Publication Sasol in pursuit of a lifeline for Secunda

We will release an in-depth analysis of SOL ahead of its AGM in November to support investor engagement. Please contact marina.lou@globalclimateinsights.org to subscribe to the upcoming report.

Sasol’s (SOL) FY30 and FY50 strategy.

SOL announced its FY50 net zero emissions ambition and decarbonisation strategy at its 2021 Capital Markets Day. This included new FY30 absolute GHG emission reduction targets covering ~91% of its reported FY21 Scopes 1, 2 and 3 GHG emissions (ex-Natref refinery JV). Addressing Secunda’s emissions, which accounts for 85% of Scope 1 and 2 emissions, and 11% of South Africa’s emissions, will be essential to its success. The key component of SOL’s FY30 decarbonising strategy is replacing 23% of its coal feedstock and increasing procurement of renewable energy (to 80% of energy required by 2030).

SOL’s targets imply a 15% reduction in absolute emissions between FY17 and FY30.

Since FY17, SOL’s absolute emissions have increased 17%. SOL targets a 30% reduction in its Scope 1 and 2 emissions (tripling previous target, 2017 base) and a 20% reduction in Scope 3 emissions (new target, FY19 base) by FY30. Its earliest emission reduction target is set for FY26, with limited reductions planned until then. Adjusting for baseline years (FY17), SOL’s target equates to a 7% increase in absolute emissions by FY26, and a 15% reduction in absolute emissions by FY30. SOL notes this is not in alignment with a 1.5C pathway.

Our view.

SOL uses the correct metric (absolute emissions) and scopes (targets for 1, 2 and 3) to set its climate targets. This creates the right framework for management and investors to assess its success. However, investors should consider the following questions in deciding whether or not to approve SOL’s plan. 1) Is it satisfactory that SOL has no emissions reduction targets in the next 5 years? We estimate that only 9% of the absolute emissions reduction required to meet the FY30 target will be achieved between FY21 to FY26. 2) SOL’s emissions reduction strategy relies on its access to affordable gas supply. Has SOL sufficiently shown how it mitigates the financial and commercial risks to secure the gas, without providing any assurances? 3) Has SOL demonstrated its vision for thriving in a zero emissions world with its plans for keeping Secunda alive. We note SOL’s strategy will increase its share of South Africa’s emissions from 18% (FY18) to 21% in FY30[1]. Its regulatory performance and past record in environmental compliance have been poor. Any vote on SOL’s plan should be caveated with the need for strong engagement and ongoing monitoring.

Chart 1: Absolute GHG emissions SOL (Actual FY17-FY20), South Africa (Actual 2017) (Mt CO2e)

GHG emission reduction targets

SOL has set emissions reduction targets for its absolute GHG emissions for Scope 1, 2 and 3 (excluding Scope 1 and 2 for Mozambique and Natref refinery JV, and excluding all Scope 3 outside of Use of Sold Energy products).

SOL has said it will not rely on Carbon Capture Utilisation and Storage (CCUS), offsets or divestments to reach its FY30 targets, excluding some use of CCUS for its International Chemicals business. The company has stated that by FY50, it will offset remaining GHG emissions using nature and technology based solutions (post-emission compensation). It is unclear how much will be required.

SOL noted in its disclosure that in FY22 it expects to adjust its Scope 1 and 2 - South Africa baseline GHG emissions. This is due to the sale of the Air Separation Units (ASUs) in Secunda, which will result in an exclusion of ~1,8 Mt CO2e of Scope 2 GHG emissions. This will not be counted as GHG emission reduction.

