020 for a 50% chance of staying within 1.5°C warming, and 400 Gt CO2 for a 66% chance.[74] These estimates are similar to those in the IPCC Special Report on 1.5°C.[75] South32’s 580 GTCO2 carbon budget represents an 18% increase in the actual available carbon budget.

ACCR recommends updating the scenario analysis using the latest 1.5C scenarios that take into account the latest assumption ranges. ACCR also recommends clearly disclosing an updated remaining carbon budget with likelihood indicator and a more complete list of assumptions used in the analysis, specifically around renewable energy uptake, the role of CCS, natural carbon sequestration (afforestation). This would better assist investors with how South32 formed its view.

7. Physical risk assessment

ACCR has not undertaken a comprehensive assessment of South32’s physical risk assessment, however it does note that the scenario used in this analysis was from the IPCC’s Representative Concentration Pathways which were developed in 2007 and used in the IPCC’s 5th Assessment report.[76] It is unclear why a dated scenario was used. ACCR recommends that South32 review and update its scenario analysis using the latest IPCC AR6 scenarios and IEA NZE scenarios.

8. Just transition

The importance for the climate transition to be both fast and fair is recognised in the Paris Agreement, which emphasises the necessity to reduce emissions but also considers, “the imperatives of a just transition of the workforce and the creation of decent work and quality jobs in accordance with nationally defined development priorities.”[77] As defined by the International Labour Organization (ILO), “a just transition for all towards an environmentally sustainable economy … needs to be well managed and contribute to the goals of decent work for all, social inclusions and the eradication of poverty.”[78] ACCR welcomes South32’s commitment to “supporting a fair and equitable transition for people, communities and other stakeholders.”[79] ACCR further notes that South32 is a member of the ILO and that 52% of its employees are covered by collective agreements, demonstrating the company already has affirmative relations with its workers.[80]

A successful just transition includes three key ingredients:[81]

- Participation of affected workers, communities, and First Nation groups; industry; unions; and governments in the establishment of working just transition principles, effective governance, and outcomes.

- Anticipation of negative impacts through long-term planning and thorough impact assessments that allow for time considerations and staggered implementation of action plans.

- Support and resourcing of targeted financial programs and capacity building that prioritises the vulnerable and enables decent work or compensation for affected workers, communities and the environment.

In addition, Australian unions consider that a range of active labour market policies are required to support workers in a just transition, including: [82]

- Job placement and networking services

- Retraining

- Financial and personal support, including access to redundancy packages and options for early retirement

- Travel subsidies and relocation assistance

Initial results from CA100+ Net Zero Company Benchmark Disclosure shows a majority of the largest global emitters are not sufficiently prepared to deliver a Just Transition,[83] with 73% of target companies meeting none of the metrics and no company meeting all metrics of the indicator. Workers are at the heart of the transition to a low-carbon world and it is of moral imperative and economic necessity[84] that just transition considerations are thoroughly mediated.

South32’s current Just Transition planning is rightly focused on Hillside Aluminium and Worsley Alumina, as these are the two operations that are closely connected to and sustain businesses in thermal coal.

At Worsley Alumina, South32 has undertaken a baseline review of Just Transition considerations at its operations and is looking to undertake a detailed assessment of potential workforce impacts and opportunities for the decarbonisation activities planned for Worsley in FY23. The company states this will include stakeholder mapping and engagement with internal and external stakeholders and will inform the company’s participation in the Collie Just Transition Working Group (Collie JTWG). The Collie JTWG was established by the Western Australian government in 2020 and brings together the workers, unions and industry affected by the announced state-owned coal-fired power station closures at Muja and Collie in WA. It is an excellent example of best practice collaboration, backed by government and industry funding. As of June 2022, the WA government had announced A$662 million in investment for the Collie Transition Package. Additionally, South32 has also committed A$415,000 to support the economic future of the region, with part of this investment funding the creation of a summer music festival.[85] While ACCR acknowledges and welcomes the contributions South32 has made to this process, ACCR looks forward to seeing the company’s detailed assessment in FY23 to better understand the Just Transition considerations at Worsley Alumina and considerations made for affected workers and communities within its supply chains.

