Publication Information

- 1 MB PDF

- 22nd August 2025

Stay Informed

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign UpUpdated August 2025 [1]

This communication is for informational purposes only and does not constitute financial, legal, or professional advice. ACCR does not hold an Australian Financial Services Licence and does not provide financial product advice. The purpose of this communication is not to provide financial product advice. Please read the terms and conditions attached to the use of this site.

The proposed Hunter Valley Operations (HVO) Continuation Project is the largest coal expansion project under NSW Government assessment. The HVO Joint Venture (51% Yancoal, 49% Glencore) is seeking to expand existing mine operations to 2045 and extract an additional hundreds of millions of tonnes of run-of-mine coal (ROM) over the coming decades.

HVO Joint Venture’s original proposal sought to extract an additional 684 million tonnes (Mt) of ROM coal, which would have resulted in an estimated 32 Mt of CO2-equivalent (MtCO2e) direct emissions within NSW, and nearly 1 gigatonne of CO2-equivalent (GtCO2e) from end-use combustion of coal in export markets. Following concerns raised by the NSW Government about the project’s significant fugitive methane emissions and impact on the State’s legislated emissions reduction targets,[2] the joint venture is revising the application – reducing the mine size by 35%,[3] resulting in 40% less scope 1 emissions[4] relative to the original proposal. The revised proposal is expected in mid-2025.

Even with a reduced size, the HVO Continuation Project represents almost 40% of emissions in the NSW Government’s coal project approval pipeline. With existing coal mining projects already straining the ability of NSW to meet its legislated emissions reduction targets, if HVO is approved it will further strain the state’s ability to meet its targets and shift the burden onto other sectors to make deeper emissions reductions.

A critical component of the assessment process will be consideration of the economic costs and benefits to NSW. ACCR has undertaken a detailed review of the cost-benefit analysis (CBA)[5] the HVO Joint Venture provided in 2024 as part of its original proposal. We found this 2024 CBA significantly understates the cost of emissions from the project, meaning it overstates its net economic benefits to the state.