Table 1: SOL GHG emissions disclosed (Mt CO2e)

| Emissions type | FY20 | FY21 |

|---|---|---|

| Scope 1* | 59.7 | 60.6 |

| Scope 2* | 6.3 | 6.5 |

| Scope 3 | 37.6 | 38.5 |

| Total GHG emissions disclosed | 103.6 | 105.6 |

| Total GHG emissions included in targets | 94.3 | 96.3 |

| % GHG emissions included in targets | 91% | 91% |

| GHG emissions excluded from targets: | 9.3 | 9.3 |

| Natref | 1.1 | 1.3 |

| Mozambique | 0.3 | 0.4 |

| Scope 3 - Other disclosed | 7.9 | 7.6 |

| Scope 3 - Chemicals, not disclosed | - | SOL to assess |

| Methane emissions (Scope 1)[2] | 2.9 | 3.2 |

SOL’s GHG emission reduction targets have increased from its prior commitments, by FY30 it is targeting a:

- 30% reduction in Scope 1 and 2 - South Africa GHG emissions (FY17 base), from a 10% reduction prior.

- 30% reduction in Scope 1 and 2 - International business (FY17 base, new target).

- 20% reduction in Scope 3 - Use of Sold Energy Products (FY19 base, new target).

Adjusting for a FY17 base, GHG emissions included in targets are expected to increase 7% by FY26 and decrease 15% by FY30. SOL does not yet fully report on methane emissions (it excludes Mozambique) and has not set a methane reduction target. We see this as a key gap in SOL’s GHG emission reduction commitments.

Table 2: SOL Absolute GHG emission reduction targets (Sept 2021)

| Emissions included | Base Year | FY26 | FY30 | FY50 |

|---|---|---|---|---|

| Scope 1 and 2 | ||||

| South Africa - Energy and Chemicals[3], excl Natref | 2017 | 5% | 30% | Net Zero |

| International - Chemicals | 2017 | 20% | 30% | Net Zero |

| Scope 3 | ||||

| South Africa and International - Use of Sold Energy Products | 2019 | - | 20% | Net Zero |

| Absolute GHG emissions included in target (Mt CO2e) | 88.4 (2017)[4] | 94.6[5] | 75.3 | Unknown |

| % change from 2017 base | +7%* | -15% | Unknown |

Table 3: SOL Absolute emission reduction targets (Prior targets from 2020)

| Emissions included | Base Year | FY25 | FY30 | FY50 |

|---|---|---|---|---|

| Scope 1 and 2 | ||||

| South Africa - Energy and Chemicals, excl Natref | 2017 | 4-5% | At least 10% | No target |

| Absolute GHG emissions included in target (Mt CO2e) | 63.9 | 60.7 | 57.5 | - |

Total SOL GHG emissions of 105.6 Mt CO2e increased 2% from FY20 to FY21. SOL attributed this to higher electricity use and less frequent shutdowns in South Africa (Scope 1 and 2), although this growth also includes the reduction in International GHG emissions (Scope 1 and 2) due to the sale of its 50% interest in the Lake Charles Base Chemicals plant.

Chart 2: SOL Absolute GHG Emissions (Mt CO2e) FY17-F21 (Actual) and FY26 and FY30 target

Chart 3: SOL Absolute GHG Emissions included in targets (Mt CO2e) FY17-F21 (Actual) and FY26 and FY30 target

Infogram

Peak emissions and production guidance

Table 4: SOL GHG emissions and production guidance

| Indicator | Prior commitment 2020 | Sep 2021 |

|---|---|---|

| Coal | Reduce reliance on coal as a primary feedstock Post FY30 not investing in growing mining operations. | Scaling down coal exports to assist Scope 3 emission reduction target. Reducing South African business coal intake from 40 to 31Mt (FY30). Will not invest in any new coal in the future leading to a natural run-off. Note: In FY19 SOL opened a new coal mine (Impumelelo) with a capacity of 10.5 Mt p.a. SOL has said that this mine will provide sufficient coal feedstock to last it until at least FY50.[6] Therefore SOL is not expected to need any additional coal. |

| Gas | Aims to utilise gas as a transition feedstock once affordable in South Africa. | Extra 40-60 PJ Gas (equivalent to 0.84-1.26 Mt LNG[7]) by FY30, bringing in LNG from FY26-FY27. |

| Renewable energy | 300MW of renewables prior to FY25, an additional 300MW in FY30. | SOL has increased its commitment to renewable energy: 600 MW renewable energy target to power Secunda by FY25, 1,200 MW before FY30[8]. 100% purchased renewable electricity target for the International Chemicals Business by FY30. |

| Oil production | Plans to discontinue all oil growth activities in West Africa. | No target. Oil is attributed to Natref JV, of which targets are under review in consultation partners. Natref accounts for ~2% of total Scope 1 & 2 emissions. |