Regarding Hillside Aluminium, for the most part, decarbonising Hillside means decarbonising the unstable South African grid. Hillside is one of the largest industrial employers in the KwaZulu-Natal province that has an unemployment rate of 33%. Hillside employs 2,500 direct contractors and an estimated 26,500 indirect full-time equivalent roles. Furthermore, approximately 27% of Hillside’s aluminium is sold to domestic markets. Hillside also contributes to grid stability. It is therefore clear that the smelter is of regional significance to South Africa, and with the viability of the smelter at risk with the emergence of border tariffs, South32 has a complex transition challenge ahead.

ACCR has considered South32’s Just Transition risks at Hillside and the possible scenarios for Hillside and the broader economy that the company could be considering (see Table 6).

Table 6: South32’s Hillside Aluminium’s Just Transition risks and possible scenarios

| Scenario | Description |

|---|---|

| Scenario 1 | Grid decarbonisation significantly delayed South Africa does not repower the grid with renewables by 2035. South32’s carbon intensive aluminium becomes uncompetitive due to carbon prices and border adjustments. Just transition risks are delayed, rushed and/or mismanaged, and the smelter closes resulting in significant job losses at Hillside and its supply chains, and negative impacts in the region and to national grid stability. |

| Scenario 2 | Management of grid repowering Decarbonisation of the grid is successful, creating transition needs for coal mine and power supply workers. Hillside Aluminium continues to operate, providing secure work and globally competitive green aluminium. |

| Scenario 3 | Just transition aligned closure of Hillside South32 realises that grid repowering by 2035 is not feasible. There is a strong risk that South32’s carbon intensive aluminium becomes uncompetitive in the global market. South32 chooses to decommission Hillside, creating a significant just transition task. |

ACCR notes that in FY22, South32 conducted an initial baseline review of Just Transition considerations at Hillside Aluminium and participated in the National Business Initiative Just Transition Pathway Project in South Africa. Further, the company is intending to work with stakeholders to conduct risk and opportunity assessments, develop metrics to measure and report on performance and undertake value chain analysis to support Just Transition planning. While ACCR does not envisage that South32 would continue business as usual, it is imperative the company undertakes detailed stakeholder engagement and thorough assessment of just transition considerations in the near term to ensure that the company is properly anticipating and planning for the various scenarios, considered above.

ACCR encourages investors to push for additional disclosure on these just transition considerations at Hillside and Worsley, which would aid in the assessment of South32’s efforts to manage and mitigate its climate transition risks.

9. Climate policy engagement

It is noted that South32 does “not support direct advocacy from industry members on energy coal expansion or energy coal subsidies”.[86] However, South32 also has an opportunity to exert climate-positive policy influence, as a means of accelerating the decarbonisation targets within its own climate change plan and of the economies in which it operates.

Positively advocating for Paris-aligned climate policy is one of the most material actions that South32 could take in support of its own decarbonisation commitments and the urgent need to limit warming to 1.5°C. The energy supply situation for Worsley Alumina in Western Australia offers a prime example of this. As coal supplies from the Griffin Coal mine become increasingly uncertain, and as the Western Australian government progresses its intention to retire two further state-owned coal-fired power stations,[87] South32 can actively encourage the rapid expansion of renewable energy capacity in the Western Australian power grid, to benefit Worsley power supply options.

In August 2022, the McGowen Government announced it was undertaking a fast-tracked assessment of new and existing demand for renewable energy for the State’s main electricity network.[88] The assessment will gather information from the industry about the size, location, and timeframe of anticipated electricity demand to 2030 and beyond. This presents an excellent opportunity for South32 to demonstrate positive advocacy in public supporting and pushing the Western Australian government to expedite and expand renewable energy capacity in the south west.

South32’s analysis of its industry associations includes insights into recently released 2022 climate change policies, demonstrating top level improvements.[89] Ongoing engagement and continued utilisation of membership to improve the climate advocacy of industry associations is welcomed. However, the databook detail of the industry association review gives extremely limited information and listed alignment does not provide insights into advocacy examples.

