Publication AGL Energy Ltd: Assessment and summary of 2022 AGM voting intentions

AGL Energy Ltd

(ASX:AGL, ISIN: AU000000AGL7)

AGM date and location: 15 November 2022 (AU).

Contacts:

Harriet Kater, Climate Lead, Australia

Dimitri Lafleur, Chief Scientist

Summary

ACCR voting intention - director candidates

ACCR has engaged with AGL since 2015. In our view, over this period the company has demonstrated an inability to maximise the opportunities in a transitioning energy sector, and has lacked long-term thinking.

After a failed demerger attempt, and with its confidence rocked, AGL has finally accepted the need to change course and confront Australia’s largest decarbonisation project. This has coincided with an opportunity for board renewal, with eight existing and proposed director candidates being voted on at the 2022 AGM.

ACCR has taken a number of factors into account in forming a view on each director’s suitability, including the overall board composition and complementarity among directors, the need for business and governance continuity, the background and skills of each director, their independence, and our impression of each candidate in our conversations.

ACCR will vote FOR all board-proposed and shareholder-proposed director candidates, with the exception of Ms Patricia McKenzie. ACCR will vote AGAINST Ms McKenzie's re-election, on the basis of her previous record.

ACCR voting intention - Climate Transition Action Plan (CTAP)

ACCR’s assessment of AGL’s CTAP has found the plan to be inconsistent with the Paris Agreement, given it is not in line with a well below 2°C pathway, nor does it use a well below 2°C consistent remaining carbon budget. Whilst the 2035 closure date of Loy Yang A is a significant improvement, ACCR encourages AGL to revisit its modelling and to base its strategy on a remaining carbon budget that is aligned with limiting warming to no more than 1.6°C, which is consistent with well below 2°C, rather than the current 1.8°C.

AGL’s 2036 goal to supply customers with 12GW of additional renewable and firming capacity, at an investment of up to $20 billion, is commendable. However the CTAP lacks detail on the specifics of the build out and it is practically silent on the potential for decentralised energy and associated customer technologies. Additionally, no scope 3 strategy has been presented and whilst there is an intention to do so, no remuneration metrics have been developed to incentivise achievement of the CTAP. Considering this transition is existential for the company, the absence of detail on remuneration linkage warrants abstention from the vote on the remuneration plan.

ACCR also holds reservations around AGL’s commitment to a 3-yearly Say on Climate vote, considering the state of flux in company leadership and the missing details of the CTAP. ACCR is confident that with a suitably qualified CEO and refreshed board, AGL will produce a significantly enhanced CTAP in the next 12 months, that should be put to a vote at the 2023 AGM.

ACCR will vote AGAINST AGL’s Climate Transition Action Plan and ABSTAIN on remuneration.

ACCR's history of engagement with AGL

ACCR has engaged with AGL since 2015 on its management of climate risk, decarbonisation strategy, management of non-carbon air pollution from its facilities and governance of industry associations. In 2015, we filed a shareholder resolution to the company, calling for it to 'prepare a business model to ensure profitability under pathways that limit the world to 2°C warming', and to disclose further details of its power generation and supply chain emissions management. ^1

We have continually raised concerns about the company's motivation and ability to manage its climate risks. Our recent engagement history is as follows:

- In October 2020, ACCR filed a shareholder resolution, requesting that AGL bring forward the closure dates of Bayswater and Loy Yang A coal-fired power stations. It was supported by shareholders representing 19.96% of votes cast.

- In March 2021, ACCR again urged AGL to embrace the energy transition, and to bring forward closure dates for Bayswater and Loy Yang A power stations. After AGL announced its plans to demerge into 'New AGL' and 'PrimeCo', ACCR commented: “AGL had the opportunity to embrace the energy transition by accelerating its decarbonisation, but it has chosen to spin off its most polluting assets to the detriment of us all.”

- In April 2021, after the resignation of CEO Brett Redman, ACCR called for accountability at AGL and a clear strategy to bring forward the closure of Bayswater and Loy Yang A. ACCR said: 'Spending years attempting a demerger will not absolve AGL of its responsibilities to its investors and the communities in which it operates.'

- In June 2021, after AGL published details of its planned demerger, and announced the chair of each demerged entity, ACCR raised concerns about the new leadership's climate competence, its capacity to transition out of fossil generation, and its continual denial of the need to bring forward the Bayswater and Loy Yang closure dates.

- In July 2021, ACCR filed a shareholder resolution to AGL, calling for the company to disclose its Paris Agreement aligned goals and targets for the proposed demerged companies, and to publish details of how the proposed demerged companies’ capital expenditure would align with those targets. It was supported by shareholders representing 53% of the votes cast. ACCR criticised AGL for 'eroding shareholder value with its eyes wide open'.

- In early May 2022, ACCR criticised AGL for ignoring the majority of its shareholders, after the company's demerger scheme booklet failed to set Paris-aligned targets for Accel Energy, or to demonstrate how AGL Australia's targets were Paris-aligned.

- In late May 2022, following AGL's withdrawal of its demerger proposal, the announcement that four board directors would depart, and the announcement that the company would undertake a strategic review, ACCR called for new leadership at AGL with direct experience in developing clean energy at scale.

- In September 2022, ACCR welcomed the exit of former AGL directors, but raised governance concerns after Patricia McKenzie was announced as the new Chair. McKenzie had led the board renewal process, which had failed to secure any other candidate.

