Investor Insight Investor Bulletin: Opportunities for improving Glencore’s 2023 Climate Report

Glencore’s inability to successfully navigate energy transition risks has been an escalating concern for investors, with 24% voting against the company’s climate progress report in 2022, followed by a 30% vote against at the 2023 AGM.

Glencore reviews and updates its Climate Action Transition Plan every three years, and with the next iteration due out sometime over the next few months, ACCR has identified key areas of potential improvement.

What does “good” look like?

A credible climate plan should include a targeted, sector-specific emissions reduction pathway that is aligned with the latest climate science and Paris goals. Currently, Glencore uses a broad fossil-fuel pathway that includes coal, oil, gas and bioenergy, even though it has a fossil fuel portfolio consisting almost entirely of coal. Improvement would look like:

- At a minimum, Glencore adopting a targeted coal emissions reduction pathway, as opposed to a broad fossil fuel approach.

- Credible, transparent disclosures on CCUS (Carbon Capture, Utilisation and Storage) should precede its inclusion in Glencore's emissions targets for coal production. Glencore should apply CCUS assumptions prudently, clearly outlining the proportion of coal to be used with CCUS in accordance with International Energy Agency (IEA) standards – and not assume as it currently does, universal application of CCUS and CDR (Carbon Dioxide Removal). Furthermore, Glencore should transparently demonstrate if and how CCUS integration is actually being applied in the downstream use of its coal products.

If, as ACCR recommends, Glencore moves away from a broad fossil fuel emissions pathway and uses the IEA Net Zero Emissions (NZE) coal production pathway, this would ensure the required reduction in coal supply is accurately addressed.

- Ideally, Glencore should disclose how the production pathways of its coal projects align with the IEA NZE coal production pathway. ACCR suggests that a cumulative assessment of production relative to the IEA NZE pathway is the optimum approach to illustrating forthcoming coal production trends and confirming to investors an alignment with the NZE goals.

A credible climate plan consistent with IEA’s NZE pathway requires targets set at intervals of no longer than five years apart. Glencore’s targets are currently nine years apart. ACCR expects Glencore to introduce a 2030 target in the updated 2023 Climate Report, so that a transparent and timely decline in emissions can be illustrated.

Glencore stated in its 2022 Climate Report that the upcoming 2023 Climate Report will implement updated methodology and make a recalculation and restatement for the 2019 baseline.[1] ACCR expects Glencore will follow through with its commitments, and use a more representative base year (i.e. a 2022 baseline as suggested in the September Bulletin[2]) or a restated 2019 baseline that accounts for the closure of the Prodeco coal mine.

To achieve a credible climate plan that aligns with investors’ expectations and IEA’s NZE scenario, ACCR expects Glencore to distinguish between expansionary and sustaining capital expenditure (capex) in its capex guidance for its energy portfolio in the Industrial segment, and that no capital should be allocated to expansionary capex for coal.

1. IEA Net Zero Emissions by 2050 Pathway

What is a credible climate transition plan and pathway?

CDP defines a credible climate transition plan as “a time-bound action plan that outlines how an organisation will achieve its strategy to pivot its existing assets, operations, and entire business model towards a trajectory aligned with the latest and most ambitious climate science recommendations.”[3]

A credible climate transition plan is also expected to use scenarios and models adapted to its sector and industry[4] to help the sector stay within the remaining global carbon budget.[5]

Key issues

Glencore's targets are based on a broad fossil fuel trajectory, including oil, gas, bioenergy and coal. This is misleading as over 99% of its fossil fuel portfolio is coal,[6] and the company does not produce any gas. In addition, coal production, specifically thermal coal, is the largest driver of Glencore’s emissions as highlighted in ACCR’s research in April 2023.[7] Coal accounted for ~90% of Glencore’s Scope 3 emissions in 2022.[8]

As shown in Chart 1, the 2023 NZE scenario[9] for coal projects a 41% reduction in coal energy supply by 2030 and 69% by 2035. This contrasts with the IEA's general fossil fuel pathway, which estimates a gentler 26% decrease by 2030, and 49% by 2035.