Table 7: South32’s industry associations that are misaligned with the Paris Agreement according to InfluenceMap[90]

| Industry Association | South32’s 2022 Review of Industry Associations findings[91] | InfluenceMap Performance Band |

|---|---|---|

| NSW Minerals Council | Aligned | E- |

| Queensland Resources Council (QRC) | Aligned | E |

| Minerals Council of Australia | Aligned | E+ |

There are three industry associations that South32 is a member of and found to be aligned, yet are misaligned with the Paris Agreement according to international advocacy researchers Influence Map (see Table 7). Below are examples for each where ACCR has identified misalignment over the past 12 months and where South32 must actively engage to ensure alignment with its own climate advocacy position.

The NSW Minerals Council does not make its key recent submissions publicly available, however its current website includes a coal ‘facts’ page with this statement: “Coal also has a continuing and important role, as outlined by modelling by the independent International Energy Agency (IEA) showing global coal demand to remain steady to 2040.”[92] This statement is completely outdated. Based on 2021 modelling from the IEA World Energy Outlook, by 2040 coal demand drops from between 75% to 100% for the Paris aligned scenarios, depending on the level of coal abatement (CCS) available. The IEA report clearly states, “All scenarios that meet climate goals feature a rapid decline in coal use.”[93] South32 must ensure the NSW Minerals Council updates its public advocacy.

The QRC used Russia’s invasion of Ukraine to push for ongoing legal and assessment processes to be disregarded in order to approve New Hope's New Acland thermal coal mine in Queensland.[94] In November 2021, the QRC put out a media release where it stated, ”Right now, steel can only be produced commercially by using metallurgical coal, and thermal coal is the only 100 percent reliable way to produce energy”.[95] In 2021, the QRC promoted the growth of thermal coal in the Galilee Basin, listing several large mooted greenfield thermal coal projects.[96]

The MCA was vocal in its criticism of the Australian Labor Party’s plan to strengthen the Federal government’s largely toothless Safeguard Mechanism in December 2021.[97] The MCA argued against more ambitious climate policy, claiming that reducing emissions should not come at the cost of international competitiveness. In its January 2022 pre-budget submission to the Federal Government, the MCA arged to retain the fuel tax credit scheme in its current form,[98] which would lock in a significant public subsidy to the coal industry. This position appears to be at odds with South32’s position to not support energy coal subsidies. Paris Aligned policy would seek to incentivise the rapid uptake of electric mining fleet vehicles instead.

10. Capital allocation

Whilst South32 has a strong focus on “allocating growth capital to commodities that support the global transition to a low-carbon world, including aluminium, copper and battery grade raw materials”[99], the company has not made an explicit commitment to align its capital expenditure with 1.5°C. When the company announced it was not proceeding with the Dendrobium mine extension, it stated that instead it would “focus on continuing to optimise Dendrobium and the broader Illawarra Metallurgical Coal complex” and that the decision increases the company’s capacity to allocate capital to “produce metals critical to a low carbon future”.[100] The company’s commitment to not “develop or invest in greenfield metallurgical coal projects”[101] is commendable, however ACCR does recommend that investors monitor the company’s allocation of capital to the extension of existing metallurgical coal mines. Particularly as South32’s Chief Executive, Graham Kerr, recently asserted that, “we still believe that metallurgical coal has a role to play in the next couple of decades, and we continue to invest in the business with that belief.”[102]

Table 8 below provides detail on the capital that South32 and its peers are allocating to the climate transition. Unlike its peers, South32 has only provided an indication of capital expenditure for decarbonisation out to FY24. There is no detail on possible expenditure out to 2030 or 2035, which perhaps is due to the major uncertainties around Hillside and Worsley decarbonisation. South32 also states that many of its decarbonisation activities are more likely to be funded through opex, rather than capex, due to renewable power purchase agreements being more probable methods for Hillside and Worsley.[103] Consequently its allocated capital can appear smaller than peers.