Assessment of director candidates

In recent years, AGL has failed to heed shareholders' calls for greater ambition on the climate transition, and greater diligence in managing climate and governance risks. These calls have come from all directions - retail shareholders, 'activist' investors, and large asset managers.

In 2020, ACCR and shareholders representing 20% of votes cast supported a resolution requesting that AGL bring forward the closure dates of Bayswater and Loy Yang A coal-fired power stations. Among this shareholder group was BlackRock, which encouraged AGL to 'proactively and ambitiously manage the climate risk in its business model, and to 'capture some of the opportunities of the global energy transition'. ^2 BlackRock stated: "We supported this proposal because we believe the company, and its shareholders, would benefit from a continued focus on long-term strategic planning covering several decades".

In 2021, ACCR and shareholders representing 53% of the votes cast called for the company to disclose its Paris Agreement aligned goals and targets for the proposed demerged companies, and to publish details of how the proposed demerged companies’ capital expenditure would align with those targets.

AGL has demonstrated an inability to maximise the opportunities ahead of it, and miscalculated the task at hand. After a failed demerger attempt, and with its confidence rocked, AGL is finally accepting the need to change course and confront Australia’s largest decarbonisation project. The company will need the right mix of skills and strategic thinking to be successful. Constructive board, employee and stakeholder relations will be essential, particularly in the role of Chair.

Does AGL currently have the leadership to refine and execute its strategy?

Since the withdrawal of its demerger proposal, AGL has undertaken a strategic review and commenced a board renewal process, involving the resignation of Peter Botten, Diane Smith-Gander, Jacqueline Hey and CEO Graeme Hunt.

On 19 August 2022, the company noted that the selection process for a new Chair, and the search process to identify potential new Non-Executive Directors, were both 'well advanced'.[1] On 19 September 2022, Patricia McKenzie was announced as company Chair, and Miles George was announced as a new Non-Executive Director (NED).

AGL has not nominated or appointed any further candidates.

ACCR notes that the maximum number of directors permitted under AGL’s Constitution is ten. Eight directors are up for election at this year’s AGM. If all are elected, and with the addition of Mark Bloom who is not up for election, as well as a Managing Director, presumably to be appointed in the near future, the board will be at, but not over, capacity.

ACCR is not persuaded by the position put forward by the board that a hard cap at eight directors is appropriate. ACCR considers between eight and ten to be an optimal number of directors. Given the sheer scale of work ahead of AGL’s Board in the immediate term, ACCR considers that it is desirable to appoint the maximum number of directors permitted under the company Constitution, at this moment in time. It may be the case that a reversion to fewer directors is desirable as the board’s workload stabilises. This is consistent with the ASX Corporate Governance Principles and Recommendations (4th Edition, 2019), which provides that: "[t]he board of a listed entity should be of an appropriate size and collectively have the skills, commitment and knowledge of the entity and the industry in which it operates, to enable it to discharge its duties effectively and to add value"[2]; "The board needs to be of sufficient size so that the requirements of the business can be met and changes to the composition of the board and its committees can be managed without undue disruption. However, it should not be so large as to be unwieldy."[3]

ACCR is also of the view that, while ASX experience is important, over-emphasis on this specific form of experience may undesirably limit the board, and squeeze out diversity of thought and experience.

Independence

ACCR considers that all existing and proposed candidates are independent, and, if elected, will endeavour to fulfil their statutory, fiduciary duties, including to act in the best interests of the company. Nothing in the track record of any current, or newly-proposed board member, suggests otherwise.

Director assessment

ACCR has taken a number of factors into account when forming a view on each director’s suitability, including the overall board composition and complementarity among directors, the need for business and governance continuity, the background and skills of each director, their independence, and our impression of each candidate in our conversations.

Board-proposed directors

We have had the opportunity to discuss the candidature with each of the directors proposed by the board, with the exception of Mr George. ACCR has found each director to be competent and capable in a general sense. ACCR supports the ongoing tenure of Mr Bloom, Mr Cockroft and Ms Sullivan, including from a business continuity perspective, and is voting for each of them.

ACCR will also be voting for Mr George, based on his experience and skillset.

After careful consideration, ACCR intends to vote against the re-election of AGL Chair, Patricia McKenzie. In forming this view, we have taken into account Ms McKenzie's record as a NED and committee member since 2019, and our engagements with the company since that time.

There is no doubt that Ms McKenzie is competent and capable, and would be suited to many major company boards. However, we are of the view that maximising the opportunities ahead of AGL and its shareholders at this moment in time requires accountability for past decisions.

Ms McKenzie has been a member of AGL's board, and its audit and risk, nominations, and remuneration committees since 2019. In this period, those committees oversaw:

- a poorly planned and executed demerger attempt;

- problematic pay practices, resulting in a significant (46.5%) 'first strike' vote against its remuneration report in 2020;

- irresponsible underinvestment in renewable energy, leaving the company in a poor position;

- a sluggish response to the pace of the energy transition, which repeatedly caught the board by surprise;

- minimal and/or poor engagement with the company's own shareholders, culminating in a majority 53% vote at its 2021 AGM on an ACCR proposal, against management;

- falling employee engagement, amid high turnover and extreme uncertainty for AGL's workforce;

- a recent board renewal process, which has not resulted in the appointment of a CEO or further proposed candidates for shareholder election.

While the election of Chair is a matter for the board as constituted after the AGM, ACCR will use its vote to signal that, should Ms McKenzie remain on the board, it is our view that she is not the best candidate for Chair of AGL. ACCR has concerns about Ms McKenzie's elevation to the role of Chair from a governance perspective, which we raised publicly at the time it was announced, as well as more recently in direct engagement with the company.