Chart 1: Change in energy supply in IEA’s 2023 World Energy Outlook (WEO), coal and all fossil fuels[10]

Source: IEA WEO 2023, adapted by ACCR

However, merely transitioning from a broad fossil fuel pathway to a coal-specific pathway is insufficient; it is also necessary to ensure CCUS is not overstated.

Glencore's gross emissions pathway includes net emissions from fossil fuels, plus reductions from all energy-related carbon removal and capture technologies, including Bioenergy with Carbon Capture and Sequestration (BECCS), Direct Air Capture (DAC), biofuel production, and carbon capture in power and industry sectors across all fossil fuels.[11]

Chart 2 below illustrates how by accounting for all the aforementioned technologies, Glencore’s gross pathway diverges from Glencore’s net pathway. It further shows a pathway for Glencore’s coal emissions that considers only sector-specific CCUS applications.

Chart 2:[12] Emissions pathways in IEA’s NZE scenario - Full fossil fuel emissions with all CCUS and CDR vs coal emissions with sector-specific CCUS

Source: IEA WEO 2023, adapted by ACCR

Chart 2's blue line demonstrates that a transition to a coal-specific emissions pathway, if it encompasses all CCUS and CDR technologies, results in disproportionately high emissions in 2050, compared to a broader fossil fuel pathway with the same technologies applied.[13]

Chart 2's yellow line suggests a more accurate pathway for Glencore's coal emissions, considering only sector-specific CCUS applications. This pathway, which aligns coal use with coal-related CCUS measures, offers a trajectory for coal emissions and could be the pathway Glencore aligns itself with in its forthcoming Climate Report. Refer to Table 1 in the Appendix for a further breakdown.

ACCR’s expectation

A credible climate plan should include a sector-specific emissions reduction pathway that is aligned with the latest climate science recommendations and Paris goals. ACCR expects Glencore to adopt a targeted coal emissions reduction pathway, illustrated by the yellow line in chart 2, in place of a broad fossil fuel pathway with all forms of CCUS and CDR approach.

Glencore should apply CCUS assumptions prudently, clearly outlining the proportion of coal to be used with CCUS in accordance with IEA standards – and not assume universal application of CCUS and CDR. Furthermore, ACCR expects Glencore will transparently demonstrate if and how CCUS integration is actually being applied in the downstream use of its coal products. Credible, transparent disclosures on CCUS should precede its inclusion in Glencore's emissions targets for coal production.

Alternatively, with a fossil fuel portfolio consisting almost entirely of coal, ACCR recommends Glencore tailor its climate pathway specifically to IEA’s NZE coal production pathway. This shift would move away from a broad fossil fuel emissions pathway which fails to address the more rapid reduction needed in coal supply.

2. 2030 Emission Reduction Target

What is a credible emissions reduction target?

To be consistent with the IPCC 1.5°C limited to no overshoot pathways[14],[15] companies should set short-term targets for periods of no more than five years apart, and the plans must also clearly outline adjusted annual progress benchmarks based on the company’s progress to meeting its target.[16]

Key issues

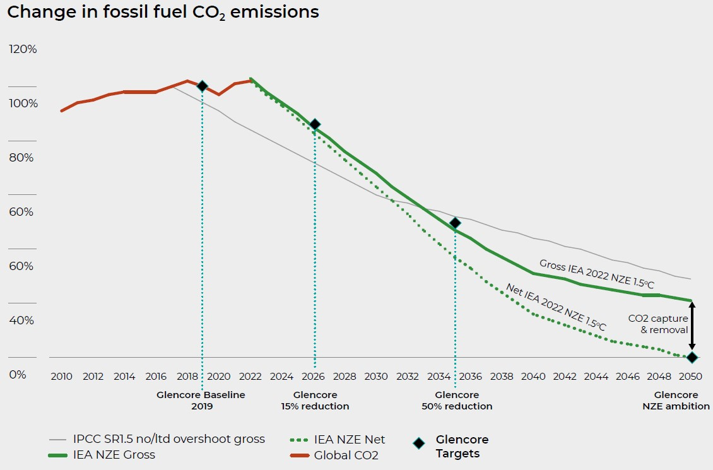

From a 2019 baseline, Glencore has an emissions reduction target of 15% by 2026, and 50% by 2035.[17] These targets are nine years apart. As ACCR has previously highlighted in an assessment of Glencore’s 2021 Climate Report, Glencore has not set an emissions reduction target for 2030, despite this being the critical decade for climate action.[18]

