Investor Insight Investor Bulletin: IEA’s 2023 World Energy Outlook

The International Energy Agency (IEA) this week released its 2023 World Energy Outlook (WEO), with coal, oil and gas all projected to enter terminal decline before 2030 under all IEA scenarios. Future profitability of LNG looks to be in question, with a forecast glut on the near horizon. The big surprise is China emerging as a key driver of the global energy transition - while it’s been the major source of global emissions over the last decade, China is now deploying over half the world's renewable energy and EVs, and with its economy at an inflection point, fossil fuel demand is set to decline.

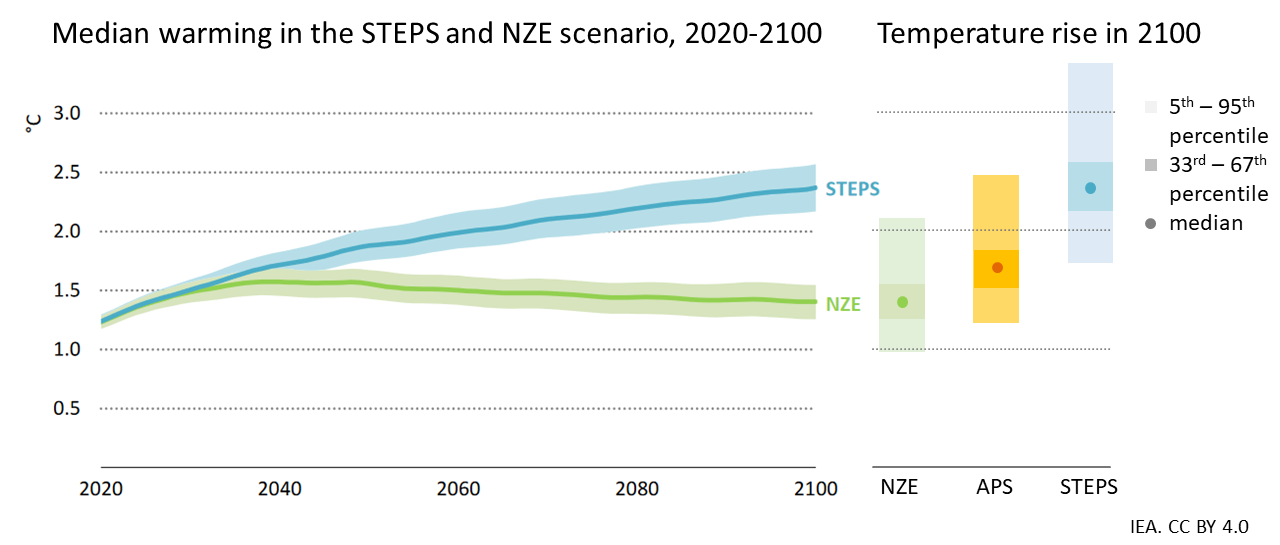

The focus of this WEO is the Stated Energy Policy Scenario (STEPS), based on implemented climate policies, and the Announced Policy Scenario (APS), based on announced climate targets. Alarmingly, the 2023 STEPS is showing a global temperature outcome of 2.4°C - an outcome scientific consensus regards as an existential threat to humanity. Already, at more than 1.2°C warming above pre-industrial levels, scientists are surprised[1] by the rapid onset and severity of extreme climate-related weather, and the imminence of tipping points: melting of the West Antarctic ice-shelf may already be irreversible.[2]