Table 8: Peer analysis on climate investments

| Company | Climate investments |

|---|---|

| Anglo American[104] | €745 million sustainability-linked bond, linked to the company’s climate commitments, commitment to reduce the abstraction of fresh water in scarce areas and support 5 jobs offsite for every job onsite. The financing mechanism will see a coupon increase of 40bps occurring from September 2031 for each target not achieved. |

| BHP Group[105] | US$400 million Climate Investment Program (CIP) over 5 years (announced July 2019) |

| Fortescue Metals Group[106] | Estimate of US$6.2 billion spend over FY24-28 for deployment of 2-3GW of renewable energy and battery storage and new green mining fleet. |

| Glencore[107] | Glencore has not disclosed a budget for investment in climate solutions, however, has committed to “align capital allocation discipline with the goals of the Paris Agreement” through prioritising investment of transition metals. |

| Rio Tinto[108] | US$7.5 billion direct capital expenditure for decarbonisation of Rio Tinto’s assets from 2022 to 2030 (announced Oct 2021), internal shadow carbon price US$75/ tCO2e. |

| South32[109] | Expect to invest US$30 million in FY23 and more than US$60 million in FY24 to execute key decarbonisation projects. |

| Vale[110] | $US4-6 billion investment by 2030 for GHG reduction and internal shadow carbon price of $US 50/tCO2e for all capital allocation decisions. |

11. Accounts and Audit

In March 2022 the Climate Action 100+ Net Zero Company Benchmark published its first assessment of the Climate Accounting and Audit indicator. This indicator considers:

“whether a company’s accounting practices and related disclosures, and the auditor’s report thereon, reflect the effects of climate risk and the global move onto a 2050 (or sooner) net-zero greenhouse gas (GHG) emissions pathway and the Paris Agreement goal of limiting global warming to no more than 1.5°C.”[111]

South32 scored poorly in the initial assessment of its FY21 disclosures and did not meet any of the sub indicator requirements.[112] Within the Annual Report 2022, South32 has made progress on this issue and we anticipate some improvement in scoring in the next assessment primarily due to:

Key estimates, assumptions and judgements:

- Recognition that the reference case scenario for the financial statements aligns with at least 2°C warming, and that transition and physical climate risks influence key estimates, assumptions and judgements affecting impairments, property plant and equipment (asset life), and rehabilitation provisions.[113]

Impairment of non-financial assets:

- A statement that management considers “a range of possible scenarios, including a 1.5°C scenario aligned with the ambition of the Paris Agreement” when “assessing whether there is any indication of impairment or impairment reversal.”[114]

- Disclosure that “the sensitivity of operations to changes in carbon prices” is considered in impairment indicators, advising that the “CGUs with a higher carbon sensitivity include Worsley Alumina, Illawarra Metallurgical Coal, Hillside Aluminium and Mozal Aluminium”.[115]

- Where impairments have been made, the climate-relevant assumptions have been disclosed, such as a range of metallurgical coal prices of $135-175/t for the impairment of Eagle Downs Metallurgical Coal.[116]

Areas for improvement within the 2023 financial statements, include:

Whilst a 1.5°C scenario is contemplated in impairment assessments, the results of the 1.5°C sensitivity are not disclosed and neither are the key assumptions, except where impairments have been made.

IMC generated more revenue and had greater capital expenditure than any other segment in FY22.[117] As such, the assumptions around metallurgical coal are key to any scenario analysis of South 32’s portfolio. If after refreshing the 1.5°C scenario South 32’s view remains that metallurgical coal is advantaged in a 1.5°C, this should be explained, since it is counterintuitive that consuming more coal, even metallurgical coal, can contribute to a lower emission scenario.

The audit report states that carbon prices have been considered,[118] but not how these have been assessed, or how climate change could have impacted other aspects of the financial statements, such as by impacting commodity prices, and the risk of physical damage.

12. Climate governance

The South32 board is responsible for climate change, the associated strategy, and it “approves the Group’s overall climate change approach, policy positions”, along with the CCAP.[119] However it is noted that, against the expectations of the CA100+ Net Zero Company Benchmark, a board position with “explicit responsibility for climate change”[120] has not been named, rather the responsibility is spread across the various board committees.[121]

Remuneration

The 2022 financial year saw climate change linked to remuneration for the first time at South32. There are two related strategic measures linked to the long term incentive (LTI), each with a weighting of 10%.[122] These are:

- South32’s response to climate change, being the achievement of the 50% 2035 Scope 1 & 2 emission reduction target; and

- The transitioning of the portfolio towards the metals critical to a low-carbon future.