ACCR’s expectation

In a credible climate plan that is consistent with IEA’s NZE pathway with targets set for no more than five years apart, ACCR expects Glencore to introduce a 2030 target in the updated 2023 Climate Report, such that investors can track a transparent and timely decline in the company’s emissions.

3. Thermal Coal Portfolio Transparency

What are investors expecting from fossil fuel producers?

Investors expect fossil fuel producers to disclose the expected peak and decline in fossil fuel production alongside the company’s diversification plans.[19] This suggests that a fossil fuel producer should disclose a forward fossil fuel production pathway that is consistent with the company’s transition plan.

Key issues

Major institutional investors filed a resolution at the 2023 Glencore AGM, seeking greater transparency on how the company’s forward thermal coal production aligns with the Paris objective of keeping global temperature increase to 1.5°C.[20] The resolution was supported by 29.2% of investors.[21]

Glencore still has a number of thermal coal mine extensions and expansions that it continues to pursue, particularly in Australia (as outlined in ACCR’s recent September Bulletin[22]). More disclosure about the expected forward coal production across Glencore’s portfolio would provide investors with better clarity on how coal production and associated emissions align with the goals of the Paris Agreement.

ACCR’s expectation

In a credible climate plan that aligns with investors' expectations, ACCR expects Glencore will disclose how the production pathways of its coal projects will align with the IEA NZE pathway. ACCR suggests that a cumulative assessment of production in relation to the IEA NZE pathway can effectively illustrate forthcoming coal production trends and confirm to investors the alignment with the NZE goals.

4. A More Representative Base Year

What is a representative base year?

According to the GHG Protocol, companies should choose a base year that is representative of the company’s typical profile, or take an average over several consecutive years to help smooth out unusual fluctuations.[23]

As discussed in ACCR’s September Investor Bulletin, Glencore uses an unrepresentative 2019 baseline year that is not aligned with the GHG Protocol guidance,[24] as illustrated in Chart 3 .

Key issues

Chart 3: Glencore coal production (2012-2022)[25]

Source: Company data, ACCR

While the 2021 Climate Report indicates restatements following the acquisition of the remaining 66.7% stake in the Cerrejón mine in 2022, the baseline has not been adjusted to account for the relinquishment of contracts at the Prodeco mine. Glencore achieved a 24% emissions reduction over just one year, influenced by relinquished contracts, external factors and market dynamics. Using 2019 as a base year enables Glencore to maintain broadly flat levels of production over the next decade, whilst still achieving a nominal reduction in emissions.

ACCR’s expectation

Glencore stated in its 2022 Climate Report that the upcoming 2023 Climate Report will implement updated methodology and make a recalculation and restatement for the 2019 baseline.[26] ACCR expects Glencore will follow through with its commitments, and use a more representative base year (i.e. a 2022 baseline as suggested in the September Bulletin[27]) or a restated 2019 baseline that accounts for the closure of the Prodeco coal mine.

5. Capital Expenditure Guidance

What investors are expecting from companies’ capex disclosures?

Investors expect a corporate transition plan to use IEA’s NZE scenario to determine appropriate capex and disclose methodology,[28] and “there is no need for new coal mines or mine lifetime extensions” in the IEA NZE scenario.[29] This suggests that in a climate plan that aligns with the expectations of investors, no capital should be allocated to expansionary capex for coal.

In addition, investors expect companies to separate growth and maintenance capex,[30] which in the case of Glencore, are equivalent to expansionary and sustaining capex respectively. This can help investors distinguish the investment spending in pursuit of growth that creates value (i.e. growth capex) and the minimum spending required to maintain or replace the long-term assets in place (i.e. maintenance capex).