Post-emission compensation usage

Table 5: SOL post-emission compensation commitments

| Indicator | Prior | Sep 2021 |

|---|---|---|

| Carbon Capture Utilization and Storage (CCUS) | No targets. | No targets. SOL is considering the options to progress CCUS. |

| Carbon offset Credits | No targets. In FY19, SOL purchased ~2.5Mt of carbon credits to offset our South African carbon tax liability. | No targets. In FY21, SOL purchased ~4.3Mt of carbon credits to offset its South African carbon tax liability. SOL does not expect to rely on carbon offsets to meet its GHG emission reduction targets prior to FY30. |

| Nature Based Solutions | No targets. | SOL aims to partner with recognised agricultural and carbon offset project developers to co-create a scalable soil carbon enhancement programme in South Africa. SOL does not expect to rely on nature-based solutions prior to FY30. |

Capital expenditure

Table 6: SOL Capital expenditure commitments

| Indicator | Prior | Sep 2021 |

|---|---|---|

| General statement | No commitment to align capital expenditure with emission reduction targets or the Paris Agreement. | SOL is targeting R20 -25bn p.a up until FY25. Of this, 10 -15% is expected to be spent on “sustainable capital expenditure” between FY21 and FY30 (total cumulative capex on transformation of R15-25bn). This is expected to fund 30% of SOL’s GHG reduction target, 65% is expected to be spent FY26 onwards. |

Decarbonisation strategy - key activities

Table 7: SOL decarbonisation activities

| Year | Prior | Sep 2021 |

|---|---|---|

| Divestment | No activity, however SOL stated they are actively pursuing divestments to reshape the portfolio. | The GHG emissions for Americas have decreased by 25% from FY20 as a result of the divestment of 50% of the Lake Charles Chemicals Complex since December 2020. |

| Key activities | Emissions reduction between 2017 and 2025: 1-2Mt CO2e p.a from energy and process efficiency. 280MW renewable energy (0.8-1 Mt CO2e). Emissions reduction between 2025 and 2030: Energy and process efficiency. Gas conversion (dependent on availability, affordability and emission reduction ambition). 300MW renewable energy (0.8-1 Mt CO2e). Divestment. | By 2030: Introducing 40-60 petajoules (PJ) p.a of LNG. Scaling down coal exports and transitioning to sustainable fuels (post-2025). Grow new product lines associated with green hydrogen and sustainable carbon feedstocks. Increasing the use of renewable energy at SOL facilities (see tables above). Beyond 2030: Substituting coal with more gas. Large-scale introduction of renewable energy. Affordable: Large volumes of green hydrogen. Sustainable carbon feedstocks. CCUS Responsibly scaling down coal exports and transitioning to sustainable fuels. Carbon Dioxide Removal offsets, including technology and nature-based solutions. |