Shareholder-proposed directors

In ACCR's view, further directors are required to deliver AGL's turnaround project. From ACCR's perspective, AGL's leadership would benefit from the following, particularly in the short term:

- Deeper knowledge/experience of the energy sector and energy transformation;

- Deeper knowledge/experience of energy regulation;

- A better understanding of distributed energy;

- Greater ability to manage the impact of energy decentralisation upon the company;

- Greater attention to customer experience;

- Greater sensitivity to the workforce transformation aspect of its project;

- Additional ability and experience managing stakeholder relationships;

- Additional corporate governance experience.

ACCR has met with each of the candidates proposed by Galipea Partnership, and considered their skills, experience and track records. In our view, each of the candidates would help to plug the above gaps, and refine and execute AGL's strategy. Each candidate brings important strategic skills, valuable knowledge and experience, and an attentiveness to constructive board and stakeholder dynamics. In addition, ACCR has raised the potential problem of over-commitment with each of the shareholder-proposed candidates, and each has indicated that, if elected, they would be prepared to reduce or limit other commitments in order to prioritise their directorship with AGL.

ACCR believes that the ambition of the company, particularly in relation to its time frame and strategies for decarbonisation, will be enhanced by the addition of these directors, and that this will be protective of shareholder value. As such, ACCR will cast its vote for each of the newly-proposed directors.

Assessment of Climate Transition Action Plan

AGL recently released its Climate Transition Action Plan (CTAP)[4] following a four month strategy review that was initiated after the abandonment of the proposed demerger on 30 May 2022. The key details of the plan are summarised in Table 1 below. The primary new announcements in the CTAP are the earlier closure of Loy Yang A (from 2045 to 2035) and the 2036 goal to supply customers with 12GW of additional renewable and firming capacity, which requires an investment of up to $20 billion. Considering where the company has come from, these are significant announcements.

The question for investors is whether the CTAP is in fact Paris-aligned and whether it is a sufficiently comprehensive plan to justify support, particularly considering that AGL has only committed to providing a Say on Climate vote every 3 years. As proxy adviser Glass Lewis stated with regard to BHP’s commitment to a 3 yearly Say on Climate vote, “in a rapidly evolving landscape, three years is enough time for today’s standards and expectations to become obsolete.”[5] Arguably this statement is even more relevant for an electric utility than a diversified miner.

Details that are missing in the CTAP include:

- Specifics on the 12GW renewable and firming target for 2036, or even the 5GW target for 2030

- Detail on small and industrial customer solutions, including electrification offerings

- Detail on the potential for decentralised energy services and related technologies

- A Scope 3 decarbonisation pathway is yet to be developed

- A breakdown of capital allocation in absolute terms, towards 2030 and 2035

- How leadership will be incentivised to deliver the CTAP within the remuneration scheme

Importantly, the CTAP was developed at a time of significant leadership upheaval at AGL, with four board members, including the Managing Director, either having left or in the process of exiting the organisation. A new CEO is yet to be appointed and there is significant uncertainty around the final make-up of the board. This is a strange time for AGL to be providing shareholders with a Say on Climate. It is ACCR’s view that a proposed delay of the vote by 12 months would have been accepted by shareholders, considering the state of flux at the organisation.

Table 1: Key details of the CTAP

| Emissions | Detail |

|---|---|

| Scope 1 & 2 | Closure of Liddell Power Station, April 2023 (-17% emissions by FY24) Closure of Bayswater Power Station by 2033 (~52% reduction by FY35) Closure of Loy Yang A by end of 2035 Net Zero for Scope 1 and 2 following closure of coal-fired power stations (residual emissions to be offset) Seeking ~12GW of additional renewable and firming capacity = $20b investment before 2036 Initial target to have 5GW of new renewables and firming capacity by 2030) |

| Scope 3 | “We will develop a decarbonisation pathway to achieve our ambition of being Net Zero for Scope 3 greenhouse gas emissions by 2050”. Main scope 3 emission sources are brown coal sales to Loy Yang B, gas retailing, electricity supply via the National Electricity Market |

1. AGL’s contribution to climate change

Since its acquisition of Macquarie Generation in 2014, AGL has been renowned as Australia’s largest greenhouse gas emitter. The company has generated at least 335 million tonnes of CO2 from its coal and gas generators since the 2014 acquisition. Loy Yang A is the largest carbon polluting power station in Australia, followed by Bayswater power station.[6] This carbon intensity and associated poor financial performance has created extremely elevated climate risks for AGL and its shareholders. The CTAP is the first sincere attempt from AGL to manage those risks.

Figure 1: AGL operational emissions by facility, FY18-22 (ktCO2-e)

Figure 2: AGL emissions by energy type, FY18-21 (ktCO2-e)

2. Paris-alignment assessment of the CTAP

The following section assesses AGL’s claim that the CTAP is aligned with the Paris Agreement’s goals.