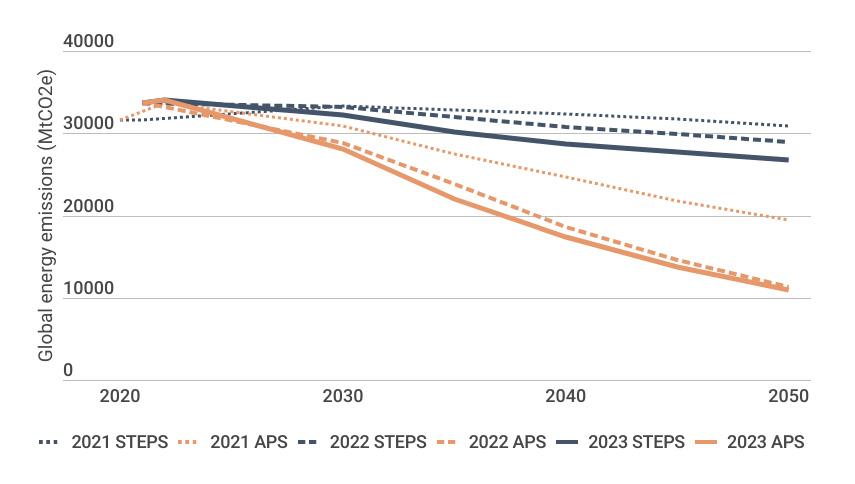

However, neither STEPS nor APS is a bankable forecast for investors. They are scenarios under the Paris Agreement, tracking the ratcheting up of ambition on climate targets (APS) and implementation of climate policies (STEPS). As Chart 1 below shows, there has been a marked increase in global ambition since the 2021 WEO, and a smaller but still steady increase in policy implementation, resulting in anticipated emissions from global fossil fuel use trending further down. While the level of policy implementation so far has not been sufficient - as evidenced by the STEPS 2.4°C outcome - investors should expect and prepare for both ambition and policy implementation to increase and the downward trend on emissions to continue. As the energy transition gathers pace and the climate crisis bites, targets and policies will move faster.

The economic benefits of taking urgent steps to reduce emissions are becoming increasingly clear. This week, Lloyd’s of London data[3] showed that the global financial cost of extreme weather events, measured over five years, could be between $3 trillion to $17 trillion - compared to the cumulative investment needed to deliver a Paris-aligned energy system, which is $5.9 trillion by 2030, and $16.7 trillion by 2037.[4]

Chart 1: Emissions from global fossil fuel use are trending down in IEA scenarios

Key insights from the 2023 World Energy Outlook:

- The world is approaching peak fossil fuels. Coal, oil and gas are all projected to enter terminal decline before 2030 in all IEA scenarios. Fossil fuel investment is projected to decline from today’s levels in all scenarios.

- Current policies (STEPS) are expected to result in 2.4°C climate change, with a one in three chance of 2.6°C or more (see Chart 2). Significantly more effort is required to deliver the Net Zero Emissions (NZE) scenario. Although PV, EVs and clean energy investment are expanding in line with a 1.5°C scenario, other sectors, including wind, are not on track.

- China is emerging as a key driver of the energy transition. China has been the main driver of emissions growth in the last decade, but is currently deploying over half of the world’s renewable energy and EVs. Structural changes in China’s economy mean fossil fuel demand is set to decline, with the balance of risk leading to slower growth and less energy demand. This decline is not offset by growth in other markets.

- There is now more LNG capacity under construction than will be needed under any scenario. This glut will place downward pressure on prices and reduce the profitability of the whole sector.

Coal, oil and gas are all expected to peak before 2030

Despite the pressing need for more action, there are already notable shifts occurring under the present policy landscape. In fact, the sectors that consume the most coal (steel, cement and power generation), oil (internal combustion vehicles) and gas (power generation and space heating) have all passed the peak of their capacity additions.

Consumption of coal, oil and gas will all peak prior to 2030 in all IEA scenarios.

Under the highest emissions scenario, STEPS:

- By 2030, fossil fuel use will decrease from 80% of primary energy to 73%; and from 70% to 40% of electricity generation.

- Coal use peaks by the mid-2020s. The rapid expansion in renewable electricity has reduced the need for coal capacity additions and coal use declines by 14% by 2030.

- Oil use peaks before 2030. By 2030, nearly 50% of cars sold will be electric, reducing the role of oil in road transport, more than offsetting growth in petrochemicals, aviation and shipping.

- Gas use peaks by 2030. The role of gas in the power sector and residential heating is declining. Heat pump sales will overtake fossil fuel boilers this decade.