Key issues

Glencore announced its Industrial segment capex guidance for 2023-2025 ($5.6 billion p.a.) in its 2022 Investor Update.[31] $1.1 billion and $3.2 billion are attributable to metals expansionary capex and metals sustaining capex each year, respectively. $1.3 billion is attributable to the energy portfolio each year (i.e. Glencore’s coal and oil upstream portfolio), which was not split into expansionary and sustaining capex.

Thus, the amount of capex that Glencore is planning to spend on coal expansions is unclear. It should be noted that Glencore did not meet any criteria for Indicator 6: Capital Allocation of the CA100+ Company Assessment,[32] and Glencore is continuing to pursue several thermal coal expansions through the planning system in Australia.[33]

ACCR’s expectation

To achieve a credible climate plan that aligns with investors’ expectations and IEA’s NZE scenario, ACCR expects Glencore to distinguish between expansionary and sustaining capex in its capex guidance for its energy portfolio in the Industrial segment, and that no capital should be allocated to expansionary capex for coal.

Appendix

Chart 4: Copy of the graphic provided by Glencore in its 2022 Climate Report[34]

Glencore used the IEA NZE pathway for all fossil fuels, with all forms of CCUS and CDR, not the IEA NZE pathway for coal, with coal-specific CCUS.

Analysing Glencore's justification for their Gross IEA NZE pathway and presenting arguments for a more suitable alternative

Table 1: ACCR's recommendations and reasoning for Glencore's emissions pathway

| Glencore's current approach | ACCR's recommendations | Rationale | How ACCR applied this in the advocated pathway in Chart 2 | ||||

|---|---|---|---|---|---|---|---|

| 1. Determine net emissions pathway | |||||||

| A broad fossil fuel pathway that covers emissions from the combustion of coal, oil, natural gas, bioenergy, and waste | Adopt a net coal emissions pathway that reflects their actual fossil fuel output, focusing on coal emissions which make up 99% of their fossil fuel portfolio. | Coal is projected to decline much faster than oil and gas in the IEA NZE scenario. Using a general decline rate for Glencore's predominantly coal portfolio leads to a less steep reduction in emissions. This approach creates a disparity, allowing for higher coal emissions and production than the IEA NZE scenario suggests. | ACCR used the coal combustion emissions data from Table A.4c[35] of the IEA's WEO as the net emissions pathway, rather than the total emissions from all fossil fuels listed in the same table. | ||||

| 2. Determine the amount of CCUS/CDR that needs to be added to the net emissions pathway | |||||||

| Glencore has incorporated all CCUS and CDR methods into their net emissions pathway, including BECCS, DAC, biofuel production, and CCUS with natural gas, to establish their gross fossil fuel emissions pathway. | Glencore should only include CCUS and CDR methods relevant to their specific products. Therefore, they should add only coal-related CCS reductions to their net coal emissions pathway. | Given that Glencore primarily produces coal, it's not suitable for them to include all forms of CDR and CCUS in their gross emissions pathway. Our recommendation is to factor in only coal-related CCUS. Since coal doesn't contribute to CDR, Glencore shouldn't include any CDR in their net pathway, and should only account for the portion of CCUS applicable to coal. | Although the IEA doesn't provide detailed data on emissions reductions from coal-related CCUS, ACCR recognises its importance in the net coal emissions pathway. We estimated these reductions using data on 'coal with CCUS' energy from Table A.1c[36] of the WEO. By comparing energy supply from unabated coal and its emissions, we determined the emissions intensity, which we then applied to the 'coal with CCUS' energy to estimate emissions reductions. We conservatively assume 100% successful capture and sequestration of emissions from 'coal with CCUS' to calculate these reductions. | ||||

| 3. Add net emissions pathway and emissions reductions from CCUS/CDR to achieve gross emissions pathway | |||||||

| Glencore combined their broad net fossil fuel emissions pathway with all forms of CDR and CCUS, to determine their gross emissions pathway. This results in a slower rate of decline for coal than the NZE pathway requires. | Glencore should add their net coal emissions pathway and coal-specific CCUS to determine their gross emissions pathway. | The issue with Glencore's gross emissions pathway calculation isn't in its logic, but lies in the chosen net emissions pathway and the assumptions regarding CCUS and CDR, as previously discussed. | ACCR calculated the gross emissions pathway by summing the net coal emissions pathway with the emissions reductions achieved from coal with CCUS. | ||||