CTAP remaining carbon budget assumptions

AGL commissioned ACIL Allen (ACIL) to undertake economic modelling of the National Electricity Market (NEM) based on four decarbonisation scenarios that form the basis of the CTAP and the transition risk scenario analysis. The four scenarios are labelled Scenario 1 to 4 and the plan laid out in the CTAP is consistent with Scenario 3. The CTAP scenarios use inputs from the related Australian Energy Market Operator (AEMO) 2022 Integrated System Plan (ISP)[7] scenarios, including the remaining carbon budgets that result in a certain level of global warming. AGL’s scenario 3 and 4 use the remaining carbon budgets for the NEM from AEMO’s ‘Step Change’ and ‘Rapid electrification/ Hydrogen Superpower’ respectively.[8] These remaining carbon budgets are the result of the CSIRO and ClimateWorks’ multi-sector modelling analysis[9] that allocates a remaining carbon budget to Australia based on the remaining global carbon budget (see ‘appendix A’). This approach establishes that the NEM’s remaining carbon budget is 453 Mt CO2e for a 1.5°C scenario and 891 Mt CO2e for a less than 2°C scenario (see table 2). We will refer to the ‘Rapid electrification/ Hydrogen Superpower’[10] scenario as the 1.5°C scenario.

Table 2. Details of AGL’s Scenario 3 and 4

| Detail | Scenario 3: “Well below” 2°C | Scenario 4: 1.5°C degree goal |

|---|---|---|

| AEMO ISP scenario inputs taken from | Step Change | Rapid electrification/ Hydrogen Superpower |

| Mean temperature rise by 2100 | ~1.8°C | ~1.6°C |

| Australia’s remaining carbon budget (2021-2050) | 6.531 Gt CO2e | 3.537 Gt CO2e |

| NEM remaining carbon budget (FY24-FY51) | 891 Mt CO2e | 453 Mt CO2e |

| AGL coal asset closures | Bayswater: FY34 Loy Yang A: FY35 | Bayswater: FY28 Loy Yang A: FY29 |

| Paris-aligned? | No | Yes |

AGL’s CTAP is not aligned with well below 2°C

The 1.5°C and below 2°C aligned scenarios in AEMO’s 2022 ISP result in a peak temperature response of 1.6°C and 1.8°C during the 21st Century. While AEMO is careful to define its Step Change scenario as less than 2°C,[11] AGL defines its scenario 3 as well below 2°C, using the same remaining carbon budget assumptions. Limiting global warming to 1.8°C is not considered well below[12] and therefore should not be communicated as such. Given the probabilistic range in outcomes of 1.5°C aligned scenarios, those that minimise temperature overshoot to around 0.10°C above 1.5°C are scenarios that provide sufficient certainty that global warming is kept well below 2°C at all times in the 21st century and beyond.[13] ACCR encourages AGL to revisit its modelling and to base its strategy on a remaining carbon budget that is aligned with limiting warming to no more than 1.6°C, which is consistent with well below 2°C, rather than the current 1.8°C. This will have implications for the suggested closure dates of AGL’s Bayswater and Loy Yang A.

Closure dates of AGL’s coal fired generators

AGL’s CTAP states that Liddell Power station will close in 2023 (first unit has been taken offline[14]), Bayswater in 2033 (‘FY34, no later than 2033’) and Loy Yang A in 2035 (‘end of FY35’). This is in line with AGL’s scenario 3. However the closure dates that AGL is proposing are later than in AEMO’s ISP less than 2°C ‘Step Change’ scenario, and much later than AEMO’s ISP 1.5°C ‘Rapid electrification/ Hydrogen Superpower’ scenario (see figure 3). AGL uses economic modelling that takes into account wholesale market profitability of each generator. AEMO uses a pure least cost approach to optimise the phase out of coal generators in line with the remaining NEM carbon budget, while ensuring a ‘secure and reliable’ system.[15]

AEMO’s ISP 1.5°C aligned scenario sees coal phase-out by 2031. This aligns with an assessment by Climate Analytics based on the IPCC SR1.5 scenarios[16] and IEA scenarios[17] that concludes that the NEM requires a coal phase-out not much later than 2030, and well before 2035. It is also in line with the 2045 net-zero target that Australia needs to work towards if the world as a whole wants to reach net zero in the second half of the century, as the Paris Agreement stipulates (see ‘appendix A’). The recent announcements by the Queensland Government (60 and 70% of electricity generation by renewables by 2030 and 2032)[18], and the election pledges by the Victorian Government (2.6GW and 6.3GW renewable energy storage capacity by 2030 and 2035 and a 95% renewable energy target for 2035)[19] and Federal Government (82% of NEM electricity generation from renewables in 2030)[20] make it clear that an accelerated closure of coal fired power plants is inevitable.

While it is understandable that an individual company would be hesitant to support a system level least cost approach if the profitability of its generators is impacted, we have to accept that decarbonisation pathways are constrained by remaining carbon budgets. While budgets do not inform or guide public policy yet, we are bound by the limiting physical constraint to limit warming to 1.5°C or well below 2°C. A least cost approach for the NEM at a system level is in the interest of the stakeholders and society at large given the opportunities that it brings in terms of renewable energy generation (see section 4.). Given the consequential financial, social and environmental impacts of every additional 0.1°C warming, we believe a system level least cost approach would minimise the risk of delaying the urgent need to decarbonise the NEM.

AGL’s suggested closure date would increase cumulative projected emissions by 132 Mt CO2e in AEMO’s Step Change scenario and by 224 Mt CO2e in AEMO’s 1.5°C scenario that would require stronger emission reductions elsewhere, at higher overall cost.[21] We therefore urge AGL to revisit the closure dates for Bayswater and Loy Yang A and bring both forward. To align with the AEMO Step Change scenario, Bayswater would close by 2033, Loy Yang A by 2030. To facilitate decarbonisation of the NEM in line with a 1.5°C pathway for advanced economies, Bayswater would close in 2027, Loy Yang A in 2028 (see table 3). NEM decarbonisation by 2031 and well before 2035 requires very large investments in transmission and much longer closure notification periods than the current 3.5 years[22], along with close collaboration between generation asset owners, AEMO and federal and state governments.

