Investor Insight Investor Bulletin: Glencore’s door open for engagement

With Glencore currently compelled under UK law to seek shareholder feedback it’s time for investors concerned about the company’s inadequate Climate Report and thermal coal expansion in Australia to come knocking.

From now until late November, a live engagement opportunity exists for Glencore investors on climate. Under the UK Corporate Governance Code the company is required to formally consult with its shareholders about reasons for the two significant votes against management at its last AGM: a 30.25% vote against its Climate Report and a 29.22% vote in favour of a co-filed shareholder resolution asking for enhanced disclosures on its thermal coal business.

This is a crucial window of opportunity for investors to provide input into Glencore’s next Climate Report, and for the company to provide greater insights to shareholders regarding its exposure to transition risk.

ACCR has undertaken a further review of company disclosures, finding it relies on accounting to reach emissions-reduction targets and it has continued to seek approvals for thermal coal extensions and expansions in Australia since the AGM.

UK law stipulates Glencore has six months from the AGM to formally consult with shareholders and report back to the stock exchange, which would be around 26 November 2023. Please feel free to get in touch if you would like to discuss your engagement or require a briefing on our research.

Key points:

- At the 2023 AGM 30.25% of shareholders voted against Glencore’s Climate Report and 29.22% voted in favour of a co-filed resolution asking for enhanced disclosures of the thermal coal business. Under UK law this triggers a consultation process that enables shareholders to provide feedback on the ways in which Glencore can better manage transition risks going forward.

- Glencore’s own production data from each of its coal assets shows planned coal production will stay roughly flat for the next 10 years. All Paris-aligned scenarios require thermal coal production to decline significantly over the coming decade.

- Glencore uses an unrepresentative baseline (2019) for all of its emissions reductions targets, which has the impact of enabling it to maintain broadly flat levels of production over the next decade, whilst still achieving a nominal reduction in emissions. This is not aligned with the GHG Protocol guidance on choosing a base year. Glencore should either use a more representative year, or take an average over several consecutive years to smooth out unusual fluctuations.

- While the 2021 Climate Report indicates restatements following the completion of transactions in Colombia in 2022, the baseline has not been adjusted to account for the removal of Prodeco. This omission significantly overstates the baseline and the subsequent reduction in emissions.

