Annual Review 20/21

This annual review complements our formal ACT and ACNC annual reporting which consists of our Annual Information Statement and Financial Report for the FY21 year. Our Annual Report to our members will be submitted at our AGM in November 2021 and available publicly shortly thereafter. ACCR’s past annual reporting is available on the ACNC website here

Forward

From our

Executive Director

Welcome to ACCR’s inaugural annual review! This year has been a year of great upheaval worldwide, with the addition of COVID-19 only exacerbating global challenges from a warming planet and increasing socio-economic disparities in our communities. In Australia, we have seen the importance of holding our largest emitters to account for their impact on our environment and the consequences for us all when frontline workers - such as cleaning, security and transport workers - are not protected. Further, we have been horrified to witness the destruction of one of the world’s oldest culturally significant sites, the Juukan Gorge caves.

Holding corporations accountable for such appalling conduct is one of the reasons ACCR was founded, and why shareholder action has a continuing vital role in our society.

I am so proud of the achievements of our team in shining a light on unacceptable behaviour, and working closely with like-minded leaders and hidden change agents to improve corporate practice as we look to our shared future.

Beyond Australia, this year we have grown a new area of work - taking on a leadership role in a global network of sister organisations and spear-heading analysis of company climate transition plans and keeping on top of emerging strategies. Our team has doubled in size, now located across eastern Australia and in Norway. Thank you to all our partners and funders! The need for our work seems ever more urgent by the day. If you consider yourself an ethical investor, or you wish to support us in any way, please get in touch. I’d love you to join us in our mission.

Brynn O'Brien

Executive Director

From the Convenor of

our Office Bearers

It’s a bit over 10 years since I spoke to the first climate change resolution at an Australian company - Woodside. A climate change denier spoke just before me. The resolution attracted support of 5.7%. Not a lot changed at Woodside that day.

I had first heard about this aspect of ethical investment - filing shareholder resolutions – in the mid-80s. It was well known outside Australia – but, then, not here. ACCR was established 9 years ago.

At the 2020 Woodside AGM one of our climate change resolutions got a touch over 50% support. Our proposed 2021 Woodside ‘Say on Climate’ resolution was withdrawn because the board agreed to provide for a vote by shareholders on the board’s climate change report in 2022.

These stark changes at Woodside illustrate a much broader transformation nurtured by ACCR. Ethical investors – filing resolutions – can bring about changes in corporate conduct today, impossible just 10 years ago.

For bringing about that transformation, on behalf of the ACCR board, my thanks to our current Executive Director Brynn O’Brien, her predecessor Caroline Le Couteur, our staff, research committee members and all our donors, grantors and ‘shareholder hub co-filer’ supporters.

Howard Pender

ACCR Convenor

Our work in focus

ACCR exists to promote ethical investment through research and shareholder advocacy. Ethical or socially responsible investors often frame their interest around ‘ESG’ concerns, that is ‘Environmental, Social, and (Corporate) Governance’. They are investors who consider it important to incorporate their values and concerns as they invest, not only looking at the financial return they receive. ACCR harnesses the power investors have to express their views on how companies they part-own are governed, creating ways for them to speak together and influence corporate behaviour. These are the agents of change our society needs if we are to pass on a cleaner, safer planet, agents of change from within!

1. Climate

We want the activities of major companies to support a safe climate and a thriving natural environment.

National climate and environment team

We want to see listed Australian companies take material, effective steps to support a safe climate and thriving natural environment

- We focus on Australia’s largest emitting companies and their investors as it’s critical we see decarbonisation and transition strategies for both the health of our planet and our long-term economy.

- We published a new report Cutting Carbon, following a number of decarbonisation commitments from Australian investors throughout 2020. The report discussed the merits of engagement with fossil fuel extractive companies and the use of carbon exposure metrics to manage transition risk. It also analysed the emissions and climate commitments of the 25 largest emitters in the ASX200.

- In December 2020, the Australian government finally abandoned its intention to use Kyoto carryover credits, which would have cut its 2030 emissions target by half. This retraction followed after extensive engagement by ACCR and institutional investors with companies that were key to support. This was a huge result for ACCR and the investors we worked with, given the Australian government previously used its position on carryover credits to disrupt climate talks in Madrid in 2019.

- We filed a shareholder resolution with AGL calling on the company to align the closure dates of three coal-fired power stations with its own 1.5°C scenario. In an Australian first, the world’s largest asset manager, BlackRock supported the resolution.