Table 3: Comparison of AGL assets closure dates for CTAP, AGL scenarios and AEMO ISP scenarios[23]

| AGL CTAP | AGL Scenario 3 | AEMO ISP ‘Step Change’* | AGL Scenario 4 | AEMO ISP ‘Rapid electrification/ Hydrogen Superpower’* | |

|---|---|---|---|---|---|

| Aligned with | Below 2°C** | Below 2°C** | Below 2°C | 1.5°C and well below 2°C | 1.5°C and well below 2°C |

| Liddell | 2022, 2023 | 2022, 2023 | 2022, 2023 | 2022, 2023 | 2022, 2023 |

| Bayswater | FY31-FY34 | FY34 | 2028, 2029, 2x 2033 | FY28 | 2026, 3x 2027 |

| Loy Yang A | FY35 | FY35 | 2028, 2x 2029, 2030 | FY29 | 2026, 2x 2027, 2028 |

** ACCR assessment based on consistent terminology and remaining carbon budget used in AEMO’s ISP

Figure 3: Difference in closure dates in AGL CTAP and AEMO’s Step Change (A) and 1.5°C scenarios (B). Figures in MW Capacity.

Figure 4: Evolution of coal generator closures in AEMO’s ISP Step Change (left) and 1.5°C scenario (right)[24].

3. A decarbonisation plan with more ambition and value-adding opportunities

AGL should improve on its decarbonisation strategy by increasing the ambition in its scope 1, 2 and 3 emission reduction targets. As outlined above AGL’s scope 1 and 2 emission reduction target of 52% by 2035 is not consistent with the Paris Agreement for a utility in an advanced economy (for Paris alignment the NEM needs to reach net zero in 2031). It is not well communicated why the FY35 target specifically excludes Loy Yang A, when the targeted closure date is ‘end FY35’ and stating that ‘AGL will be Net Zero for operated scope 1 and 2 emissions following closure of its coal fired power stations’.

Increasing the ambition of scope 1 and 2 emission reduction targets come with risks that need to be properly mitigated but also with large opportunities as an early mover in an already decarbonising sector that will decarbonise the earliest of all sectors in the Australian economy.

Opportunities for larger scope 1 and 2 emission reductions

There are significant challenges associated with closing coal fired power stations that require extensive planning by asset owners, AEMO and governments. These challenges include a lack of sufficient coordinated government policy, supply chain considerations and risks around build out of transmission infrastructure. However, they don’t outweigh the upsides of large opportunities for electricity generators, and society at large, from rapid decarbonisation. Considerations for AGL include:

- Given the very large role renewable energy generation will play in the NEM, AGL should leverage this opportunity and accelerate the development of its large scale and behind-the-metre renewable energy and battery portfolio. The target to develop or contract 12GW of additional renewable and firming capacity, with an investment up to $20billion, is fantastic to see. However it is ACCR’s view that AGL is cannibalising its own opportunities by leaving coal fired power stations open for longer. AGL must work actively with governments and AEMO on the transmission requirements and on firming closure dates of its coal generators.

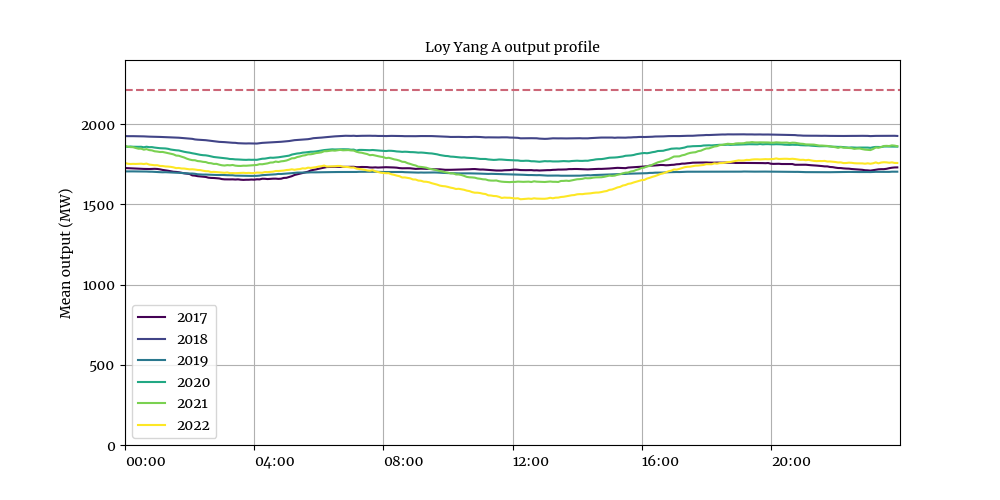

- The economics of coal generation are only going to get worse as a higher share of renewable energy connects to the grid. This is demonstrated in Figure 5, showing the year-on-year impact of solar generation on Loy Yang A’s output. The economics may force AGL to announce earlier closure than currently planned. By announcing the earliest possible closure of its coal assets AGL would provide certainty to affected stakeholders and AEMO, so that transmission works can be prioritised, without compromising Australia’s ability to meet and exceed its contribution to stay well below 2°C.

- Announcement of earliest possible closure dates compatible with the Paris Agreement will complement a successful Just Transition for the affected communities (see section 7.).