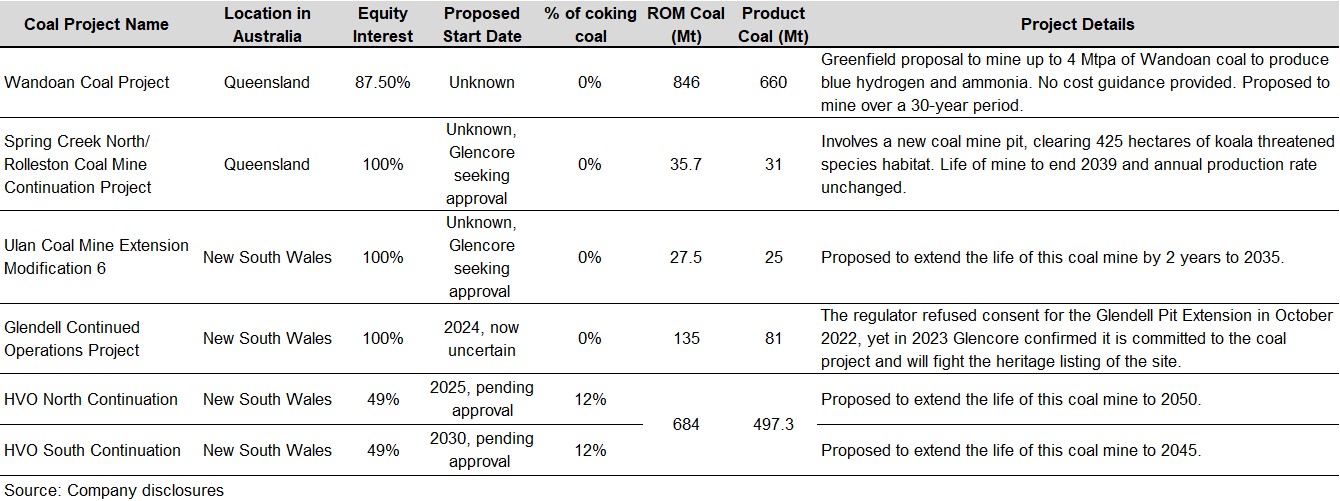

- Since the 2023 AGM, Glencore has continued to seek approvals for thermal coal extensions and expansions in Australia. It has also undertaken negative lobbying in relation to coal activities in Australia.

- The Teck coal offer remains topical. However, Glencore is now just one offer among several to buy Teck’s metallurgical coal mines. And, if a purchase and subsequent coal demerger were to take place, Glencore’s proposed demerged coal business (CoalCo) would still be 74% thermal coal. This high percentage of thermal coal raises questions about if it will materially change the value proposition of the coal business.

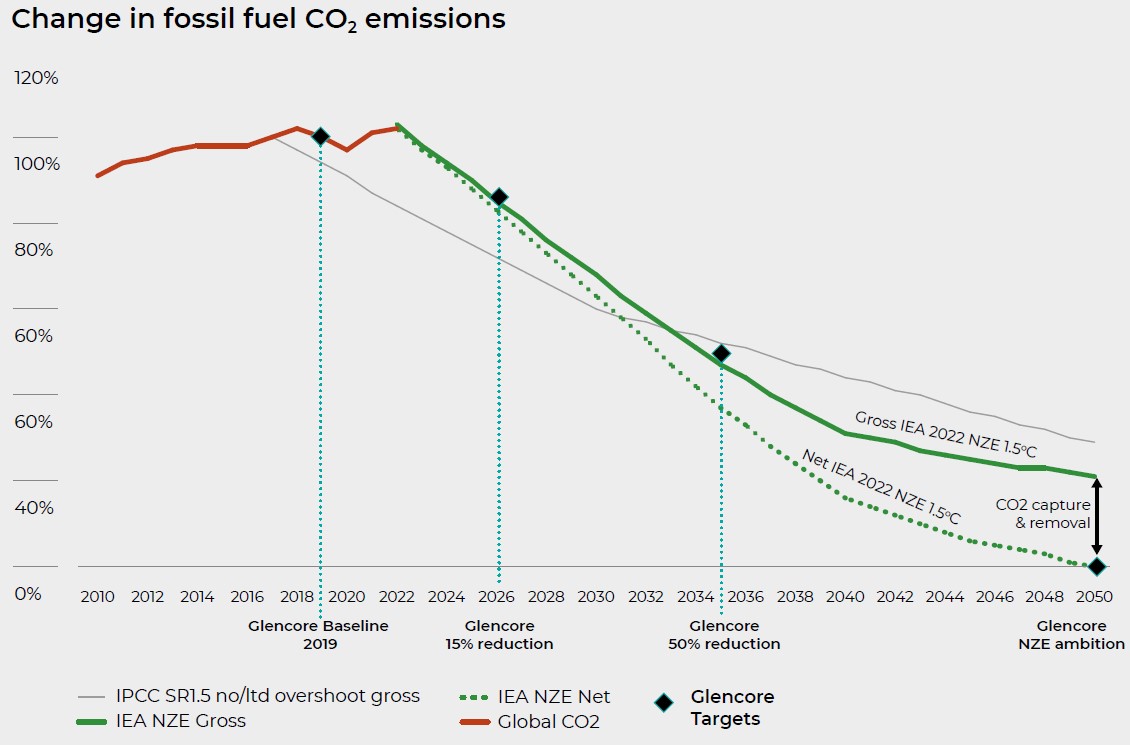

- As highlighted in previous research, the company’s 2035 and 2050 emissions reduction targets are not aligned with the updated 2022 International Energy Agency Net Zero Emissions (IEA NZE) coal pathway. (Glencore self-selects the general IEA NZE pathway for all fossil fuels, not the coal specific pathway.) 90% of Glencore’s emissions are due to its coal business.