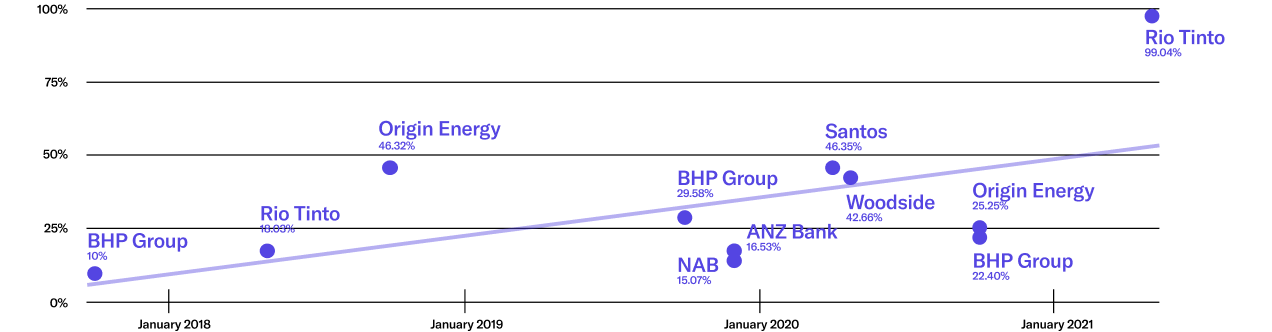

- Other than decarbonisation, ACCR also focuses on the role companies’ direct and indirect lobbying through industry associations has on climate and energy policy. We filed shareholder resolutions with BHP and Origin Energy calling for the suspension of membership of industry associations that had sought to exploit the COVID-19 pandemic to garner government subsidies for fossil fuels. Subsequently, both BHP and Origin Energy suspended their membership of the Queensland Resources Council, following its partisan advertising campaign during the Queensland state election.

- We filed a similar resolution with Rio Tinto in 2021, calling for the suspension of membership of industry associations whose advocacy is inconsistent with the Paris Agreement. In another Australian first, the board of Rio Tinto supported the resolution, which was subsequently supported by 99% of shareholders.

- This year, ACCR joined hedge fund activist investor Chris Hohn’s Children’s Investment Fund Foundation to promote the Say on Climate initiative. Already gaining traction in Europe, we led the push for Australian companies to disclose credible climate transition plans, and to put those plans to a shareholder vote at their AGM. Rio Tinto became the first Australian company to adopt Say on Climate. We also filed shareholder resolutions to Santos, Woodside and Oil Search, all of which were withdrawn once those companies committed to a Say on Climate in 2022.

Upward trend in support for climate-related lobbying resolutions

Media Highlights

- ACCR’s work profiled in the Financial Times

- ACCR’s first op-ed published in the Australian Financial Review

Global climate team

This year we launched our global climate team which builds on our established work on climate in Australia. We seek to influence and empower global investors to play their role in transforming global companies to ensure a safer climate.

- Our work will support investors by providing outstanding climate-related equity research and analysis and supporting them to use their ownership powers. We distributed an in-depth analysis of Shell’s climate transition plan which Shell put to a shareholder vote as part of its Say on Climate commitment. Our analysis helped investors record the highest ‘no’ vote on an inadequate company transition plan this year.

- We have supported the work of organisations like us throughout the world, resulting in record shareholder support for climate related resolutions at the likes of Chevron, Shell, BP and Equinor.

Introducing Global Climate Insights

In 2021, we launched our company-focused climate analysis, research and insights to empower global institutional capital to transform corporates towards a safe climate.

In 2020 ACCR played a crucial role in raising the Juukan Gorge Caves disaster to the attention of Australian and overseas investors, and in maintaining shareholder pressure on Rio Tinto until its board was forced to respond. ACCR was at the forefront of the new engagement between First Nations leaders and investors in Australia's mining industry. ACCR is a valued First Nations partner.

3. Governance

We monitor Australian corporate governance trends and identify developments that impact on ethical investors.