- AGL should explore opportunities around demand-side management of customers in the heavy industry sector. This could create favourable conditions for accelerated renewable energy generation and battery storage.[25]

- AEMO’s ISP assumes 50% renewable energy generation in Queensland by 2030 (QRET), but the government of Queensland now aims for 60% by 2030 and 70% by 2032, which means there are drivers in place for a faster uptake of renewable energy than AEMO’s ISP assumed. The same may become reality for the Victorian renewable energy target (VRET) which the ISP assumes to be 50% by 2030, increased to 65% in the Labor government’s election pledge.[26]

- Cost curves for wind and solar are declining rapidly and unit cost curve projections are often underestimated in models.[27] The growing role of renewable energy generation is therefore not adequately represented.

Figure 5: Loy Yang A generation profile[28] by time of day through 2017-2022 showing the continued decline in coal generation during the day time

4. Scope 3 emissions plan

As stated, the CTAP does not present a strategy for decarbonising AGL’s scope 3 emissions. Two thirds of the company's scope 3 emissions sit within the electricity sector. This sector needs to reach net zero in 2035 at the latest to be able to comply with the Paris Agreement, taking into account Australia’s role in the world. Gas use in the residential sector (and industry somewhat later) will also decline for Australia to align with the Paris agreement.[29] A 2050 net zero target is unambitious and lacks credibility for the reason given above.

The Victorian Labor Government’s election commitment to “end reliance on privatised coal..by 2035”[30] would have significant implications for AGL’s brown coal contract with Loy Yang B, which comprises over one third of the company’s scope 3 emissions.[31] Engaging proactively in such policy discussions is a key option available for AGL to address this major source of scope 3 emissions.

AGL should not use offsets to address future scope 3 emissions from the electricity sector, nor seek to offset existing emissions, through biological offsets. It is well documented that temporary biological offsets cannot offset permanent[32] fossil fuel emissions. Companies should move away from ‘avoided emission offsets’ and towards permanent geological offsets if they wish to offset fossil fuel emissions.[33]

5. Assessing capital alignment with 1.5°C

AGL has not made an explicit commitment to align its capital allocation with 1.5°C, which is perhaps unsurprising considering the company’s CTAP is also not aligned with 1.5°C. This is at odds with the expectations of the CA100+ Net Zero Company Benchmark capital allocation indicators. The planned investment of up to $20 billion in renewables and firming by 2036 is significant, however it is currently unknown what share of that sum might be channelled into fossil-based firming, such as gas peaking plants. In addition, with the 2035 and 2033 closure dates for Loy Yang and Bayswater, significant capital will still need to be allocated to these “thermal assets to ensure they remain safe and reliable”.[34] Earlier closure dates would naturally see a smaller sum of capital allocated to thermal generation.

6. Just transition

AGL rightly recognises that it has a “critical role to play in a just transition”[35] and that decisions around early closure of power stations have “very significant impact[s] on our people and communities”.[36] The decarbonisation of the economy is in everyone’s interests however communities in carbon-rich areas must be appropriately supported in that effort.

As defined by the International Labour Organization (ILO), “a just transition for all towards an environmentally sustainable economy … needs to be well managed and contribute to the goals of decent work for all, social inclusions and the eradication of poverty.” It is crucial that the principles of a Just Transition are enacted by AGL through the closure of its coal-fired power stations, Liddell, Bayswater, and Loy Yang A. It is now widely recognised that any transition that does not include the fair treatment of workers and communities and does not involve serious efforts to ensure ongoing opportunity in regions, carries an additional set of risks for investors. AGL recognises these strategic risks in community expectations relating to Australia’s energy transition, particularly in ensuring energy system stability, affordability, and appropriate shareholder value outcomes.[37]

AGL’s commitments to a responsible and orderly transition are as follows:

Site repurposing and investment

AGL has committed to repurpose its large thermal generation sites into low-carbon industrial Energy Hubs by planning to include solar thermal storage systems, grid-scale batteries, energy from waste facilities and green-hydrogen production facilities. Former coal regions come with workforces and grid connections needed for future heavy industry, such as green hydrogen production and green-steel manufacturing. However, there are challenges for AGL in the repurposing of its coal generation sites, including the sites being a significant distance away from the coast, making it harder to export future materials; and substantial rehabilitation requirements and costs.

In addition, AGL’s CTAP is lacking crucial detail on specific timelines and capital allocation announcements for actual investment. ACCR acknowledges the company has commenced feasibility studies to explore the development of green hydrogen projects, however investors would be well placed to push for more granular and tangible updates from reportable activities including the signing of MOUs, planning applications, disclosure of comprehensive site rehabilitation plans, costs, etc.

Worker and community engagement

ACCR welcomes AGL’s commitment to work with the community and its workforce in a “transparent, sensitive and constructive manner”, and in particular, “work closely with impacted employees to explore opportunities for career transitions including transition to retirement, retraining, reskilling and alternative career pathway opportunities”.

ACCR also welcomes the foundational commitment of no forced redundancies at Liddell. It will also be crucial to ensure that no workers are left behind and that energy transition impacts do not fall unfairly on contractors, casuals, and labour hire workers who are not covered by the commitment. While AGL does not disclose what percentage of its workforce are labour hire workers, ACCR notes that 59% of AGL’s workforce are casual and contracted workers.[38]

ACCR notes that AGL intends to disclose a template for Liddell at the end of April 2023, however this is too late to assess the appropriateness of the engagement and transition of the workforce conducted at this site.[39]

Recommendations for AGL:

Enhanced disclosure of plans and just transition metrics, including:

- Disclosure of timelines, capital allocation, studies and research plans, participation in working groups.