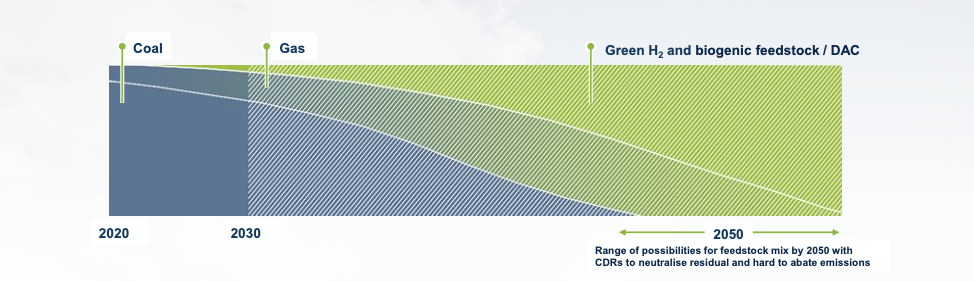

Chart 4: SOL transition pathway for conversion of feedstocks

Remuneration

Table 8: SOL retrospective remuneration and future target

| Target | Sep 2021 |

|---|---|

| Target FY21 (retrospectively applied) | SOL did not have remuneration targets that specifically included the delivery of its GHG emission reduction targets. However, SOL retrospectively applied a 10% weighting to the Group Executive Committee (GEC) short-term incentives (STI) in FY21 for delivering its climate change program, of which it received an 11.17% score (above 100% of total weighting). This was awarded for: Releasing the 2030 and 2050 GHG roadmaps. Selecting the short-list of bidders to provide 600 MW of Renewable Energy. A 0.4% year-on-year improvement on Energy Efficiency. |

| Target FY22 | SOL LTI plan references the delivery of its Scope 1 and 2 - South Africa FY24 GHG emission reduction targets when assessing performance. This forms part of its 25% weighting for ESG detailed below. In FY22, 20% of the GEC STI will be linked to “advancing sustainability” including: Reducing GHG Emissions via securing Power Purchase Agreements (PPA’s) for SOL’ FY25 renewables target, a 1% energy efficiency improvement (30 June 2021 baseline), and securing PPAs that will save 0.65 Mt CO2e by 2024 (15% weighting); and Shifting to lower-carbon products and green hydrogen by setting up the new sustainable business venture, establishing two sustainable synthetic fuels (PtX) partnerships, and competition of two feasibility studies submitted for approval (5% weighting). In FY22, 25% of the Long-Term Incentives (LTI) for the GEC will be linked to a “Holistic Focus on ESG”, which includes: A 3.8% reduction (equating to 2.36 Mt p.a. CO2e) in Scope 1 and Scope 2 emissions from a FY17 baseline by end FY24 for the Energy Business. 60% Renewable power for its Chemical operations in Europe and America by the end of FY24. Within 6% of the DJSI inclusion score by November 2023. We note in FY21 25% of SOL LTI incentives were linked to increases in production, which works against GHG emission reductions required under its decarbonisation strategy. |

Governance and reporting

Table 9: SOL governance and reporting link to its climate transition strategy

| Area | Prior | Sep 2021 |

|---|---|---|

| Climate engagement | Associations are not fully disclosed. SOL's association review is focused on policy views rather than actual lobbying activity. | Completed audit of alignment with industry associations on climate policy. This audit did not recognise how key industry associations are engaged in lobbying activities misaligned with the Paris Agreement, nor set out how misalignments will be addressed. |

| Climate governance | The board committee of Safety, Social and Ethics Committee (SSEC) is responsible for climate change. SOL has not disclosed a review of its board climate competencies. Muriel Dube, its non-executive director, has climate experience. | No change. |

| TCFD | SOL has been a TCFD supporter since September 2018 and sign-posts TCFD disclosures. A 1.5°C scenario has not been included in its scenario analysis. | SOL incorporates their own ‘Accelerating to 1.5oC’ scenario, however, this results in a 1.5-1.7oC range by 2050. |

Sasol: Capital Markets Day | 6/10/21

South Africa’s emissions are based on the South Africa updated first Nationally Determined Contribution under the Paris Agreement (2021), the lower boundary which is roughly aligned with 1.5C global warming. SOL’s emissions are Scope 1, 2 and 3 emissions of its South African operations included in its 2030 target. ↩︎

Converted to CO2e using IPCC 6th Assessment Report 100-year Global Warming Potentials, SOL does not disclose methane emissions for its Mozambique operations which may be a material part of methane emissions. ↩︎

The Chemicals Business at Secunda and Sasolburg are integrated into the South Africa energy targets. ↩︎

Includes 0.6Mt CO2e adjustment for production increases from the Lake Charles Chemicals Project. ↩︎

Assumed 10% reduction in Scope 3 by FY26. ↩︎

Sasol (2019), Coal mine opening ↩︎

Assumes conversion factor: 1 PJ natural gas = 0.021 Mt LNG ↩︎

Note: SOL is responsible for 200 MW share of FY25 target and 800 MW share of 2030 target ↩︎