- Investors have been asking Glencore for an emissions reduction target for 2030, to be able to track emissions decline between 2026 and 2035, yet this has not been forthcoming.

- Glencore has not disclosed its planned capital expenditure allocated to emissions reduction, nor its planned capital expenditure towards new and expanding coal projects over the coming five years.

Key stewardship considerations for investors

Now is the time to present your views into Glencore’s upcoming Climate Report, and to seek clarification of whether Glencore is adequately addressing climate transition risk. Consider incorporating the following questions into your engagement meetings.

Forward emissions from Glencore’s coal projects show coal production staying mostly flat between now and 2033. This appears to be an outdated climate strategy and not one that meets investor expectations to lower coal emissions in line with the Paris Agreement. How will Glencore update this coal strategy in its 2024 Climate Report?

Will Glencore now chart its emissions against the 2022 IEA NZE pathway for coal, and demonstrate to investors how operations will align to this pathway?

Will Glencore align its coal expansion strategy with IEA’s NZE pathway for coal? I.e. “There is no need for new coal mines or mine lifetime extensions.”[1]

Will Glencore set an ambitious 2030 emissions reduction target, linked to remuneration?

Will the next Climate Report include a clear outline of what emissions reduction investments are being made and clear capex guidance for the coal business over the coming five years?

When will Glencore rebase for the Prodeco coal mine closure, and what is the current status of this coal mine?

Considering that the 2019 baseline year is not representative of Glencore’s usual emissions, will the company consider an alternate approach that is aligned with the GHG Protocol guidance?

Operational management was contracted to Glencore for some South African mines[2], suggesting Glencore has operational control of these operations. Why were restatements not made in the 2022 Climate Report?

Why have Cerrejón Scope 3 emissions not been previously reported?

If Glencore acquires Teck’s coal mines and a CoalCo style demerger does eventuate:

- Is expansionary capex excluded from the cash flow definition?

- Will the balance sheet maintain net-zero debt or is the plan to increase net debt levels over time?

- Will CoalCo pursue any greenfield developments? If so, how is this consistent with a 100% cash flow payout?

New ACCR research insights to support engagement

ACCR has undertaken a further review of Glencore’s disclosures and assessed other publicly available third party disclosures to bring together this research update for investors.

1. Glencore’s latest emissions accounting misses the mark

Glencore continues to use accounting tools to make it appear as though it is reaching emissions reduction targets.

Glencore uses an unrepresentative baseline for all of its emissions reduction targets

Using 2019 as a base year enables Glencore to maintain broadly flat levels of production over the next decade, whilst still achieving a nominal reduction in emissions. This is not aligned with the GHG Protocol guidance on choosing a base year.[3] It should either use a more representative year, or take an average over several consecutive years to smooth out unusual fluctuations.

In Glencore’s 2022 Climate Report key changes were made to restate its 2019 baseline, including:

- changing from equity-based reporting of emissions to operational control based reporting

- updated emission factors

- including the acquisition of the remaining 66.7% stake in Cerrejón.

The impact of these changes in the context of coal production are summarised in Chart 1. These adjustments amplify the 2019 baseline, and while 2020-2022 sees some inflation, a natural production dip relative to 2019 mutes the effect. The inflated 2019 baseline allows for sharper reductions in the years that follow.

Chart 1: Glencore coal production (2012-2022)[4]

While the 2021 Climate Report indicates restatements following the completion of transactions in Colombia in 2022[5], the baseline has not been adjusted to account for the removal of Prodeco. This omission significantly amplifies the baseline and hence subsequent emissions reductions.