- Report on specific programs developed; how many workers, sessions or hours were made available; how much funding was allocated to training; and numbers on redeployments, retirements, and successful employment elsewhere.

- Comprehensive and funded mine and power station site rehabilitation plans, which can provide a significant source of employment.

- Funding and support to retrain power station workers.Funding and support to diversify the regional economies of coal regions.

AGL must also provide a clearer sense of the support to be made available to contract, labour hire workers, casual and supply chain workers.

AGL should commit to no forced redundancies at any of its power stations.

7. Climate policy engagement

The absence of a national policy to facilitate an orderly transition of the NEM has been costly for consumers and has delayed necessary investment in renewable generation and transmission infrastructure.[40] It has prolonged the NEM’s vulnerability to fossil fuel price shocks, as experienced mid 2022.[41] Industry influence, particularly that of the incumbent generators and coal lobby, has been a key reason for this absence of policy.[42] With AGL’s recent shift in Loy Yang’s closure date and the company’s strategic embrace of renewable energy and firming capacity, ACCR looks forward to seeing the company engage proactively in the policy discussion. In the CTAP the company makes a commitment to “advocate for a responsible transition that balances energy reliability and affordability with the need to decarbonise”.[43]

Recent state and federal government announcements around legislated emission reductions and renewable energy targets[44] show the potential for very rapid change in the NEM. The announcements in Queensland and Victoria alone could provide some 40GW of additional renewable energy generation.[45] Given the pace of updating targets with new and more ambitious ones, it is possible that NSW and Tasmanian targets may also be updated, which would have further financial implications for existing coal fired power stations.

We expect to see AGL engage proactively with all emerging policies that incentivise the rapid decarbonisation of the NEM as it will better enable the company’s execution of its current and future strategies.

8. Climate governance - remuneration

AGL introduced three carbon transition metrics in its executive long term incentive (LTI) plan in 2020 (see Table 1 for FY23 metrics). Whilst ACCR encourages companies to embed decarbonisation goals in remuneration, the level of ambition in AGL’s metrics has been insufficient to incentivise the much needed transition of the company.

AGL has not announced what the remuneration incentives will be for implementation of the CTAP. However, to ensure that the incentives are appropriate, it is ACCR’s view that the CTAP should first be enhanced prior to an update of the remuneration plan. Since transitioning the company is an existential task, it is ACCR’s view that this lack of detail on remuneration incentives warrants abstention from voting on the remuneration plan.

Table 4: FY23 Carbon transition metric vesting schedules[46]

| Controlled generation intensity at June 2025 | Vesting of award (% of maximum) | % Controlled renewable & storage capacity at 30 June 2025 | Vesting of award (% of maximum) | Revenue from green & carbon neutral products & services in FY25 | Vesting of award (% of maximum) |

|---|---|---|---|---|---|

| More than 0.875 | 0% | Less than 30.8% | 0% | Less than 22.2% | 0% |

| 0.875 to 0.800 | Straight line vesting between 50% and 100% | 30.8% to 39.6% | Straight line vesting between 50% and 100% | 22.2% to 27% | Straight line vesting between 50% and 100% |

| Less than 0.800 | 100% | More than 39.8% | 100% | More than 27% | 100% |

Appendix A: Australia’s share of the remaining carbon budget and 1.5C aligned pathway to net zero

Using the IPCC remaining CO2 carbon budget[47] as a starting point, one can calculate the remaining global greenhouse gas budget at any point in time. There are various ways that Australia’s share of the remaining greenhouse gas budget can be calculated, but they all are based on the premise of what fairness is. The allocation that has been used here is based on a modified contraction and convergence approach that essentially means that all nations convert to the same per-capita emissions value at a point in the future. Australia’s share of the remaining carbon budget is determined to be 0.97%. While this takes into account the present circumstances of nations, it favours nations that today are - and historically have been - built on a fossil fuel economy.[48]

The second goal of the Paris Agreement is to achieve net zero greenhouse gas emissions in the second half of the century. It’s worth noting that in order to achieve that goal, developed countries have to do their bit earlier than developing countries. The current pledges and long term net zero targets as submitted to the COP26 in Glasgow complemented by the announcement of India’s long term net zero target by 2070 would result in limiting global warming to 1.9 or 1.8C.[49] This is not considered well below 2C,[50] which implies that net zero targets need to shift forward. It would require strengthening net zero ambitions of all nations to meet the Paris agreement goals of limiting global warming to the long term temperature goal of well below 2C, and pursue meaningful efforts to limit global warming to 1.5C and achieve net zero greenhouse gas emissions in the second half of the century. For rich nations such as Australia this means bringing the net zero target forward to 2045,[51] which emphasises the urgency for very rapid emission reduction in the electricity sector since it plays the leading role in rapid decarbonisation of an economy.

Disclosure of potential conflict of interest: Ms Armina Rosenberg, who sits on ACCR’s Office Bearers’ committee, is a portfolio manager at Grok Ventures. Grok Ventures is a business name used by the private investment group controlled by Mike Cannon-Brookes. "Grok Ventures" is a registered business name of Cannon-Brookes Services Pty Limited (ACN 616 170 542) (CBS). An affiliate of Cannon-Brookes Services Pty Limited, the Galipea Partnership, is the holder of an 11% interest in AGL. Ms Rosenberg has had no role in ACCR’s decision-making and analysis in relation to AGL and its CTAP, the directors proposed for election, and the expired takeover bids. No financial relationship exists between ACCR and Grok or any Mike Cannon-Brookes entity, and no Grok or Mike Cannon-Brookes entity is or has ever been an ACCR donor.