The linkage of 20% of the LTI to shifting the business in response to climate change is notable in aggregate. However, considering the commercial imperatives associated with decarbonising Hillside and Worsley, having a higher weighting on the achievement of the 2035 target could be worthwhile. It is interesting to note the timing of this change in the remuneration scheme and the company’s decision and messaging on the Dendrobium mine expansion.

The remuneration report states that “the success of these strategic initiatives will be measured by our ability to make material progress in these areas, whilst protecting and creating shareholder value as we navigate this business-critical transformation”.[123] It is critical that a quantifiable reduction in emissions is the primary input to assessing success for the first strategic measure.

Board skills assessment: Environment and climate change

To inform the board skills matrix, South32 directors are assessed on their ability to “demonstrate an understanding of the key environmental impacts, risks and opportunities for a global mining company, including fluency in the implications of climate change.”[124] The 2022 assessment concluded that 50 per cent of the board is highly skilled in this area, 25 per cent are “skilled” and the remaining 25 per cent are “knowledgeable”.[125] It is not disclosed which directors fall into what category. ACCR’s recommendations for future assessments include:

- Disaggregating the category, so that climate change is assessed separately to environment. Climate change is a systemic, existential risk that warrants discrete focus.

- Considering the evolving nature of climate science and the escalating impacts, it is recommended that the climate assessment include an expectation that directors have an understanding of the most recent climate science from the IPCC.

Download our full analysis.

Please read the terms and conditions attached to the use of this site.

Australasian Centre for Corporate Responsibility

South32 Sustainability Databook, FY22 ↩︎

South32, Sustainability Report FY22, p. 73 ↩︎

South32, Sustainability Report FY22, p. 71 ↩︎

TPI, Carbon performance assessment of aluminium producers, note on methodology, December 2020 ↩︎

CA100+, South32 Ltd Final Company Assessment, October 2022 ↩︎

ibid. ↩︎

Fortescue Metals Group, “Fortescue announces target to achieve net zero Scope 3 emissions”, 5 Oct 2021 ↩︎

Glencore, Climate Change webpage ↩︎

Anglo American, “Anglo American sets to halve Scope 3 emissions by 2040,” 29 Oct 2021 ↩︎

Anglo American, Climate Change Report, 2020 ↩︎

BHP, Climate Transition Action Plan 2021; BHP, Climate Targets and Goals, July 2022 ↩︎

Fortescue Metals Group, Climate Change Report, FY22 ↩︎

Glencore, Pathway to Net Zero 2021 ↩︎

Rio Tinto, Our Approach to Climate Change 2021 ↩︎

From Rio Tinto own and time-chartered fleet. ↩︎

South32, Sustainability Report FY22, p. 4 ↩︎

Vale, Climate Change Report 2021 ↩︎

South32 sustainability data books FY21 and FY22 ↩︎

Seriti, Our Business: Seriti Coal ↩︎

South32, Sustainability Report FY22, p. 81 ↩︎

ibid. ↩︎

Meridian Economics, “Resolving the power crisis Part A: Insights from 2021- SA’s worst load sheeting year so far,” June 2022, p.ii ↩︎

South32, Sustainability Report FY22, p. 82 ↩︎

Martin Creamer, “Working on options to secure green energy for Hillside Aluminum - South32,” Mining Weekly, 7 Jan 2022 ↩︎

Ember Climate, “Global Electricity Review 2021,” March 2021 ↩︎

Blended Finance & The Centre for Sustainable Transitions, “Making Climate Capital Work: Unlocking $8.5bn for South Africa’s Just Energy Transition,” May 2022, p. 8 ↩︎

Meridian Economics, “The Just Transition Transaction: A developing country coal power retirement mechanism,” September 2021, p. 9 ↩︎

Compared to using gas in peaking plants to complement renewable generation; Meridian Economics, “Hot Air About Gas: An economic analysis of the scope and role for gas-fired power generation in South Africa,” June 2022 ↩︎

Meridian Economics, “Resolving the power crisis Part A: Insights from 2021- SA’s worst load sheeting year so far,” June 2022, p.ii ↩︎