Demand for, and investment in, each fossil fuel declines faster in the APS and faster again in the NZE.

The gap to the Net Zero Emission Scenario

The chart below shows the global temperature implications of the current gap between STEPS and NZE.

Chart 2: Median warming for IEA scenarios through the 21st century and in 2100

Left: from IEA, 2023, Net Zero Roadmap (figure 2.3). Shaded area represents the 33-67% confidence interval. Solid line represents median warming. Right: from IEA, 2023, WEO (amended from figure 4.1)

To reach NZE, we need to accelerate our ambition. We need more government support, stronger policies and more collaboration between nations, companies and investors.

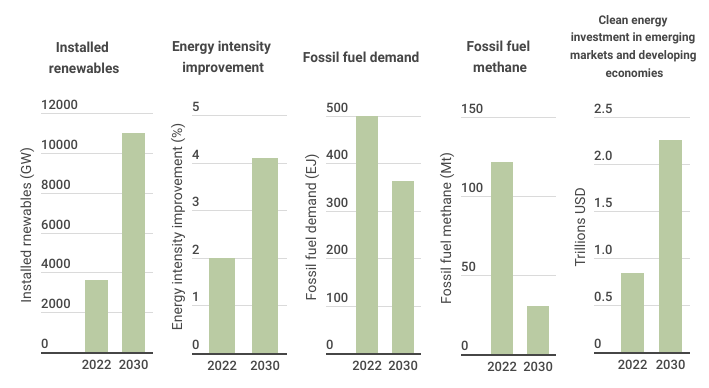

Chart 3: Five pillars to keep 1.5°C alive

- While solar deployment and EV sales have been in line with the NZE scenario, other technologies have not seen the same success (e.g. wind)

- Global installed renewables capacity, which has doubled in the last seven years, needs to triple by 2030. Energy intensity improvement needs to double by 2030. These two conditions make no new approvals of unabated coal plants possible.

- Methane emissions from the energy sector need to be cut by 75% by 2030. If methane emissions are not reduced in the oil and gas sector, CO2 emissions from the energy sector need to reach net zero by 2045, which has strong implications for equitable pathways.

- By 2030, the annual investment gap between STEPS and NZE reaches US$1.5trn.

- Clean energy investment in emerging economies needs to increase 5x by 2030.

China is driving the global energy transition

Over the past decade, China has driven global energy trends, accounting for two-thirds of oil consumption growth, a third of natural gas growth, and nearly all coal consumption growth. However, China's economy is at an inflection point.

High debt, a peaking construction sector and declining working-age population, indicates that China's energy-intensive sectors are poised for a decline. Whilst China’s energy demand is tapering, its commitment to clean energy remains robust - China led in global wind and solar additions and EV sales. China's fossil fuel demand will likely peak this decade, offsetting potential demand rises in emerging markets, such as India.

China has contracted to purchase 80bcm more LNG than it needs in 2030 under the APS - equivalent to a third of its contracted portfolio. This would create an unusual situation where China may be simultaneously importing gas and competing with gas exporters as it tries to redirect contracted cargos. If this eventuates it is likely to further depress prices and saturate the LNG market. Our view is that if China continues to increase domestic gas production, this may further reduce gas imports.