Download our full analysis.

Please read the terms and conditions attached to the use of this site.

Australasian Centre for Corporate Responsibility

Annual Report FY2022, p3 ↩︎

https://www.asx.com.au/documents/asx-compliance/cgc-principles-and-recommendations-fourth-edn.pdf ↩︎

https://www.asx.com.au/documents/asx-compliance/cgc-principles-and-recommendations-fourth-edn.pdf p12 ↩︎

AGL, Climate Transition Action Plan, September 2022\ ↩︎

Glass Lewis, Glass Lewis raises concerns over BHP’s Climate Transition Action Plan, 4 October 2021\ ↩︎

Clean energy regulator, electricity sector emissions and generator data 2020-2021 \ ↩︎

AEMO, 2022, 2022 Integrated System Plan ↩︎

AGL, 2022, Climate Transition Action Plan ↩︎

Reedman, et al, 2021, Multi-sector energy modeling ↩︎

‘Rapid electrification’ is equivalent to Hydrogen superpower but with a sensitivity that excludes hydrogen exports ↩︎

Note: Separately, AEMO’s Forecasting Assumptions Update workbook mentions ‘limiting temperature to 2 degrees’, i.e. not less than 2°C ↩︎

Climate Analytics, 2022, New pathways to 1.5°C: interpreting the IPCC’s Working Group III scenarios in the context of the Paris Agreement ↩︎

IPCC, 2022, Summary for Policymakers, SPM-28. In: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change ↩︎

Reneweconomy, 2022, AGL marks the beginning of the end for Liddell, closing first unit ↩︎

AEMO, 2022, 2022 Integrated System Plan ↩︎

Climate Analytics, 2019, For climate’s sake: coal-free by 2030 ↩︎

IEA, 2021, Net zero by 2050. A roadmap for the global energy sector ↩︎

Queensland Government, 2022, Queensland Energy and jobs plan ↩︎

Victoria State Government, 2022, Australia’s Biggest Renewable Energy Storage Targets ↩︎

ALP, 2022, Powering Australia ↩︎

Based on FY18-22 average asset specific emissions, and assuming AGL CTAP and AEMO scenario closure dates ↩︎

AEMO, 2022, 2022 Integrated System Plan, ↩︎

Energy & Resource Insights, 2022, Research note: Coal power closure under AEMO’s 2022 Integrated System Plan, ↩︎

Amended from Energy & Resource Insights, 2022, Research note: Coal power closure under AEMO’s 2022 Integrated System Plan ↩︎

Garnaut, R., 2022, The superpower transformation; McConnell, Chapter 4 ↩︎

Andrews, D., 2022, Putting power back in the hands of Victorians ↩︎

Xiao, M. et al., 2021, https://doi.org/10.1016/j.esr.2021.100636 ↩︎

McConnell, D., 2022, Loy Yang A output profile. University of Melbourne. Figure. https://doi.org/10.26188/21365946.v1 ↩︎

Reedman, et al, 2021, Multi-sector energy modeling ↩︎

Victoria State Government, 2022, Australia’s Biggest Renewable Energy Storage Targets ↩︎

AGL, Climate Transition Action Plan, September 2022\ ↩︎

e.g. Mackey, B. et al, 2013, Untangling the confusion around land carbon science and climate change mitigation policy ↩︎

Allen, M., et al, 2020, Oxford Principles for Net Zero Aligned Carbon Offsetting ↩︎

AGL, Climate Transition Action Plan, September 2022\ ↩︎

AGL, 2022, Annual report 2022, p.12 ↩︎

RenewEconomy, 2022, AGL is quitting coal: What now on renewables, workers and the bottom line? ↩︎

AGL, 2022, Annual report 2022, p.12 ↩︎

AGL, ESG Data Centre FY22 ↩︎

Sophie Vorrath, “AGL is quitting coal: What now on renewables, workers and the bottom line?” Renew Economy, 29 September 2022 ↩︎

Michael Mazengarb, “Australia is falling behind: Clean energy investment shackled by outdated rules, February 2022\ ↩︎

Giles Parkinson, “The staggering cost of Australia’s fossil fuel energy crisis”, June 2022\ ↩︎

Giles Parkinson, Utilities may push for new RET review if Coalition returned, June 2016 ↩︎

AGL, Climate Transition Action Plan, September 2022\ ↩︎

Queensland Government, 2022, Queensland Energy and jobs plan ↩︎

VIC: 4.5GW additional renewable energy generation by 2035, 6.3GW of battery storage by 3032. QLD: 22 GW additional wind and solar by 2032, 7GW additional pumped hydro by 2032 ↩︎

AGL Energy, Annual Report 2022, p71 ↩︎

IPCC, 2019, Global Warming of 1.5C Chapter 2 ↩︎

In other words the people in these nations are deemed to have a larger carbon budget than others. If all human carbon budgets would be equal Australia’s share would be 0.33% (see Garnaut, R., 2022, Chapter 2 in The superpower transformation) ↩︎

Meinshausen, et al, 2022, https://doi.org/10.1038/s41586-022-04553-z ↩︎

Brecha et al, 2022, https://doi.org/10.1038/s41467-022-31734-1 ↩︎

Garnaut, R., 2022, The superpower transformation; Meinshausen, Chapter 2, based on SSP1-1.9 GHG emissions. Consistent with a Australian net zero target as put forward by Climate Analytics, 2022 ↩︎