Meridian Economics, Resolving the power crisis Part B: An achievable game plan to end load shedding, June 2022, p. vi ↩︎

ibid, p. 17. ↩︎

Meridian Economics, “The Just Transition Transaction: A developing country coal power retirement mechanism,” September 2021, p. 2 ↩︎

Blended Finance & The Centre for Sustainable Transitions, “Making Climate Capital Work: Unlocking $8.5bn for South Africa’s Just Energy Transition,” May 2022, p. 15\ ↩︎

ibid. ↩︎

South32, Sustainability Report FY22, p. 82 ↩︎

A joint venture between Eskom and the national electricity utilities of Mozambique and Eswatini. ↩︎

See South32 Sustainability reporting for FY18, FY19, FY20, FY21 and FY22. ↩︎

South32, Sustainability Report FY22, p. 83 ↩︎

South32, Worlsey Alumina ↩︎

Peter Milne, “South32’s coal-fired Worsley Alumina two-thirds dirtier than Alcoa,” Boiling Cold, 3 May 2021 ↩︎

The industrial process of refining bauxite to produce alumina. ↩︎

South32 Sustainable Development Report, 2022, pg 84 ↩︎

ibid. ↩︎

Andrew Main, Griffin Coal goes into administration, The Australian, 3 January 2010 ↩︎

AFR, South32 importing coal to keep refinery running, 14 September 2022 ↩︎

Australian Aluminium Council, “Alumina: Australia will help develop low carbon alumina refining technologies for the world,” July 2022 ↩︎

Frank Muller, Hugh Saddler & Hannah Melville-Rea, “Carbon Border Adjustments: What are they and how will they impact Australia?” The Australia Institute, June 2021, p.23 ↩︎

See James Fernyhough, “Alcoa to trial new alumina process that uses renewables instead of fossil fuels,” Renew Economy, 21 May 2021, link; Australian Renewable Energy Agency, “World-first pilot to electrify calcination in alumina refining,” Australian Government, 12 April 2022. ↩︎

Electric calcination is the direct replacement of a traditional, direct-fired calcination plant, which is powered by coal or gas, with renewable energy drive calcination. Electric calcination combined with MVR has the potential to reduce emissions by 98%. ↩︎

South32, Sustainability Report FY22, p. 86 ↩︎

Ember Climate, “Tackling Australia’s Coal Mine Methane Problem,” June 2022, p. 4 ↩︎

Ember Climate, “Tackling Australia’s Coal Mine Methane Problem,” June 2022, p. 22 ↩︎

Ben Langford, “Illawarra coal mines among the nation’s heaviest emitters, analysis shows,” Illawarra Mercury, 8 June 2022 ↩︎

South32, Sustainability Report FY22, p. 86 ↩︎

ibid. ↩︎

Regional NSW, “$15 million for South32 emissions abatement demonstration facility,” NSW Government, 26 April 2022 ↩︎

Regional NSW, “Fugitive methane emissions from coal mines,” NSW Government ↩︎

South32, Sustainability Report FY22, p. 87 ↩︎

South32, Dendrobium Next Domain Update, August 2022 ↩︎

Dendrobium Mine Extension Project, Air Quality and Greenhouse Gas Assessment ↩︎

South32, Annual Report FY22, p. 45 ↩︎

South32, Sustainability Report FY22, p. 80 ↩︎

South32, Sustainability Report FY22, p. 89 ↩︎

Science Based Target Initiative (SBTi), The Net Zero Standard, 2021\ ↩︎

UNFCCC, “Microsoft: Carbon Negative Goal”, 2020 link; George Monbiot, “Carbon offsetting is not warding off environmental collapse - it’s accelerating it”, The Guardian, 26 Jan 2022\ ↩︎

South32, Sustainability Report FY22, p. 90 ↩︎

South32, ESG Databook FY22 ↩︎

Dendrobium Mine Extension Project, Air Quality and Greenhouse Gas Assessment ↩︎

South32, Sustainability Report FY22, p. 90 ↩︎

South32, Sustainability Report FY22, p. 91 ↩︎

South32 Sustainable Development Report, 2022, pg 77 ↩︎

ibid. ↩︎

IEA, “Net Zero by 2050: A roadmap for the global energy sector,” May 2021, p. 103 ↩︎

