Publication Investor briefing: Shareholder Resolutions to BHP Group Ltd on climate advocacy and accounting

AGM date and location: 10 November, Perth, Australia

Contacts:

Harriet Kater, Climate Lead, Australia

Naomi Hogan, Strategic Projects Lead

Other key links: Resolutions and Supporting Statements.

Background

ACCR has engaged regularly with BHP on its decarbonisation commitments and climate lobbying footprint for several years. This year, ACCR has filed two shareholder resolutions for consideration at BHP’s November 10 AGM, seeking advocacy for policy that is aligned with limiting warming to 1.5°C and a climate sensitivity analysis in the company’s financial statements.

1. Ordinary resolution on company consistency with limiting warming to 1.5°C

Shareholders request that our company proactively advocate for Australian policy settings that are consistent with the Paris Agreement's objective of limiting global warming to 1.5C.

Nothing in this resolution should be read as limiting the Board's discretion to take decisions in the best interests of our company.

Reasons to support this resolution

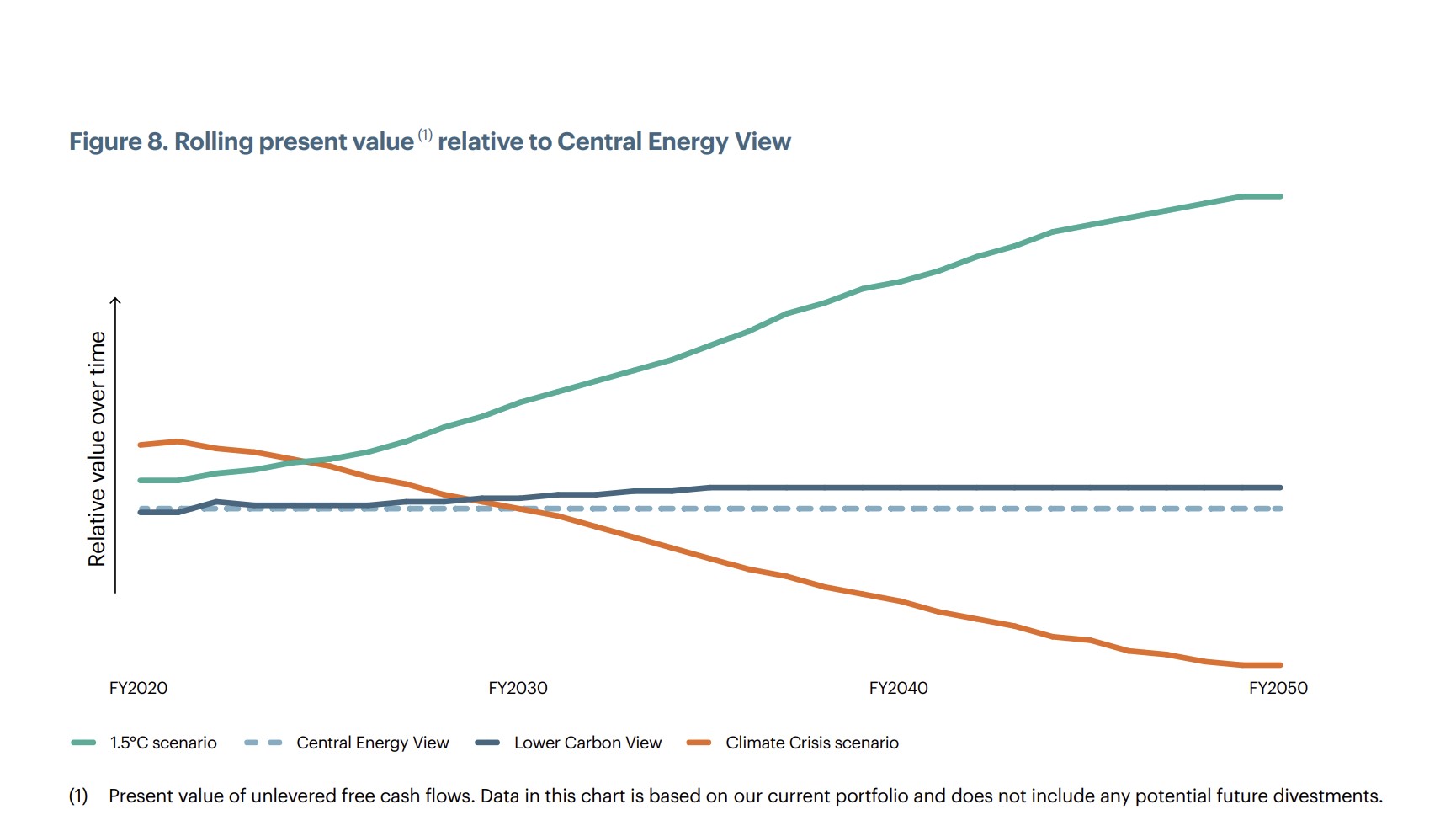

BHP is Australia’s largest company and it holds immense political power, which it willingly wields on various policy issues. Since 2020 the company has stated that a 1.5°C pathway is the best outcome for shareholder value (see figure below).[1] BHP should be deploying its influence to enhance the probability of that outcome for shareholders.

This is a critical moment in Australia following a change in federal government. It is essential that the winners from rapid decarbonisation in Australia, such as the major diversified miners, step up to counter the power of the fossil fuel lobby in this country.

Miners of future-facing metals must counter the fossil fuel lobby

The 2022 IPCC Working Group III report on Mitigation of Climate Change identified that a major threat to limiting warming to 1.5°C is the “power of incumbent fossil fuel interests to block initiatives towards decarbonisation”.[2] The coal lobby, including BHP’s industry associations such as the Minerals Council of Australia (MCA) and the NSW Minerals Council, continue to play a damaging role in Australia.[3] Recent submissions to the Federal Government safeguard mechanism demonstrate that the MCA[4] and the oil and gas industry[5] are actively seeking to undermine the effectiveness of evolving climate policy.

Unsurprisingly, campaigns that are oppositional to rapid decarbonisation are wielded by industries that have the most to lose as the world transitions away from fossil fuels. The share of BHP’s revenue that is driven by fossil fuels has declined as a result of the BHP Petroleum spinoff. Diversified mining companies and their shareholders have a significant amount to gain from ambitious climate policy.[6]