Super Votes 2021

ACCR published its annual proxy voting report analysing the proxy voting records of the fifty largest funds in Australia's $3 trillion superannuation industry. As ESG resolutions increase in number, prominence and impact, ACCR's extensive archive of fund voting records, dating back to 2017, continues to be a critical source for journalists, academics and investors wanting to understand corporate governance issues and trends in Australia and abroad. This year’s report examined 959 shareholder proposals filed at 307 companies since 2017. The report found that aggregate support for shareholder proposals fell slightly in 2020 from 43% to 42%. This is a significant fall from 54% support for proposals in 2018. Eight funds supported a majority of shareholder proposals between 2017 and 2020, while 22 funds supported a significantly higher proportion of proposals at US companies than at Australian companies between 2017 and 2020. On disclosure, 23 funds published complete voting records in 2020. Of these, nine funds have consistently published complete voting records since ACCR began tracking disclosures in 2017. In 2020, five funds have published complete voting records for the first time since 2018. The report also found that Members of the Australian Council of Superannuation Investors (ACSI), the Investor Group on Climate Change (IGCC), the UN Principles for Responsible investment (PRI) and/or the Responsible Investment Association of Australasia (RIAA) were more supportive of proposals between 2017 and 2020 than funds which are non-members.

AGM Watch

In 2020, annual general meetings (AGMs) moved online with the federal government temporarily waiving existing provisions of the Corporations Act to enable virtual instead of in-person meetings for ASX-listed companies. While this move has allowed for greater accessibility in terms of attending a meeting, in some important respects, shareholders’ ability to engage meaningfully with company boards has been impaired. We identified a decrease in transparency around questions and question-askers as well as a decrease in direct interaction between company boards’ and shareholders. In 2021, the companies monitored have delivered their AGMs with mixed methods; some have remained completely virtual, while others have adopted either a hybrid practice with the possibility of both online and in-person attendance, or reverted back to in-person attendance (although this was more rare). Overall, company conduct has been mixed this year and we will continue to monitor the way in which AGMs are delivered and how shareholders’ rights are being upheld and facilitated.

Our ethical investor community

We work with shareholders to channel their ownership powers toward making companies more responsible and transparent. Together with 100 registered shareholders, we can put shareholder resolutions on issues like climate change, political lobbying, decent work, and human rights to Australian companies. If you own shares in ASX-listed companies, register with us via our Shareholder Hub to raise your voice.

Over the years we have partnered with ACCR on many different shareholder campaigns which have attracted significant public interest as well as the attention of the boards of directors. The impact of these campaigns has seen large companies commit to real and lasting change, achieving more than we dared hope and making the world a better place. ACCR’s expertise in strategy, communication and execution has lifted shareholder engagement to a new level, and empowered small scale investors to raise their collective voice for the greater good.

Managing Director, Ethinvest

You can also continue your support by:

- Registering new shareholdings or updating your existing ones on the shareholder hub - Keeping your information up-to-date ensures that the submission of resolutions remains a smooth process.

- Telling your family, friends and colleagues about us. Direct them to our website or social media, or tell them to get in contact with us. We welcome further support of any kind.

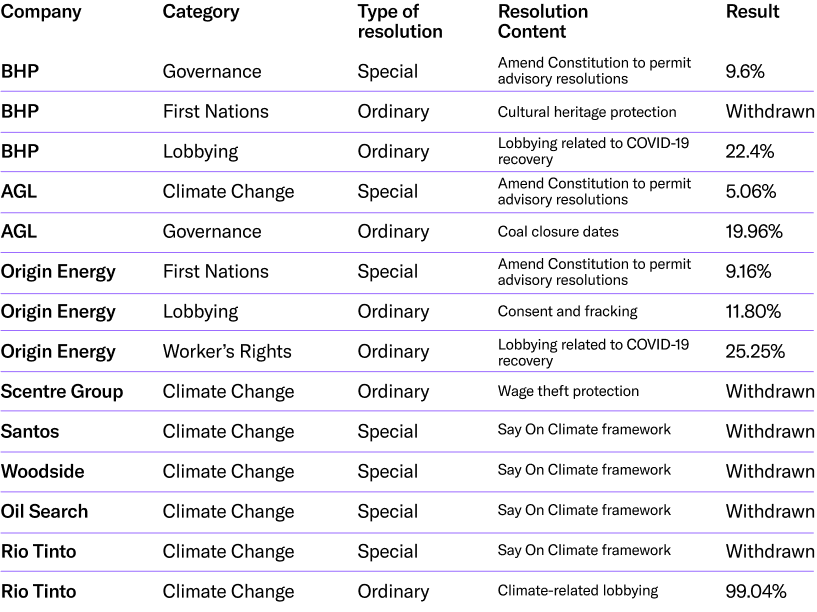

Resolutions brought in FY21 by ACCR and the Outcome

Ordinary Resolution

These resolutions cover general matters, such as the everyday running of the company and the appointment of auditors.