Zeke Hausfather, “Analysis: What the new IPCC report says about when world may pass 1.5C and 2C,” Carbon Brief, 8 October 2021 ↩︎

IPCC, “Sepcial report: Global Warming of 1.5C,” October 2018 ↩︎

South32 Sustainable Development Report, 2022, pg 76 ↩︎

United Nations, “Paris Agreement”, 2015, p2 ↩︎

International Labour Organisation, “Guidelines for a just transition towards environmentally sustainable economies and societies for all”, 2015 ↩︎

South32 Sustainable Development Report, 2022, pg 89 ↩︎

South32 Sustainable Development Report, 2022, pg 23 ↩︎

Mathilde Bouyé, Alexander Tankou and Delfina Grinspan, “Growing Momentum for Just Transition: 5 success stories and new commitments to tackle inequality through climate action,” World Resources Institute, 6 August 2019 ↩︎

Australian Council of Trade Unions, “Sharing the challenges and opportunities of a clean energy economy: A Just Transition for coal-fired electricity sector workers and communities ↩︎

Climate Action 100+, “A need for robust Just Transition Planning,” 16 June 2022 ↩︎

Climate Action 100+, “A need for robust Just Transition Planning,” Anne Simpson, 16 June 2022 ↩︎

Jacinta Cantatore, “South32 funding put premier music concert on the cards for Kaya Collie celebrations,” South Western Times, 9 June 2022 ↩︎

South32 Sustainable Development Report, 2022, pg 74 ↩︎

Western Australian Government, State-owned coal power stations to be retired by 2030 with move towards renewable energy, August 2022 ↩︎

Western Australian Government, Assessment of electricity demand to inform WA’s future network, August 2022 ↩︎

South32 Sustainable Development Report, 2022, pg 74 ↩︎

InfluenceMap, Industry Associations, accessed September 2022 ↩︎

South32, Sustainability Databook 2022, Industry Associations ↩︎

NSW Minerals Council, Coal, accessed 27 September 2022 ↩︎

International Energy Agency, World Energy Outlook, October 2021 ↩︎

QRC, Time to approved New Acland, March 2022 ↩︎

QRC, Qld’s high quality coal industry here for the long haul, November 2022 ↩︎

QRC, Media Release, Met Coal makes it great in the sunshine state, Sept 2021 ↩︎

Tania Constable, “MCA supports maintaining international competitiveness as Australia heads towards net zero,” Minerals Council of Australia, 3 Dec 2021 ↩︎

MCA, Pre Budget Submission 2022-23, January 2022 ↩︎

South32, Sustainable Development Report 2022, p77 ↩︎

South32, Dendrobium next domain update, 23 August 2022 ↩︎

South32, Sustainable Development Report 2022, p73 ↩︎

Peter Kerr and Simon Evans, “Coal mine closure a test for BlueScope,” Australian Financial Review, 23 August 2022 ↩︎

South32, Sustainable Development Report 2022, p75 ↩︎

Anglo American, Anglo American launches E745 million sustainability-linked bond, 14 Sept 2022 ↩︎

BHP, Climate Transition Action Plan 2021 p. 10. ↩︎

Fortescue Metals Group, Fortescue announces execution plan for industry leading decarbonisation, September2022 ↩︎

Glencore, Climate change, p.24-25. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, p. 26. ↩︎

South32, Sustainable Development Report 2022, p75 ↩︎

Vale, Climate Change Report 2021, p. 8. ↩︎

CA100+, Climate Accounting and Audit Indicator, November 2021\ ↩︎

CA100+ Benchmark, South32\ ↩︎

South32, Annual Report 2022, p110 ↩︎

South32, Annual Report 2022, p135 ↩︎

ibid. ↩︎

South32, Annual Report 2022, p131 ↩︎

South32, Annual Report 2022, pp114-115 ↩︎

South32, Annual Report 2022, p169 ↩︎

South32, Sustainable Development Report 2022, p96 ↩︎

CA100+, Net Zero Company Benchmark South32 ↩︎

South32, Corporate Governance Statement 2022, p8\ ↩︎

South32, Annual Report 2022, p82 ↩︎

ibid. ↩︎

South32, Corporate Governance Statement 2022, p12\ ↩︎

ibid. ↩︎