A part of the reported 24% drop in emissions by 2020 can be traced back to the cessation of operations at Prodeco and mining licence relinquishment. Yet, even after adjusting for Prodeco, there is a notable 17% emission reduction by 2020. This is largely attributable to external factors, in particular, "the impacts of the pandemic via stopped or reduced work periods in Colombia and South Africa," coupled with "market-related supply reductions in Australia in H2 2020”[6].

To sum up, Glencore achieved a 24% emissions reduction over just one year, influenced by relinquished contracts, external factors and market dynamics. This is in sharp contrast to Glencore's six-year target of a 15% reduction by 2026. This disparity underscores the inadequacy of the 2019 baseline and calls for a more robust and reflective benchmark.

Glencore’s emissions forecast with 2022 baseline

To better capture Glencore's future trajectory and the effects of its skewed baseline, we have charted a 2022 baseline year below for comparison. We believe this is a more representative baseline than 2019, as it:

- avoids the impacts due to relinquishment of contracts at Prodeco

- avoids the changes in production due to Covid-19 and external factors

- aligns closely with the average production of the past three years', with a minor 4% deviation.

Chart 2: 2019 base year vs 2022 base year (incl. unapproved projects & rebased for Cerrejon)

Chart 2 highlights the main impacts of a more accurate baseline. It shows that while the IEA NZE coal trajectories remain relatively consistent regardless of the baseline year, the future coal emissions pathways exhibit significant differences relative to their respective NZE pathways.

- Using a 2022 baseline eliminates the pronounced emission drop in 2020. Using a 2019 baseline, Glencore's emissions appear tailored to hit specific point-in-time targets, rather than achieving genuine reductions. Glencore’s 2026 target is predominantly achieved due to the steep 2020 drop, with emissions then plateauing (and even ticking up) until 2026. Emissions remain roughly constant until 2033, before a marked decrease leading up to its 2035 target, coinciding with the closure of major mine sites, notably Cerrejón in 2033.

- Under the 2022 baseline, Glencore will significantly miss its short and medium-term emission targets if it proceeds with all greenfield and expansion projects. Importantly, Glencore's targets do not follow the IEA NZE coal pathway, instead using the IEA fossil fuel pathway, despite coal accounting for nearly 90% of its emissions.

The 2019 baseline is pivotal to Glencore’s public commitment[7] to support the Paris Agreement. By shifting to a more representative year like 2022, in accordance with the GHG Protocol, and excluding benefits from external factors and one-off events like cessation of operations at Prodeco, Glencore's trajectory of future coal emissions starkly deviates from the IEA NZE coal pathway.

Impacts of different reporting methods on cumulative NZE alignment

Chart 3: Different approaches: Cumulative coal production relative to IEA NZE pathway for coal

Chart 3 above shows cumulative coal production based on different reporting methods, relative to the IEA NZE pathway for coal. Any value below zero means Glencore is producing coal in deficit of the IEA NZE coal aligned pathway, i.e. it is aligned, and above zero means Glencore is producing coal in excess and is therefore not aligned with the IEA NZE coal pathway.

- By switching from an equity-based reporting of emissions to an operational-based approach, Glencore reduced its overshoot of the IEA NZE coal pathway by 80 Mt by 2050, moving from 424 Mt to 344 Mt, assuming all unapproved projects proceed. This shift is depicted by the green and blue lines in Chart 3.

- When Prodeco is removed from the baseline, Glencore's overshoot jumps by 190 Mt, totaling 534 Mt against the IEA NZE coal benchmark by 2050. This shift is marked by the jump from the blue line to the black-dashed line.

- If Glencore retained the equity approach and accounted for Prodeco as the GHG Protocol dictates, the deviation would climb to 618Mt (indicated by the dashed yellow line), a 274Mt increase from where it stands now.

In summary, Glencore's reporting approach significantly affects its NZE alignment. By employing the operational control approach and relying on an inflated, non-representative base year, Glencore significantly reduces its cumulative overshoot from an NZE coal aligned pathway.

These accounting strategies fall well short of the pressing call for real-world emission reductions. Before considering new and expansionary projects, which are in direct opposition to IEA guidance, we strongly urge Glencore to adopt a baseline that genuinely aligns with the GHG Protocol.