| 4. Understanding the gross emissions pathway | |||||||

| Glencore has aligned their pathway with the net emissions from all fossil fuels combined with the emissions reductions from all forms of CDR and CCUS. | Glencore should apply CCUS assumptions prudently, clearly outlining the proportion of coal to be used with CCUS in accordance with IEA standards – and not assume universal application of CCUS and CDR (Carbon Dioxide Removal) | For Glencore, the gross emissions pathway should be their target, given they produce coal but lack control over its downstream use — they can't confirm if it's used with CCUS and how efficiently. While ACCR recognises the consideration of downstream CCUS emissions reductions, a responsible coal producer should verify if these CCUS assumptions are met in practice. If not, Glencore should adjust their pathway to reflect the actual extent of CCUS applied. | ACCR hasn't explicitly included this in Chart 2, but it is mentioned here as we expect Glencore to account for this in their updated climate report. | ||||

Download Opportunities for improving Glencore’s 2023 Climate Report | 09/11/23

Please read the terms and conditions attached to the use of this site.

Glencore, Climate Report 2022, p36, https://www.glencore.com/.rest/api/v1/documents/529e3b5028692472bc9f97e143d73557/GLEN-2022-Climate-Report.pdf ↩︎

ACCR, Investor Bulletin: Glencore’s door open for engagement, Sep 2023, https://www.accr.org.au/insights/investor-bulletin-glencore’s-door-open-for-engagement/ ↩︎

CDP Technical Note: Reporting on Climate Transition Plans, p7, Feb 2023, https://cdn.cdp.net/cdp-production/cms/guidancedocs/pdfs/000/003/101/original/CDP_technical_note-_Climate_transition_plans.pdf?1643994309 ↩︎

Climate Policy Initiative, What Makes a Transition Plan Credible? Considerations for financial institutions, p5, Mar 2022, https://www.climatepolicyinitiative.org/wp-content/uploads/2022/03/Credible-Transition-Plans.pdf ↩︎

Climate Bonds Initiative, Transition Plans: The key to a credible net zero pathway, May 2023, https://www.climatebonds.net/2023/05/transition-plans-key-credible-net-zero-pathway ↩︎

By mass. ↩︎

ACCR, Pre-AGM analysis: Glencore plc 2023, p5, Apr 2023, https://www.accr.org.au/downloads/accr_glencoreagmanalysis_apr2023.pdf ↩︎

Glencore, Climate Report 2022, https://www.glencore.com/.rest/api/v1/documents/529e3b5028692472bc9f97e143d73557/GLEN-2022-Climate-Report.pdf ↩︎

The updated 2023 NZE pathway projects a slower decrease in coal usage until 2030 than earlier estimated in the 2021 NZE pathway, primarily to allow for a more manageable and equitable near-term pathway for emerging market and developing economies and due to energy security concerns around natural gas. This requires more to be done after 2030. ↩︎

IEA, 2023 WEO, https://iea.blob.core.windows.net/assets/66b8f989-971c-4a8d-82b0-4735834de594/WorldEnergyOutlook2023.pdf ↩︎

IEA, 2022 World Energy Outlook, p434, https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf ↩︎

Glencore’s representation of their Net and Gross NZE pathways has been derived from the chart in the Appendix. ↩︎

This discrepancy is largely due to an over-reliance on cross-sectoral CCUS and CDR in relation to the actual volume of coal emissions. ↩︎

IEA’s NZE scenarios are consistent with IPCC’s C1 1.5°C limited to no overshoot pathways. ↩︎

IEA, Net Zero Roadmap 2023 Update, p58, https://iea.blob.core.windows.net/assets/13dab083-08c3-4dfd-a887-42a3ebe533bc/NetZeroRoadmap_AGlobalPathwaytoKeepthe1.5CGoalinReach-2023Update.pdf ↩︎