Special Resolution

A special resolution is for matters beyond the everyday. These include when the company wants to change its constitution. The Corporations Act 2001 (Cth) outlines the process for special resolutions. Note that the ‘result’ percentage given is the percentage of the proxies supporting the resolution whereas the figure for the special resolution is the percentage of all votes cast at the meeting. Under Australian law the ordinary resolutions are not formally put to the meeting.

Putting ESG into our practice

We seek to hold ourselves to the same high standards we expect of corporate Australia.

- We are a member of the UN Principles for Responsible Investment (UNPRI) and continue to report annually to it. We are also a member of the Responsible Investment Association of Australasia (RIAA).

- This year we have been reviewing and updating our internal policies. As we grow quickly, this is ever more important. In the year ahead, we have committed to assess how we measure and report on our own emissions. Although a small office/home-based organisation, we want to excel in this. We’d love to hear from similar organisations who may have tips for us on how to do this well.

- We seek to steward our resources well, wisely using the funds generously given by our donors. This year our Office Bearers appointed a sub-committee to form ACCR’s Audit and Compliance Committee which will develop and oversee our risk monitoring and management.

- We also seek to look after our growing staff team and treat them well. This doesn’t just mean decent pay, though this is fundamental. It means recruiting the best staff, reflective of our diverse community. And nurturing a super-smart, creative and inclusive (dispersed!) workplace, listening to our ever-evolving needs. We’re working at that and welcome suggestions from those who have been in organisations that grow at 200% per year!

- ACCR itself has a portfolio of shares - we are a genuine investor too. This investment helps to ensure we can be a sustainable organisation into the future. We have committed to transparency on our own voting record as to resolutions for the shares we hold. In the year ahead we will be publishing our full historic voting record on ESG resolutions.

Our People

Our Office Bearers

Rachel Etherington

Rachel has worked in sustainable investment for more than 15 years in the US, UK and Australia, particularly with family offices and those managing wealth intergenerationally. She is an Investment Adviser at Crestone Wealth Management and an active mentor of emerging female leaders.

John McKinnon

John was awarded a University Medal in Mathematics from ANU, has an MA in Biblical Studies and a PhD in Social Enterprise and development. He spent 17 years in the finance industry before joining overseas aid and development NGO, TEAR Australia, in 2005.

Brynn O’Brien Executive Director

Brynn has 15 years’ experience as a lawyer and strategist. She has worked as a consultant and advisor on business and human rights projects and practised as a corporations and international lawyer.

Howard Pender Convenor

Howard co-founded and was a Director of Australian Ethical Investment for 20 years until 2011. He was also a Director of 2 other ASX listed companies and is currently Chair of the ACT Long Service Leave Authority and a Director of Centre for Australian Ethical Research (CAER).

Armina Rosenberg

Armina is Portfolio Manager at Grok Ventures, the private investment firm of Mike Cannon-Brookes, one of the co-founders of software company Atlassian. Prior to Grok, she spent eight years at J.P. Morgan in the Equities Research Team covering Emerging Companies.

Adam Verwey

Adam is the founder and executive director of the Future Super Group. He leads the investment and ESG teams which manage the assets of ethical super funds Future Super, Verve Super and Cruelty Free Super, as well as providing ESG services to institutional investors.

At Grok, we are passionate about creating a better tomorrow. Our leader, Mike Cannon-Brookes, is singularly focused on wanting to decarbonise the world fast. For too long Australian companies have been allowed to bury their heads in the sand when it comes to climate change. ACCR shows how we can harness the power of shareholder activism to advance much needed positive climate action and demand a response from our biggest companies. I joined the Board to be a key part of this transformation.

Global Listed Equities at Grok Ventures.

Our Research Committee

Emeritus Professor Robert (Bob) Matheson Douglas AO MD

During his forty-year medical career, Bob Douglas worked as a general practitioner, a specialist physician, a researcher and a community medicine academic. Bob has received an Officer of the Order of Australia (AO) for his contributions to medicine.

Emeritus Professor Meredith Edwards, AM

Meredith has been a lecturer, researcher, policy analyst and administrator through her career. She has served as a Deputy Secretary of the Department of Prime Minister and Cabinet and as Deputy Vice-Chancellor of the University of Canberra.