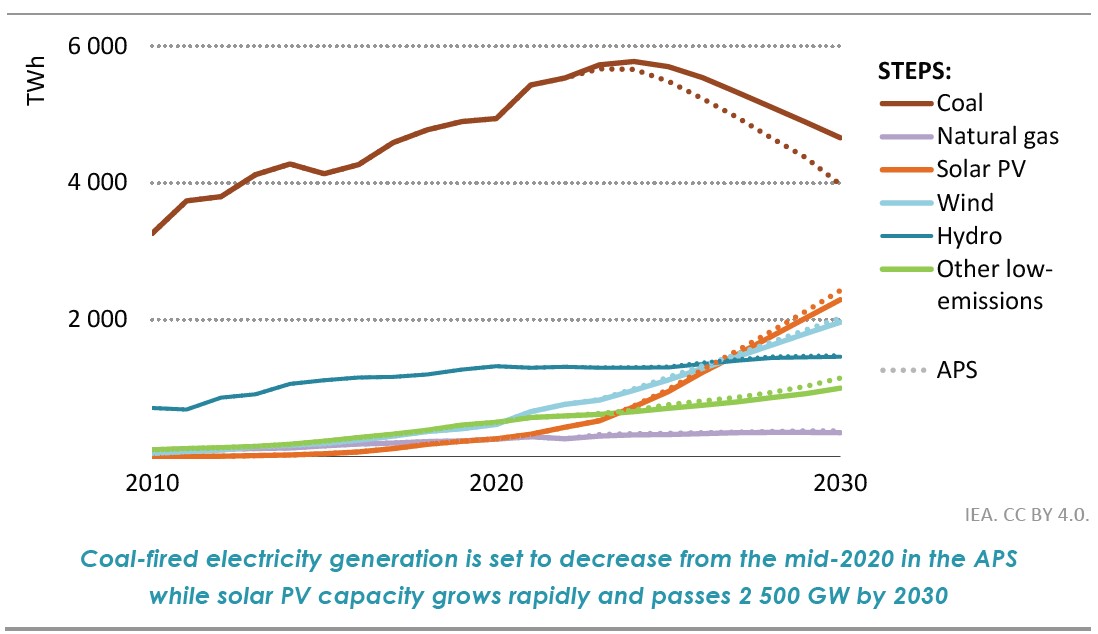

Chart 4: Electricity generation by source in China in the STEPS and APS, 2010-2030. Gas does not replace coal fired generation

From IEA, 2023, WEO, figure 5.21

China's coal power is expected to start rapidly declining before 2030, shifting towards renewables with an installed capacity of 5,400 GW of solar PV by 2030 in APS. Previous claims that gas is needed to displace coal seem to be unfounded - with effectively all Chinese coal power reductions being due to increased renewables in the STEPS, and additional efficiency measures in the APS. This contributes to the substantial LNG surplus in APS.

This is key to reducing global CO2 emissions, with China's coal emissions expected to drop from 8.6 GtCO2e in 2022 to 1.1 GtCO2e in 2050 in the APS, accounting for 30% of the global CO2 reduction target in this scenario.

Despite China's ongoing expansion of coal power capacity, its current fleet currently operates at about 50% capacity, down from 81% in 2007. With expected declines to 40% and 35% by 2030 in STEPS and APS scenarios, respectively, new capacity is not expected to supply bulk energy, but rather to provide flexibility in the grid.

Fossil fuel CAPEX has peaked

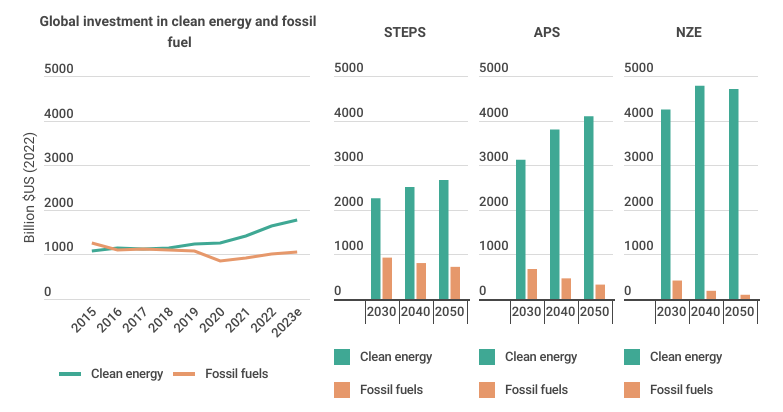

Investment in clean energy has outstripped investment in fossil fuels since 2016. In 2023, clean energy investment exceeded fossil fuel investment by 80%, with the gap expected to increase.