BHP has considerable influence

BHP is clearly willing to wield its political influence in the interests of its business. In 2010, it helped to bring down Australian prime minister Kevin Rudd due to his proposed super profits tax for the mining industry.[7] In 2017, BHP lobbied against a proposed mining tax in Western Australia that saw a party leader lose his seat.[8] In 2022, it has thrown its weight behind an emerging campaign against the Queensland government’s coal royalty rate rise.[9]

Whilst such aggressive lobbying against taxation is not condoned, shareholders should question why BHP is not applying a similar assertive approach to advocacy for the policy settings required to limit warming to 1.5°C. On numerous occasions, such as when BHP and its industry associations were successful in campaigning for the repeal of Australia’s carbon pricing mechanism,[10] it has used its influence to undercut climate action.

Recent approach is mixed

Whilst there are some early signs that BHP may start to advocate for the opportunities and new sources of national prosperity from decarbonisation,[11] the messages are mixed. CEO Mike Henry advised the recent Federal Government Jobs Summit[12] “Australia should harness the transition to its full advantage, but let’s make sure it’s grounded in reality… We don’t have the same natural advantages in renewable energy, or frankly in copper, nickel or lithium and so on.” This comment is perplexing considering Australia’s abundant sun and wind resources, along with having the highest nickel reserves globally[13] and second highest copper and lithium reserves.[14]

The company’s Safeguard Mechanism submission[15] was also variable. Whilst it advocated in favour of removing overly generous baselines (i.e. headroom), it advocated for the use of international offsets, even though it claims to support the mitigation hierarchy. It also warned against imposing best practice emissions performance requirements on new facilities, stating that “most new investment in the next 5-10 years will be determined by technical and financial studies carried out in the previous 5-10 years”. This comment does not reflect the culture of innovation and agility required to align BHP to a 1.5C pathway, nor the urgency of the climate challenge.

A range of positive policy opportunities exist for BHP

As a major winner from rapid decarbonisation, BHP should consistently and positively advocate in line with the 1.5°C goal. Specific advocacy opportunities include:

- Publicly supporting significantly enhanced ambition in Australia’s Nationally Determined Contribution for 2030 and 2035.