2. Thermal coal expansions/extensions still underway in Australia

Glencore is continuing to pursue several thermal coal expansions through the planning system in Australia, despite ongoing public statements to investors that the company is undertaking a “managed decline” of its coal portfolio. Shareholders have been provided with very little detail about the specifics of these coal expansions and how Glencore categorises capital allocation towards these activities. Pursuing these projects also does not align with IEA’s NZE pathway for coal, in which it states “there is no need for new coal mines or mine lifetime extensions.”[8]

Table 1: Glencore thermal coal mines seeking approval

3. Buying Teck’s coal mines looks uncertain

Earlier this year, Glencore attempted a merger with Canadian company Teck Resources which was ultimately rejected by the Teck board of directors,[9] citing on 2 April 2023 the risk to its shareholders of Glencore’s coal exposure:

“The Glencore proposal would force Teck shareholders to hold massive thermal coal exposure, which would be value destructive, drive away current and future investors who cannot hold thermal coal assets, and result in Teck’s world-class steelmaking coal business trading at a discount.”

Glencore's ongoing negotiations with Teck Resources has also raised questions around Glencore's corporate governance record. Teck has cited a 'significant ESG misalignment' between it and Glencore. Glencore's operations in Democratic Republic of Congo and Kazakhstan are geopolitically risky for Teck, as are its ongoing coal operations.[10]

Glencore confirmed on 12 June 2023[11] that it submitted an alternate proposal to the Board of Directors of Teck Resources in which it offered to acquire Teck’s steelmaking coal business for cash, a deal that now would not include the (arguably more attractive) Teck copper business. One mining commentator[12] pointed out that if Glencore was to buy Teck’s coal mines and then spin out the coal business to a stand alone entity, it “would create a coal mammoth with few rivals in scale anywhere in the world.”

Glencore’s ongoing focus on expanding its coal exposure impacts shareholder returns. As noted by Bloomberg on 8 August 2023[13] after the half year results:

“Glencore Plc underlined its continued interest in a deal with Teck Resources Ltd. by holding back $2 billion for a potential purchase of the Canadian miner’s coal business — cash it would otherwise have returned to shareholders.”

4. Broader governance concerns, including negative climate lobbying

Glencore's ability to engage directly with shareholder concerns, responsibly manage its portfolio, and uphold basic standards of corporate governance, remains in doubt.

- Criticism of ESG-focused investors. In June 2023 Chief Executive Office Gary Nagle publicly criticised European investors for being too ESG focused. Nagle dismissed increased shareholder discontent over its climate planning as the fault of 'some ESG person in the basement in office number 27'.

- Cerrejón and human rights. Cerrejón has been the subject of multiple, high-profile legal disputes regarding the project's impact upon the environment and the health and human rights of local populations. In August, it was estimated that coal exports would drop by 20% that month amid ongoing blockades by local communities at the mine. An OECD complaint, filed by the Global Legal Action Network (GLAN) and six other complainants, alleged that Irish electricity supplier ESB's purchase of coal from Cerrejón mine was a breach of its obligations in relation to due diligence, disclosure, human rights and environment. The complaint was deemed worthy of further investigation by the Ireland National Contact Point (NCP) and is under review. GLAN and ESB will begin mediation in October 2023.

- McArthur River Mine (Australia) Supreme Court appeal. Aboriginal Traditional Owners and the Environment Centre Northern Territory (ECNT) are appealing the Northern Territory Supreme Court’s decision in relation to the McArthur River Mine, the state’s most toxic industrial site. The appeal is ongoing.

- Bribery and corruption investigations. The UK's Serious Fraud Office is investigating former Glencore employees and will decide whether to charge any of them with bribery offences by the end of 2023. Glencore is subject to ongoing investigation by the Office of the Attorney General of Switzerland over its organisational failure to prevent alleged corruption. The Dutch Public Prosecution Service is conducting an investigation 'of similar scope'. The timing and outcome of these investigations is unknown.