Chart 5: Global investment in clean energy and fossil fuels since 2015 and by scenario

All IEA scenarios see a decline in fossil fuel capital expenditure from today’s levels. And compared to previous STEPS scenarios, projected fossil fuel capital expenditure is lower in the current STEPS scenario.

Natural gas and LNG outlook

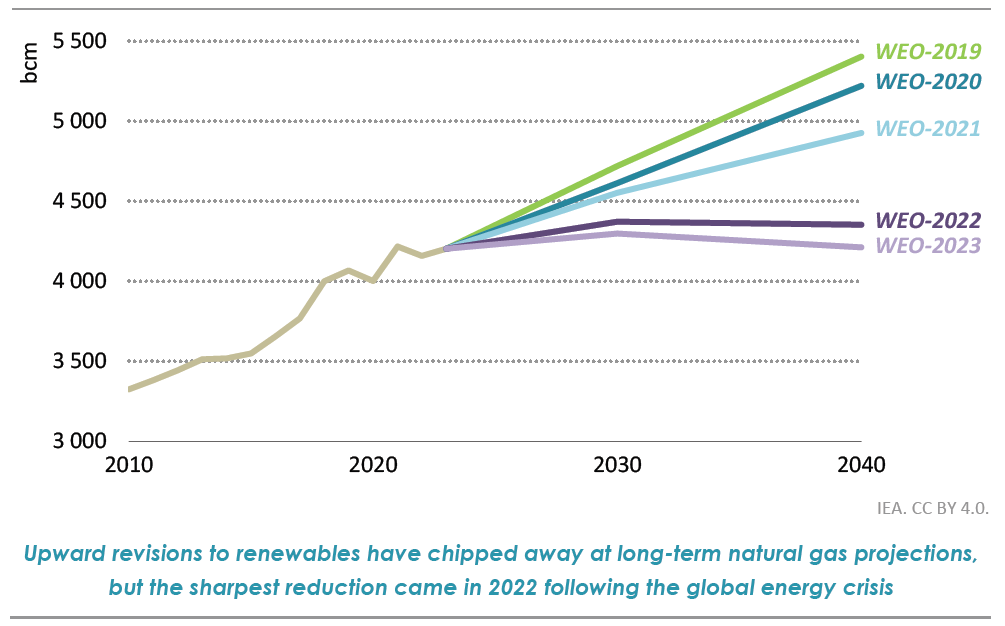

Chart 6: Natural gas demand projections in the STEPS to 2040 in five editions of the World Energy Outlook, 2010-2030

From IEA, 2023, WEO, figure 1.35

Before WEO 2022, STEPS predicted strong global natural gas growth. Events in 2022, including the Russian invasion of Ukraine, prompted a significant revision in natural gas outlook.

WEO 2023 projects a 140 bcm reduction in 2040 natural gas demand, largely due to rising renewable expectations. This is equivalent to all of Russia’s gas exports prior to 2019. Advanced economies, especially Europe, drive most of this decrease.

LNG glut poses risk to sector’s profitability

From 2022 to 2030, global gas trade in the STEPS scenario increases by 15%, surpassing overall gas demand growth. This growth is primarily due to LNG, which increases by 130bcm, resulting in LNG making up 66% of global gas trade in 2030.

The LNG industry is currently constructing 250 bcm of new capacity - mostly in Qatar and the US. This exceeds the projected increase in LNG consumption, resulting in an LNG ‘glut’ even in the highest emissions scenario, STEPS. This will put downward pressure on prices and reduce profitability of the whole sector.

Download Investor Bulletin: IEA’s 2023 World Energy Outlook | 27/10/23

https://academic.oup.com/bioscience/advance-article/doi/10.1093/biosci/biad080/7319571?login=false ↩︎

https://www.lloyds.com/about-lloyds/media-centre/press-releases/lloyds-new-data-tool-highlights-vulnerability-of-the-global-economy-to-extreme-weather ↩︎

Source: World energy outlook 2023, based on cumulative additional investment in NZE scenario vs STEPS scenario ↩︎