- Proactively engaging with policy ideas to decarbonise Australia’s mining industry, such as proposals to phase out the fuel tax rebate for the mining sector to incentivise the electrification of mine haulage.[16] Just last year the MCA, BHP's industry association, aggressively resisted such a proposal.[17]

- Openly supporting proposals to insert a climate trigger for state and federal government project approvals.

- Actively supporting enhanced renewable energy rollout and electrification policies.

- Advocating for the adoption of the Global Methane Pledge and best practice technologies to accurately measure methane fugitives from coal mining, including the use of local ground based monitors, satellites and aerial surveys.

- Lobbying governments to establish enabling policy for a global green iron and steel industry.

BHP’s response to the resolution

The BHP board has recommended[18] that shareholders vote against this resolution. ACCR has commented on the majority of its reasons below, overall finding them to be inconsistent and insufficient to justify a vote against.

| BHP reason | ACCR response |

|---|---|

| BHP already advocates for climate policy that is consistent with the Paris Agreement’s objective of limiting warming to 1.5°C | If this is the company’s view and current advocacy position, then it could have supported this resolution. |

| The resolution interferes with the Board’s discretion | The resolution text specifically states it should not be read as limiting the Board’s discretion. |

| The resolution is too broad and ambiguous | This resolution is principles-based but directed, and is appropriately non-prescriptive as to particular positions to be taken by BHP. To aid with interpretation, the supporting statement listed a number of policy areas where there is opportunity for BHP to influence, which are directly relevant to its industry. |

| The resolution commits BHP to “forward-looking positive actions”, creating a greenwashing risk for the company | This is a non-binding, advisory resolution. Further, BHP states, as a matter of fact, in its opening response to the resolution, that it advocates in line with 1.5°C, so such a risk already exists for the company. |

| BHP is best able to support climate policy by meeting its own targets, goals and commitments and making the case for economic opportunities arising from the energy transition | BHP’s targets and goals are not yet aligned with 1.5°C, in contrast to the policy commitments of many of its shareholders. We encourage BHP to advocate for policy that enables Australian industry to align with scientifically credible decarbonisation pathways for decarbonisation, and for policy that expedites the energy transition. |

Ordinary resolution on climate accounting and audit

Shareholders request that from the 2023 financial year, the notes to BHP’s audited financial statements include a climate sensitivity analysis that:

- includes a scenario aligned with limiting warming to 1.5°C,

- presents the quantitative estimates and judgements for all scenarios used, and

- covers all commodities.

Nothing in this resolution should be read as limiting the Board’s discretion to take decisions in the best interests of our company.

Reasons to support this resolution

BHP aims to ensure its ‘capital expenditure plans are not misaligned with the Paris Agreement’s aim to pursue efforts to limit global warming to 1.5°C’.[19] It also 'regularly test(s) [its] portfolio against a range of climate change scenarios'.[20] BHP is 'committed to lead the evolution of our industry'.[21] However, BHP is not sufficiently transparent about how it considers climate change in its audited financial statements. This “reduces an investor’s ability to make investment, engagement and voting decisions”.[22]

This resolution warrants shareholder support, given:

- The requested disclosure is consistent with both regulatory and investor expectations, as well as Australian and international accounting standards.

- BHP’s financial statements already meet much of the request, so the resolution will take minimal effort to comply with.

- BHP positions itself as a leader with regard to climate disclosure.

What exactly does this resolution require?

This resolution seeks the following in the notes to BHP’s financial statements:

- Scenarios and assumptions: Disclosure of which scenarios have been used and the quantitative assumptions they include. Explanation and justification for any deviations from commonly used scenarios, such as the IEA or the Network for Greening the Financial System Net Zero by 2050 scenarios. This includes detail on 1.5°C overshoot and key variances in commodity price assumptions.

- Results: Disclose how the transition and physical risks affect asset valuation and impairments, provisions and credit losses in the different climate scenarios. Provide results by commodity.

It is also expected that the audit report demonstrates the auditor has assessed the impacts of climate-related matters, ensured the veracity of the scenario(s) selected and identified inconsistencies between the financial statements and other information, such as climate change disclosures.

BHP is already meeting much of the request, but assumptions need to be more clearly disclosed

In the 2022 CA100+ Net Zero Company Benchmark, BHP's 2021 financial statements and audit report failed to meet six out of seven assessment criteria.[23] The remaining criteria relate to disclosing climate related assumptions, disclosing a 1.5°C sensitivity, ensuring consistency with other reports and expanding the audit scope.