- Monitorship. Glencore will be subject to a three year monitorship by the US Department of Justice, set to begin in 2H 2023.

- London High Court case. In August 2023, 197 funds (together managing £3.7bn) were named as those seeking damages in London's High Court over allegations Glencore made "numerous untrue and misleading statements" in its 2011 (LSE listing) and 2013 (Xstrata merger) prospectuses. Investor actions were publicised in 2022, but the specific allegations and the participating investors are now known. Dozens of pension funds have joined the action.

- Human rights track record. The Business and Human Rights Centre’s 2022 Transition Minerals Tracker found, for the second consecutive year, that Glencore had the most recorded allegations of human rights abuses of all tracked companies (70 from 2010-2022, including 5 in 2022).

- Lobbying in the US. Glencore spent $60,000 in Q1 2023 lobbying Congress and the State and Treasury departments on issues related to foreign sanctions, critical minerals, and the Lower Energy Costs Act.

- Lobbying in Australia. Glencore lobbied against the Albanese government's new carbon policy, suggesting that Australia was in some ways 'racing ahead of the rest of the world'. Australia is still widely regarded as a 'climate laggard', including by the MIT Review index. This month, in response to a coal royalty increase in NSW, Glencore called for “policy clarity for the treatment of future coal mine investment and approvals”. This position appears at odds with the ‘responsible coal wind down’ message provided to investors and further highlights the need for investors to have visibility over what additional coal mine investments Glencore is considering.

Appendix

Chart 4: ‘Say on Climate’ votes internationally

Chart 5: Copy of the graphic provided by Glencore in its 2022 Climate Report.[14] Glencore used the IEA NZE pathway for all fossil fuels, not the IEA NZE pathway for coal.

Download Glencore Update for Engagement | 14/09/23

Please read the terms and conditions attached to the use of this site.

IEA Coal in Net Zero Transitions , p44, https://iea.blob.core.windows.net/assets/4192696b-6518-4cfc-bb34-acc9312bf4b2/CoalinNetZeroTransitions.pdf ↩︎

African Rainbow Minerals 2022 Integrated Annual Report, p88-89, https://arm.co.za/wp-content/uploads/2022/10/2022-Integrated-Annual-Report-1.pdf ↩︎

GHG Protocol (Corporate Standard) 2004, p35, https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf ↩︎

Per the GHG protocol, Cerrejón's pre-baseline production from its 66.7% stake acquisition is not included; restatements apply only from the baseline year onward. ↩︎

Glencore, 2021 Climate Change Report, p5, https://www.glencore.com/.rest/api/v1/documents/12b9c4417f45c969007f6e09ebf2ca67/2021-Climate-Change-Report-+(2).pdf ↩︎

Glencore, 2020 Production Report, p9, https://www.glencore.com/.rest/api/v1/documents/dc7f94242470cab4334efa0072014a82/GLEN_2020-Q4_ProductionReport.pdf ↩︎

https://www.glencore.com/sustainability/esg-a-z/climate-change ↩︎

IEA Coal in Net Zero Transitions , p44, ↩︎

https://www.teck.com/news/news-releases/2023/teck-board-of-directors-rejects-unsolicited-acquisition-proposal ↩︎

https://www.wsj.com/articles/environmental-issues-complicate-glencores-23-billion-merger-fight-7df8e96a ↩︎

https://www.glencore.com/media-and-insights/news/glencore-confirms-that-it-submitted-alternative-proposal-to-acquire-tecks-steelmaking-coal-business ↩︎

https://www.mining.com/glencore-bids-for-teck-resources-coal-unit/ ↩︎

https://www.bloomberg.com/news/articles/2023-08-08/glencore-keeps-dealmaking-powder-dry-for-teck-as-payouts-drop#xj4y7vzkg ↩︎

Glencore, 2022 Climate Change Report, p10 ↩︎