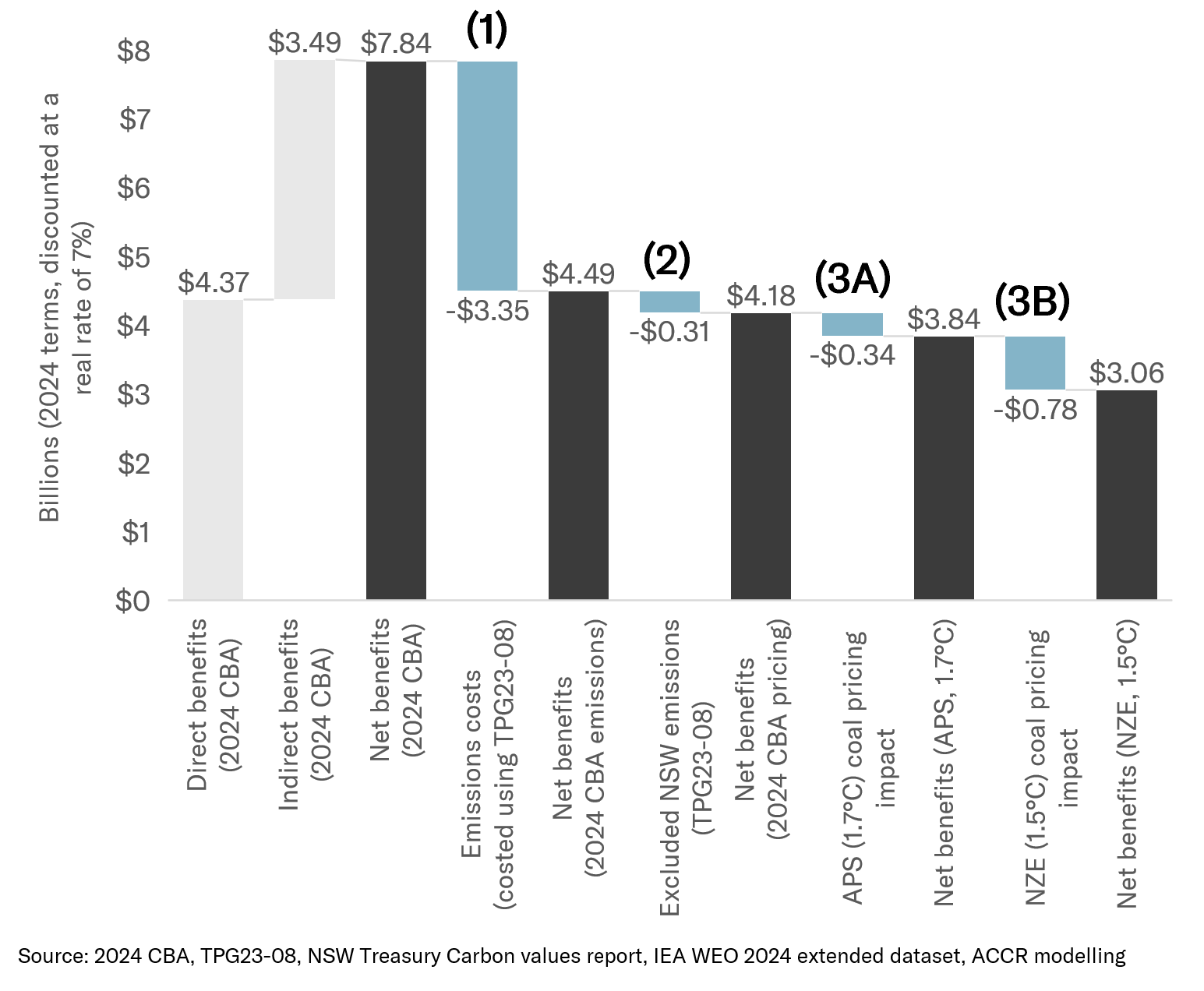

When we applied the latest NSW Treasury guidance to the 2024 CBA, and considered the full scope of relevant emissions in NSW, the estimated net benefits to the NSW community reduced by 47% – from $7.84 billion to $4.18 billion.[6] Further, when we used a coal price forecast more aligned with federal and state commitments to the Paris Agreement, the project’s net benefits to the NSW community dropped to around $3.06 billion.

The insights gleaned from this analysis aim to inform a more robust and credible CBA for the upcoming revised application. A CBA which uses the most up-to-date guidance, includes all relevant emissions, and considers coal price assumptions consistent with government commitments to the Paris Agreement will provide the NSW Government a more credible basis for decision-making.

The 2024 CBA uses NSW Treasury Guidance TPP17-03 as a framework to quantify the cost of carbon emissions of the project. This is in line with 2018 guidance from the Department of Planning, Housing and Infrastructure (DPHI). However, TPP17-03 has since been superseded by TPG23-08, which uses a NSW-specific Marginal Abatement Cost (MAC) and aligns emissions valuation with the state’s legislated emissions targets.

The APS reflects the global policy direction based on announced government commitments, while the NZE scenario aligns with NSW and Federal commitments to the Paris Agreement.

Chart 1.1: Analysis of the 2024 CBA using the current Treasury Framework, the full scope of NSW emissions, and APS and NZE pricing shows a significant reduction in the project’s net benefits to NSW[8]

ACCR recommends that any future application for the HVO Continuation Project must include a cost-benefit analysis that incorporates:

The NSW Government should assess all projects – public and private – using consistent methodologies. TPG23-08 is mandatory for assessing public investments and should be applied to private investments to ensure the consistency and integrity of planning processes. Project assessments should be based on sound economic analysis and not subject to differential treatment based on ownership.

The impact of each recommendation on project value to NSW has been modelled by ACCR and is labelled accordingly in Chart 1.1.

Download a PDF of More cost, less benefit for NSW: the flawed rationale for the Hunter Valley expansion | Updated August 2025

After the publication of this report in June 2025, ACCR obtained clarification from NSW Treasury on the application of discount rates to carbon values. As a result of this clarification, we have adjusted the original calculation of the cost of emissions when Treasury Guidance TPG23-08 is applied to the 2024 cost benefit analysis. The updated figure is $3.35 billion, down from $6.34 billion. Consequently, when TPG23-08 is applied to the 2024 CBA, the full scope relevant emissions in NSW included, and a coal price more aligned with the Paris Agreement is used, we find the project’s net benefits to NSW are approximately $3.06 billion, up from below zero in the original calculation. All new numbers and charts are reflected in this updated report, dated August 2025. It supersedes the original June 2025 report entirely and should be relied upon going forward. ↩︎

NSW DPHI, Consideration of Climate Change (Net Zero Future) Act 2023, Scope 3 Emissions and Mining Panel Advice, letter to HVO Pty Ltd, July 2024. https://majorprojects.planningportal.nsw.gov.au/prweb/PRRestService/mp/01/getContent?AttachRef=RFI-75053457!20240822T212521.152 GMT ↩︎

ACCR estimate based on a reduction of ~220 Mt ROM coal relative to the original proposal. HVO Pty Ltd, Response to RFI and Proposed Project Amendments, letter submitted to the NSW DPHI, March 2025, p. 4. https://majorprojects.planningportal.nsw.gov.au/prweb/PRRestService/mp/01/getContent?AttachRef=RFI-75053457!20250326T060538.621 GMT ↩︎

HVO Pty Ltd, Response to RFI and Proposed Project Amendments, letter submitted to the NSW DPHI, March 2025, p. 5. https://majorprojects.planningportal.nsw.gov.au/prweb/PRRestService/mp/01/getContent?AttachRef=RFI-75053457!20250326T060538.621 GMT ↩︎

Ernst and Young (EY) published a revised Economic Impact Assessment in May 2024 which included the cost-benefit analysis of the project to the NSW community. https://majorprojects.planningportal.nsw.gov.au/prweb/PRRestService/mp/01/getContent?AttachRef=SSD-11826621!20240513T231653.019 GMT ↩︎

Unless otherwise stated, all monetary values in this report are expressed in Australian dollars (AUD). ↩︎

Under current NSW Treasury guidance all emissions that occur within NSW should be included in a cost-benefit analysis. ↩︎

NSW Treasury carbon values are calculated using a 5% discount rate, consistent with TPG23-08. Because the 2024 CBA applies a 7% discount rate, the carbon values were discounted at 7% to obtain present value terms. In the absence of Treasury’s underlying MAC model calculated using a 7% discount rate, this adjustment provides the best available estimate. Numbered labels in the chart correspond to the key findings and recommendations. ↩︎

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign Up