In 2022 BHP appears to have done much of the work to earn a higher score. BHP’s 2022 financial statements qualitatively discussed the financial impacts of climate change, including a 1.5°C scenario.

BHP’s chosen 1.5°C scenario assumed that, “the long-term commodity price outlooks under this scenario for iron ore, copper, metallurgical coal, nickel and potash are either largely consistent with or favourable to the price outlooks in the Group’s current operational planning cases”. As such, “a material adverse change is not expected to the valuation”.[24]

Importantly, the AASB / AUASB Joint Practice statement says that where no financial impacts are expected to the amounts recognised, there is still an expectation for issuers to ‘explain assumptions made’.[25]

Although BHP provides commentary on the demand for each of these commodities, that is only an input into the asset value calculations, insofar as it informs commodity prices. Disclosing price assumptions would provide investors with more transparency.

ACCR expects investors will pay particular attention to metallurgical coal, as the remaining fossil fuel in BHP’s portfolio. The 2022 financial statements do not articulate BHP’s view of metallurgical coal demand or prices in a 1.5°C sensitivity, except to say that steel demand will double.[26] BHP’s 2020 climate change report also concluded that metallurgical coal demand over the next 30 years would be effectively the same under all of their assessed climate scenarios.[27]

With steel responsible for 8% of global emissions[28] and increasing investments in green steel manufacturing,[29] the conclusion of robust metallurgical coal demand in a 1.5°C scenario may no longer be reasonable. The International Energy Agency’s Net Zero Emissions Scenario for example, states that “demand for coking coal falls at a slightly slower rate than for steam coal, but existing sources of production are sufficient to cover demand through to 2050”.[30] This suggests BHP’s metallurgical coal assets may be impaired in a 1.5°C pathway.

ACCR’s resolution is however not asking for these assumptions to be changed, rather for more specific disclosure. Disclosure of pricing assumptions will allow investors to make more informed investment and engagement decisions.

ASX-listed company recognition of climate in financial statements is improving

ACCR filed a similar resolution with Origin Energy (ASX:ORG). In its Notice of Meeting, Origin stated that, ‘We support including a climate sensitivity analysis using a 1.5°C scenario in our financial statements and commit to doing so from FY2023.’ This sensitivity analysis would present ‘the quantitative estimates and judgements’.[31] As such, Origin’s equivalent resolution has been withdrawn.

In its FY22 financial statements South32 materially improved its recognition of climate change. It now explicitly considers a 1.5°C scenario when assessing for impairments[32] and where impairments are made, the relevant commodity prices are disclosed.

Response to BHP’s Notice of Meeting

BHP’s notice of meeting for the 2022 AGM provides reasons for why the board does not not support ACCR’s resolution.[33] In ACCR’s view these responses are inconsistent with the company’s disclosures to date and willfully misrepresent the request.

| BHP reason | ACCR response |

|---|---|

| The resolution breaches accounting standards since it may require ‘positive remeasurement’ of property plant and equipment asset values, ‘which is not permitted under the accounting standards’ | The resolution is not requesting a ‘positive remeasurement’. An increase in asset values would result in no impairment. Disclosing an impairment of zero for a sensitivity analysis, is common practice[34] and would satisfy both the resolution and the accounting standards. |

| ‘BHP does not consider it appropriate that its statutory financial statements include inappropriately speculative predictions about future outcomes’ | BHP’s support for the Paris Agreement and the views of stakeholders makes a 1.5°C scenario material and therefore discloseable in accordance with guidance from the AASB and AUASB.[35] If the inclusion of a 1.5°C sensitivity breaches accounting standards, ACCR would question why BHP discussed the impact of a 1.5°C scenario on BHP’s portfolio in both its FY21[36] and FY22[37] financial statements. |

| The accounting standards ‘require that the financial statements of the Group reflect our best estimate of the range of economic conditions that could exist in the foreseeable future’ | The resolution is not asking for any change in BHP’s best estimate of the future; it is simply asking for a sensitivity to different assumptions. |

| BHP is a ‘market leader in this space’ | ACCR agrees BHP has been a market leader in climate disclosure. That is why the gap between the resolution and BHP’s current practice is smaller than it would be for many other companies. This reduces the impost of the resolution which should make it more supportable. |