Climate Policy Initiative, What Makes a Transition Plan Credible? Considerations for financial institutions, p5, Mar 2022, https://www.climatepolicyinitiative.org/wp-content/uploads/2022/03/Credible-Transition-Plans.pdf ↩︎

Glencore, Climate Report 2022, p8, https://www.glencore.com/.rest/api/v1/documents/529e3b5028692472bc9f97e143d73557/GLEN-2022-Climate-Report.pdf ↩︎

ACCR, Glencore Plc: Assessment of progress against its climate plan, Mar 2022, https://www.accr.org.au/research/glencore-plc-assessment-of-progress-against-the-climate-plan/ ↩︎

IGCC, CORPORATE CLIMATE TRANSITION PLANS: A guide to investor expectations, p16, Mar 2023, https://igcc.org.au/wp-content/uploads/2022/03/IGCC-corporate-transition-plan-investor-expectations.pdf ↩︎

https://www.accr.org.au/news/the-statement-of-indicative-support-for-the-glencore-thermal-coal-resolution/ ↩︎

https://www.glencore.com/media-and-insights/news/results-of-2023-agm ↩︎

ACCR, Investor Bulletin: Glencore’s door open for engagement, Sep 2023, https://www.accr.org.au/insights/investor-bulletin-glencore’s-door-open-for-engagement/ ↩︎

GHG Protocol (Corporate Standard) 2004, p35, https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf ↩︎

ACCR, Investor Bulletin: Glencore’s door open for engagement, Sep 2023, https://www.accr.org.au/insights/investor-bulletin-glencore’s-door-open-for-engagement/ ↩︎

Per the GHG protocol, Cerrejón's pre-baseline production from its 66.7% stake acquisition is not included; restatements apply only from the baseline year onward. ↩︎

Glencore, Climate Report 2022, p36, https://www.glencore.com/.rest/api/v1/documents/529e3b5028692472bc9f97e143d73557/GLEN-2022-Climate-Report.pdf ↩︎

ACCR, Investor Bulletin: Glencore’s door open for engagement, Sep 2023, https://www.accr.org.au/insights/investor-bulletin-glencore’s-door-open-for-engagement/ ↩︎

IGCC, CORPORATE CLIMATE TRANSITION PLANS: A guide to investor expectations, p15, Mar 2023, https://igcc.org.au/wp-content/uploads/2022/03/IGCC-corporate-transition-plan-investor-expectations.pdf ↩︎

IEA, Net Zero Roadmap 2023 Update, p76, https://iea.blob.core.windows.net/assets/13dab083-08c3-4dfd-a887-42a3ebe533bc/NetZeroRoadmap_AGlobalPathwaytoKeepthe1.5CGoalinReach-2023Update.pdf ↩︎

CFA Institute Member Poll: Cash Flow Survey, Jul 2009, https://www.ifrs.org/content/dam/ifrs/meetings/2009/october/joint-iasb-fasb/fsp-1009jb07a-appbobs.pdf ↩︎

Glencore, 2022 Investor Update, p21, Dec 2022, https://www.glencore.com/.rest/api/v1/documents/8b6635428cf3e09828ea2d8b79fd0223/20221206+GLEN+Investor+Day+2022.pdf ↩︎

ACCR, Investor Bulletin: Glencore’s door open for engagement, Sep 2023, https://www.accr.org.au/insights/investor-bulletin-glencore’s-door-open-for-engagement/ ↩︎

Glencore, 2022 Climate Change Report, p10, https://www.glencore.com/.rest/api/v1/documents/529e3b5028692472bc9f97e143d73557/GLEN-2022-Climate-Report.pdf ↩︎

IEA, 2023 WEO, p280, Table A.4c, https://iea.blob.core.windows.net/assets/66b8f989-971c-4a8d-82b0-4735834de594/WorldEnergyOutlook2023.pdf ↩︎

IEA, 2023 WEO, p276, Table A.1c, https://iea.blob.core.windows.net/assets/66b8f989-971c-4a8d-82b0-4735834de594/WorldEnergyOutlook2023.pdf ↩︎