Dr Graeme Ivan Pearman, AM

From 1971 to 2004 Graeme worked at the CSIRO. Prior to his departure he was Director of the Division of Atmospheric Research. He was awarded the CSIRO Medal (1988), a United Nations' Environment Program Global 500 Award (1989), Australian Medal of the Order of Australia (1999) and a Federation Medal (2003).

Mr Howard Pender

Howard was awarded a university medal in Economics at the Australian National University. He worked at the Australian Treasury, an investment bank and was a Visiting Fellow at the Centre for International and Public Law at the Australian National University.

Mr Julian Poulter

Julian sits on a range of international committees, advisory boards and councils relating to climate risk, sustainability and responsible investment. From 2008 to 2017 he was the Founder and Chief Executive Officer of the Asset Owners Disclosure Project (AODP).

Our Staff Leadership Team

Brynn O’Brien Executive Director

Brynn has 15 years’ experience as a lawyer and strategist, and is an expert in corporate governance, active ownership, and ESG materiality. She has degrees in Medical Science and Law from the University of Technology Sydney and a Master of Laws from Columbia University.

Elisabeth Baraka Chief Operations Officer

Elisabeth has over 20 years’ experience, as a lawyer and non-profit manager, having worked globally on business and human rights, rule of law development and using the law towards the Sustainable Development Goals. She holds a Bachelor of Arts (Hons in Psychology) /Bachelor of Laws (Hons) from the University of Sydney, and Master of International and Community Development from Deakin University.

Dan Gocher Director of Climate and Environment

Dan spent fifteen years in investment banking and asset management. More recently, he was the asset management campaigner at the environmental NGO Market Forces. Dan holds a Bachelor of Commerce from the University of Sydney.

Dr Katie Hepworth Director of Workers Rights

Katie has worked as a researcher, strategic campaigner and policy officer for over two decades, including within the Australian and international trade union movements. She completed her PhD in International Studies at the University of Technology, Sydney, for which she received a UTS Chancellor's Listing.

Judy Mills Global Team Chief of Staff

Judy worked for over 20 years in investment banking, predominantly in equity and financial markets, working across Australasia, UK and Europe, and most recently with a fintech start up. She holds a Bachelor of Arts, Bachelor of Law (Hons) degree (University of Sydney) and is a graduate of the Australian Institute for Company Directors (AICD).

Our Finances

The Australasian Centre for Corporate Responsibility (ACCR) is an association incorporated under the Associations Incorporation Act 1991 (ACT). We are registered as a charity with the Australian Charities and Not-for-profits Commission. Our Research Fund has Deductible Gift Recipient status so donations to ACCR’s Research Fund by Australians are tax-deductible.

ACT Association number: AO 5319.

ABN: 95 102 677 417.

ARBN: 648 883 194.

- ACCR’s income has grown substantially this year with the inception of its global work and leadership in Australia of the Say on Climate initiative. By the end of the financial year, we had 21 staff (FTE 16.5), a substantial increase from the 11 staff (FTE 8.15) we had at the end of FY2020!

- This annual review complements our formal ACT and ACNC annual reporting which consists of our Annual Report, our Annual Information Statement and our Financial Report for the FY21 year. Our Annual Report to our members will be submitted for approval at our AGM in November 2021 and available publicly shortly thereafter. ACCR’s past ACNC annual reporting is available on the ACNC website.

Donations

We rely on grants and donations to fund our work. We have never received support from any listed companies or governments.

Thanks to our donors and funders - without you we could not exist. Those who supported us with funding of at least AUD50,000 this year include:

- Howard Pender

- LUCRF Super

- McKinnon Family Foundation

- The Sunrise Project

- ACME Foundation

- And more who wish to remain anonymous

Fund our work

ACCR is an Approved Research Institute and donations to our Research Fund are tax deductible. Donations to support our other work are also very welcome!

Join us as a shareholder

Follow ACCR on social media

Have a question? Check out our FAQs or get in touch: office@accr.org.au

2. Social

Impacts

We want Australian-listed corporations to understand and take into account the long-term interests of all stakeholders. We elevate the voices of impacted stakeholders, from Traditional Owners facing the destruction of cultural heritage, to front line workers putting themselves at risk throughout the pandemic, to advance the interests of a just and equitable society.