| Climate change is covered in other BHP publications, including ‘our Annual Report 2022, Climate Change Report 2020 and Climate Transition Action Plan 2021’ | Climate change is financial risk. It belongs in financial statements. Alternative climate change disclosures are welcome, but are not a replacement for disciplined accounting and disclosure of material information in the financial statements. |

| BHP supports non-financial climate reporting standards such as those being developed by the International Sustainability Standards Board | The draft standard that BHP refers to, clearly states that it is intended to support rather than supplant the disclosures in financial statements. If Australia develops sustainability-related reporting requirements that are aligned with the ISSB [Draft] IFRS S2 Climate-related Disclosure the AASB has stated these will ‘supplement and complement’ information provided in financial statements.[38] |

BHP's value is sensitive to climate change

BHP accepts it “is exposed to a range of transition risks that could affect the execution of our strategy or our operational efficiency, asset values and growth options, resulting in a material adverse impact on its financial performance, share price or reputation, including litigation. The complex and pervasive nature of climate change means transition risks are interconnected with and may amplify our other risk factors”.[39] Changing weather patterns and more extreme weather events, driven by climate change, also directly confront BHP's business operations.

Whilst the energy transition presents significant upside for a number of BHP’s commodities, transition risks have been realised for the New South Wales Energy Coal Cash Generating Unit (CGU), as seen in the restated 2021 financial statement, when it was impaired by $1,057 million due to “changes in energy coal prices”.[40]

Resolution is consistent with investor expectations

In 2020, investor groups representing over US$103 trillion AUM globally issued a letter seeking that companies reflect climate-related risks in financial reporting.[41]

Subsequently, the Institutional Investors Group on Climate Change (IIGCC) outlined its 'unequivocal' expectation that companies and auditors will deliver 'Paris-aligned accounts', defined as "accounts that properly reflect the impact of getting to net zero emissions by 2050 for assets, liabilities, profit and losses".[42] IIGCC expects directors to: affirm that the Paris Agreement goals were considered in preparing the accounts; explain, in the Notes, how critical accounting judgements are consistent with NZE by 2050 (or if these assumptions are not used, why not); present results of sensitivity analysis around Paris-aligned assumptions; state any implications for dividend paying capacity of Paris-alignment. IIGCC also expects companies to account for any inconsistency between its narrative reporting on climate risks and the assumptions made in accounting.

CA100+'s Net Zero Benchmark assesses whether company accounting disclosures and practices adequately reflect climate change risk, and the global movement towards NZE GHG emissions by 2050 or sooner. The CA100+ initiative —representing more than 700 global investors managing AUM $68 trillion— expects that 'net zero aligned' companies and auditors will provide investors with oversight of how accelerating decarbonisation, in line with the 2050 trajectory, will affect a company's financial position and profitability.[43]

Some investors are already expressing their expectations around reflection of climate in company financial statements and audits in their voting decisions.[44]

Resolution is consistent with accounting standards and guidance

Existing Australian and global accounting standards set a clear expectation that climate-related risks are integrated into financial statements.

The Australian Accounting Standards Board (AASB) Practice Statement 2, Making Materiality Judgements, is clear that 'information is material if omitting it or misstating it could influence decisions that users make on the basis of financial information about a specific reporting entity'.[45] Therefore, and as the AASB/AUASB noted in 2019, investor statements on the importance of climate-related risks to their decision-making will often render these risks 'material' to a company, requiring them to be reflected in financial statements.[46]

BHP considers climate change to be “a material governance issue and a strategic issue”.[47]

In 2020, the International Financial Reporting Standards (IFRS) board issued an implementation document explaining how elements of 12 separate IFRS standards may introduce requirements to make climate disclosures in financial statements.[48]

Finally, if Australia develops sustainability-related reporting requirements that are aligned with the ISSB [Draft] IFRS S2 Climate-related Disclosure standard,[49] the AASB has stated these will ‘supplement and complement’ information provided in financial statements.[50] Consequently this shareholder resolution is a complementary extension of the anticipated sustainability standards.

ACCR urges shareholders to support these proposals.

Download our full analysis.

Please read the terms and conditions attached to the use of this site.

