Investor Insight Investor Bulletin: Shell and BP FY22 Q4 results and CO2 implications

BP and Shell Analysis:

- BP’s revised production guidance and associated wind back of climate targets will result in an additional estimated 338 Mt of cumulative emissions out to 2030.

- Shell’s $26b in distributions seem to contradict the company's prior aspirations for cleaner energy, which Shell asserted could only be funded through the sale of oil and gas.

- These significant pivots damage the credibility of existing climate transition plans.

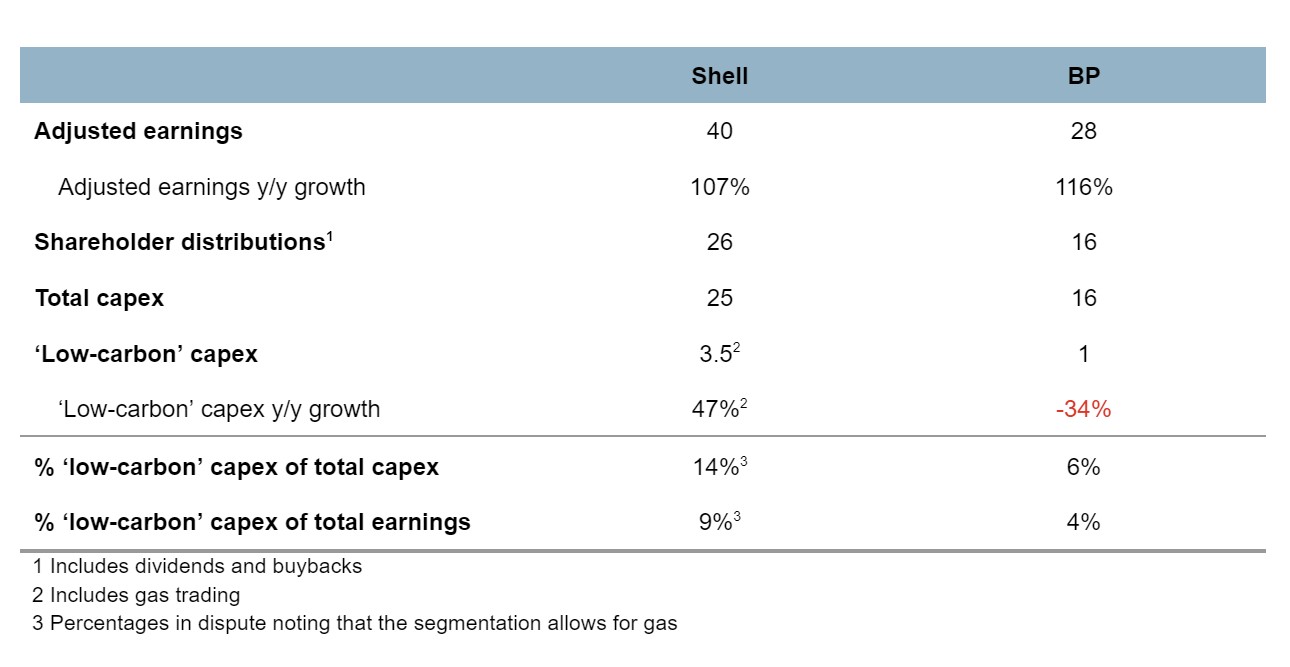

- BP's capital expenditure on low carbon declined y/y despite adjusted earnings more than doubling.

BP

ACCR has reviewed BP’s revised production guidance and less ambitious climate targets (announced with FY22 earnings results last week) and implications for the company's total emissions footprint out to 2030. BP is now targeting 2030 headline production of 2 mmboe/d of oil and gas, a 26% decline in production, compared to the previous target of a 40% decline from a 2019 baseline.

In ACCR’s view, this change to BP’s production profile will result in an estimated 900 million boe of additional oil and gas production by 2030. That is equivalent to an additional estimated 338 million tonnes of cumulative emissions that will be pumped into the atmosphere between now and 2030.

Chart: BP forecast oil and gas production FY19-30 - previous vs updated targets (mboe/d)

*Forecast assumes production growth follows implied CAGR between FY22 and target years.

As a result of this updated production guidance, BP has downgraded its 2030 Aim 2 emissions reduction target (scope 3 emissions from upstream oil and gas production) from 35-40% to 20-30%.

Chart: FY30 Aim 2 target emissions, updated vs prior (Mt CO2e)

Shell

Shell’s $26b cash splash for investors and paltry $3.5b spent on Renewables and Energy Solutions appears to contradict the company's prior statement that Shell's aspirations for cleaner energy could only be supported through the sale of oil and gas. It's important to note that Renewables and Energy Solutions includes the gas trading business, so the actual underlying capex in genuine Renewables is lower.

Activist group, Global Witness, has recently lodged a complaint with the SEC against Shell, alleging that this type of segmental reporting is misleading and constitutes greenwashing. The group argues that Shell's investment in genuine Renewables in FY21 was only 1.5% of the company's Capex, in contrast to the 12% allocated to its Renewables and Energy Solutions segment.

We also note the public announcement last week that law firm ClientEarth is going to court against Shell’s Board of Directors for failing to move away from fossil fuels fast enough. This is the first ever case of its kind seeking to hold corporate directors personally liable.

Short term gain but long term pain?

Both Shell and BP are prioritising returning windfall fossil-fuel profits to shareholders, rather than deploying more of these profits towards accelerating much needed funding for the energy transition.

Table: Key metrics from Shell & BP FY22 Q4 results ($US billion)

Current conditions represent an opportune time to accelerate (rather than decelerate) capital expenditure into low carbon energy, especially in light of the IEA’s recent prediction that we are now in a period of peak gas. Whilst not discouraging shareholder distributions, in ACCR’s view the balance between the deployment of windfall profits towards shareholder distributions relative to the investment into the low-carbon energy business looks out of sync for both BP and Shell.

With transition capex materially reduced going forward, the risk that Shell and BP will be left behind in the energy transition has increased. It is our firm view that creating shareholder value over the long term requires a capital allocation strategy with foresight around how the energy system will transition over the next 10-20 years. A focus on short-term returns and outcomes is not always aligned with this goal, and can at times contradict the objective to maximise long-term shareholder value. In this case, long-term value creation is also inextricably linked with the world keeping temperatures below 1.5 degrees this century.

Next month, ACCR will provide investors with a deeper dive into BP’s change of strategy and updated ESG data. We will assess the changes in approach and what that means for BP’s ability to align with the objectives of the Paris Agreement. We will also review how it impacts the remaining global carbon budget. We have a finite global carbon budget, and every company has to do their bit to meet it.

The question then becomes, how do investors engage with the majors from here?

BP’s updated production guidance and step back from shareholder-endorsed climate targets throws up many questions about climate, transition and company governance. This is a crucial window for climate aware investors to reflect and redouble efforts towards achieving a positive influence on the forward emissions of oil majors like BP and Shell.

ACCR will be continuing to dive deeper into the numbers and to consider options for investor escalation. If you are interested in discussing this with us, please reach out to Gemma Yeates via gemma.yeates@accr.org.au

Please read the terms and conditions attached to the use of this site.