Australasian Centre for Corporate Responsibility

BHP Group Ltd, 2020, 'Climate Change Report 2020', p21 ↩︎

IPCC, 2022, 'Climate Change 2022: Mitigation of Climate Change' ↩︎

ABC, 2020, 'Climate change action stymied by Australian business lobby, UK think tank finds' ↩︎

MCA, Safeguard consultation submission, 29 September 2022 ↩︎

APPEA, Safeguard consultation submission, 29 September 2022 ↩︎

Cox et al. 2022, 'The mining industry as a net beneficiary of a global tax on carbon emissions', Communications Earth & Environment, 3(17) ↩︎

SMH, 2011, 'A snip at $22m to get rid of PM' ↩︎

AFR, 2017, 'How BHP Billiton, Rio Tinto felled WA Nationals leader Brendon Grylls' ↩︎

AFR, 2022, 'Queensland coal royalty increase will scare investors away: BHP' ↩︎

ABC, 2020, 'Climate change action stymied by Australian business lobby, UK think tank finds' ↩︎

BHP, “BHP Pre-Budget submission 2022-23,” March 2022 ↩︎

AFR, 2022, ‘Bridge gap between ‘hope and a plan’ in clean energy race: BHP’ ↩︎

INN, Nickel Reserves: Top 8 Countries (Updated 2022) ↩︎

INN, 5 Top Copper reserves by country, Lithium ↩︎

BHP, Submission to Safeguard Reform, September 2022 ↩︎

AFR, 2021, 'Forrest says diesel rebate should go after 2025' ↩︎

Mining Weekly, 2021, 'Miners warn against change in fuel rebate' ↩︎

BHP, Notice of Annual General Meeting, October 2022 ↩︎

BHP, 2022, 'Appendix 4E' ↩︎

BHP, 'Climate Change Report 2020' ↩︎

Ibid. ↩︎

Carbon Tracker Initiative / CAP, 2021, 'Flying blind: The glaring absence of climate risks in financial reporting' ↩︎

CA100+, 'Company assessment: BHP Group' ↩︎

BHP, 2022, 'Appendix 4E', p118 ↩︎

AASB/AUASB, 2019, 'Climate-related and other emerging risks disclosures: assessing financial statement materiality using AASB/IASB Practice Statement 2', p2 ↩︎

BHP, 2022, 'Appendix 4E', p118 ↩︎

BHP, 'Climate Change Report 2020', p6 ↩︎

Yonggi Sun, et al. 2022. Decarbonising the iron and steel sector for a 2°C target using inherent waste streams. Nature Comms, 13, 297 ↩︎

Agora Industries, Global Steel Transformation Tracker, last updated 11 August 2022 ↩︎

IEA, 2021, ‘Net Zero by 2050’, p103 ↩︎

Origin, ‘Notice of Annual General Meeting 2022’, p13 ↩︎

South32, Annual Report 2022, p135 ↩︎

BHP, ‘Notice of Meeting 2022’, p22-24 ↩︎

For example Woodside discloses a range of impairment sensitivities that result in no impairment. Woodside, ‘Annual Report 2021’, p116 ↩︎

AASB/AUASB, 2019, 'Climate-related and other emerging risks disclosures: assessing financial statement materiality using AASB/IASB Practice Statement 2' ↩︎

BHP, 2021, ‘Appendix 4E’, p136 ↩︎

BHP, 2022, ‘Appendix 4E’, p118 ↩︎

Ibid, p19 ↩︎

Ibid, p67 ↩︎

Ibid, p139 ↩︎

IIGCC, 2020, 'Investor expectations for Paris-aligned accounts' ↩︎

UNPRI, 2020, 'Investor groups call on companies to reflect climate-related risks in financial reporting' ↩︎

CA100+, 2021, 'Climate Accounting and Audit Indicator - Framework' ↩︎

Sarasin & Partners, 2022, 'Rio Tinto 2022 AGM: Voting for Net-Zero Accounting' ↩︎

AASB, 'AASB Practice Statement: Making Materiality Judgements' ↩︎

AASB/AUASB, 2019, 'Climate-related and other emerging risks disclosures: assessing financial statement materiality using AASB/IASB Practice Statement 2' ↩︎

BHP, 'Climate Change Report 2020' ↩︎

IFRS, 2020, 'Effects of climate-related matters on financial statements' ↩︎

AASB, 2022, 'Request for Comment on ISSB [Draft] IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and [Draft] IFRS S2 Climate-related Disclosures' ↩︎

Ibid, p19 ↩︎